Is A Manufactured Home A Good Choice

A manufactured home can be a good choice. It really comes down to your goals and priorities.

If youre worried about the homes value, research shows that a well-maintained mobile home on a foundation can appreciate at a similar rate as site-built houses. Additionally, manufactured homes must be built to strict HUD codes to ensure quality, so buyers can get a safe, well-built home by going this route.

And if your local real estate market is very competitive, buying a manufactured home can be a way to bypass the bidding wars and buy a brand-new, beautiful home with less stress.

How Long Is Seasoned Money For Mortgage

Seasoned funds are those that have been in the home buyers bank account for a period of time. Usually, funds that have been in your bank account for at least two months wont be questioned by your lender, because its seasoned money.

Fha 203k Loan Requirements

If you think you want to pursue a fixer-upper, you might be wondering…Who qualifies for a 203k loan?Here are the FHA 203K loan requirements:

- You can get an FHA 203 loan with a credit score as low as 500, but some lenders can set a higher minimum.

- Down payment: Like the standard FHA loan, you need at least 3.5% down. Credit scores below 580 require 10% down.

- Maximum loan amount: FHA limits vary by location, but are generally capped at $356,362. Unless youre in a high-cost county, then you may be able to borrow up to $822,375.

- Foreclosure: Generally, you must not have had a foreclosure in the past three years to qualify.

But rememberYoull need to apply with FHA 203k lenders, like us here at Good News Lending.

Did You Know?

Mortgage rates have hit all-time lows in recent months. Some people have been able to take advantage of the opportunity and secure a historically low rate. Since rates change all the time, give us a call at 901-651-9935 for an up-to-date rate quote.

Also Check: Usaa Car Loan Application

Equal Credit Opportunity Act

But there is a light at the end of the tunnel. As long as your 401k, pension, or Social Security benefits are scheduled to continue for over three years, getting an FHA loan can be a fairly straight forward process. In fact, your age or retirement status should not even be a factor in getting a loan as long as your finances fit into the FHA guidelines. The Equal Credit Opportunity Act has made it illegal for a lender to discriminate against age for any qualified borrower.

What Is Fha Mortgage Insurance

The FHA mortgage insurance premiums provide lenders with protection against any future losses in the event that a borrower defaults on the loan. The lenders are protected because the FHA will cover the FHA lenders losses in the event of a homeowners default. Loans must meet the requirements referenced above to qualify for insurance.

You May Like: Fha Limits Texas

Fha Minimum Credit Score: 500

FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

However, it’s important to bear in mind that while the FHA sets out guidelines for credit score minimums, FHA lenders may require higher minimum scores. FHA loans don’t come directly from the government the FHA insures them on behalf of the lender. Despite having that as backup, lenders often choose to minimize their risk by mandating higher credit minimums. This is one of the reasons why it’s smart to shop and compare FHA lenders. Not only might they have different qualifications, but you can also weigh different lenders’ rates and fees.

It’s worth noting that even with a lender who’s following FHA guidelines to the letter, you’ll get better terms if you have a higher credit score. A stronger credit score should also help you get a better FHA mortgage rate.

Why Do The Fha Property Requirements Exist

FHA loans are backed by the Federal Housing Administration , which is part of the U.S. Department of Housing and Urban Development .

These loans are designed to help low- to moderate-income folks on the path to homeownership. Borrowers with credit scores as low as 580 can qualify for FHA loans with just 3.5% down.

But because the government backs these mortgages, the FHA wants to make sure that borrowers are buying homes that are safe, livable, and will afford them good quality of life. They dont want low-income borrowers ending up with properties that are unsafe or that they cant afford to maintain.

Appraisals are required by lenders, but theyre good for you, too.

Recommended Reading: Capital One Auto Pre Qualify

How Much Will Fha Mortgage Insurance Cost

LTV Greater than 90% Mortgage Insurance Premiums must be paid until the end of the loan term, or 30 years, whichever occurs first.

LTV less than or equal to 90% Mortgage Insurance Premiums must be paid for 11 years or the end of the loan term, whichever comes first.

Mortgage Insurance Premium Base Rate Calculation

Loans less than or equal to $625,500

- < = 95% LTV 80 basis points

- > 95% LTV 85 basis points

Loans greater than $625,500

- < = 95% LTV 100 basis points

- > 95% LTV 105 basis points

Mortgage Insurance Calculation Example:

- Purchase Price = $315,000

- Loan to Value Ratio = 95.23%

- Result of example above = 85 basis points or .0085

- Mortgage Insurance Premium = = $2,550 annual or $212.50 per month

Fact : Fha Loans Arent Expensive

FHA loans can be more expensive, or less expensive, than other loan types. The longterm cost of an FHA loan depends on your loan size, your down payment, and your location.

