Best Egg Approval Requirements

| Minimum Credit Score Requirement | Over 650 |

Best Egg requires a minimum credit score of over 650. Credit scores usually range between 300 and 850. Higher scores are considered better, so its important to try to continuously improve your score to have a better chance of obtaining favorable terms and rates. The company states that it is recommended to have a score over 700 and an annual salary over $100,000 to have the option of having the best-offered loan terms and rates.

Pre-approval can help streamline the loan process, but its not required to receive a loan. The pre-approval process does not mean automatic loan approval, but it helps to indicate that you are likely to obtain a loan. Pre-approval can be earned through special mail offers.

The application process can take less than 5 minutes. During the loan process, have additional financial content available such as financial documents in case Best Egg needs to verify your information. Funds can take between one and three business days to be received.

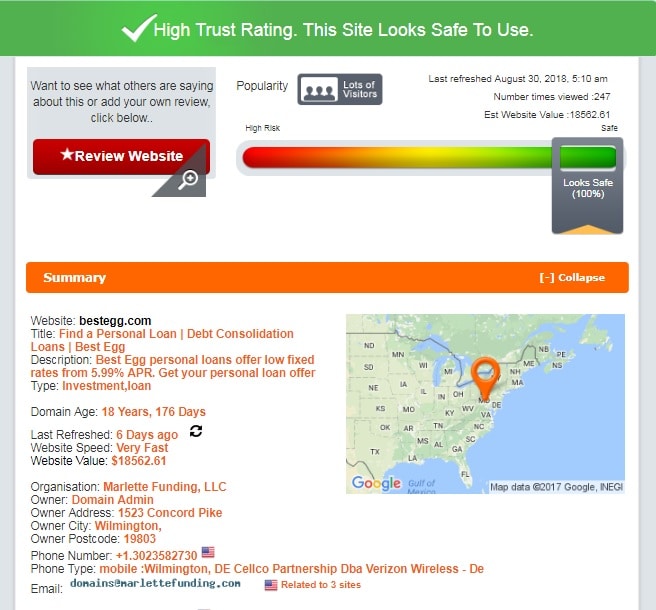

Is Marlette Funding Llc A Legit Company

Best Egg Personal Loans was founded in 2014. It is an established company that has been in business for 8 years.Based on their “mostly recommended” SuperMoney community rating, they seem to be a reputable company.

Best Egg Personal Loans DisclosureSuperMoney DisclosureEditorial Disclaimer

Is Best Egg A Good Idea

If you are going to take out a personal loan, Best Egg is a personal loan issuer that has good customer reviews and that offers loans at a competitive rate. While you should compare rates and terms among different lenders to see who makes you the best financing offer, there is no reason not to make Best Egg one of those lenders.

Also Check: Where To Send Loan Forgiveness Application

Best Egg Loan Reviews

Best Egg is an online lender that offers personal loans to would-be borrowers. Whether you need to consolidate your debt, do some home improvement, buy a new car, or deal with an unexpected expense, contacting Best Egg may be your solution.

Since its founding in 2014, Best Egg has earned a reputation as a reputable lending company. From their headquarters in San Antonio, Texas, Best Egg have lent out more than $11 billion in unsecured personal loans to customers across the United States. Best Egg has an A+ rating with the Better Business Bureau and has brilliant customer reviews on different sites.

Best Egg Interest Rates Fees & Other Terms

Category Rating: 84%

- Overall APR range: Best Egg offers personal loans with an APR range of 4.99% – 35.99%. Best Egg interest rates are fixed, which means your rate will never change during the entire time you pay off the loan.

- How rates are determined: Your individual rate will be selected from the advertised range based on your credit score, income and existing debts, among other factors.

- Origination fee: Best Egg charges an origination fee ranging from 0.99% to 5.99% of the loan amount. This fee will be subtracted from the initial amount you receive.

- Other fees: Best Egg has a $15 fee for late or returned payments. The company does not charge any early repayment fees.

- Loan amounts & timelines: Best Egg personal loan amounts are usually between $2,000 – $50,000, depending on the state. Repayment terms range of Up to 60 months.

Also Check: What Is Best Loan For Home Improvement

Check Your Interest Rate Without An Impact On Your Credit Score

One special feature that Best Egg offers is the ability to check the interest rate youd pay without impacting your .

