How Does A Va Loan Work

VA loan process is an opportunity to get a loan to people with disabilities, war veterans, military personnel, or their widows. This is a loan issued by private lenders with the support of the US Department of Veterans Support.

The Law on VA credit has existed since 1944 when it was adopted in the legislative system. Over the past two years, the popularity of the VA loans process has doubled. Thus, for example, in 2018, 8% of all purchases was carried out thanks to this law.

How do VA loans work? This is a prototype of a mortgage loan, but the state gives guarantees. The state itself takes on a small risk of payment.

If a citizen fails to repay the loan or loses his home through a buyout, then the state will pay for it. Thanks to such a system, obtaining such a loan is easier than any other home loan.

What If I Dont Meet The Minimum Service Requirements

You may still be able to get a COE if you were discharged for one of the reasons listed below.

You must have been discharged for one of these reasons:

- Hardship, or

- The convenience of the government , or

- Early out , or

- Reduction in force, or

- Certain medical conditions, or

- A service-connected disability

How To Prepare To Get Your Coe

Jonnie and Sharlene decided to purchase their first home after moving to this area. Because we both attend the same church, they asked me to assist them with the loan.

Jonnie advised me that he had been in the Air Force Reserves as a Captain. I asked how long he had been in and he said about 8 years. I asked him for is DD 214 and any other information he might have to help me get his Certificate of Eligibility, also known as the COE.

Using the automated certificate of eligibility portal thats available to VA lenders, it came back saying we had to manually request the certificate. Sometimes this happens.

Often, I can get a COE in a few minutes online sometimes I need to upload a few documents to VAs system. Even with the upload, getting a COE typically doesnt take more than a few days.

But at this point it got frustrating for Jonnie and Sharlene. We uploaded the required information to the website, but then they came back and asked for what we thought we had already given them.

Finally, after getting someone on the phone that would explain things to us, we found that although Jonnie had the time in the service, he still did not qualify for the certificate.

So what does it take to qualify?

To learn more about the specifics of eligibility, click here.

I was once told that that the only person that can take care of you is yourself. Thats certainly the case when talking about VA home loan eligibility.

Read Also: Can You Switch Your Car Loan To Another Bank

Other Uses For A Va Loan

While a VA loan is often used to purchase a home, it can also be used to construct a home. Its also possible to use VA financing for a cash-out refinance or in conjunction with the Native American Direct Loan program. Finally, you can also use your VA loan benefits with adapted housing grants. This can be a big help if youre struggling with homeownership.

Do Ask Your Lender For Help

Common delays may be prevented if you go straight to your VA-approved lender to get your COE. Most approved lenders have access to the VA online system and can print most COEs on the spot in a matter of seconds. Not all COEs can be obtained this way, but many can. If your document cannot be obtained instantly, its still a very good idea to enlist your lenders help in obtaining it another way.

