How Do I Apply For A Personal Loan

If youre ready toapply for a personal loan, follow these four steps:

Research and compare lenders.

Pick a loan option.

After comparing lenders, choose the loan option that best suits your needs.

Complete the application.

Once youve chosen a lender, youll need to fill out a full application and submit any required documentation, such as tax returns or pay stubs.

Get your funds.

If youre approved, the lender will have you sign for the loan so the money can be released to you. The time to fund a personal loan is usually about one week though some lenders will fund loans for applicants as soon as the same or next business day after approval.

Why Borrow With Key

- Competitive interest rates

With competitive rates and a variety of flexible terms, youll find a loan or line of credit to meet your individual needs.

- Keep track of your finances more easily

Consolidate high interest debt1 and take advantage of a lower interest rate and one simple loan to manage.

- Fast and easy access to money

Whether you choose funds availability in the same day,3 a loan or line of credit with no collateral required, flexible terms, or flexible payment options, we have an option for you.

- Secure online and mobile banking

Sign on for 24/7 account access to make payments, transfer money, check balances, and view your statements online.

- Key Financial Wellness Review®

In just 30 minutes, an experienced banker will help you see where your finances stand and show you how to reach your financial goals. Schedule an appointment.

All credit products are subject to credit approval.

Savings vary based on rate and term of your existing and refinanced loan. Refinancing to a longer term may lower your monthly payments, but may also increase the total interest paid over the life of the loan. Refinancing to a shorter term may increase your monthly payments, but may lower the total interest paid over the life of the loan. Review your loan documentation for total cost of your refinanced loan.

Please refer to specific account disclosures for details. The actual rate and payment amount may vary and is determined by the product, term, loan amount and your credit qualifications.

How Do I Get The Best Personal Loan Rate

The best personal loan rates are usually granted to borrowers with a great credit score, a healthy financial history, a secure income, and a low amount of debt.

If your financial standing isnt where you want it to be and you think it may hurt your chances of qualifying for a personal loan with a decent rate, there are steps you can take to prepare.

You May Like: What Is An Equity Loan

How To Get The Most Affordable Personal Loan

Trends in overall interest rates are just one factor that make up the rate you receive on a personal loan. Heres how to maximize your chances of getting the cheapest loan possible.

Check your credit: Your credit score and credit history have a big impact on your personal loan rate. Build your credit before applying for a loan, and look for any errors on your credit report that could bring down your score.

Pay off other debts: Lenders will evaluate your other debts when assessing your loan application. If you can pay down any debts before applying, this can lower your rate.

Reduce your loan amount and term: Larger loans may come with a steeper interest rate, since they represent more risk to the lender. And the longer the repayment term, the more interest youll pay. To reduce costs, ask for the lowest loan amount that still covers your expense and choose the shortest term with monthly payments you can afford.

Add collateral: Tying collateral like your vehicle or an investment account to your loan application helps guarantee the loan, leading to a more competitive rate. However, if you default, the lender can seize the asset.

Add an applicant: Joint and co-signed loans can mean lower interest rates if the additional applicant has a higher credit score or income than you do. This applicant will be held equally responsible for loan payments.

Auto Loan Providers With The Best Rates

Based on our research, these providers are among the top car loan lenders in the industry, and weâve ranked them after evaluating their rates, reputations, availability, and customer service. Be sure to compare personalized quotes from lenders before making a decision.

| Lender | |

|---|---|

| 8.9 | 9.5 |

When it comes to the best auto loan rates, each provider offers varying rates to car buyers in different situations. While one lender may offer lower interest rates for borrowers with good credit than other financial institutions, another provider may specialize in lending to people with bad credit. Weâve noted the starting APRs for top providers in the table above, but only borrowers with excellent credit will be eligible for rates that low.

Each of our five best auto loan providers has its benefits, as well as drawbacks. Based on what we learned from studying the top auto lenders in the country, our team recommends the following providers to start your search for the best auto loan rates.

Read Also: Do You Pay Closing Costs With Fha Loan

Also Check: Why Should I Refinance My Car Loan

Personal Loan Vs Credit Cards With Promotional Rates

If youre looking to consolidate debt, then you may want to consider credit cards with promotional rates instead of a personal loan. Many credit cards come with 0% introductory APR on purchases and balance transfers for as long as 15 months, and those go a long way in helping pay down debt if you can qualify for such offers. Keep in mind, however, that its strongly encouraged that you pay off the card within the introductory period. Otherwise you may face interest rates between 15% and 25%. Additionally, if you miss a payment, the 0% APR will revert to the regular purchase and balance transfer APR.