The biggest cost of an FHA home loan is usually not its mortgage rate. In fact, FHA loans often have lower interest rates than comparable conventional mortgage rates via Fannie Mae and Freddie Mac.

The biggest cost is the FHA mortgage insurance.

FHA mortgage insurance premiums are payments made to the FHA to insure your loan against default. MIP is how the FHA collects dues to keep its program available to U.S homeowners at no cost to taxpayers.

You pay MIP in two parts:

- The first part is known as upfront MIP. You can pay this outofpocket as part of your closing costs, have a motivated home seller pay it for you, or wrap it into your new loan balance. Its up to you

- The second part comes due each year. Its your annual MIP. Your lender will split this annual payment into 12 installments and add one to each of your monthly mortgage payments

Annual MIP can range as high as 1.10% for highcost homes in areas such as Orange County, California Potomac, Maryland and New York City.

For most borrowers, MIP is between 0.45% and 0.85%, depending on your loan term and the loantovalue .

You May Like: How To Apply For Sss Loan

What Is The Purpose Of An Fha And Va Amendatory Clause

What Is An FHA And VA Amendatory Clause The purpose of an FHA And VA Amendatory Clause to alert home buyers, sellers, buyers realtor, and sellers realtor the rights of the home buyer in their rights to back out of a real estate purchase transaction in the event if the value comes in less than the purchase price.

Is Fha Addendum Required

According to industry sources, the FHA home loan program accounts for as many as 50% of the mortgages issued to home buyers. However, if the amendatory is not included within the sales contract, the parties must sign the amendatory form as an addendum to the sales contract if the buyer is obtaining a FHA loan.

Read Also: Loan Processor License California

An Fha Loan Is A Federally Insured Home Loan That Allows You To Make A Down Payment As Low As 35% If You Qualify