You May Like: Should You Refinance Your Auto Loan

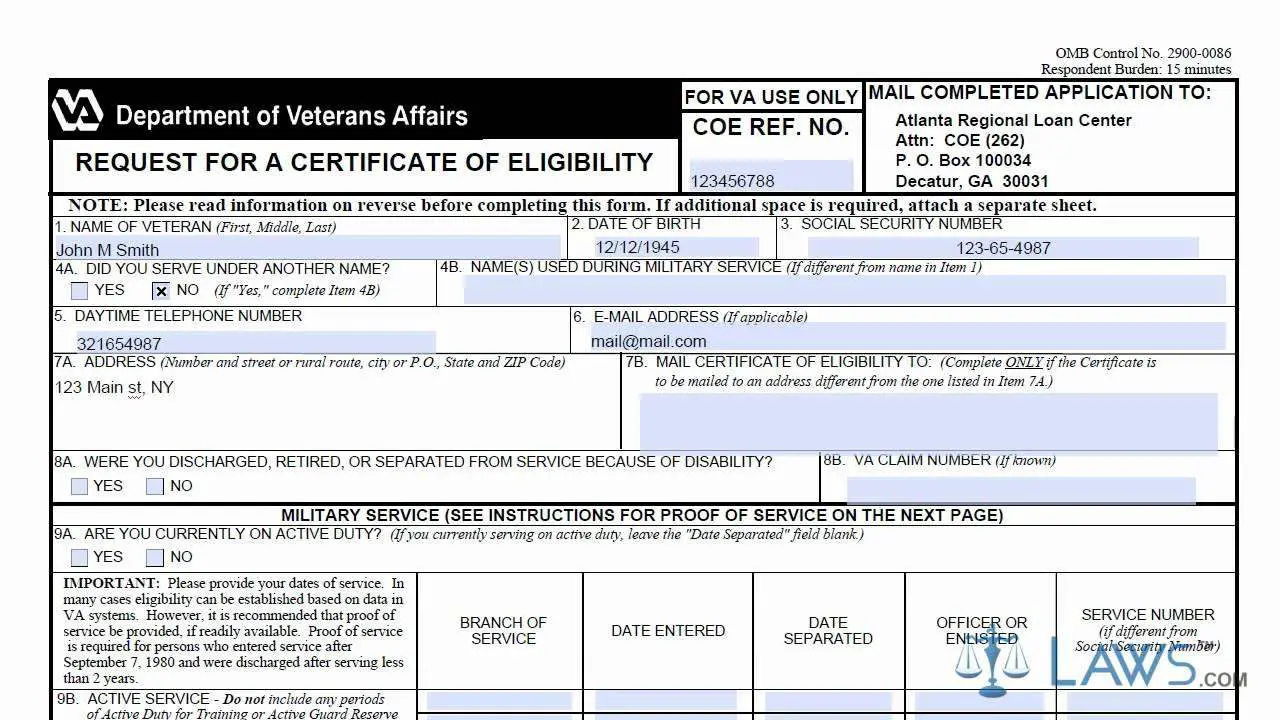

Va Loan Certificate Of Eligibility

Do you know what it means to have a VA Loan Certificate of Eligibility ? This important document is necessary in the lending process when using your VA Home Loan benefit to buy, build, or refinance a home.

Eligible veterans who have met the minimum time-in-service requirements to be eligible for a VA loan can apply online via the VA for their COE, or ask the lender to help.

The COE contains important information for you and the lender including how much VA loan entitlement you have , whether or not you are exempt from paying the VA Loan Funding Fee, and much more.

The VA Home Loan offers $0 Down with no PMI. Find out if youre eligible for this powerful home buying benefit. Prequalify today!

The VA Loan Process: COE First

The VA loan process begins with establishing that you, the borrower, are eligible to apply. This is what applying for your COE is all abouttelling the participating VA lender that you are allowed to apply for consideration to get a VA mortgage.

You are not automatically approved for a VA mortgage once you are awarded your COE. All applicants must financially qualify for a VA mortgage loan the same as with any other major line of credit. The COE merely establishes you as an eligible applicant for the loan.

What Are The Va Loan Home Occupancy Requirements

In addition to making sure youre eligible for a VA loan, you must meet occupancy requirements. You must live in the home youre financing as a primary home the money cannot be used for an investment property or vacation home.

Its also possible to refinance a VA loan, and the VA offers a program designed to help you refinance to a lower-rate loan.

Recommended Reading: How To Check Student Loan Interest

What Are Va Loan Underwriting Requirements

Each lender has its own criteria for deciding whos a good risk for a mortgage. However, there are some basic things to keep in mind:

- Borrowers need to show they have the income to make the mortgage payments.

- They shouldnt have a huge debt load.

- While there is no minimum credit score requirement, borrowers might have a hard time getting approved by a lender if they dont have at least a 620 FICO Score.

Its also possible to use home loan benefits after bankruptcy, as long as sufficient time has passed.

Are Housing Prices In My Area Too High For A Va Loan

VA loans are designed to help veterans become homeowners no matter where they live, so dont let a costly housing market stop you from exploring this option. In fact, with the recent passing of the Blue Water Navy Act of 2019 veterans and active duty can take advantage of zero down VA loans past the county loan limits well into the million dollar plus jumbo territory. For example, a qualified veteran can put zero down payment when purchasing $1.5 million dollar home.

Also Check: Can The Bank Loan You Money

Eligibility Requirements For Va Home Loan Programs

Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan. Find out how to apply for a Certificate of Eligibility to show your lender that you qualify based on your service history and duty status. Keep in mind that for a VA-backed home loan, youll also need to meet your lenders credit and income loan requirements to receive financing.

