Documents Needed For A Mortgage Application

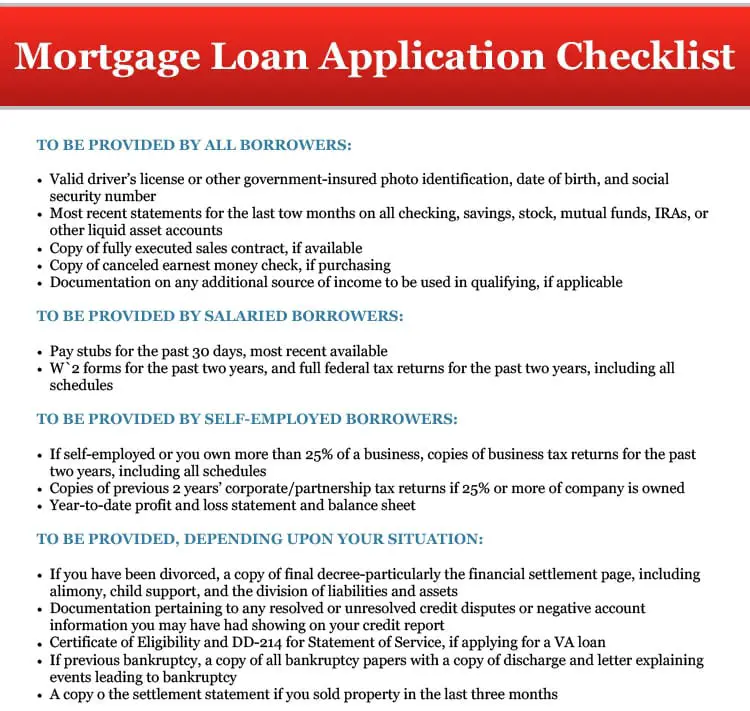

Unlike the prequalification process, there are some standard documents youll need to submit for a mortgage preapproval. Most of these are standard for all borrowers. However, other documents may be required depending on the type of loan you want to get, the type of residence you wish to buy and the kind of work you do.

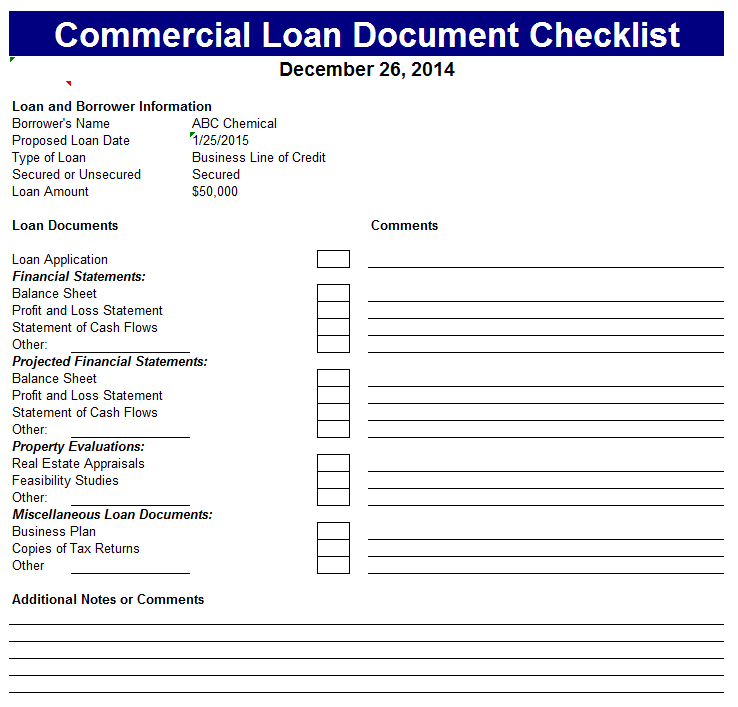

Checklist Of Documents Youll Need For A Mortgage

Through December 31, 2023, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’re applying for a home loan, your mortgage lender will want to take a deep dive into your financial life. This is to ensure that you meet all of their underwriting guidelines and are in the position to easily afford your new mortgage payment. Throughout the approval process, you can expect to be asked for documents that substantiate different aspects of your income, work status, expenses and more. It’s little wonder that it can take up to 60 days to complete.

Getting your paperwork organized in advance is a great way to streamline the process and improve your odds of getting approved. Here we take a closer look at the supporting documents you’ll need if completing the uniform residential loan application . It’s the form most lenders use to determine a borrower’s mortgage eligibility.

Next Steps: Can You Afford To Buy A House

Your lenders goal is to assess you as a borrower and ensure you can make your payments on time.

