The Cons Of An Interest

Choosing an interest-only loan could be a risk for borrowers. Some cons with this type of loan include:

- Youre not building equity in the home: Building equity is important if you want your home to increase in value. With an interest-only loan, you arent building equity on your home until you begin making payments towards the principal.

- You can lose existing equity gained from your payment: If the value of your home declines, this may cancel out any equity you had from your down payment. Losing equity can make it difficult to refinance.

- Low payments are temporary: Low monthly payments for a short period of time may sound appealing, but they dont last forever it doesnt eliminate the eventuality of paying back your full loan. Once the interest-only period ends, your payments will increase significantly.

- Interest rates can go up: Interest-only loans usually come with variable interest rates. If rates rise, so will the amount of interest you pay on your mortgage.

Information For Customers Already On An Interest Only Mortgage

The Financial Conduct Authority has published its research into consumers ability to repay their interest-only mortgages when they mature. The findings show that many people should be in a good position to repay their mortgage when it is due for repayment.

However some borrowers will need to take control of their mortgage repayment planning now. To that end the FCA, the Council of Mortgage Lenders and the Building Societies Association are working together to ensure lenders contact their borrowers in order to prompt them into checking their plan for repayment is on track and considering the options available to them.

The FCA believes that with careful planning, consideration and engagement with their lender, many interest only borrowers should be able to find a viable way to pay off their mortgage if they take control now.

If you have any concerns or questions please contact us using the details shown on the bottom of this page.

Pros And Cons Of An Interest

When weighing the pros and cons of an interest-only mortgage, keep in mind:

Pros

-

A lower monthly payment during the interest-only term.

-

Since interest-only mortgages are usually structured as adjustable-rate loans, initial rates are often lower than those for fixed-rate mortgages.

Cons

-

You dont gain any equity in your home while making interest-only payments.

-

If market values decline, you could lose any equity in your home provided by your down payment and perhaps any opportunity to refinance.

-

Unless you move, youll face much larger monthly installments down the road, when principal payments are required.

-

Some interest-only mortgages require a substantial balloon payment, a lump-sum payment at the end of the loan term.

About the author:Hal Bundrick is a personal finance writer and a NerdWallet authority in money matters. He is a certified financial planner and former financial advisor. Read more