Understanding The Va Loan Statement Of Service Letter

Service members, military Veterans, and qualified surviving spouses have the benefit of the Veterans Administration home loan. VA home loans offer up to 100% financing, flexible guidelines, affordable payments, and can be used multiple times. One of the most popular process-related VA questions we receive from active service members involves the VA statement of service letter. Examples of some questions include:

- Why do you need a statement of service? You have my LES.

- Who completes the statement of service?

- What information is included in the letter?

Recommended Reading: Can I Buy Two Houses With Va Loan

Down Payment And Assets

VA loans are one of the few loan options that dont require a down payment. Your lender may have specific requirements for a no-down-payment VA loan.

For example, they may require that you have a higher credit score if youre putting down less than 10%. The requirement to purchase a home with a VA loan through Rocket Mortgage® with no down payment is still a median of 580.

Its important to keep in mind that no down payment doesnt mean zero cost. Here are some other costs, akin to closing costs due at a conventional mortgage closing, to be prepared for, even if youre putting 0% down:

Keeping Your Mortgage Documents Safe

The last piece is considering what to do with these documents as you’re collecting them.

Many new homeowners often overlook the importance of keeping important mortgage documents. From the deed to the purchase contract, closing disclosure and home inspection report, keeping your home loan paperwork in a safe place will protect you from unforeseen problems arising after you close on your mortgage such as an IRS audit.

You should keep some mortgage documents indefinitely and store them in safe spots like a fireproof box or in the cloud using password-protected folders. And, you should never send any of your mortgage documents to anyone who wasn’t part of your mortgage qualification process.

Since mortgages require so much paperwork, it is smart to get your documentation house in order. Being a prepared homebuyer can prevent costly delays and get you to closing quicker.

Our LenderVeterans United Home Loans is a VA approved lender Mortgage Research Center, LLC NMLS #1907 . Not affiliated with the Dept. of Veterans Affairs or any government agency. Not available in NV. 1400 Veterans United Dr., Columbia, MO 65203. Equal Housing Lender

Don’t Miss: Can You Ask For More Federal Student Loan

What Is The Purpose Of A Statement Of Service

Mortgage lenders must verify employment income using a verification of employment form. The employer completes the VOE. It provides the date started, position, income breakdown, the probability of continued employment, and more, but lenders do not use the standard VOE for military borrower verification. For military borrowers, there are two employment verification options. First, there is the Status Report Pursuant to Service Members Civil Relief Act. Our VA processors obtain this report which saves the borrower any work. Although, it is not always available or does not verify all necessary areas. Secondly, there is the Statement of Service.

Proof Of Service Requirements For Va Home Loans

Are you an active duty service member looking to buy property with a VA home loan?

When you start the process of applying for a VA mortgage, one of the first things you’re required to do is prove that you’re on active duty and in good standing with your branch of the service. Where your loan officer is concerned, that might mean simply showing your current military ID card and a Leave and Earning Statement, but the Department of Veterans Affairs requires something more.

In order to be approved for a VA home loan, the VA requires you to provide a signed statement from your unit commander or a designated representative. The statement must list you by name, rank, Social Security number and also the nature of your current active duty service commitment or the length of your current assignment.

That’s a bit complicated compared to the requirements retirees and honorably separated military members have to do to show proof of service in those cases it’s simply a matter of submitting a copy of the DD form 214 which acts as proof of service and also shows the nature of the discharge.

Both a statement of service for active military and a DD-214 for veterans are essential for obtaining a Certificate of Eligibility. This is a formal VA document indicating your eligibility for a VA home loan.

Check VA Loan Eligibility Today!

