Our Picks For Auto Financing In Canada

As mentioned above, there are three ways to get a car loan in Canada and dozens of lenders. Finding the right one for you can be tricky, which is why we are sharing our picks for the best car loans given the current car loan rates in Canada. Even if you are struggling with your credit score, our suggestions below provide options for everyone.

S To Compare Car Loans

A good thing to do, is to write each car loan offer down to do a side-by-side comparison. Always start by asking each lender who has quoted you for the total amount to repay.

This is a really quick way to see what car loan is the lowest cost overall.

Here are 5 things you need to compare when assessing which car loan option is best for you.

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Also Check: How Long Does Pmi Stay On Fha Loan

Penfed Credit Union: Top Credit Union

Starting APR:0.99% for new vehicles, 1.99% for used vehiclesLoan amounts:$500 to $100,000Loan terms: 36 to 84 monthsAvailability:50 statesMinimum credit score:610

Pentagon Federal Credit Union, or PenFed, is a military credit union that offers some of the best auto loan rates on the market. We named it Top Credit Union for auto loans because of its availability and fantastic rates.

While PenFed is primarily for military members and their families, it is also open to people who work for certain government agencies and nonprofit organizations. Even if you dont fall into any of these groups, you can join by making a donation to an approved charity.

At 0.99%, PenFeds starting APR for new vehicles is the lowest of any of the auto loan providers we researched. To get that rate, however, youll need to buy a new car through PenFeds car buying service. If you shop for a car on your own, the APR starts at 1.79%. Like with most credit unions, PenFed members are eligible for special deals, such as discounts and reimbursements for shopping at partner dealerships.

However, qualifying for a PenFed auto loan might be hard for some. The credit union only accepts borrowers with credit scores of 610 or higher. In addition, PenFed has a steep $29 charge for late loan payments.

Strategies For Digging Out Of Debt

2. Test drive, test drive, test drive.

These days many of us like to research things we buy online. And that’s good. But you also need to get your hands off the laptop or smartphone and onto some steering wheels or you’ll waste a lot of time researching vehicles that you won’t like in the end.

Dianne Whitmire sells cars at a Toyota dealership near Los Angeles. She says she constantly sees people who spend hours and hours online researching a car, finding the best price, all the other information. They call her 10 times. But when they finally show up to drive the car, they say, “I didn’t realize this seat was this way. This is not the model I want.”

Whitmire says you need to be a bit more old school about things and actually drive a bunch of cars. “I’ve been doing this for 40 years,” she says. “It used to be that people would go to a dealership and drive around and figure out what car they actually wanted, what their choices were.”

She suggests driving cars that are within your budget so you aren’t seduced by what you can’t afford. This means you want to find salespeople who are OK showing you a bunch of cars and not being too pushy or trying to upsell you into a pricier model.

“That person who says, ‘What about right now, that car right out there right now? What would it take?'” repeatedly trying to sell you a car that very day she says that’s probably a sign you’ve got the wrong salesperson.

Read Also: Fha Title 1 Loan Rates

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

How Do I Calculate Car Loan Interest

A car loans interest rate depends on the amount it costs the lender to borrow money and how risky a borrowers profile is. Interest rates increase as a loan gets longer. Higher monthly payments can save you money in the long run if it means a shorter loan.

Use HelloSafe’s car loan calculator to estimate monthly payments and loan amortization.

Also Check: Usaa Used Car Refinance Rates

How To Get The Best Auto Loan Rates

There are a few different ways to save money and find the best auto loan rates. First of all, if saving money is your goal, you might look into purchasing a used or certified pre-owned car instead of a new one. A two- or three-year-old model will be significantly cheaper than a brand-new car. Even if your APR is 1 to 2% higher, you can still save money this way.

