You Could Get Parent Plus Loan Forgiveness Through Income

One way to get your Parent PLUS Loans forgiven is through the income-driven plan known as ICR. This plan caps your monthly payments at 20% of your discretionary income or the amount you would pay on a fixed 12-year plan, whichever is lower.

It also extends your repayment terms to 25 years, so youll be paying less each month. If you still have a balance at the end of 25 years, the remaining amount will be forgiven.

Your remaining balance will be discharged, but it will still be considered taxable income. So make sure to prepare for one last expense before you can say goodbye to your Parent PLUS Loans.

This kind of loan forgiveness takes a long time, but it could be a good option if you need relief from high monthly bills. The Office of Student Aid offers a handy Repayment Estimator tool to predict your monthly payments.

Theres just one problem with getting your Parent PLUS Loans on ICR, though to make them eligible, you need to consolidate them first with a Direct Consolidation Loan.

Here are the steps to take in order to get your Parent PLUS Loans on ICR and eventually, qualify for loan forgiveness:

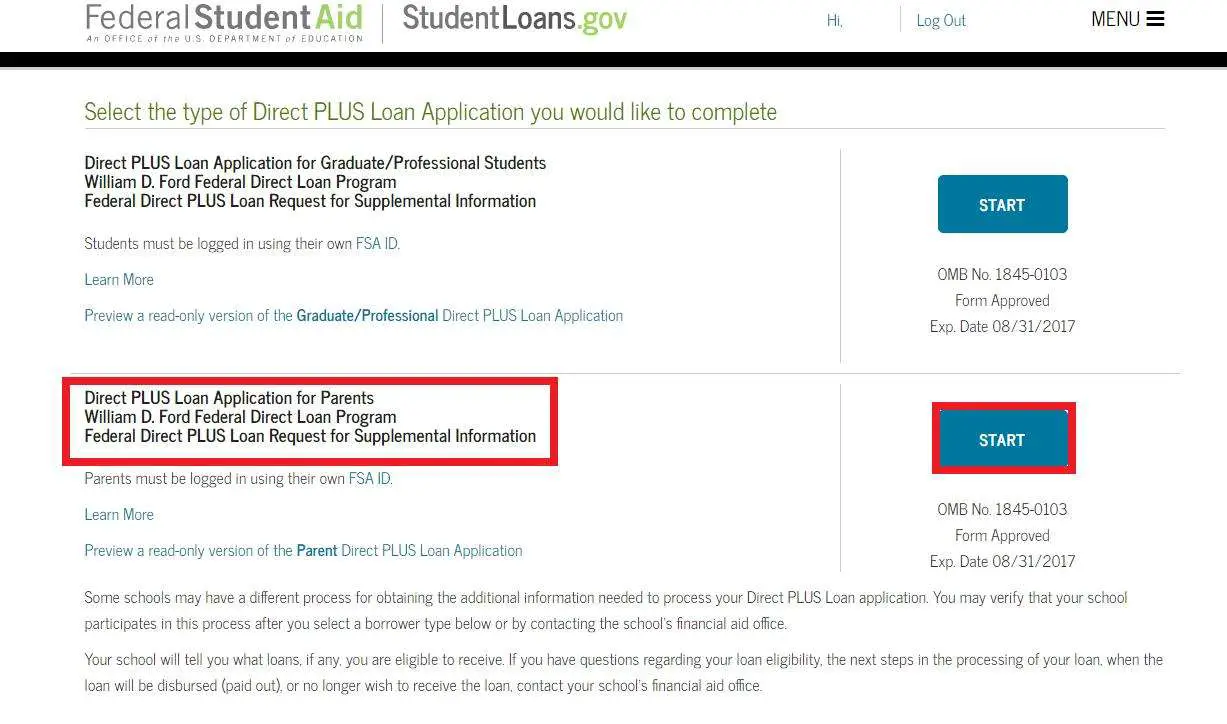

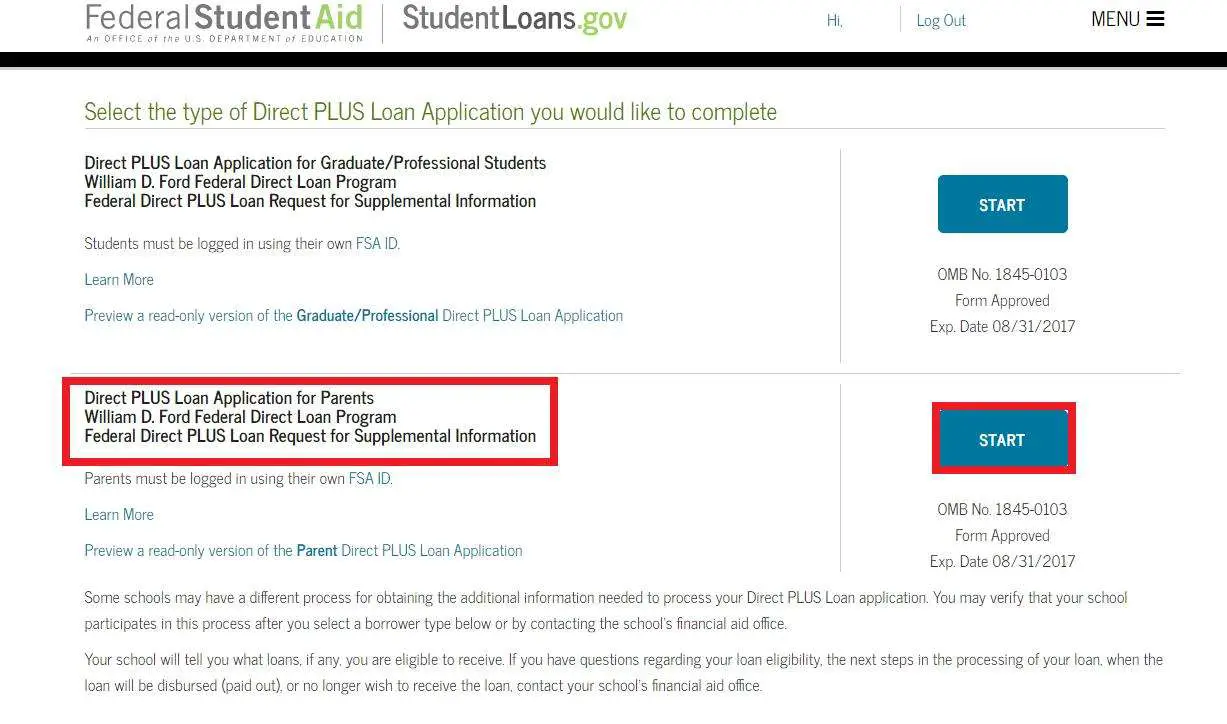

Step 1: Apply for a Direct Consolidation Loan through StudentLoans.gov.

Step 2: Talk to your loan servicer and choose ICR.

Step 3: Make payments on time for 25 years to get your loans forgiven. Pay any potential tax bills related to your loan forgiveness.

S To Apply For A Parent Plus Loan

If a Parent Plus Loan is the best option for your situation, you should follow these 7 clear steps to apply.

Problem #: Strict Parent Plus Loan Eligibility Requirements

Parent PLUS loan eligibility requirements are strict, and students may be forced to seek private loans when their parents are denied.

To meet Parent PLUS loan eligibility requirements, a borrower must be the parent of a dependent undergraduate student who is enrolled at least half-time at a qualifying school, and the borrower must pass a credit check without being deemed to have adverse credit. Read here for the full definition of adverse credit along with more information about Parent PLUS Loan eligibility.