Many lenders wont be willing to give you an interest rate quote until after youve applied for the loan.

Unfortunately, each time you apply for a loan, your credit score drops by a few points. That can make it difficult to shop around as your credit score drops with each new rate check.

Best Egg avoids this by doing a soft pull on your . This gives the company enough information to provide a quote without impacting your credit.

Who Should Not Choose Best Egg

A Best Egg personal loan may not be the best choice for borrowers who want to avoid fees and high APRs. Compared to other lenders, Best Eggs maximum APR is quite high. A borrower with bad credit or low income can receive a high APR on their personal loan. Loan terms affect the APR as well.

Best Egg charges origination and late fees. The origination fee of 0.99% to 5.99% is only charged once from your principal loan amount. A return fee of $15 will also be charged to the borrower when their checks do not clear on time or if they do not have enough funds.

Recommended Reading: How Fast Can I Pay Off My Loan

What Borrowers Are Saying About Best Egg

Reading lender reviews is an important part of deciding which lender is best for you. Not only can reviews let you know the pros and cons of each lender, but they can also give you a heads up on what you can expect throughout the process.

On LendingTree, consumers have given Best Egg a 4.8 out of 5 rating. Consumers say the process is quick and easy with one reviewer, Rob, from Livonia, Mich., saying Best Egg is a head and shoulders above the rest. Peggy, from Lovell, Wyo., elaborated, Im actually speechless. To have a loan approved in less than an hour is totally unheard of. The amount is exactly what is needed to consolidate some bills and the rate reasonable, based on my credit score. Best of all? The funds will help smooth out cash flow to make budgeting easier.

Best Egg has few negative reviews, but out of those who have rated Best Egg poorly, the common complaints tend to be centered around difficulty getting approved and loan fees.

Best Egg Personal Loans: 2022 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Also Check: Will Personal Loan Hurt My Credit

It’s Early But We’re Very Grateful

We are fortunate that, though our debt to income ratio was high, we had been able to manage our debt payments well. We tried several methods including balance transfers , banks and credit union loans and other debt consolidation assistance services . Best Egg was the only one that was willing to help us and we are grateful. We had a little technical hiccup with our first payment today and Sean in customer service could not have been more helpful, concerned and informed. A+ for Sean and Best Egg customer service today!

Date of experience:September 18, 2015

How Does It Compare

Best Egg isnt the only lender that offers personal loans. Take the time to find a lender that offers the best loan for your unique situation.

The interest rate of the loan is possibly the most important part. It affects your monthly payment and the loans total cost. Look for the lowest rate possible.

Equally important are any fees charged on the loan. The lower the fees, the better.

Finally, make sure you can choose a term that works for you. Strike a balance between an affordable monthly payment and a low total loan cost.

Also Check: How To Get Better Interest Rate On Car Loan

A Best Egg Personal Loan Is Right For You If:

When it comes to personal loans, you have options. However, a Best Egg personal loan may fit the bill if:

- You have a relatively high income and a great credit score

- You would benefit from a debt consolidation loan — combining your debt payments into a single, lower-interest payment

- You want a fast loan decision

No matter how well a particular loan seems to fit your situation, do yourself the favor of rate shopping before settling on a lender. The best loan is the one that saves you the most money.

Which Do You Think Is Best

About CreditDonkey CreditDonkey is a credit card comparison website. We publish data-driven analysis to help you save money & make savvy decisions.

Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Advertiser Disclosure: Many of the offers that appear on this site are from companies from which CreditDonkey receives compensation. This compensation may impact how and where products appear on this site . CreditDonkey does not include all companies or all offers that may be available in the marketplace.

*See the card issuer’s online application for details about terms and conditions. Reasonable efforts are made to maintain accurate information. However, all information is presented without warranty. When you click on the “Apply Now” button you can review the terms and conditions on the card issuer’s website.

Also Check: How To Get An Auto Loan With Navy Federal

Who Should Borrow With Best Egg

No lender can serve everyone equally. The best candidates for a Best Egg loan include:

- The tech-savvy: The online application process can throw some people off, but if youre comfortable with online banking and social media, youll navigate Best Eggs application process just fine.

- Big earners: Best Egg likes borrowers who have higher than average incomes , so if you earn significantly less, consider some other loan providers. The average borrower earns $80,000 annually, and Best Egg requires a minimum debt-to-income ratio of 40% .