Also Check: Does Fha Loan Require Down Payment

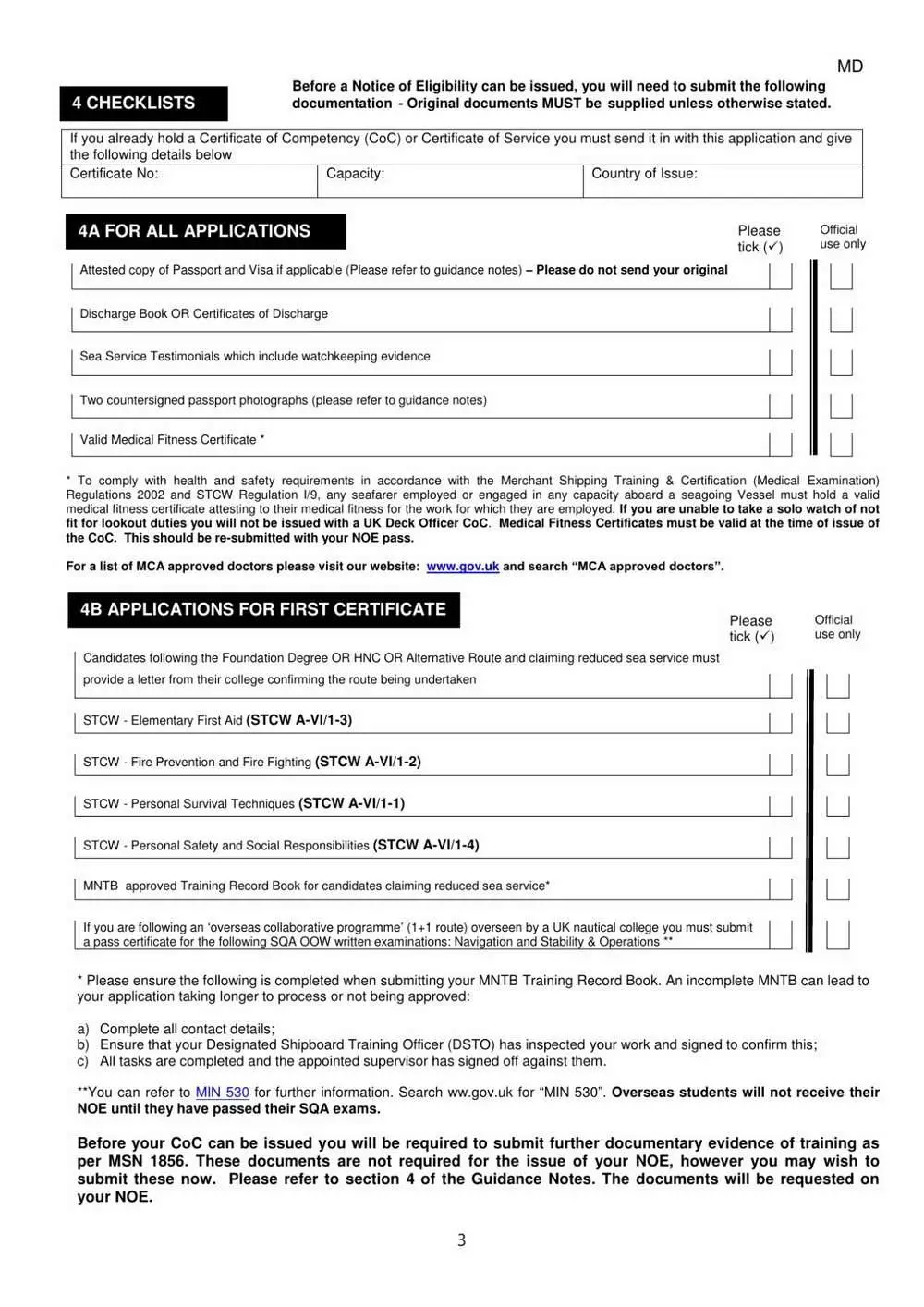

Additional Documents Needed For Your Coe

In many cases, your lender can access a COE almost instantly. However, there are times when records are missing from the system and additional documentation is required to verify a borrowers request. Naturally, anyone requesting a COE through other methods will need to submit the required documentation in order to achieve their goal. Documentation requirements vary depending on your service. The VA explains whats needed:

Va Loan Checklist Summary

The following is a summary of the documents typically required for a VA loan:

- A government-issued ID, such as a drivers license

- Past two years of W-2 statements

- Past two years of tax returns

- Most recent bank statements from checking, savings and retirement accounts

- Most recent pay stubs

- VA disability awards letter

- Social Security awards letter

- Divorce decree

- Bankruptcy discharge letter

- A DD-214, Statement of Service or Points Statement

Our LenderVeterans United Home Loans is a VA approved lender Mortgage Research Center, LLC NMLS #1907 . Not affiliated with the Dept. of Veterans Affairs or any government agency. Not available in NV. 1400 Veterans United Dr., Columbia, MO 65203. Equal Housing Lender

Recommended Reading: How Do I Refinance An Auto Loan

Access To Other Adaptation Grants

Disabled veterans may also qualify for a Temporary Residence Adaptation grant to add modifications to your property that make it easier to navigate if you live with a family member. Like SAH grants, you wont need to pay back your TRA grant, which makes them a powerful tool for veterans with mobility-related disabilities.

