How Is Fha Monthly Mortgage Insurance Calculated

FHA charges an upfront mortgage insurance premium equal to 1.75% of the loan amount. This can be rolled into your loan balance. It also charges an annual mortgage insurance premium, usually equal to 0.85% of your loan amount. Annual MIP is paid in monthly installments along with your mortgage payment.

How To Reduce Fha Mortgage Payments

If you purchased your home with an FHA loan before June 3, 2013, you may be able to drop your MIP when you reach 20% equity in your home. But mortgages originating after that date are held to the standard of either waiting 11 years for the MIP to come off, or not being able to drop it at all. In those cases, you may be able to reduce your mortgage payments with one of two types of refinances:

What Percentage Is Mortgage Insurance On Fha Loan

Asked by: Mr. Arnulfo Zemlak MD

Mortgage insurance is required on most loans when borrowers put down less than 20 percent. All FHA loans require the borrower to pay two mortgage insurance premiums: Upfront mortgage insurance premium: 1.75 percent of the loan amount, paid when the borrower gets the loan.

You May Like: What Is The Fha Loan Limit In Texas

Pmi: A Necessary Evil

Like many these days, I bought a home in an expensive coastal city, with expensive coastal listings and I only put 10% down instead of the standard 20%. I did this intentionally so Iâd be able to more easily afford remodeling the condo I bought.

Unfortunately, since that meant I had less than 20% equity in the home, I had to settle for PMI as well. This ended up costing $120 a month it didnât break the bank but it wasnât pleasant, either. I certainly wasnât the first with PMI, either. Itâs a necessary evil in cities like Seattle, San Francisco and New York with expensive housing and competitive markets. I wish I had known the techniques for avoiding PMI that I know now, but you live and learn. One thing is for certain: from the moment I started paying PMI I was wondering how to get rid of PMI insurance.

Donât Miss: Minimum Credit Score For Rv Loan

How Long Does Mip Last

Unfortunately, if you purchased or refinanced with an FHA loan on or after June 3, 2013 and you had a down payment of less than 10%, MIP lasts for the term of the loan. With down payments of 10% or more, you still have to pay MIP for 11 years.

If you havent purchased or refinanced with an FHA loan since June 3, 2013, the outlook is a little better. On a 15-year term, MIP is canceled when your LTV reaches 78%. For longer terms, the LTV requirement remains the same and you have to pay MIP for at least 5 years.

Theres one other way to stop paying these premiums if youre currently in an FHA loan. Assuming you meet the other qualification factors , you can refinance into a conventional loan and request mortgage insurance removal once you reach 20% equity in your home.

You May Like: Refinance Auto Usaa

Natural Value Increase Cancellation

If youre requesting removal of your PMI based on natural increases in your property value 2 5 years after your loan closes, both Fannie Mae and Freddie Mac require a new appraisal, and the LTV has to be 75% or less. If your removal request comes more than 5 years after your closing, the LTV can be 80% or less with a new appraisal. These requirements apply to insurance removal based on market value increases not related to home improvements.

On a multi-unit residence or investment property, you can cancel PMI on your own when LTV reaches 70% based on the original value with Fannie Mae. Freddie Mac requires 65% for cancellation. Keep in mind that if youre requesting removal based on home improvements from Fannie Mae, you must have had the loan for at least 2 years prior to requesting PMI removal on your investment property.

Mortgage Insurance Requirement For Fha Loans

All borrowers need to pay a mortgage insurance premium on their FHA loans. This is because FHA insures the lender against any losses that may occur due to foreclosure or default on the borrowers part.

In most cases, a borrower must pay a mortgage insurance premium , which is around 1.25% of the outstanding balance. The borrower will pay this fee for his entire FHA loan tenure, i.e., until he spends the whole loan amount to FHA.

However, there are exceptions, even in the case of MIP, where one can lessen their burden by refinancing their home with conventional Florida mortgage loans. For example, if the borrower has paid off 20% of his FHA loan, he can switch to a traditional loan for which MIP will not be required.