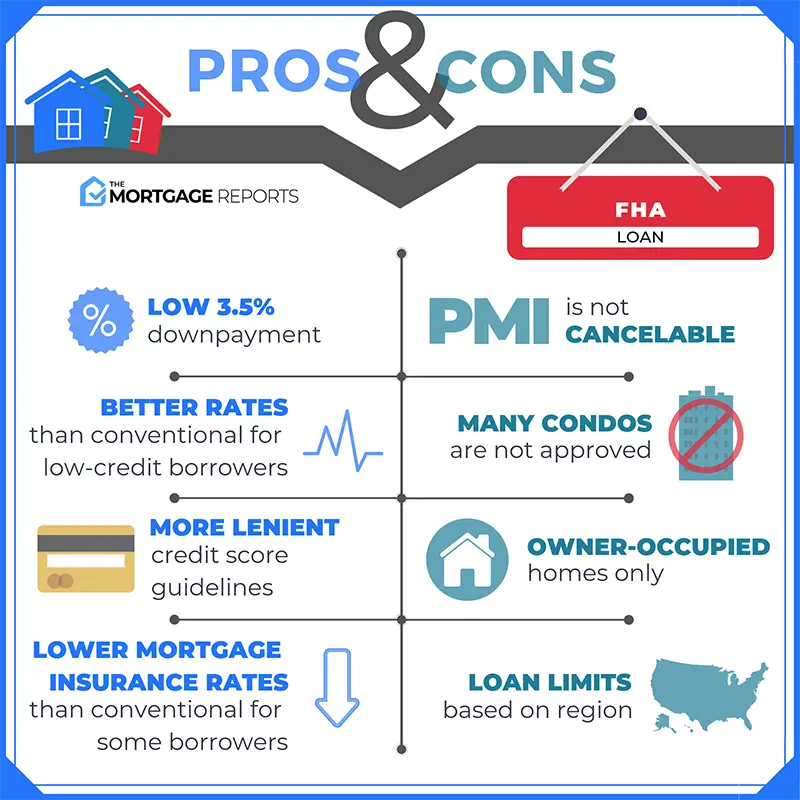

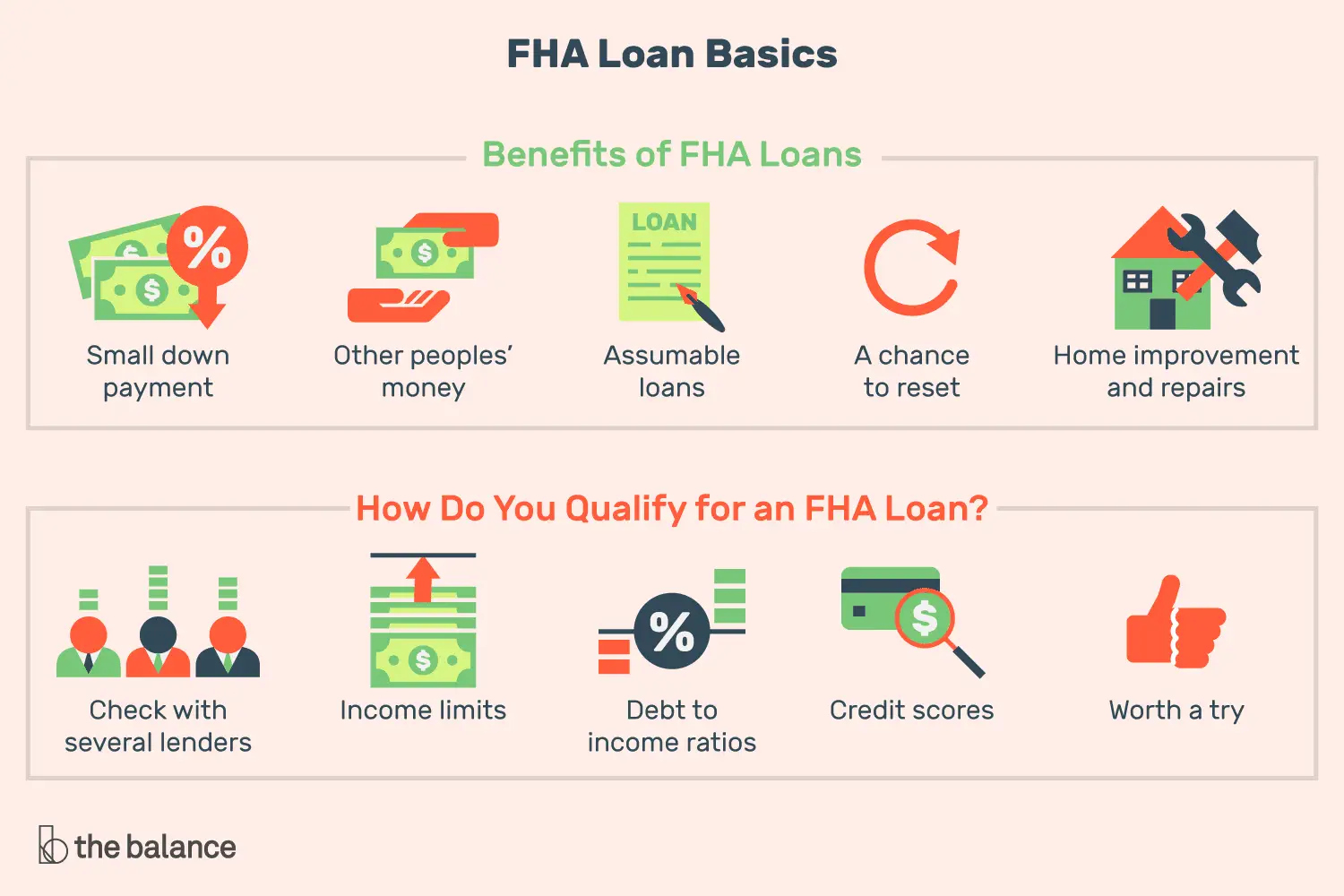

FHA loans can be helpful for first-time homebuyers, but you dont have to be a first-time buyer to qualify. They also may be a good option if you have less-than-perfect credit since they have an easier qualifying process than most conventional home loans.

But you should be aware that there are some downsides to FHA loans. The amount you can borrow is capped and if youre taking out an FHA loan to take advantage of the low down payment, youll have to buy mortgage insurance, which can make FHA loans more costly than some other types of mortgages.

Read on to learn more about FHA loans and how they work.

Can You Apply For An Fha Loan More Than Once

There’s good news and there’s bad news here: FHA loans aren’t limited to first-time home buyers, and there’s no restriction on how many times you can take out an FHA loan in your lifetime.

However, because these loans are for primary residences only, you generally can’t have more than one at a time. There are some exceptions, however, such as if you’re relocating for an employment-related reason or if you’re permanently vacating a jointly owned property .

Also Check: Fha Loan Refinance Calculator

Fha 203 Appraisal Requirements

Homes in the 203 loan program must be appraised and inspected by FHA-approved appraisers who use a specific FHA process. An FHA appraisal not only determines the homes value, but it determines if the property meets minimum property standards. These standards ensure that the property is structurally sound and livable and that it serves as adequate collateral for the loan.

