Advantages And Disadvantages Of A 5/1 Hybrid Arm

In most cases, ARMs offer lower introductory rates than traditional mortgages with fixed interest rates. These loans can be ideal for buyers who plan to live in their homes for only a short period of time and sell before the end of the introductory period. The 5/1 hybrid ARM also works well for buyers who plan to refinance before the introductory rate expires. That said, hybrid ARMs like the 5/1 tend to have a higher interest rate than standard ARMs.

-

Lower introductory rates than traditional fixed-interest mortgages

-

Interest rates possibly drop before the mortgage adjusts, resulting in lower payments

-

Good for buyers who will live in their homes for short periods of time

-

Higher interest rates than standard adjustable-rate mortgages

-

When mortgage adjusts, interest rates probably rise

-

Could be trapped in unaffordable rate hikes due to personal issues or market forces

Theres also a chance that the interest rate might decrease, lowering the borrowers monthly payments when it adjusts. But in many cases, the rate will rise, increasing the borrowers monthly payments.

If a borrower takes out an ARM with the intention of getting out of the mortgage by selling or refinancing before the rate resets, then personal finances or market forces might trap them in the loan, potentially subjecting them to a rate hike that they cant afford. Consumers considering an ARM should educate themselves on how they work.

Sofrs Are Named Differently

Most ARMs start with an introductory interest rate that lasts for several years before the first adjustment, or reset. A Libor ARM with a three-year introductory rate is called a 3/1 ARM because the initial rate lasts three years, then the rate is adjusted every one year afterward. The number before the slash is the length of the introductory rate, and the number after the slash denotes how many years pass between rate adjustments.

Because SOFR ARMs will be adjusted at six-month intervals, the number after the slash denotes how many months, not years, pass between rate adjustments. When a SOFR ARM has an initial rate lasting three years, followed by rate adjustments every six months, its called a 3/6 ARM. If the initial rate lasts five years, it’s a 5/6 ARM. There are also 7/6 and 10/6 ARMs.

Lenders know there’s a learning curve. “We explain and educate borrowers on the new terminology and adjustment periods in our new ARM disclosures, which are provided on all SOFR ARM applications,” says Mark Daly, Flagstar Bank’s senior vice president for mortgage originations support.

How A 5/1 Mortgage Loan Works

A 5/1 mortgage loan is generally a good choice in two scenarios. Youll save big by getting a 5/1 loan rather than a 30-year fixed mortgage if you dont plan to stay in the home very long. If you’re fairly sure that a career change or a move is in the cards before your five-year fixed period is up, for example, this might be the right option for you.

The initial interest rate on these 5/1 mortgage loans is typically pretty favorable.

You might also want to consider a 5/1 ARM if you know that you can comfortably afford a little unpredictability when the five-year term expires. You can enjoy a relatively low interest rate for the first five years. If your income is sufficient to cover ebbs and flows in your monthly payment after this timeor to allow you to pay the fees and costs of refinancinga 5/1 ARM could be a good choice.

These hybrid loans generally arent a good move if youre tight on cash and need to rely on having a consistent, reliable payment. You also likely shouldn’t get one if you plan to put down serious roots and remain in your home for a long stretch of years.

Some 5/1 ARMs do come with rate caps, so your rate can never increase beyond a certain threshold. These caps help protect you from sky-high payment jumps when your five-year fixed-rate period expires. Otherwise, your monthly interest payments could double or even triple when the interest rate becomes variable.

Read Also: Usaa Credit Score For Mortgage

When Were Arms First Offered To Home Buyers

ARMs have been around for several decades, with the option to take out a long-term houseloan with fluctuating interest rates first becoming available to Americans in the early 1980s.Previous attempts to introduce such loans in the 1970s were thwarted by Congress, due to fears that they would leave borrowers with unmanageable mortgage payments. However, the deterioration of the thrift industry later that decade prompted authorities to reconsider their initial resistance and become more flexible.

What Is The 5 Year Arm

Theres one thing you will know for certain about the 5-year ARM it has a fixed rate for five years. After that, its anybodys guess what your new rate will be. The rate may adjust once a year on the same date. So you do have some predictability regarding when the rate will change. Guessing what the rate will be, though, is anyones guess.