Don’t Miss: Usaa Auto Loan Requirements

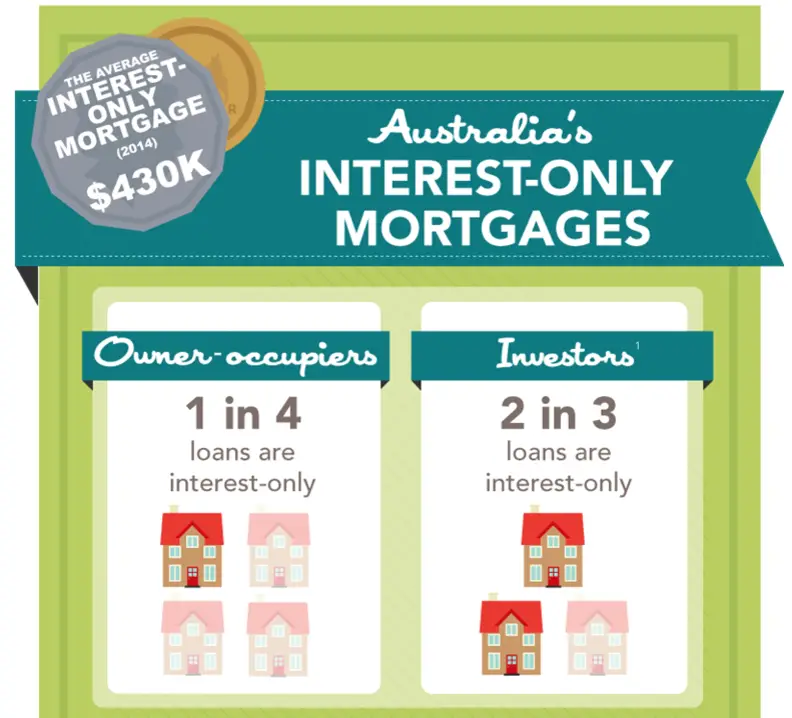

Can You Still Get Interest Only Mortgages

A number of lenders have gradually returned to offer interest only mortgages in the years since the stricter rules were introduced, but the options available to residential borrowers are nowhere near as wide as they once were. Interest only mortgage loans are only available for much lower amounts against the value of the property, often capped at around 60-75%. The exception is buy to let interest only mortgages, which make up the majority of the mortgage options available to landlords.

» COMPARE:Buy-to-let mortgages

How Much Do I Have To Earn To Get An Interest

The total amount you can borrow will typically be a multiple of how much you earn. But getting an interest-only mortgage can depend on lots of factors, not just earnings. These can include the price of the property, how much you want to borrow, your individual circumstances and the lenders criteria.

Read Also: Www.upstart.com/myoffer

Others Who Would Benefit From An Interest

- Anyone with a short-term time horizon for owning the home

- Those going through a divorce wherein one spouse needs to buy out the other and needs a low payment in the interim until they decide what to do with the marital home

- Someone looking to buy a second home and then turn it into the primary residence later on

- A person without a steady income therefore, its ideal to pay a large amount at once instead of a high monthly payment

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

How To Apply For An Interest Only Mortgage

If you decide to apply for an interest only mortgage, you can expect the usual questions youd face when applying for a mortgage of any kind, and a few more besides.

When checking if an interest only mortgage is affordable to you, a lender will want to assess your income, outgoings, savings and existing debts, so you should have the necessary information to hand. Documents including payslips, your latest P60, your final accounts , and bank, loan and credit card statements are usually needed, so gather them in preparation. Your proves important with any mortgage application as well.

In addition, youll need to show how you intend to pay off your loan amount at the end of the term. This means youll need the paperwork associated with any investments, pensions, property, and endowments that you want considered as a repayment vehicle.

Recommended Reading: Usaa Car Financing

What To Do If You Cant Repay An Interest Only Mortgage

If youre approaching the end of your interest only mortgage deal and your repayment plan wont cover all of what you need to pay back, your options may include:

-

asking your lender to extend the term of your mortgage to give you more time to raise the funds required.

-

remortgaging to another interest only mortgage will provide you with further time and potentially a lower rate to help save the money you need.

-

moving to a repayment mortgage. Your monthly payments are almost certain to rise, but youd also start making inroads to paying off your loan. You could ask for a longer term or use a part and part mortgage to make your payments more affordable too.

-

selling your home. This is usually an option of last resort, but if the value of your home has increased, you may still have funds left over once your mortgage is settled to help find a new place to live. However, if house prices have dropped, and your property is now worth less than your mortgage, youre in negative equity and selling wont raise enough to repay what you owe.

Not being able to repay an interest only mortgage has been a major problem for many borrowers in the past, and will continue to challenge more going forward. If this is a concern for you, talk to your lender or a mortgage adviser about your situation and theyll help explain the options that are available to you.

Can You Switch From One To The Other

-

Yes, you can switch from a repayment mortgage to an interest only mortgage, although the total amount you repay is likely to increase

-

You can also switch from an interest only mortgage to a repayment mortgage, although your monthly mortgage repayments will increase

Here is how to switch to a new mortgage deal and how much it costs.

If you’re a first time buyer or looking to move house or remortgage, we can help you find the best mortgage deal to suit your needs.

Also Check: How Long Sba Loan Approval

How Does An Interest Only Mortgage Work

At the end of an interest only mortgage term, you need to have paid off the original amount borrowed. This is usually through the sale of a property, or with investments.

Who can apply foran interest only mortgage?

Interest only mortgages are often used for Buy to Let properties. Its also possible to get one for a residential property you want to live in if you meet the lenders policy requirements.