Borrowers are responsible for the appraisal cost, which typically ranges from $300 to $700.

Heres a look at some of the FHA 203 appraisal requirements:

- Home must be a single real estate entity.

- Home must be accessible to vehicles.

- Property must be free of conditions that endanger safety or health of occupants.

- Home must have a safe drinking water supply.

- Foundation must be in good condition.

- Utilities must be in working order.

What Are Some Fha Loan Alternatives

If youre not sure if an FHA loan is right for you, there are a few other options to consider.

- Conventional loan A conventional loan means your mortgage isnt part of a government program. There are two main types of conventional loans: conforming and non-conforming. A conforming loan follows guidelines set by Fannie Mae and Freddie Mac such as maximum loan amounts. A non-conforming loan can have more variability on eligibility and other factors.

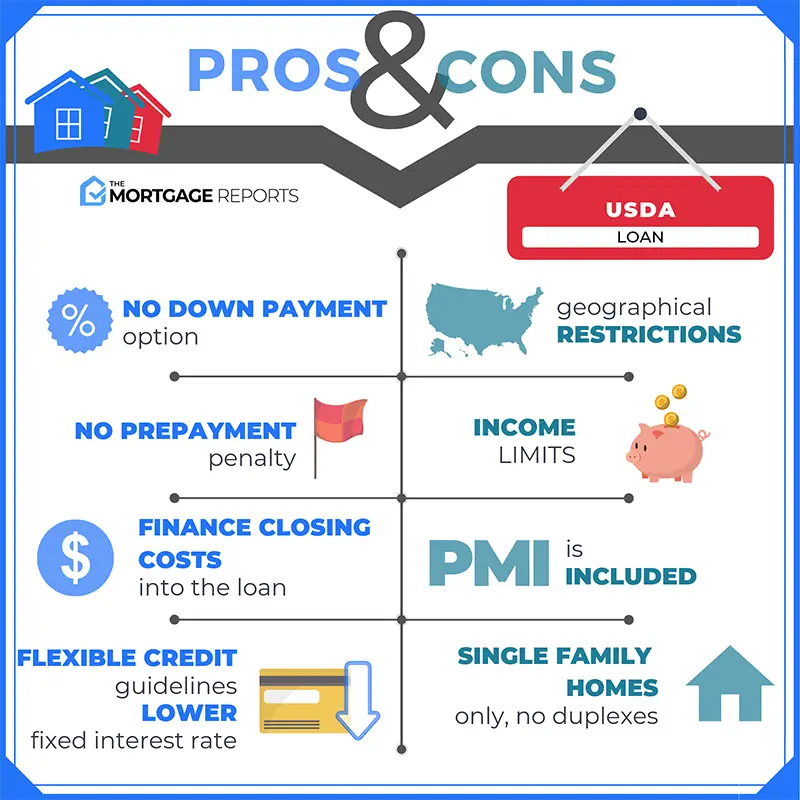

- USDA loan A USDA loan, also called a rural development loan, may be an option for people with low-to-moderate incomes who live in rural areas. They can be attractive because they offer zero down payments, but youll have to pay an upfront fee and mortgage insurance premiums.

- VA loanVA loans are made to eligible borrowers by private lenders but insured by the Department of Veteran Affairs. You may be able to make a low down payment . Youll probably have to pay an upfront fee at closing, but monthly mortgage insurance premiums arent required.

Recommended Reading: Usaa Car Loan Refinance Rates

Title I Vs Title Ii Fha Manufactured Home Loans

FHA manufactured home loans fall under two categories, Title I and Title II.

Title I loans can be used to purchase a manufactured home, a lot, or both a home and a lot. The repayment term of a Title I loan can be up to 20 years for a home or a home and a lot. If you get one for a lot only, the maximum term is 15 years.

There are also loan limits for Title I loans:

- $92,904 for a manufactured home and lot

- $69,678 for a home only

- $23,226 for a lot

Title II loans apply to all single-family home residences that meet FHA guidelines, including manufactured homes. These can offer financing terms up to 40 years and they are subject to the standard FHA loan limits.

The FHAs loan limits are pegged to 115% of the median home price in a given area, and theyre usually set by county. In 2022, Title II loan limits range from $420,680 to $970,800 for a single-family home, and there is no minimum required loan amount.

You can look up the limit for your area using the HUD search tool.