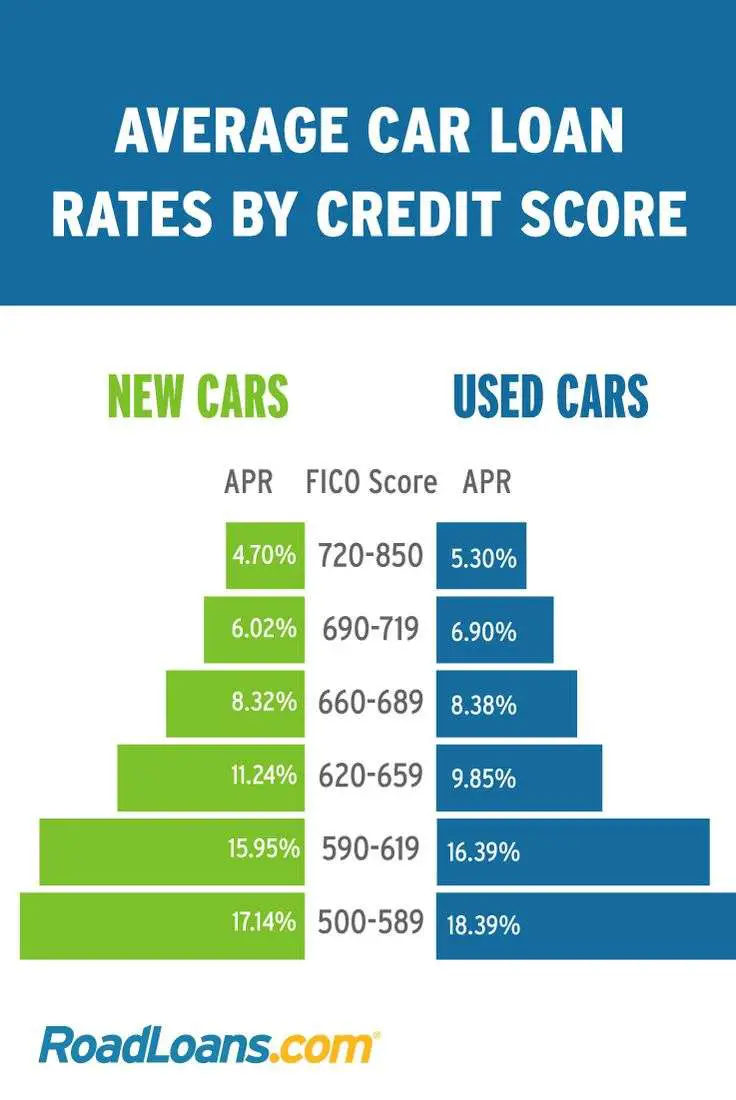

You can also do a few things to get a lower interest rate. For example, you can raise your credit score over a few months to a year if you work hard at it. Even 20 or 30 points can move you up a bracket and make a big difference in your auto loan options. You can also make a larger down payment to reduce your APR.

If your credit score isnt quite as high as youd like, you can also see if a family member with an excellent score can cosign on your loan. You can use their good credit to get the best auto loan rates. If you go this route, make sure youll be able to make your monthly payments, because if you dont, both of your credit scores will take a hit.

On a related note, if you purchase an extended auto warranty through a dealership, the cost can often be rolled into your monthly car payment. However, that will increase your loan amount and the total interest you pay. It can be a better idea to purchase a standalone vehicle service contract a bit later on if you want to save money and keep your car protected.

What Minimum Credit Score Is Required For A Car Loan

Most buyers with a score of 660 and sufficient income can easily get approved for a car loan from a traditional bank or credit union.

There is, however, no explicit rule about what score is required for a car loan. Beyond credit, lenders also evaluate loan applications on their employment history, income, the value of the car, and more. Below that 660 score threshold, alternative lenders can be an attractive option. They offer more flexible standards, albeit at less favourable rates.

Want to see what kind of car loan you can qualify for? Use the comparison tool below:

Compare current car loan interest rates!