Once the borrower pays down 25% of the original principal amount, he is free from paying mortgage insurance premiums. As a result, some home buyers choose to refinance their loans after building enough equity to avoid paying higher premiums for FHA loans.

Recommended Reading: Usaa Auto Refinance Reviews

Consider A 10 Percent Down Payment

If you can afford it, consider putting 10% down. Although the minimum down payment for an FHA loan is 3.5%, a larger one could mean youll only pay MIP for 11 years and significantly reduce the overall cost of your home loan.

However, most people refinance out of FHA MIP into a conventional loan after a few years anyway. Few keep paying MIP until it drops off after year 11. So from a mortgage insurance perspective, it often doesnt make sense to make a large down payment on FHA.

If you cant afford a 10% down payment, dont let MIP put you off FHA loans. Its better to take the 3.5% down option and pay MIP while building equity than to delay homeownership and the associated wealth-building opportunities for several years. A smaller down payment can keep your emergency fund intact, too.

Is Mortgage Insurance Required On A Fha Loan

But there’s a catch: Borrowers must pay FHA mortgage insurance. This coverage protects the lender from a loss if you default on the loan. … All FHA loans require the borrower to pay two mortgage insurance premiums: Upfront mortgage insurance premium: 1.75 percent of the loan amount, paid when the borrower gets the loan.

Recommended Reading: Co-applicant In Home Loan

Estimating Rates For Private Mortgage Insurance

Many companies offer mortgage insurance. Their rates may differ slightly, and your lendernot youwill select the insurer. Nevertheless, you can get an idea of what rate you will pay by studying the mortgage insurance rate card. MGIC, Radian, Essent, National MI, United Guaranty, and Genworth are major private mortgage insurance providers.

Mortgage insurance rate cards can be confusing at first glance. Heres how to use them.

What Are The Property Requirements For An Fha Loan

Popular among first-time homebuyers but available to other consumers are home loans backed by the Federal Housing Administration . FHA loans are mortgages insured by the FHA and subsequently issued by an approved lender. These loans are geared toward low-to-moderate income borrowers.

An FHA loan requires a significantly lower down payment than a traditional mortgage and comes with lower credit score requirements. In 2020, you were able to borrow up to 96.5% of the value of a home with one of these loans, and you needed a credit score of just 580 to make a down payment of 3.5%. With a 10% down payment, you might get approved with a credit score between 500 and 579.

If youre financing a home purchase with an FHA loan, you might not be able to buy a particular property if it doesnt meet the requirements. The FHA has minimum property standards as a way to protect lenders.

Recommended Reading: How To Know How Much Mortgage I Can Afford

Read Also: Bayview Mortgage Modification

How To Avoid Fha Mortgage Insurance

If youre using an FHA loan program, you will pay mortgage insurance. All FHA loans involve mortgage insurance, either for the life of the loan or for a set number of years.

To avoid FHA mortgage insurance, youll have to use a different lending program. This could mean getting a conventional loan with a 20 percent down payment, but there are other options. One option is accepting an FHA loan and the MIP that it comes with, then refinancing into a non-FHA loan once youve built enough equity in your home.

If youre not willing or able to make a 20 percent down payment, another option is a lender-paid mortgage insurance loan. With this type of loan, the lender covers the PMI in exchange for a higher interest rate.

Yet another option is a piggyback loan. With this type of loan, you make a 10 percent down payment, then get a second mortgage to add another 10 percent to your down payment. You wind up with a 20 percent down payment overall, avoiding PMI, but youll have to repay two loans.

There are also some special programs that allow borrowers to make a low down payment without PMI. These range from VA loans to programs directly from major banks and lenders.

Conforming Loans With Private Mortgage Insurance

Conforming loans get their name because they meet or conform to Fannie Mae or Freddie Mac guidelines for the loan amount and the borrower’s creditworthiness.

Key Takeaways

Conforming Loan Insurer

A loan conforming to Fannie Mae or Freddie Mac’s standards is not insured by either Fannie or Freddie. PMI is not government insured it’s backed by private companies.