There are specific rules when applying for an interest only mortgage. For example, a low loan to value ratio or a high annual income.

Providers may want more details on how you will repay the mortgage at the end of the term.

This is called a repayment vehicle inheritance, for example, cant be used as a repayment vehicle. Funds that are usually accepted as a repayment vehicle include:

- Stocks and shares ISAs

- Endowment policies

If you have an interest only mortgage with Lloyds Bank, you may want to read our existing customers FAQs page.

Complete Guide To Interest

There is a reason why conventional loans have been named as such. Most consumers presume that 30-year and 15-year mortgages are their only real options, though some consumers know of adjustable rate mortgages . These start with a lower interest rate before ballooning higher after a designated period, and they are popular due to the fact that the borrower has to pay less during the earlier portion of the mortgage.

They are not, however, the lowest potential monthly mortgage payments under the ARM umbrella. Interest-only loans are one of the least appreciated options for consumers seeking to pay less at the start of their mortgage. Here are eight important facts about interest-only loans.

Also Check: Capital One Auto Loan Private Party

Tips To Understand An Interest

Muhammad Mu’az 1 day agoMortgage618 Dibaca

10 Tips to Understand an Interest-Only Mortgage

Interest-only mortgages are a hot topic in the financial world. This blog article gives a brief overview of an interest-only mortgage, but also provides some tips for understanding your credit score and the amount of your monthly payment.

What is an Interest-Only Mortgage?

An interest-only mortgage is a loan with a fixed interest rate for a set period of time. The borrower then pays the principal and interest at the end of the contracted period. Interest is usually paid in installments, which can be spread out over several years, and the borrower doesnt need to make any payments on principle until the end of the contract term. This type of loan often comes with low monthly payments and an option to pay off the balance at any time early without paying fees or penalties.

Pros and Cons of an Interest-Only Mortgage

Interest-only mortgages have many benefits and some drawbacks that you should consider before deciding whether to make the leap. Interest-only mortgages are a fairly new product, which means its difficult for people to fully understand their benefits and risks. The decision to go with an interest-only mortgage should be made with your long-term goals in mind.

Terms to Understand in an Interest-Only Mortgage

Considerations Before Borrowing Money on an Interest Only Mortgage

Tips for Rolling Over an Interest Only Mortgage

What Are The Disadvantages Of Interest

The biggest disadvantage is the pressure of knowing that you have to ensure the loan is repaid in full at the end of the interest-only mortgage term.

- Youâll usually pay more interest overall than with a repayment mortgage, because the amount you pay interest on doesnât decrease during the term

- Youâre only paying off interest each month, so youâll still owe full the full amount at the end of the term

- You have to look after your repayment vehicle as well as a mortgage

- If your repayment vehicle relies on investments, pension funds, an inheritance or a rise in house prices, it may not make enough to pay off your mortgage

As with repayment mortgages, if youâre on a fixed rate and you want to pay off your interest-only mortgage early you may be charged early repayments fees â check the terms of your mortgage for details about this.

Don’t Miss: Loan For Good Credit

Choose Which Is Right For You

Interest only mortgages do not suit most borrowers. Only get one if you are aware of the risks and have a repayment plan to save enough capital by the end of the term.

You would need to be able to make a profit from your investment vehicle and preferably have a backup option to help you pay off the mortgage.

Fill out this simple form to find a mortgage broker or talk to an independent financial adviser to help you work out if you can afford an interest only mortgage.

How To Pay Off An Interest Only Mortgage

The type of repayment plan a lender would need to see before they will approve an interest only mortgage might include:

- savings in a savings account or cash ISA

- investments in bonds, shares and unit trusts

- a regular savings plan, such as an endowment policy

- a pension from which you could potentially take a 25% tax-free lump sum

Not all lenders will deem all types of repayment option as acceptable – for instance, some dont consider savings to be a suitable strategy – and it is down to lender discretion as to whether they feel you have an adequate plan in place. The mis-selling of endowments in the past, and their unreliability in delivering the returns promised, means many lenders also want to see recent projections of growth if you plan to use one going forward.