If youre thinking about a home purchase in the near future, these are some good questions to ask yourself to prepare for the home-buying process.

- How much down payment can you afford? A higher down payment is often a good sign for the lender about your finances.

- What is your debt-to-income ratio? Youll likely need to keep this number below 43%.

- What monthly mortgage payment can you comfortably afford in your budget?

- Are you prepared for closing costs, such as an appraisal or prepaid property taxes?

Recommended Reading: Is Parent Plus Loan Interest Tax Deductible

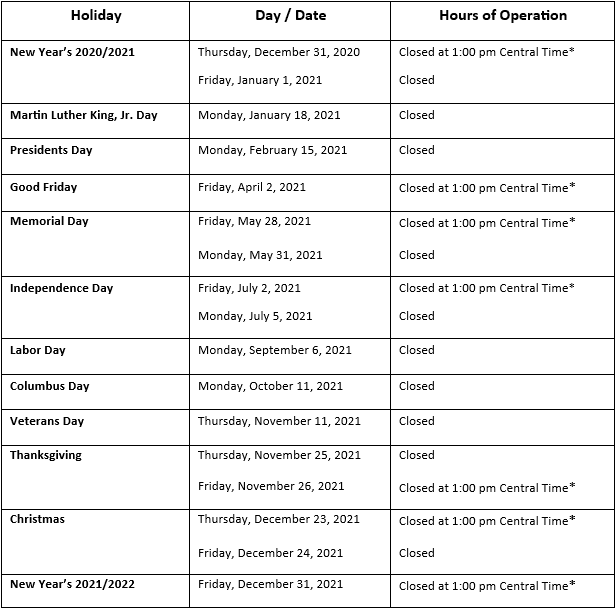

Documents Youll Need For Nonconventional Loans

The documents listed above are typically required for both conventional and nonconventional loans, including FHA loans and USDA loans. However, some nonconventional loans may require additional documents for the mortgage process.

For example, since only certain people may qualify for the VA loan , youll need to provide further documentation to verify your eligibility. Depending on the borrower, such required forms may include:

- DD Form 214: This verifies your military discharge, retirement or separation and is required for veterans. Surviving spouses must provide their spouses DD Form 214, along with their marriage license and spouse’s death certificate.

- Retirement Points Statement : This form confirms the number of credible years of service in the military, including attending drills and going through training. This is needed for discharged members of the Army National Guard.

- Statement of Service: A statement of service proves active military status for active-duty service members or current National Guard or Reserve members. It must be printed on official military letterhead and include the service members full name, date of birth, Social Security number, entry date of duty and time lost. It may also include credible years of service, date of activation, orders activated, training status and the name of the commander providing this information.

The Bottom Line: Knowing What You Need For A Mortgage Preapproval Can Help Speed Up The Process

A lender wants to make sure that youll be able to pay back your loan and arent too much of a risk to lend to. In order to do this, they will need to verify your income, assets and debt. To ensure this process goes smoothly, we recommend preparing all of these documents before starting the home buying process. By ensuring that you have all the information required by your lender, you can quickly progress to the next step in your homeownership journey.

If you have more questions about getting mortgage approval, contact a Home Loan Expert today.

Get approved for a mortgage.

Find out how much you can qualify for.

Also Check: What Is American Web Loan

List Of Kyc Documents For Home Loan Application

Some of the usual documents admitted as KYC are mentioned below:

- Passbook or Bank Statement with address

Besides the ones mentioned above, the banks have the right to ask for any document they deem necessary to the loan sanctioning and verification process.

Statement Of Savings Or Investments

This document proves that the funds you use for your down payment are liquid . The statement must be less than 90 days old and list the account holder, account number, type of account, and current balance. If you are selling stocks in a taxable account, keep in mind thecapital gains taxyou will need to pay at the end of the tax year.

You May Like: Credit Union Private Party Auto Loan

Checklist Of Loan Against Property Documents Required

For Salaried Applicants:

- Proof of identification :

- Address proof :

- Utility bill less than 2 months old

- Letter from a recognized public authority verifying the customers residence address

- Bank passbook or Bank account statement

- Residence ownership proof :

- Property documents

- Proof of income :

- Certified letter from Employer

- Proof of job continuity :

- Current job appointment letter

- Current employment certificate

- Experience certificate

- Bank statement: Last 6 months bank statements of salary account

- Existing loans: In case of any existing loan, need to submit sanction letter, payment track record

- Investment proof : fixed deposit, fixed assets, shares, etc.