Common Types Of Personal Loans

Personal loans come in all shapes and sizes. Although some lenders prohibit borrowers from using personal loan funds for college expenses, you can use the money for nearly anything you want.

The nature of personal loans makes them especially suitable for large, one-time expenses. Here are some ways you might use one.

Also Check: How Much Loan I Can Get For Business

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car you are buying as collateral. You are typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because when you finance a car it is a secured loan, they tend to come with lower interest rates than unsecured loan options like personal loans. As of September 8, 2022, the average APRs according to a Bankrate study are the following.

How Does The Coronavirus Affect Personal Loans

The impact of COVID-19 has left millions of Americans without a reliable source of income, and many may be searching for personal loans to cover emergency expenses. In response to unprecedented market conditions, some banks announced new loan offerings and lower interest rates, though many have also tightened their eligibility requirements.

For existing borrowers, some lenders have extended their loan relief programs into 2021, waiving fees or letting customers temporarily defer payments. Long-term unemployment will mean some borrowers continue to rely on these programs, says Greg McBride, Bankrates chief financial analyst. He encourages those who are having trouble making payments on their personal loans to contact their lenders rather than ignoring the problem.

Read Also: What Are Good Loan Companies

Will Rates Go Up Further

The RBI raised the Repo rate by 50 basis points to 5.90 in the last monetary policy review as the Monetary Policy Committee seeks to ensure that inflation remains within the target, while supporting growth. The regime of high-interest rates is expected to last for two to three years or till when the inflation level comes down and the central bank cuts down the Repo rate.

While the central bank retained its CPI inflation projection at 6.7 per cent for FY23, it downgraded the real GDP growth projections for FY23 to 7 per cent from 7.2 per cent and FY24 at 6.5 per cent. CPI is likely to remain above 6 per cent for the first three-quarters of FY23.

Elevated imported inflation pressures remain an upside risk for the future trajectory of inflation, amplified by the continuing appreciation of the US dollar. We believe that a 35 bps rate hike in December looks imminent but beyond December it would be touch and go, said Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Check Your Credit Score And Credit Report

Your credit score is one of the single most important factors thatll impact your loan rate. Why? It determines your creditworthiness, which means that it acts as a financial health grade for lenders to help them understand how responsible you are about managing your finances. If you have a low credit score, your lender will likely give you a loan at a higher interest rate, or may not approve you for a loan.

Before applying, check your credit score and your credit report. A credit report is a financial transcript that includes your debt, credit history, and credit score. Order free copies of your reports from the three major credit bureaus and check them to see what might be hurting your credit score. Address the issues to improve your credit score before you apply for a loan. Improving your score now will help you qualify for better personal loan interest rates in the future. Credit scores can range from:

- Excellent credit: 800 850

- Very good credit: 740 799

- Good credit: 670 739

- Bad credit: 300 579

Read Also: How Do I Find Out My Student Loan Balance

Secured Versus Unsecured Personal Loans

How a personal loan functions depends on the type of personal loan chosen. As you research loan options, you may come across options for secured and unsecured personal loans.

Whats the difference between a secured and unsecured personal loan?

A secured personal loan requires the borrower to pledge collateral to guarantee the loan. This collateral is something of value that the borrower owns, such as a car, investments, or savings account. If the borrower cannot or does not make the loan payments, then the lender can seize that collateral.

An unsecured personal loan, also called a signature loan, is backed by the borrowers estimated creditworthiness. If the borrower cant pay back the loan, the lender cant take any of their property or valuables to recoup its loss. The lender can, however, take other steps to recoup its loss, such as suing the borrower, which may affect the borrowers credit score and future financial options.

Borrowers may offer only certain types of loans. And secured personal loans may go by different names, such as a car title loan. People who may not qualify for an unsecured personal loan, or may only be offered an unsecured personal loan with high interest rates, may find more options with secured loans. But, as with any financial decisions, its important to weigh the pros and cons of each option.