Read Also: Rv Loan Calculator Usaa

What Happens When A Parent Is Not Eligible For A Plus Loan And Gets Denied

When a parent is denied for a PLUS loan, the dependent child is given extra unsubsidized Stafford Loans. The student can be given as much as an independent student at the same grade level. Independent students in their third or fourth year are eligible to receive up to $12,500 in Stafford loans, with a limit of $5,500 on subsidized loans.

So, a third year student would be eligible for up to $7,000 in unsubsidized Stafford loans if his or her parent was denied a PLUS loan. Keep in mind, the student may have used some of this $7,000 allotment already, if unsubsidized Stafford loans were part of the financial aid package offered by the school. According to the Federal Student Aid website, the student should contact his or her school to begin the process of securing more Stafford Loans.

But what if the extra $6,000 is not enough to cover the rest of the cost? Then, the student or parent will have to seek private student loans. Since we already know that the parent has adverse credit, there is a strong likelihood that the student will end up with what we call .

So now, lets look at how much more this family will have to pay because of the adverse credit.

Lets assume the student would need $12,000 to meet the full cost of college. Heres how much the family would owe if they qualified for a $12,000 Parent PLUS Loan vs. how much the student will owe if he or she takes $6,000 of extra Stafford Loans and $6,000 in a private student loan at 10% interest.

Explore Different Ways To Manage Your Parent Plus Loans

While none of these options will make your Parent PLUS Loan disappear overnight, they could lead to significant financial relief down the line. If youre looking for more immediate help, consider putting your loans on Income-Contingent Repayment or refinancing for new terms and a lower rate.

By exploring all the options available to you, you can make repaying your Parent PLUS Loans a lot more manageable.