- Copies of all property documents: Sales deed/copy of Agreement, share certificate , latest maintenance bill

- Advance processing cheque: to process loan documents for sanction

For self-employed Individual/Businessman:

Find The Perfect Loan For Your Unique Needs

Every home buyers financial situation is different, so your mortgage should be tailored to fit. But with so many types of mortgages, how do you know which one is best for you?

Conventional mortgages are popular options for those with good credit. They generally have fewer restrictions than government-backed loans, but theyre not the only option. Federal Housing Administration loans offer lower credit and down payment requirements for qualified home buyers. If youre a Service member, Veteran or eligible surviving spouse, a Veterans Affairs loan could be good option for you.

There are plenty of other options, including Adjustable Rate Mortgages and Jumbo loans. Compare mortgage options to learn more on your own, or contact a mortgage loan officer to help you determine the best loan to meet your specific needs.

Also Check: How To Check Credit Score For Home Loan

Documents Youll Need If Youre Self

If youre self-employed or own a business, youll also be required to provide your tax documents and business returns for the past 1 to 3 years, depending on your lenders requirements.

Youll also need to show your year-to-date audited Profit and Loss statement. If you cant obtain that statement, youll need to provide a year-to-date unaudited Profit and Loss statement, along with your most recent 60 days of business bank statements.

The 7 Types Of Documents You Need For A Refinance

Get these documents together before you start the refinance process to streamline your loan.

With so many people filing for refinance these days, it can take a lot longer than youd expect to have your refinance go through. You dont have control over how backed up your lender is with applications. However, you can speed things up on your end by gathering all of the appropriate documents before starting the refinance process.

Think back to your original mortgage and all of the documents that you had to gather. For a refinance, the documentation for your refinance is pretty much the same. The overall purpose is to prove different aspects of your finances to your lender.

All lenders have slightly different requirements, but you can bet that theyll probably ask for documents in the following seven categories:

1) Proof of income: Proving your income generally requires the following documents.

-

The last 30 days of pay stubs

-

Your current tax returns

-

Tax forms like W-2s and 1099s

2) Insurance: Youll probably need to produce documentation for two kinds of insurance:

-

Homeowners insurance, to verify that you have enough current coverage for your home.

-

Title insurance, to help your lender to check the taxes, the names on the title, and the legal description of the property.

3) Credit information: Youll need a recent credit score and credit reports.

-

Your current mortgage

Recommended Reading: Bofa Home Loan Navigator

Recommended Reading: Loan Direct Lender Bad Credit

Documents Required For Mortgage Preapproval

If youre obtaining the recommended mortgage preapproval, your lender wont require any property documentation. Thats because, at preapproval, you havent yet entered an agreement to purchase a specific home, your lender is simply qualifying you based on your income and your creditworthiness. When you do find a house to purchase, thats when youll return to your lender with the purchase and sale agreement, MLS listing, etc.

Commonly Asked Documents For Lenders

After applying for your mortgage, there are a few documents that you need to provide before you can be approved. The documents that your lender requests ensure that you will be able to pay off this mortgage. With every mortgage and lender, there will be some variation of what is needed document-wise. Yet, the following are a few of the primary documents that most lenders will ask for.

Income

Pay Stub

One of the documents that are needed to validate your income is a pay stub. The lender will require a recent pay stub from your employment. This will provide them with valid proof of what you are making every pay period. In addition, they can establish what mortgage you can afford based on this income.

Letter of Employment

Another item needed for your income is a letter of employment. This letter offers information on the company you work for, how long you have been employed there, and how much you make. Depending on your employment and the lender, they may only require the employment letter and not a pay stub.

T1 General/T4

These documents are usually needed for income verification for a two-year average or new to your job. The T1 general or T4 will show precisely how much your salary is and what you made in the previous year. It is normal to notice slight differences in years, depending on if you worked more or less. The lender will calculate an average from the two numbers, which will become your income amount.

Notice of Assessment

DOWN PAYMENT

Bank Statements

Gift Letter

Read Also: Personal Loan Against Income Tax Return

Mortgage Application Documents For Self

Self-employed consumers have more complicated profiles, and documents required for a mortgage may be more extensive. These are the people that so-called “lite doc” loans or “stated income” loans were originally created to serve. The idea was to cut onerous paperwork, while still establishing that the borrower has enough cash and income through alternative methods. Stated income loans are no longer legal.

Today, traditional lending programs require income tax forms to verify income. However, other programs use bank statements to determine income for self-employed applicants. Here are the requirements you may face as a self-employed borrower.