PMI Cost for Conforming Loans

PMI is generally cheaper than the mortgage insurance premiums on FHA loans. How much a borrower will pay for PMI depends on the loan type, down payment percentage, property type, location and other factors.

You May Like: Does Usaa Do Car Loans

Determine Your Loan Amount

The FHA caps the amount you can borrow based on your geographic area. FHA loan limits depend on home prices in a given county or area, which can vary widely and are subject to change each year. For example, you could borrow only up to $294,515 in low-cost areas of the country as of the time of publication, and up to $679,650 in high-cost areas, such as the San Francisco Bay Area. You can find your areaâs maximum loan amount by using HUDâs website search tool. The exact loan amount you qualify for depends on how much you can afford based on your debt and income. Maximum loan limits simply establish the highest amount you can borrow in a given area using an FHA loan.

Pmi Vs Guarantee Fees

Another mortgage option, a USDA loan, requires the borrower to pay a guarantee fee, which is similar to, but distinct from, mortgage insurance. USDA loans help reduce the cost for home buyers living in rural areas and in some suburban areas. As with FHA loans, rates are set by the government, but USDA rates are generally lower.

At this time, Rocket Mortgage® doesnt offer USDA loans.

Recommended Reading: Can You Use The Va Loan To Buy Land

Reduced Upfront And Monthly Mip For Certain Refinancing Homeowners

If you got your FHA loan prior to May 31, 2009, you can receive lower MIP rates via an FHA Streamline Refinance.

Eligible candidates receive annual MIP of 0.55% and reduced upfront MIP of 0.01% .

Thats a savings of $3,480 upfront and $50 per month on a $200,000 loan.

Youd need a perfect payment history for the past three months to qualify.

Fha Mortgage Insurance Costs

There are two components to FHA mortgage insurance. First, theres an upfront mortgage insurance premium of 1.75% of the total loan amount. So if you borrowed $150,000, youd be required to pay an upfront fee of $2,625.

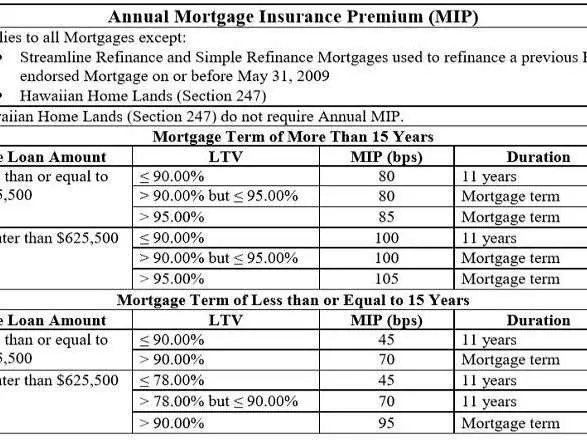

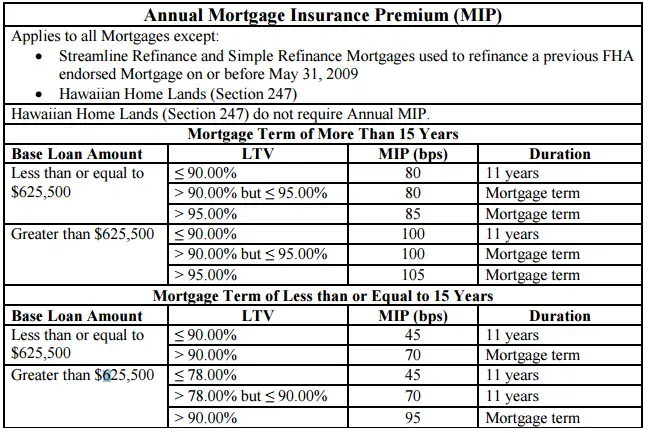

Youre also required to pay an annual mortgage insurance premium of 0.45% to 1.05% of the loan amount, depending on a few factors.

Read Also: Is The Student Loan Forgiveness Program Legit

Current Fha Mortgage Insurance Rates

FHA loans that have terms of 15 years or less will qualify for reduced MIP, which is as low as 0.45% annually. Furthermore, theres the Upfront MIP thats required for FHA loans that are equal to 1.75% of the loan amount. If you refinance into another FHA loan within 3 years, you may be entitled to a partial FHA MIP refund.