What Is The Fha Credit Score Requirement

Borrowers who are interested in an FHA mortgage can qualify for a mortgage with a . However, any borrower with a credit score that is less than 580 will need to put at least 10% down on their purchase or have 10 percent equity in a refinance and the rate will be higher. So, there is a benefit to doing whatever you can to improve your credit score. We can help you in this area as well.

Recommended Reading: Does Usaa Do Car Loans

Who Qualifies For An Fha Loan

Qualifying for an FHA loan is often easier than qualifying for a conventional loan because the credit requirements aren’t as strict. You need a FICO credit score of at least 580 to qualify for a 3.5% down payment. If your score is between 500 and 579, you can still qualify for an FHA loan with a 10% down payment from some lenders.

FHA loan qualifications are relatively straightforward, but lenders can impose their own minimums on credit scores. Borrowers pay private mortgage insurance every month, which usually has an annual cost of around 0.85% of the loan amount. The PMI is rolled into your monthly payment and protects the lender if the borrower defaults on the loan.

Once you have paid off enough of the loan that you owe 80% or less of the home’s value, you can refinance your FHA mortgage to a conventional mortgage and get rid of your PMI payment. For more information, read about how an FHA loan works.

You need a FICO credit score of at least 580 to qualify for a 3.5% down payment. If your score is between 500 and 579, you can still qualify for an FHA loan with a 10% down payment from some lenders.

Fha Loan Requirements Faq

What is an FHA loan?

An FHA loan is a home purchase and refinance loan just like a conventional mortgage. The main difference? FHA loans feature mortgage insurance from the Federal Housing Administration. This insurance shields lenders from losses in case the borrower defaults. With help from this insurance, borrowers with lower credit scores and higher existing debt payments can still qualify for lower interest rates.

Is FHA only for first-time home buyers?

No. Firsttime homebuyers as well as repeat homebuyers can get FHA loans. However, FHA loans are for first homes and not vacation homes or investment properties.

What are the qualifications for an FHA loan?

Qualifying for an FHA loan usually requires a credit score of at least 580, a 3.5 percent down payment, and a debttoincome ratio of 43 percent or less. Individual lenders have some leeway with these requirements. So if you get turned down with one lender, you may be approved by another.

What will disqualify you from an FHA loan?

A home purchase price above the FHAs loan limits for your area will disqualify your application. Buying an investment property or a vacation home will also exclude your loan. As for personal underwriting, a debttoincome ratio above 50 percent or a credit score below 500 would make getting approved almost impossible unless you added a coborrower who has better borrowing credentials.

How hard is it to get an FHA loan?Can I get an FHA loan without 2 years of employment?

You May Like: Usaa Used Car Loan Interest Rates

Fha Loans In Nc And Sc

Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas.

FHA loans, which are backed by the Federal Housing Administration , may help qualify for a home if you do not meet other requirements. Theyre ideal for individuals and families with low to moderate income and less than perfect credit scores.

What Is The Fha 203 Loan Process

To start the FHA 203K loan process, youll get pre-approved. Good News Lending makes this step a breeze. Well evaluate your credit score, credit history, income, debts and assets to come up with the amount that makes sense for you. This includes the homes purchase price and the cost to renovate it. Once you find a home, well work together every step of the way to complete the application and requirements to close on the home.Youll work with contractors to determine the improvements you want. Sounds intimidating? But dont worry

This 3-Digit Number Can Save You Thousands!

The average credit score for new, approved home mortgages is 732 according to the FHFA while borrowers with a 600 credit score or less make up just 6.5% of approved home loans.

What’s your credit score? Give the Good News Lending team a call at 901-651-9935 to discuss your options.

Well be there with you to go over the contractors information, bids and timelines, helping you choose the options that fit within the loan parameters.Once youre clear to close, part of the funds go to the seller while the rest goes into a renovation fund account, only to be disbursed as discussed between the lender and contractor. After the contractors complete the repairs and the home is cleared for occupancy, you move in.And thats when you get to enjoy the personal touches you put into the home renovations and repairs.

Don’t Miss: Usaa Credit Score For Auto Loan

The Dash Home Loans Process

Getting a home loan is often a stressful process, especially when most mortgage lenders work with a middleman who you never meet.

Dash simplifies the process for you by cutting out the middleman. With our team, the process of getting an FHA loan is very easy. Our Mortgage Coaches will work with you to prequalify you for these loans, going to bat for you as your advocate with the underwriters who review your application. Well work closely with you to ensure you meet all FHA loan requirements, including completing the necessary application and all required paperwork.

And if you dont qualify for an FHA loan? Well tell you immediately and work with you to find another option that meets your needs.

Ready to get started? Contact our team.

Let’s get started