Underwriters use a complicated form to adjust self-employment income, adding back deductions for items such as depreciation or depletion, because they don’t come out of your bank account, and subtracting expenses that were not deducted on your tax returns, for instance the 50 percent of business meals that you did not get to deduct on taxes are subtracted from your taxable income because you did spend the money.

Helpful Tips To Ensure A Smooth Loan Process

Before we get into all the documents that youll need when you apply for a home loan, here are some tips to help make sure that the loan process is a smooth and streamlined one:

- All documents can be uploaded through our Secure Inbox

- Send copies or PDFs of actual statements and documents rather than screen shots, overview, or photos.

- Numbered pages require ALL numbered pages on statements, even if blank.

- Tax returns require all federal schedules and please sign and date page 2 of your 1040s if not already.

- Uploading all at once is much easier to execute the process.

Also Check: Cc Connect Loan Payment Login

Documents Needed For A Mortgage In Winfield Fl

It is easy to feel a bit overwhelmed by the number of documents you need to get approved for a mortgage in Winfield, FL. Fortunately, knowing the documentation you need ahead of time can help you get prepared, whether you are buying a home or refinancing a mortgage. Summit Funding will work with you and your lender to make the application process as easy as it can be.

Throughout the loan process, you will need to provide many types of documents to your lender such as information about your bank account, employment history, credit history, and more which is used to assess your risk as a borrower.

Read Also: Reverse Mortgage Mobile Home

Documents Needed For Mortgage Preapproval

Documents needed for a mortgage preapproval may include various financial statements, tax returns, and more so that your lender knows the limits of your budget. It also indicates to them your reliability as a borrower.

Here are some of the documents you should prepare if you want a mortgage preapproval:

Also Check: What Banks Have The Best Auto Loan Rates

Documents You’ll Likely Need

For all borrowers listed on application:

- Recent pay stubs

- W-2 forms from the past two years

- If self-employed:

- Year-to-date profit and loss statement

- Documents to show unpaid accounts receivable

- 1099 forms from past two years

- Bank statements for all your checking and savings accounts

- Statements for all investment accounts, including:

- Accumulated cash value from life insurance, if applicable

- Down payment gift letters, if applicable

- Alimony and child support, if applicable

- If you have income from a rental property:

- Documentation of rental income

- Property appraisal report

Mortgage Loan Documents Checklist

Its been well documented that buying a home is one of the most stressful things Canadians will ever do. There are so many details choosing the perfect location, finding a home that meets your needs, negotiating the purchase, dealing with the entire moving process, and last, but not least, getting approved for mortgage financing.

Mortgage financing can be one of the most difficult aspects of buying a home, in part because there are so many documents required by your lender before your approval can be finalized. Following is a list of mortgage loan documents to reference to make sure youre completely prepared when the time comes.

Read Also: Proof Of Income For Car Loan

The Basis Of Mortgage Application

- Your income lenders will look at your annual income, bonuses and if you have overtime into account. If you are planning on renting out a spare room, they may also factor it in.

- Outstanding loans if you availed of other loans, it may lessen the value of the money you can borrow or will not get approved.

- Savings to show that you can pay the deposits and other expenses

- to show that you are a good creditor and made on time repayments.

As stated before, many lenders will give you approval in principle which means that the lender approves you for a mortgage based on the details you have provided to them. Make sure to keep all the copies of documentation and correspondence from your lender in a safe place.

Minimum Mortgage Application Documents For Wage Earners

If you’re a full-time W-2 employee who does not earn commission or bonus income, you may need just a few documents – enough to prove that you have predictable and sufficient income and funds to close. In this case, you supply these things:

It’s not uncommon to be asked for the most recent two pay stubs, or bank statements covering a three month period. If you are an ordinary W-2 wage earner with a couple of years on the job, you may just need a bank statement and a pay stub. And you might be able to text it to your lender. Probably a lot easier than you imaged.

Also Check: Rate For Home Equity Loan

A Final Mortgage Loan Documents Checklist

As you locate and organize your documents, cross-check your stack of paperwork against this checklist to make sure your lender will have all the information they need:

- 2 years of tax returns

- W-2s from the past 2 years

- Recent pay stubs

- Proof of gift funds and gift letters

- Documents for the sale of assets

- Proof of outstanding, long-term debts

- Letters of explanation for credit mishaps

- Documented rent payments for current renters

Of course, youll also need to assemble your actual mortgage application, which will include additional information about your current financial standings and the real estate youre looking to purchase. Similar to other large purchases, your lender will likely verify your identity with a photo ID, so its a good idea to have one readily available with the rest of your documents.