Property Tax Exemption

Property taxes fund things like libraries, fire departments, and local road and development projects. Disabled veterans property tax exemptions can lower the amount you must pay in property taxes.

These tax exemptions arent a federal program, and they vary by state, so check with your local VA office to learn the exemptions youre eligible for. Some states offer an exemption to all veterans, while other states limit this benefit to veterans who are currently receiving disability payments. Disabled veterans are 100% exempt from property taxes in some states.

Pay Credit Balances Before The Statement Closing Date

Before applying for a va loan make a payment to your account before your cards statement closing date, instead of on or before its payment due date. Card issuers typically report the statement closing date balance to the credit bureaus on the statement date. Thus, even if you pay off your credit balance before the due date your credit report may still show a balance which will effect the utilization percentage used to calculate your credit score. This is true even if you pay off your balances monthly and never have a revolving balance.

Don’t Miss: Is It Easy To Get Loan From Credit Union

When Is A Statement Of Service Is Required

1. When the Certificate of Eligibility is not available online and is needed to request the COE from VA

2. When the borrower has less than 12 months on the ETS date to show:

- They are eligible to re-enlist

- There are no re-enlist restrictions for the borrower

3. Using other pays other than Base, BAH, BAS. Proof pay will continue 12+ months after closing

4. Using a reservists pay. Would show:

- How many drills borrower has participated in

- If active reservists training with units throughout the year

- If participating in annual active duty for training

An LES will show the pay rate, rank, separation date, allotments, and more. Then, the W2s and tax returns show the previous years income. The Statement of Service fills in the holes needed to fully verify the income verification. VA handbook chapter 2, 4.b, Veterans on active duty, require the statement of service form. This guideline states, Proof of service for Veterans on active duty is a statement of service signed by, or by the direction of, the adjutant, personnel office, or commander of the unit or higher headquarters they are attached to. There is no one unique form used by the military for a statement of service. While statements of service are typically on military letterhead, some may be computer generated.

Things Are Different For The Cash

If you want to extract some cash from your home’s equity, you can opt for a VA Cash-Out Refinance.

The cash-out refinance process is similar to your original VA loan, so you’ll need to provide many of the same documents you needed for your original mortgage.

Keep in mind that a VA IRRRL/Cash-Out Refinance must provide you with at least one net tangible financial benefit. For example, you may not qualify if you just want to take out some extra cash from your home’s equity, but the new loan simultaneously raises your interest rate and monthly payment.

You May Like: Should I Pick Variable Or Fixed Rate Student Loan

What Is A Statement Of Service Letter

When veterans apply for a VA loan they are required to provide a Statement of Service letter, otherwise known as a SOS.

The Statement of Service letter has to be specifically geared towards a home loan, and can be obtained through your local office for military personnel.

A Statement of Service is a document which verifies that you are either an active military member, or are retired with at least 6 years of active service prior to retirement or discharge.

A SOS letter is required for VA loans in order to combat fraud and incorrect information. Although it is an extra step in the process, SOS letters ultimately help guard military service members by restricting VA loan availability to only those who qualify due to their service. Because of this, SOS letters are an integral part of the process behind getting approved for a VA loan.

After obtaining a SOS, the next step is to accurately complete it and have it signed by your commanding officer. It is very important that your SOS has both correct information and a signature.

Plan ahead and obtain your Statement of Service letter early in the VA loan process. This will help ensure that your VA loan approval process goes as quickly and smoothly as possible.

According to the Department of Veterans Affairs, if you retired or were discharged from the military after January 1, 1950, you can provide a copy of your DD Form 214 as evidence. If you are still active in the military, a Statement of Service letter is required.