This is called a hybrid mortgage. It gives you the benefits of a fixed mortgage for the first few years and then turns into an adjustable rate down the road.

Don’t Miss: The Mlo Endorsement To A License Is A Requirement Of

What Is A 3/1 Arm Mortgage Loan

Lenders offer a variety of different mortgage loan options. One of the options is an adjustable rate mortgage, also know as an ARM, rather than a mortgage with a fixed rate. Each ARM has an introductory period where the rate is fixed and then an adjustment period, where the interest rate adjusts periodically depending on the loan.

When Should You Consider A 3

The most ideal time to consider a3-year ARMis when the APR on a comparable fixed-rate mortgage is high. The low introductory rates on a 3-year ARM can be an incentive for some home shoppers who are planning to sell or refinance after the first 3 years. Ifthe value of the houseincreases before the fixed-rate period ends, you may be able to get a higher return. Keep in mind the housing market can be unpredictable. If considering a 3-year ARM, ask yourself:

Before committing to a 3-year ARM,estimate how much you’ll oweat the maximum interest rate so you don’t risk defaulting on your home loan and severelyimpacting your credit.

You May Like: Fha Refinance Fees

Does A 3 Year Arm Adjust Every 3 Years

A 3/1 ARM has a fixed interest rate for the first three years. After three years, the rate can adjust once every year for the remaining life of the loan. … If the rates increase, your monthly payments will increase however, if rates go down, your payments may not decrease, depending upon your initial interest rate.

/3 And 3/1 Hybrid Arms

Mortgages where the monthly payment and interest rate remains the same for 3 years are called 3/3 and 3/1 ARMs. At the beginning of the 4th year, the interest rate is changed every three years. That is 3 years for the 3/3 ARM and each year for the 3/1 ARM. This is the type of mortgage that is good for those considering an adjustable rate at the three-year mark.

Don’t Miss: When Should I Refinance My Fha Mortgage

Is A 5/1 Arm A Good Idea

Itâs difficult to justify a 5/1 ARM if interest rates are already low, or if the difference between an ARM and a fixed-rate mortgage is low. If the savings are not low enough, then a 5/1 ARM may not be worth the risk of future rate changes.

Instead, borrowers who plan to move out or refinance before five years may be able to benefit from a 5/1 ARM. But keep in mind that there are no guarantees that you will be able to sell the house in five years. The house may lose value as the neighborhood changes or a downturn in the economy might result in a low demand for homes. Of course, itâs possible that the opposite may happen. You can always talk to a real estate agent about the prospects of your local market and a financial advisor about what might be best in your situation.

Similarly, while refinancing can get you out of an ARM, a mortgage refinance means taking out a new mortgage loan to repay the old one. The interest rates at the time of refinance may end up higher than you anticipated, which may make you wish you had taken out a fixed-rate loan at the start. You may also have to pay a few closing costs again, like an origination fee, which might diminish your potential savings if you canât refinance to a lower rate.

If you plan to pay off the mortgage early and want to make use of the 5/1 ARMâs initial low interest, you may benefit if the mortgage doesnât have a prepayment penalty.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: One Main Financial Bill Payment

Types Of Arm Loan Terms

Most ARM loans are actually hybrid ARMs. They combine features of a fixed-rate mortgage with those of an adjustable-rate mortgage. Theyre expressed with two numbers, like 3/1. The first number is the length of your fixed-rate period. The second number is how often the rate will adjust after the initial period.

If you see ARMs advertised as 2/28 or another larger number, that indicates the number of years the rates will be adjustable. They could adjust every six months rather than annually. If you have questions about exactly how a specific ARM works, ask the lender or review your loan estimate.

3/1 ARM

A 3/1 ARM has a fixed rate for the first three years. After that, the lender can adjust rates annually based on the performance of the index it uses.

