Secured Debt Unsecured Debt And Monitoring Your Credit

Whether you have secured or unsecured debt, monitoring your credit can help you see how debt is affecting your financial standing and whatâs being reported to credit bureaus. can help. Itâs free for everyoneânot just Capital One customersâand using it wonât hurt your credit.

You can also get free copies of your credit reports from all three major bureausâExperian®, Equifax® and TransUnionâby visiting AnnualCreditReport.com.

Why You Need A Secured Loan To Buy A Home

While unsecured loans are typically the way people make smaller purchases, for larger items like a car, boat, or home, youll need a secured loan. For real estate in particular, youll get a mortgagethe most common kind of secured loan there is.

Mortgage loans are always secured by real property. That is the collateral, says Andrew Weinberg, a principal at Silver Fin Capital. But there are other kinds of secured loans, too. A car loan uses your vehicle as collateral, for example.

Basically, if you want to buy a home but lack the cash to cover this massive purchase in full, you will apply for a mortgage by approaching a lender who will loan you most of the money to cover this purchase. Then, you pay the lender back in monthly installments, plus interest.

The clincher is if you dont pay up, eventually your lender has the right to foreclose and take your property to recoup its expenses, says Manjari Ganti, associate compliance counsel at Planet Home Lending. Thats the secured part, and the reason why your lender was willing to fork over such a big pile of cash. The lender knows that even in the worst-case scenario in which you flake, itll get something valuable back!

Secured Vs Unsecured Loans: Which Is Better

It depends on what youre using the loan for. If youre buying a home, a mortgage is definitely the way to go.

Secured loans are safer loans for the lender, so theyre less expensive for the customer, says Craig Garcia, president of Capital Partners Mortgage. They will usually have better interest rates, and most mortgage interest is tax-deductible.

Still, there are some instances when an unsecured loan makes sense for certain purchases. For one, unsecured loans are faster to get.

If the need for money is immediate, its quicker and easier to get an unsecured loan, says Garcia. A secured loan has to be underwritten and have a closing, whereas you can walk into a bank or apply online and get a line of credit right away.

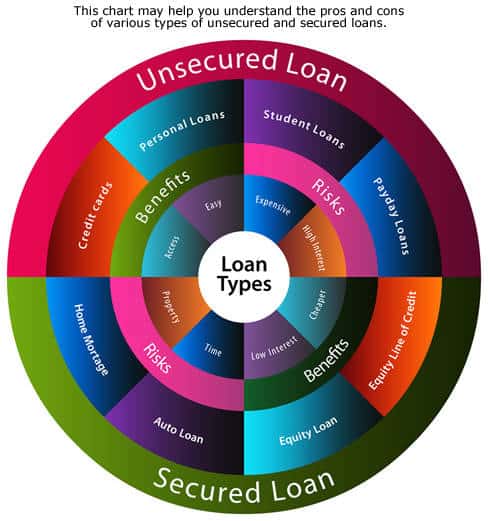

Here are some of the pros and cons of these two types of loans:

Secured loan

- Interest rates are usually lower, repayment terms are usually longer.

- It takes longer to get, and requires more paperwork.

- If you default on the loan, you could lose your house or car.

- Its possible to qualify for much bigger loans than unsecured loans.

- For home buyers, programs such as FHA loans help buyers with checkered credit histories to qualify.

Unsecured loan

- Rates are higher, and repayment terms are usually shorter.

- Youre relying on your creditworthiness to get the loan, so not everyone can qualify.

- Interest is not tax-deductible.

Also Check: Can You Pay Off Lightstream Loan Early

When Its Better To Borrow A Secured Loan

The main benefit of a secured loan is that it can be easier to qualify for, especially if your credit isnt in the best shape, according to Galstyan: Secured loans also have higher borrowing limits, so they might be the right type for you if you need to borrow a significant amount. Plus, he says, the lower interest rates of secured loans also make them less expensive over time than unsecured loans.

On the other hand, secured loans can be riskier for you. If you dont pay secured debts, the lender can take the collateral, and you can be charged fees and penalties for the missed payments, Galstyan said.

In some cases, you dont get a choice when choosing between a secured or unsecured loan. Auto loans and mortgages, for example, are always secured. But if you have the choice, opting for a secured loan is best when you would otherwise not qualify for the amount and terms you desire.

Applying For Personal Loans

Although you can get a personal loan at a credit union, a bank or another lender, all might not offer a secured loan option. As always, when borrowing from Benchmark Credit Union, we offer both secured and unsecured personal loans, as well as a convenient, local lending decision-making process. Still confused? Talk to your credit union lender for more information. Remember, no matter which type of personal loan you choose, secured or unsecured, you should always shop around to compare personal loan rates, fees, lending limits and terms.

Learn more about Benchmark Federal Credit Union personal loans online or read our blog, when to choose personal loans over other credit. Always keep in mind that not repaying a loan can negatively affect your credit history and credit score. Not repaying a secured loan can also jeopardize your collateral.