Lower Your Fha Mortgage Insurance Rate

Not everyone is eligible for a conventional refinance, and thats ok. There may be a way to lower your FHA mortgage insurance cost even if you cant remove it altogether.

You may have a higher rate of MIP than what is available today because these rates have decreased since 2015.

Here is a history of FHA MIP rates charged by the Federal Housing Administration:

- Prior to January 2008: 0.50% annual MIP

If you received a loan in January 2013, for instance, you could refinance into todays lower MIP and save $40 per month per $100,000 borrowed. Plus, you may save even more by getting a lower mortgage rate.

Keep in mind, though, that your new FHA loans MIP will become noncancelable. Thats because your new loan will originate after June 2013, when FHA MIP rules changed.

Don’t Miss: Do Lenders Verify Bank Statements

How Does Fha Mortgage Insurance Work

FHA loan mortgage insurance is charged at the beginning of your loan and then on an annual basis. But you dont have to pay that annual premium directly. Instead, the amount is divided up and evenly distributed across your 12 monthly payments. Say your loan amount is $300,000 and your MIP rate is 0.80%. Your annual premium would be $2,400. Divided over 12 months, that would add $200 to your monthly payment.

Pros And Cons Of Fha Mortgage Insurance

FHA loans come with higher mortgage insurance premiums than average, but they also have easier eligibility requirements for borrowers. Here are a few of the advantages and disadvantages of this type of mortgage.

Pros:

- Minimum credit score is just 500 to 580

- Competitive interest rates may balance extra cost

Cons:

- Must pay MIP both at closing and annually

- Must pay for the entire loan period if your down payment is less than 10%

Read Also: Mlo Endorsement To A License Is A Requirement Of

Refinancing Your Conventional Mortgage Into An Fha Mortgage

If you’re having trouble with your conventional loan, you can refinance it into an FHA loan. There are a few reasons someone would do this, and they are listed below.

- Fixed Rate Terms. One of the most common FHA loans is the 30-year fixed-rate mortgage. If a person refinances from a traditional mortgage to the FHA program, they won’t have to worry about their interest rates fluctuating. The fixed-rate mortgage will lock an interest rate in. and this can save the borrower money over the life of the loan.

- Underwriting. The FHA offers much more flexible underwriting than traditional mortgages. This means that there is more flexibility when it comes to things like credit history, credit score, or missed payments. The FHA guidelines are commonly called common sense guidelines. For example, if a person has credit issues but they have higher household income or increased assets, the FHA will concentrate more on those factors than their credit history.

Canceling Mip On Fha Loans

Depending on when you applied, FHA guidelines may allow for MIP to be canceled if you:

- Applied between January 2001 and June 2013: Please contact us when you meet all three of the following conditions, and we will review your loan for MIP removal eligibility:

- Applied after June 2013: If your original loan amount was less than or equal to 90% LTV, MIP will be removed after 11 years.

- Closedbetween July 1991 and December 2000

- Closed before December 28, 2005 on a condo or rehabilitation loan

- Applied after June 2013 and your loan amount was greater than 90% LTV

Also Check: How Much Car Can I Afford Based On Income

Refinance To Remove Fha Mip

Most FHA homeowners today have a loan with the following characteristics:

- Opened on or after June 3, 2013

- Less than 10% original down payment

- 30year loan

These FHA mortgage loans are not eligible for automatic mortgage insurance cancellation.

To stop paying mortgage insurance premiums youd need to refinance out of your FHA loan.

The good news is that there are no restrictions on refinancing out of FHA into a conventional loan with no PMI. Plus, there are never any prepayment penalties on FHA loans, so you can refinance any time you want.

You will need about 20% home equity to do so. To find your home equity, subtract your current mortgage balance from the value of your home.

You also need a credit score of at least 620 to refinance into a conventional loan with most lenders. The higher your credit score, the more you could save on your monthly mortgage payments.