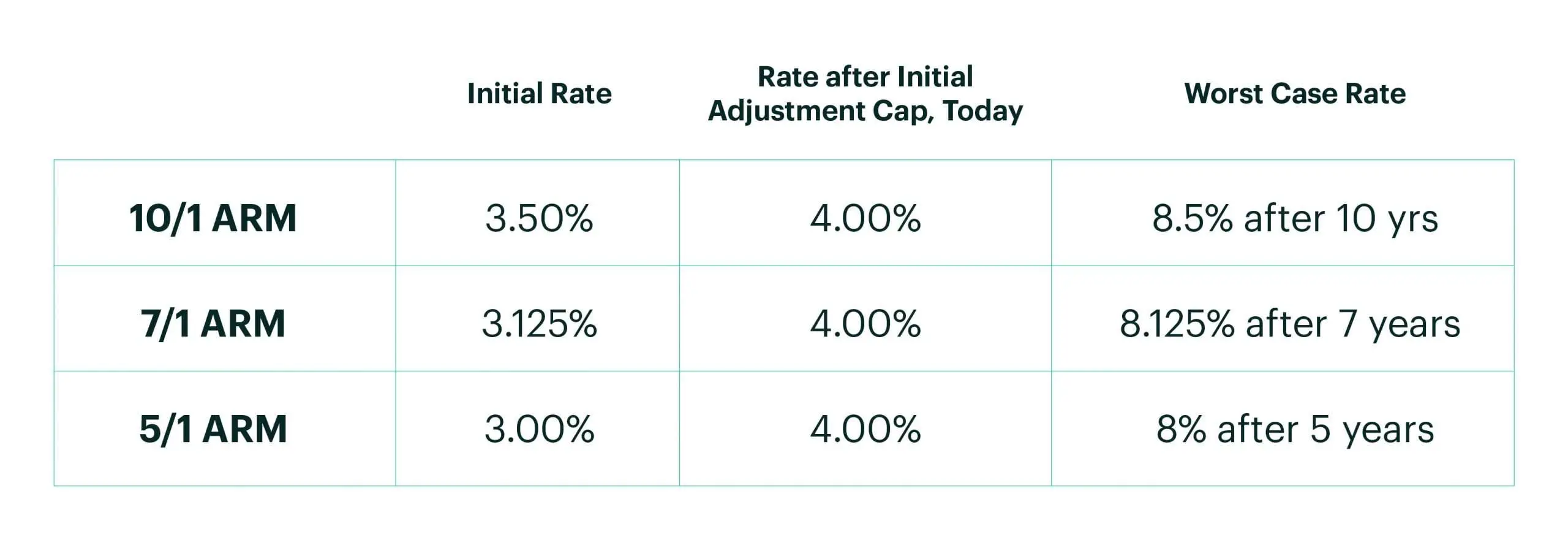

5/1 ARM

A 5/1 ARM has a fixed rate for the first five years and adjusts annually after the initial period ends.

7/1 ARM

A 7/1 ARM has a fixed rate for the first seven years and adjusts annually after that.

10/1 ARM

A 10/1 ARM has a fixed rate for the first 10 years. After that, it adjusts annually.

/1 Adjustable Rate Mortgage

This 30-year loan offers a fixed interest rate for the first 3 years and then turns into a 1 Year Adjustable Rate Mortgage for the remaining 27 years of the loan. This loan has recently become quite popular by those seeking to minimize monthly payments while accepting a certain amount of risk.

This loan may be right for you if you wish to maximize the amount of loan you qualify for and expect to remain in this home for more than 3 years. This loan is generally the least expensive way to fix your monthly payment for the first three years of your loan. After that, this loan is like a 1 Year ARM with all of its risks and rewards. This loan may not be right for you if you are concerned that your income in three years may not cover your monthly payment after your first adjustment.

Also Check: Www.capital One.com/autopreapproval

One Year Traditional Arms

A mortgage loan in which the interest rate changes based on a specific schedule after a fixed period at the beginning of the loan, is called an adjustable rate mortgage or ARM. This type of loan is considered to be riskier because the payment can change significantly. In exchange for the risk associated with an ARM, the homeowner is rewarded with an interest rate lower than that of a 30 year fixed rate. When the homeowner acquires a one year adjustable rate mortgage, what they have is a 30 year loan in which the rates change every year on the anniversary of the loan.