Main Office:

Recommended Reading: Where Do I Find My Student Loan Number

When To Consider Unsecured Loans And Lines Of Credit

The main advantage of an unsecured loan is faster approvals and less paperwork. Unsecured loans are generally harder to obtain because a better credit score is required, since your loan would not be secured by any assets or collateral.

While unsecured loans might be obtained more quickly, it’s important to remember you’ll likely pay a higher interest rate. The four most common reasons why clients choose unsecured loans are for buying a car, home renovations, medical bills and education costs, and debt consolidation.

- Car loans take less time to process than a secured loan, and interest rates are very competitive

- Taking out an unsecured personal loan for home renovation projects is ideal, because you can access funds quickly to complete projects with predictable costs

- For ongoing expenses such as paying tuition or covering the cost of medical bills, you may be interested in an unsecured personal line of credit

- If you have outstanding debts, consolidating them with a personal loan can help. With interest rates that are lower than credit cards, this solution can help you manage your monthly payments.

Apply For A Loan Or Line Of Credit With Cibc

No matter what your borrowing needs are, CIBC has secured and unsecured loans and lines of credit that can help you meet your financial obligations. You can apply for a loan or line of credit online, or speak with a CIBC advisor at 1-866-525-8622 if you have questions, or would like to learn more about possible lending options.

Also Check: $10 000 Dollar Loan Monthly Payment

What Is Unsecured Loan

An unsecured type of loan does not require you to provide any Tangible security to the lender when taking a loan from them. These may have comparatively higher interest rates as compared to secured loans due to the absence of security. The creditor grants you the loan mainly by assessing your ability to repay the debt. This is done by analysing your bank account statements and CIBIL score, among other factors. Having a stable source of income can help you procure an unsecured loan with ease. A stable employment history along with references are also considered by banks when reviewing your application for an unsecured loan. Lenders also take into consideration your monthly income in combination with your existing debts. This helps them accurately understand your financial capacity for repaying the loan.

An unsecured loan is a great option for people who need to borrow money but have no collateral to pledge. Thus, even if you do not have assets like a home or jewellery, you can still get the funding that you need.

Secured Loans Vs Unsecured Loans: Whats The Difference

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The main difference between secured and unsecured loans is collateral: A secured loan requires collateral, while an unsecured loan does not.

Unsecured loans are the more common of the two types of personal loans, but interest rates can be higher since theyre backed only by your creditworthiness.

Here are key differences in how secured loans versus unsecured loans work, which lenders offer them and how to qualify.

Read Also: Navy Federal Loan Calculator Auto

Square Loans: Unsecured Business Loans Based On Cash Flow

The good news: theres another way to access the money you need to create the business youve always dreamt of!

Square Loans represent the future of unsecured lending. These loans have been designed to be repaid daily, in small amounts, based on the sales that you make. Rather than demanding a minimum repayment every month, Square Loans pay down your loan by deducting a small percentage from any payments taken through Square. Your repayments adapt to your situation: on busy days you pay more, on slow days you pay less.

Whats more, Square Loans feature no interest, no credit checks, and dont require collateral for loans under $75K. Theres a single, simple and 100% transparent loan fee, which is gradually paid down as you make sales.

With Square Loans, unsecured loans for your new business venture are made accessible, fast, easy and perfectly affordable.This article is only for educational purposes and does not constitute legal, financial or tax advice. Make sure you consult a professional regarding your unique business needs.

Square Loans

Which Type Of Loan Is Better For You

If youre unsure if an unsecured or a secured personal loan is better for you, here are some considerations to keep in mind:

- If youre buying a vehicle. The age, cost and type of vehicle will have an impact on whether you can or should get a secured car loan, or whether an unsecured loan will be a better option for you. Some lenders will only accept newer vehicles as a guarantee, while other lenders may require the vehicle to pass an inspection check.

- If you want to use the loan amount for various purposes. Lenders offering secured loans tend to place restrictions on the use of the loan amount. For instance, if youre taking out a secured car loan but also want to buy some furniture, the lender may not let you borrow more than the cost of the car.

- If you arent looking to purchase an asset. You will need to already own the asset you want to use as security. While this is a less common form of secured personal loan, it is an option offered by some lenders.

You May Like: How Much Of Personal Loan Can I Get

Secured And Unsecured Loans: Whats The Difference

The main difference between a secured loan and an unsecured loan is one requires security, or collateral, that the lender can take and sell if you dont repay the loan. The security might be the item purchased or something else of value, like a savings account or other personal property. Collateral reduces the lenders financial risk when lending money.

Unsecured loans are more difficult to qualify for than secured loans because they are riskier for the lender.

For example, if you get a loan to buy a new or used vehicle, the lender will put a lien on the title. If you default on the loan, the lender can legally repossess the car and sell it to recover the money you borrowed.

Conversely, an unsecured loan doesnt require collateral. Instead, the only guarantee the lender has is your signature on the loan agreement. If you default, the lender may report it to the credit bureaus, start debt collection or bring a lawsuit.