Some potential options for repaying that usually wont prove acceptable include:

- the expectation of an inheritance, bonus from work or other windfall.

- relying on a rise in the value of your home that would allow you to downsize and settle your mortgage with the remaining funds.

Read Also: Usaa Rv Loan Reviews

Understanding Interest Only Mortgages

Interest only mortgages can seem enticing due to the lower monthly payments that they require you to make. This can seem like a good offer to many people because it means that the amount they pay back each month is hugely smaller than it would be on a standard mortgage. However a lot of people do not quite understand exactly what an interest only mortgage is.

This guide will explain everything that you need to know about interest only mortgages. We will talk you through the positives and negatives of this type of mortgage and how they compare to full repayment mortgages. It will also explain who is eligible to take out an interest only mortgage and what type of requirements a lender is likely to ask you to meet before you can be put onto an interest only mortgage.

In This Guide:

You May Also Be Interested In

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME OR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

PLEASE NOTE: THE FCA DOES NOT REGULATE MOST BUY TO LET MORTGAGES

For online mortgage comparison and advice Gocompare.com introduces customers to Mojo Mortgages which is authorised and regulated by the Financial Conduct Authority. Mojo Mortgages is a trading name of Lifes Great Limited. Gocompare.coms relationship with Lifes Great Limited is limited to that of a business partnership, no common ownership or control exists between us. Please note, we cannot be held responsible for the content of external websites and by using the links stated to access these separate websites you will be subject to the terms of use applying to those sites.

Read Also: Refi An Fha Loan

The Bottom Line: Interest

Interest-only mortgages may seem like a good way to snag a lower monthly payment, but theyre actually a bit more complex than other mortgage options. Heres what is most important to know when considering an interest-only mortgage:

- Most interest-only mortgages come as an ARM, with a set term where the borrower pays only interest and zero principal on the loan.

- Interest-only mortgages can save money upfront, but typically payments double after the introductory term expires.

- Only individuals with stellar credit and high liquidity qualify for an interest-only loan, but these loans are not predatory or bad for consumers.

Its important to note that just because an interest-only loan comes with the interest-only payment period, borrowers can absolutely pay more than the interest should they opt to do so. Many enjoy this flexibility to pay above the interest to make additional debt progress and build equity.

To learn more about buying a home, visit the Rocket Mortgage Learning Center.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

How Much Do They Cost

A mortgage for £160,000 with a 4% interest rate would cost:

| £326,175 | £166,175 |

Repayment mortgages cost less overall but come with higher monthly repayments than interest only mortgages. For example, the above mortgage would cost:

-

£841.05 per month with a repayment mortgage

-

£553.92 per month with an interest only mortgage

Also Check: Best Mortgage Companies For Fha Loans

The History Of Interest

Interest-only lending soared ahead of the 2008 financial crisis and customers were able to borrow on an interest-only basis without showing lenders how the debt would be repaid. After the credit crunch struck it emerged that hundreds of thousands of interest-only customers would struggle to pay off their home loan later on.

For this reason, its now very difficult to borrow on an interest-only basis. Not all lenders offer interest-only and those that do will have strict criteria such as a decent deposit and an approved repayment vehicle in place to pay off the capital at the end of the term.

The one exception is buy-to-let. Many landlords pay their mortgages on an interest-only basis and lenders generally accept this.

Either way, if you cant repay the amount you borrow at the end of the term youll need to take out a new mortgage or sell the property to pay off your mortgage.

What Is Your Loan’s Monthly Interest

Are you considering an interest-only loan?

It helps to know what your payment will be before you sign on the dotted line.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

This Interest Only Loan Calculator figures your payment easily using just two simple variables: the loan principal owed and the annual interest rate. Click Calculate Interest Only Payment and your monthly interest payment will display.

Interest-only loans are simple. Read on to better understand how these loans work and how they might affect your finances.

Recommended Reading: Arvest Construction Loan