However, obtaining a one-year adjustable rate mortgage can allow the customer to qualify for a loan amount that is higher and therefore acquire a more valuable home. Many homeowners with extremely large mortgages can get the one year adjustable rate mortgages and refinance them each year. The low rate lets them buy a more expensive home, and they pay a lower mortgage payment so long as interest rates do not rise.

Can You Handle Interest Rates Moving Higher?

The traditional ARM loan which resets every year is considered to be rather risky because the payment can change from year to year in significant amounts. Unless the buyer plans to quickly flip the property or has plenty of other assets and is using an interest-only loan as a tax write off, almost anyone taking adjustable rates should try to pay extra in order to build up equity in case the market turns south.

Is A 5/1 Arm Loan Right For You

Assuming market conditions with a decent spread between fixed and adjustable rates, it can make sense to get an adjustable-rate mortgage, particularly if you know you plan to be out of the house by the time the rate would adjust. This is because the upfront interest rates can be lower than anything you would get for a fixed rate under normal circumstances.

If market conditions change and theres more of a difference between adjustable rates and fixed-rate mortgages, the lower rate on an ARM can help provide you financial flexibility. In addition, as we saw earlier, you can pay down quite a bit of principal by taking the payment savings in the initial years and putting it back toward the balance.

If you plan on being in your house for a long time, its probably best to take a look at a fixed-rate mortgage. This will provide you with long-term payment certainty.

Don’t Miss: What Credit Bureau Does Usaa Use

The Arm’s Moving Parts: How They Work Together

ARMs operate differently than fixedrate loans. There are a few factors that go into setting an ARM rate, so its important to understand what they are.

The ARM you choose is named for the way it works. For instance, a 5/1 ARM has a fixed rate and payment during its first five years, and then it resets annually, according to its terms.

Similarly, 10/1 ARM rates remain fixed for the first ten years of their terms.

Start rate

This may also be referred to as teaser rate. Without this lower start rate, no one would ever choose an ARM over a fixed rate. Youd be taking on extra risk without getting any reward.

The ARMs lower start rate is your reward for taking some of the risk normally born by the lender the chance that interest rates may rise a few years down the road.

In the example above, the start rate for the 5/1 ARM is 3.202 percent.

Fully-indexed rate

The fullyindexed rate is the interest rate that youd pay once the start rate expires. However, this rate is subject to some limitations called caps and floors.

To calculate the fullyindexed rate, you add two figures an index and a margin.

This rate is sometimes used by lenders to qualify you for your mortgage.

The index + the margin = your fullyindexed rate.

Index

The index is a published measurement of financial activity. Here are some of the most common:

As of this writing, the oneyear LIBOR rate is 1.71 percent.

Caps

Other caps apply to every year your loan is due for a reset or adjustment.

Floors

What Drives Arm Rates

The rates for adjustable-rate mortgages are based on an index plus the lenders margin to total the loans indexed rate. Lets take a deeper look at how that works as well as other factors that affect ARM mortgage rates.

Caps

A cap is the most your interest rate or monthly payment can increase. There are four types of caps that affect adjustable-rate mortgages.

- Initial adjustment caps. This is the most your interest rate can increase the first time it adjusts.

- Subsequent adjustment caps. These caps limit the amount your interest rate can increase in one adjustment period after the initial adjustment. If the index rate increases but cant be fully applied in one period due to the cap, your rate may increase the next period, which is called carryover.

- Lifetime caps. These caps limit the amount your interest rate can increase over the life of your loan. Nearly all ARMs have a lifetime cap, according to the Consumer Financial Protection Bureau .

- Payment caps. These limit the amount your monthly payment can increase at each adjustment.

Economic indexes

An index is a benchmark variable rate thats used to establish the interest rate of an ARM mortgage. Indices change based on economic conditions. The three most common indices used for ARM mortgage rates are:

- One-year constant-maturity Treasury securities

- The Cost of Funds Index

- London Interbank Offered Rate

Also Check: Is The Student Loan Forgiveness Program Legit