You May Like: Auto Calculator Usaa

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

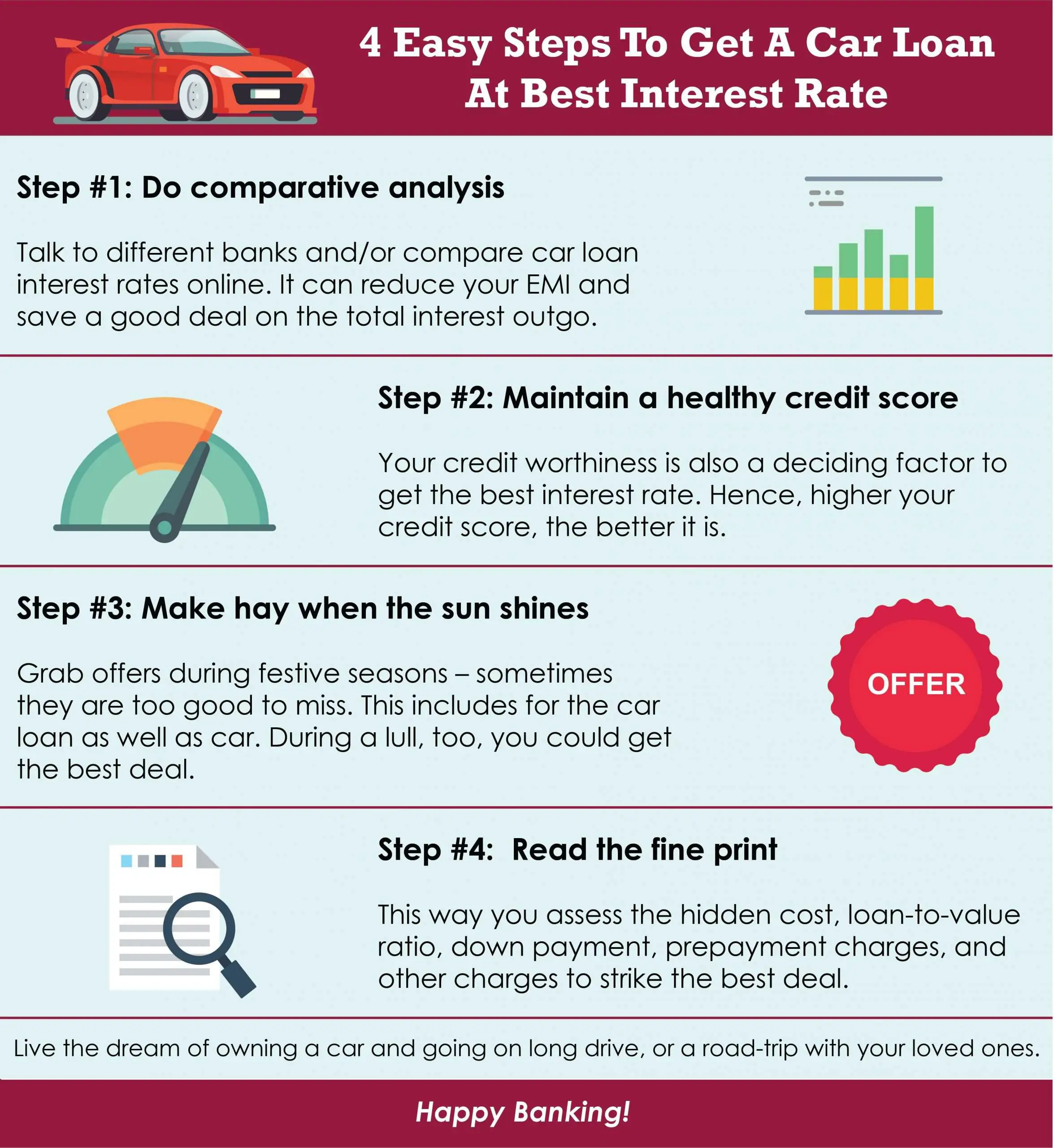

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Factors That Affect Your Car Loan Rate

Similar togetting a mortgage in Canada, lenders will assess you on various factors. These include your credit score, income, loan characteristics, and the asset in question. In this scenario, the secured asset is your car. This section will dive into these factors to provide a deep understanding of how your car loan rate is calculated.

| Factor |

|---|

| Larger down payments will decrease your interest rate. |

Read Also: Typical Student Loan Debt

Car Loan Application Checklist

You can expedite your car loan application by getting your finances in order and by being ready to provide any required documentation.

Proof of Employment: Most lenders want to see that you are employed and earning enough income to cover your car payments. Copies of your bank statements, pay stubs, or notice of assessment should be adequate. Some lenders also accept government assistance or benefits.

: Your 3-digit credit score is a measure of your creditworthiness. If you are not sure what your credit score is, you can check it for free here.

Your credit report also details how you have managed your finances over time. Typically, lenders want to see your debt-to-income ratio, payment history, and account balance. You can improve your credit score by paying bills on time.

Bank Details: You will need to show that you have a bank account in Canada. A void cheque to set up your monthly payment is typical.

Drivers License and Proof of Residence: A government-issued ID such as your drivers license is used to confirm your province of residence and address. Other documents that may be requested include your utility bills.

Vehicle Information: Duh! Of course, you need to know the type, make, and purchase price of the vehicle you want.

Proof of Car Insurance: Before driving off the lot, you may have to show you have purchased car insurance.

Whats A Good Car Loan Interest Rate

So, what is a good car loan rate today? According to the National Credit Union Administration , the average 60-month new car loan from a credit union has an interest rate of 3.09%. From a bank, the average rate is 4.81%. So, if you find these rates or better, you know youre getting a fair rate on your car loan.

Recommended Reading: Usaa Auto Refinance Reviews

How Do I Get A Car Loan For A Pre

Financing exists for used cars and trucks sold by a dealership or by private sellers. Dealership or their banking partner may offer them. They resemble a loan for a new vehicle. If you buy a used car in a private sale, your lender a traditional car loan may not be available. In this instance, a personal loan is an option. Typically unsecured by the vehicle itself, the interest rate on a personal loan for a used car will be higher than a traditional car loan for a new one.