Sign up for weekly digest to receive the latest rate updates and refinance news!

Thank you! Keep an

Don’t Miss: What Car Loan Can I Afford Calculator

Additional Information On Borrowing

You can estimate your monthly payments with various repayment plans using repayment calculators available online from the U.S. Department of Education. The site also contains information on consolidating your PLUS loan with other personal loans or discharging your loan under specific circumstances.

For more information on the cost of borrowing or repayment, call the Federal Student Aid Information Center at .

What Are Direct Plus Loans

The PLUS is a long-term, credit-based loan program with a variable interest rate. This program is designed to assist parents of dependent undergraduate students or graduate students in meeting the educational cost of education.

In the case of a parent of a dependent student, the parent is the borrower and is responsible for repayment of the loan. These loans may not exceed the cost of education minus other aid. Generally, repayment must begin 60 days after receipt of funds unless the parents qualify for deferment.

The student must be enrolled at least half time and be eligible for federal student aid. Approval for the PLUS Loan is based on the credit of the borrower. The maximum amount requested can equal the students cost of attendance minus other financial aid. Interest is charged during all periods.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Direct Parent Plus Loan Instructions

Step 1: To apply for a Parent PLUS Loan:

- Log in to your account using your FSA ID.*

- Select “Parent Borrowers” dropdown

- Choose ‘Apply for a PLUS Loan’

- Follow the instructions to apply for a PLUS Loan

If you are a first-time parent borrower, then you will need to complete the following:

Step 2: Complete a Parent PLUS MPN

- Log in to your account using your FSA ID.*

- Select “Parent Borrowers” dropdown

- Choose ‘Complete Loan Agreement for a PLUS Loan ‘

- Follow the instructions to complete the Master Promissory Note.

If a parent successfully appeals or obtains an endorser, the parent borrower is required to complete online credit counseling for PLUS Loan borrowers. The PLUS Credit Counseling will help parents understand the obligations associated with borrowing a PLUS loan and assist them in making careful decisions about taking on student loan debt.

Complete Online Credit Counseling Only for an Appeal or Endorsed PLUS Loan

- Log in to your account using your FSA ID.*

- Select “Parent Borrowers” dropdown

How To Get Parent Plus Loan Forgiveness

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

There are two main ways to get parent PLUS loan forgiveness: through the Public Service Loan Forgiveness program and through the Income-Contingent Repayment plan.

Public Service Loan Forgiveness involves a lot of red tape but is the better option if you qualify. Income-Contingent Repayment forgiveness takes a long time. Stick to the standard 10-year plan to if you can afford to. Its faster and will likely cost less overall.

If you do want to pursue parent PLUS loan forgiveness, heres how.

» MORE:

is available to all federal student loan borrowers, including parent PLUS loan holders, who make 120 qualifying payments while working full time in a government position, or for an eligible nonprofit employers.

Only payments made on the standard and income-driven repayment plans qualify for PSLF. Because the standard plan pays off the loan in 120 payments, parent PLUS borrowers aiming for PSLF should enroll in the Income-Contingent Repayment plan .

If you’ll qualify for forgiveness, skip the so you start making eligible payments right away.

» MORE:

» MORE:

There are a few other circumstances that could cause your to be discharged:

» MORE:

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Should You Get Parent Plus Loans

Parent PLUS loans can help some families pay for college, but they wont be right for everyone. First, consider whether you should borrow for your childs education at all.

Consider how adding new student loan payments will affect your finances. If theyd stretch your budget too thin or detract from other important financial goals like retirement, that might be a sign that its wise to reconsider.

If you can afford this new debt, also investigate alternatives to parent PLUS loans. Max out other , such as scholarships, savings, and lower-cost undergraduate federal loans, first.

Private student loans might be a better fit for some borrowers, too. Parents who dont want to shoulder this debt alone, for example, could co-sign a private student loan with their childmaking both family members legally responsible for this debt.

How Plus Loans Work

PLUS is an acronym for Parent Loan for Undergraduate Students.

The parent PLUS program allows parents to borrow money for dependent students to pay any costs not already covered by the student’s financial aid, such as Pell Grants, student loans, and paid work-study jobs.

PLUS loans have fixed interest rates for the life of the loan. They are typically repaid over 10 years, although there is also an extended payment plan that can lengthen the term up to 25 years. Interest on student loans from federal agencies has been suspended until September 31, 2021.

Parent PLUS loans are the financial responsibility of the parent rather than the student. They cannot be transferred to the student, even if the student has the means to pay them.

Don’t Miss: How Do I Find Out My Auto Loan Account Number

Final Step: Sign The Master Promissory Note

After submitting your application, the schools financial aid office should reach out to you to sign the Master Promissory Note , where you agree to the terms and conditions of the loan. If you have an endorser, theyll also have to sign the MPN.