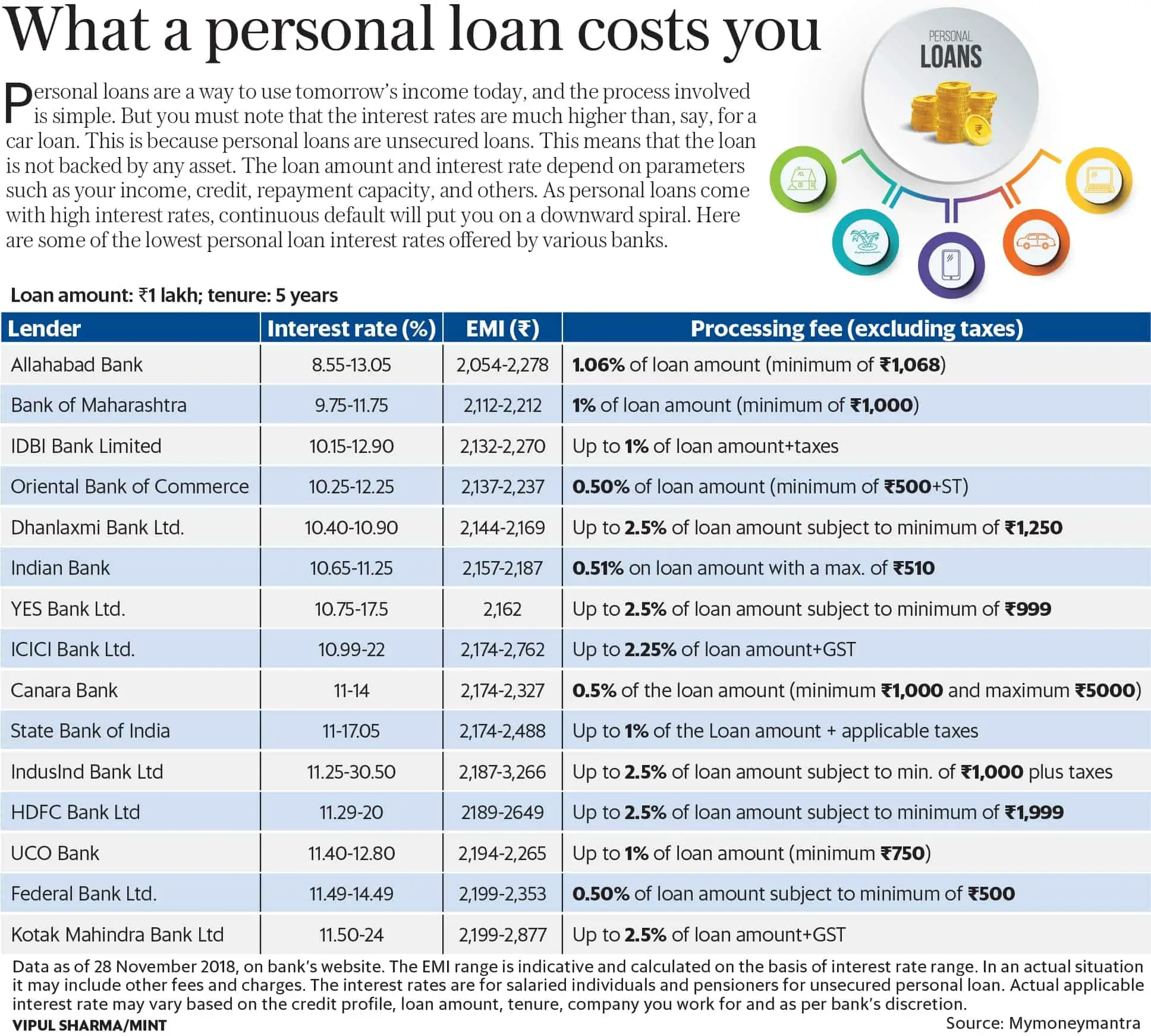

Best Personal Loan Rates Of September 2022

The best personal loan rates go to borrowers with excellent credit, low debt and strong income. Compare personal loan rates to find the best offer.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Personal loan interest rates currently range from 4.99% to about 35.99%. The interest rate you may get on a personal loan depends on factors including your credit score and credit history, annual income, existing debt and whether you get a loan from a bank, credit union or online lender.

Comparing personal loan rates along with monthly payments and total interest can help you choose the most affordable loan. Heres a look at the best personal loan interest rates from online lenders, banks and credit unions.

Why trust NerdWallet? NerdWallet’s editorial team has reviewed more than 35 personal loan providers and compared them to find the best personal loan rates. We’ve selected these lenders based on their minimum and maximum APRs.

Comparing personal loan rates along with monthly payments and total interest can help you choose the most affordable loan. Heres a look at the best personal loan interest rates from online lenders, banks and credit unions.

Read Also: Can You File Bankruptcy For Student Loan Debt

Income And Employment Status

Your income and employment status may affect the rate youre offered on a personal loan. And you might need additional paperwork to prove your income if youre a freelancer, independent contractor, or business owner than you would if you worked a W-2 job.

If your income is irregular, having a creditworthy co-applicant may help you be approved for more favorable interest rates. Asking someone to be a co-applicant is a big commitment, though, and having a conversation about all that it entails can help alleviate any concerns of both parties.