Considering buying a used car with a personal loan? See Safes guide to personal loans to learn more.

Best Credit Union For Auto Loans: Consumers Credit Union

Consumers Credit Union

- As low as 2.24%

- Minimum loan amount: None

-

No minimum or maximum loan amount

-

Offers new, used, and refinance loans

-

Offers transparent rates and terms

-

Lowest rates require excellent credit

-

Membership in credit union is required

Consumers Credit Union offers auto loan rates to its members as low as 2.24% for new car loans up to 60 months. Like other credit unions, it requires membership, but it’s easy to join. You can become a member by paying a one-time $5 membership fee. There are no geographic or employer requirements.

CCU doesn’t have a minimum or maximum loan amount. Your loan is approved based on your credit score, credit report, and vehicle information. There’s also no minimum loan termyou submit a request based on what you need.

Generally, borrowers with excellent credit will qualify for the lowest rates from Consumers Credit Union. But even members who have less than excellent credit have access to discounts. There’s a 0.5% discount available for those who autopay from a CCU account. The discount falls to 0.25% for those who make automatic payments from an outside financial institution.

Read Also: How To Get Mlo License California

How Do You Transfer A Car Loan To Another Person

Unfortunately, it is not always possible to transfer a loan to someone else. As each lender has different conditions, it is best to check the terms and conditions of your current contract.

Depending on the length of the loan and the vehicles age, it is possible to owe more than the car is worth on the resale market. A bank is unlikely to sign a new loan agreement against a depreciated vehicle.

What Are The Disadvantages Of A Car Loan

- Car loans can come with various fees. For example, there may be establishment fees, service fees, late payment fees, extra repayment fees and early repayment fees.

- You must make your repayments or your lender could repossess your car or take you to court .

- You will pay more than just the principal cost of a car if you take out a car loan. Youll also usually need to pay interest, and this can add to the total cost of purchasing a car overall.

- If you take out a car loan and do not consistently make the repayments on time, there may be a negative effect overall on your . This may, in turn, impact how lenders perceive you as a borrower for future requests for credit. If you have a low credit score, it can impact the interest rate you pay on personal and car loans.

Recommended Reading: How Long For Prosper Loan Approval

Best Bank For Auto Loans: Bank Of America

Bank of America

- As low as 2.14%

- Minimum loan amount: $7,500

Bank of America auto loans come with the backing of a major financial institution. Low rates and a big selection of loan options make it a major competitor in the auto loan landscape. In J.D. Power’s 2020 Consumer Financing Satisfaction Study, which deals with auto loans, Bank of America ranked seventh out of 12 in its segment and scored equal to the average.

-

Offers new, used, and refinance auto loans

-

Transparent rates and terms online

-

Well-known financial institution

-

Restrictions on which vehicles it will finance

-

High minimum loan amount

Bank of America is a large financial institution offering a number of auto loan options, including new, used, refinance, lease buyout, and private party loans.

For the most creditworthy borrowers, APRs start at 2.14% for new vehicles. Used vehicle loans start at 2.34% APR, while refinances start at 3.14% APR. Customers of the bank who are Preferred Rewards members can get up to a 0.5% discount on their rate.

BofA provides a no-fee online application that it claims can offer a decision within 60 seconds. You can choose from a 48-, 60-, or 72-month term online, but there are additional options ranging from 12 to 75 months if you complete the application process at a branch or over the phone.

Best Overall: Penfed Credit Union

PenFed Credit Union

- As low as 0.99%

- Minimum loan amount: $500

PenFed Credit Union provides some of the best rates available. It also has flexible loan amounts and a number of auto loan options for members. Even though membership is required, a disadvantage for some, PenFed makes the requirements to join fairly straightforward.

-

Offers new, used, and refinance loans

-

Loan amounts from $500 to $100,000

-

Provides rate discounts for using its car buying service

-

Borrow up to 125% on new and used vehicles

-

High minimum loan amount for longer terms

-

Excellent credit history required for lowest rates

-

Membership in the credit union is required

Our top pick for auto loan rates, PenFed Credit Union, offers some of the lowest rates available.

At PenFed, rates for 36-month refinance loans start as low as 1.79%. Deep discounts are available for members who use the credit union’s car buying service, with rates starting as low as 0.99% annual percentage rate for a new car and 1.99% APR for a used vehicle.

You’ll have to become a member of the credit union, but the requirements to join are fairly easy to meet. Car loans from PenFed start as low as $500 and move up to $100,000, a wide range that beats out many of the lenders we surveyed.

You May Like: How Long Before Sba Loan Is Approved