When you receive the MPN, review or complete the borrower information and details about your child. Youre required to add the names and contact information of two references youve known for at least three years who dont live with you and arent the student.

Review the information about how the Parent PLUS Loan works before signing and dating the MPN. If you completed it online, you can submit it online. Otherwise, follow the schools instructions on where to send it.

What If I Am Denied For A Direct Plus Loan

Dependent undergraduate students, if your parent is unable to secure a PLUS loan, you may be eligible for additional unsubsidized loans to help pay for your education. You would need to provide the PLUS Loan Application and the denial letter from the Department of Education. The additional Unsubsidized Loan your are eligible for would be offered on your Student Center after processing.

Don’t Miss: Can I Refinance My Car Loan With The Same Lender

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Your Career Might Qualify You For Repayment Assistance Programs

While public servants could qualify for Parent PLUS loan forgiveness through PSLF, professionals in other sectors might be eligible for state-run repayment assistance programs. Some common careers that qualify include doctor, nurse, teacher, lawyer, pharmacist and dentist.

Some private companies also help their employees pay off their loans with a student loan matching benefit. Similar to a 401 match, these companies pay off their employees student loans up to a certain amount.

Depending on your career or employer, you could qualify for student loan assistance and get rid of your Parent PLUS Loans ahead of schedule.

Also Check: Defaulting On Sba Loan

Consider All Your Funding Options

The lack of a credit score requirement and guaranteed loan amount makes parent PLUS loans a good fit for some parents who want to help pay for a child’s college expenses, but it might not be the best option for everyone. For example, sometimes having a child borrow more in federal student loans and then making payments on their behalf may make more sense in your situation. Or, if you have good credit, you may find private student loans offer a better rate than federal parent PLUS loans, but remember that private loans usually don’t offer the same types of benefits federal loans do. Additionally, you should encourage your child to apply for scholarships and grants every school year to limit how much both of you might need to borrow.

Tips For Parent Plus Loans

- Calculate the total cost and consider options that may be needed to cover any remaining cost. Options can include the Tuition Payment Plan, a Parent PLUS loan and Alternative loans. Review your options to determine what is best for your family.

- The Parent PLUS Loan is borrowed only by a parent for their student’s educational expenses.

- A Parent PLUS Loan is not listed on the award offer for the student to accept.

- Parents wishing to borrow the Parent PLUS Loan must be U.S. citizens, and may be the biological, adoptive, or stepparent of the dependent student.

- The Parent PLUS loan borrower does not have to be the same parent used on the FAFSA.

Also Check: How Do I Refinance An Auto Loan

Student Loan Rates Are Rising

Apply for a private student loan and lock in your rate before rates get any higher.

Before you apply for a parent PLUS loan, its helpful to check if youll qualify for this type of federal student loan.

And dont just go off your childs financial aid award letter. Even if parent PLUS loans are included, youll need to meet the eligibility guidelines. On the other hand, you might be able to borrow through Parent PLUS loans even if they arent listed on the award letter.

Eligibility requirements for parent PLUS loans include the following:

- You must be the biological or adoptive parent of a current student.

- Your child must be a dependent undergraduate enrolled at least half time at a college that participates in the federal direct loan program.

- You and your child must meet all other eligibility requirements for federal student loans.

- You must not be in default on any federal student loans.

- Your credit must not be adverse. The Department of Education defines an adverse credit history as one that includes a current delinquency of 90 days or longer. It also includes borrowers who have certain derogatory marks within the past five years, such as bankruptcy discharge or foreclosure. The full definition of adverse credit is outlined here.

The last requirement makes parent PLUS loans unique among federal student loans, most of which have no credit requirements.

Whom Are Parent Plus Loans Best For

Youre probably suited for one if youre a parent who:

- Has a student whos borrowed up to the maximum undergrad loan limits and is able and willing to help

- Wants to be responsible for this student debt rather than having it burden their child

- Has compared parent PLUS loans with private student loans, and has found that the federal option offers lower interest rates and total costs

- Cant qualify for private student loans

- Wants access to federal student loan benefits, such as deferment and forbearance, federal repayment plans, or even forgiveness.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Parent Plus Loan Interest Rate

The interest rates on Parent PLUS Loans are fixed and do not change over the life of the loan. The interest rate for the 2020-2021 academic year is 5.30%.

Every year on July 1, interest rates are reset based on current market rates.

The interest on a Parent PLUS Loan starts to add up from the date the loan is first disbursed. If the borrower does not pay the interest as it accrues, it will be capitalized , increasing the size of the loan.