Average Personal Loan Interest Rates

For good to excellent credit, the average is 10% to 15%

CONTENTS

Interest rates on personal loans vary widely, so it can be tough to know whether youre getting a good offer. Currently, the average rate tends to be 10% to 15% for those with good to excellent credit. If youre considering applying for a personal loan, its a good idea to know average rates. Youll also want to know the factors that affect your personal rate.

Read Also: Can I Refinance My Mobile Home Loan

What To Do If You’re Not Offered A Good Personal Loan Interest Rate

If you’re only being offered personal loans at very high rates — above the national average rates — you need to consider why.

Your priority should be to find out if there’s something in your borrower profile that is a red flag for lenders, such as a low credit score or insufficient income. If that’s the problem, you either need to improve your credit or earn more income — or get a cosigner to vouch for you. If you have bad credit, for example, you can get a much better rate if the cosigner has a high credit score.

You can also get a lower rate by putting up collateral, like a bank account or vehicle. A loan with collateral is called a secured loan . Secured loans often have lower interest rates, but be careful: the lender can take your collateral if you miss a monthly payment.

If you’re a well-qualified borrower and aren’t being offered a loan at a good rate, you may simply need to shop around to see if another personal loan lender can offer a competitive rate. You can also consider borrowing for a shorter period of time or borrowing a bit less money so you present less of a risk.

RELATED:What is a good interest rate for a savings account? Also, check out The Ascent’s article on why interest rates are so low on savings accounts.

With A Variable Rate Loan

- Your interest rate is generally lower than rates offered by fixed rate loans.

- Your interest rate is variable and will rise and fall with changes in the RBC prime rate.

- If interest rates rise, your payments will likely stay the same, but your amortization term will increase.

- If interest rates fall, your payments will stay the same and your amortization term will decrease, meaning you could pay off your loan sooner.

- You can switch to a fixed rate loan or pre-pay your loan at any time without penalty.

If you are not sure what’s right for you, an RBC Royal Bank can help you choose.

Recommended Reading: Where Can I Find My Student Loan Account Number

What Is The Average Interest Rate On A Car Loan

Auto loan interest rates vary based on a number of factors, including the amount you are borrowing, the loan term, loan type and your credit history. The average interest rate for a new car is 4.33 percent, and the average interest rate for a used car is 8.62 percent according to the Experian State of Automotive Finance Market report from the second quarter of 2022.

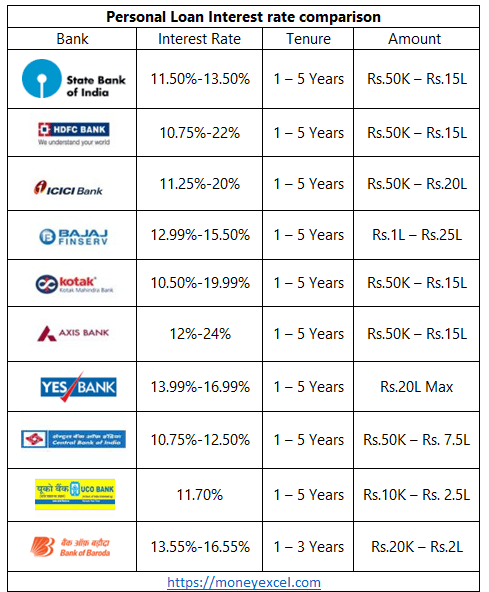

Tips To Avail Personal Loan At Low Interest Rate

Below stated are a few important points that must be considered to get a personal loan at a low interest rate:

- Build and maintain your credit score of 750 or above

- Check for pre-approved offers from banks and NBFCs

- Enquire with banks/NBFCs with whom you already have the deposit and/or loan accounts

- Keep a track of interest rate concessions offered by lenders during festive seasons

- Visit online financial marketplaces to check and compare personal loan offers from various lenders

Get a Personal Loan Online at low interest rates Apply Now

You May Like: Do Fha Loans Require Inspections

A Closer Look At A Truist Personal Loan

- Low interest rates Truists best APRs for personal loans are among the lowest on the market, though only customers with excellent credit will qualify for this lenders lowest rates. Youll also have to have a loan term of three years or shorter for the best rate.

- Fees on small-dollar loans While Truists traditional personal loans do not charge fees, youll have to pay an origination fee of $5 for every $100 borrowed through the banks Ready Now loan program if you want a smaller amount. This program is available only to checking account customers.

- Payment relief program You can apply for Truists payment relief program if you have a sudden financial hardship. The bank may agree to suspend your monthly payments or extend the length of your loan. However, interest will continue to accrue on your account.