Unsecured loans are riskier for lenders. As a result, they tend to have higher interest rates, lower borrowing limits and shorter repayment times. You are more likely to qualify for an unsecured loan if you have a strong credit history and a stable source of adequate income.

What To Know About Secured Loans

Qualifying: Secured personal loans can be easier to qualify for than unsecured loans. A lender considers your credit score, history, income and debts, but adding collateral to the application can lower the lenders risk and give it more confidence to lend to you.

Rates: Secured loans typically have lower annual percentage rates than unsecured loans. Rates are decided using the same factors lenders review to qualify you, so the value of your collateral can affect your rate.

If you secure financing with a vehicle, for example, the value of the vehicle is a factor in deciding whether you qualify and what rate youll get.

» MORE: Compare secured loans from banks, credit unions, online lenders

Repayments: Secured personal loans are usually repaid in fixed, monthly installments over a few years. Secured loans may have variable rates, which means monthly payment amounts can also vary.

Risk: The penalty for not repaying a secured loan is twofold: Your credit will suffer, and the lender can seize the collateral, sometimes after only a few missed payments.

Even one missed payment can drop your credit score by as many as 100 points, and the impact on your credit wont be softened because its a secured loan.

Online lenders that offer secured loans tend to require a vehicle as collateral: Oportun, Upgrade and OneMain all offer vehicle-secured loans. The lender may want the vehicle appraised before it lends to you.

Also Check: Who’s Eligible For Va Loan

What To Know Before You Take Out A Loan

Before you take out a personal loan, whether it’s secured or unsecured, make sure you have a clear payoff plan.

As a general rule, only borrow what you know you need and can afford to pay back. Make sure you are comfortable with the repayment timeframe. Just because you can get a loan doesn’t mean you should, so take your time and do your research before you sign on the dotted line.

Learn more: 10 questions to ask before you take out a personal loan

Information about the Capital One Platinum Secured and the Platinum Secured Mastercard® has been collected independently by Select and has not been reviewed or provided by the issuer prior to publication.

Editorial Note:

Qualifying For A Personal Loan

Theres no one specific, step-by-step way to qualify for a personal loan. Thats because every lender has somewhat different requirements for credit scores and other factors, and every borrowers personal situation is somewhat different.

That said, there are some basics you can expect. Most lenders will check your credit history and credit scores, review your income, and consider how much debt you already have before they approve your loan. One key question the lender is likely to investigate is whether you earn enough income to afford the payments you have to make each month. If you apply for an unsecured loan, your credit, income and current debt will likely receive more scrutiny, because theres no collateral to back your loan.

If you apply for a secured loan, the lender will want to feel confident about your collateral, its value and the fact that you own it outright.

Recommended Reading: Proof Of Income For Car Loan

What Is A Secured Vs Unsecured Credit Card

Unsecured Card What’s the Difference? A secured credit card like the UNITY Visa Secured Card is a credit card that is funded by you. The amount you deposit for the card determines your limit. … An unsecured credit card, on the other hand, typically requires the applicant to have a decent credit score.

Where Can You Get Help With Repayment

If youre struggling to keep up with your debt payments, there are a few options that might help. For one, you could consider consolidating your debt with a debt consolidation loan, which could potentially readjust your monthly payments, lower your interest rate and simplify debt repayment.

You might also reach out to your loan servicer about setting up an alternative arrangement that better fits your budget, or you could seek out credit counseling from a nonprofit organization.

Finally, you might consider alternative options, such as a debt management plan, debt settlement or even bankruptcy. This guide explains more about your options for debt relief.

Read Also: Why Is My Student Loan Not On My Credit Report

Do Unsecured Loans Hurt Your Credit

What Happens if You Default on an Unsecured Loan? Failing to repay any debt will have a negative effect on your credit. Although you don’t have to worry about losing your collateral with an unsecured loan, the cascading effects of falling behind in your payments can do real damage to your creditand your finances.

How To Shop For A Personal Loan

Speaking of personal loans, these are a popular source of financing that can be either secured or unsecured. Personal loans allow you to borrow money for almost any reason, and often have lower interest rates than credit cards. Most commonly, personal loans are used to consolidate debt, finance big-ticket purchases and fund home improvement projects.

When shopping for a personal loan, your first instinct may be to check with banks. However, traditional banks are not the only place to find one. You can also get personal loans from credit unions, online lenders and even peer-to-peer lending platforms.

When comparing personal loan offers, its important to evaluate a few factors. The interest rate is a big one rates can vary widely depending on your credit and other factors. Today, the average personal loan interest rate can range between 5% to 36%.

Youll also want to pay attention to origination feesthese cover the lenders cost of processing the loan, and can range from 1% to 8% of the loan amount. Some lenders also charge a penalty for paying your loan off early , so its a good idea to check before committing to a loan.

Here are top-rated banks reviewed by Sound Dollar:

Don’t Miss: Fast No Credit Check Loan