- Borrowers with excellent: Borrowers with damaged or broken credit have great loan options online, but Best Egg wont be one of them. Best Egg will likely decline your application. Its focused on borrowers with excellent credit . You could get approval with a score as low as 640.

Best Egg Loans Give An Answer On Your Loan Quickly

Best Egg was very quick I’m approving my loan request. I tried through a credit card that I currently have, and was denied. I also tried through another loan company, and they denied me, yet are still sending emails to finish my application. What? I emailed them that I was all set.Best Egg gave me options for different monthly payments, depending on length of loan. It was quick and easy. I was very impressed.

Date of experience:September 20, 2022

Reply from Best Egg Personal Loans

Don’t Miss: What Car Loan Will I Be Approved For

How To Get Approved For A Personal Loan

The first step towards getting approved for a personal loan is to apply for a personal loan.

When you apply for a loan from any lender, youll have to provide a variety of personal information.

The lender will use this information to look up your financial history and to make a decision on your application.

Some of the information youll be asked to provide may include:

- Proof of identity, such as a drivers license

- Social Security number

- Proof of income, such as bank statements or pay stubs

- Verification of employment

Getting all of this information and supporting paperwork together can be daunting.

Despite that, its very important to do it properly. When you apply for a loan, you want to leave the lender with as clear a picture of your financial life as possible.

If your lender has any questions, it will affect your chances of getting a loan.

At best, it will slow down the process as the lender contacts you to ask for clarification. In the worst case, your application will be denied.

Best Egg Personal Loans Review

Disclaimer: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Read our Disclaimer Policy for more information.

Best Egg offers competitive personal loans in amounts as small as $2,000 or as large as $50,000. Theyre particularly well-regarded for their long-term loans, which can be as long as 60 months.

The main market for Best Egg is individuals with fair to moderate credit. They even offer secured loans to help you get a better rate.

Heres a guide to what Best Egg has to offer and how their personal loan works.

- Estimated APR Range: 5.99%-29.99%

- Minimum Credit Score: 600

- Minimum Credit History: Three years

- Loan Amounts: $2,000-$50,000

- Loan Terms: Up to 60 months

Read Also: Can I Refinance My Car Loan With Wells Fargo

Offers Unsecured And Secured Personal Loans

One benefit of Best Egg is that they offer secured as well as unsecured loans. A secured loan is similar to a home equity loan in that you put up assets in exchange for collateral.

However, you dont put up your home itself. Instead, you put up appliances and other major fixtures as security.

When you secure your loan, you get a lower interest rate, and potentially, a higher loan amount. Exactly what you get will depend on your individual circumstances.

Great For Borrowers With Fair Credit

Many personal loan providers require a credit rating of 700 or higher. If you only have moderate credit, this can leave you out in the cold.

On the other hand, you can qualify for a Best Egg personal loan with a score as low as 600. That said, borrowers with fair credit will normally need to pay a higher APR. This means youll spend a lot more money to get the same loan.

Don’t Miss: What Are Commercial Real Estate Loan Rates

How Do I Work With Best Egg

Best Egg is very good about simplicity. While other financial institutions make borrowing money a high-stress hassle, Best Egg does things very differently. As a one-stop-shop for personal loans of all kinds, they make it easy to apply and service your loan. Debt consolidation is one of the best ways for people to get a handle on financial hardships. Beyond their debt consolidation lending, they offer a number of other personal loan options including the following.

- Debt consolidation

- Vacation funding

Best Egg puts money in your pocket for a number of occasions that you may not have considered. They make it possible for dreams to come true through their willingness to provide opportunities. While personal loans for any reason are relatively straightforward with a percentage of interest calculated based upon your credit profile, the difference is that Best Egg sees more than just risk. There is finally a financial institution that recognizes the many financial burdens in life that you cant always predict.

Top Features Of Best Egg

Best Egg is very clear about its target customer and has created loan features to appeal to that client.

Swift process for preapproval, final approval, and funding:

- Soft credit pull for preapproval

- Extra-low APR for highly-qualified applicants

- Highly-rated customer service

- Direct payment to creditors

You May Like: How Long Does An Auto Loan Approval Last

U Send Me Letters With Personalized

U send me letters with personalized codes saying u can do this and that. When u cant follow thru. Whats the point of reaching out to me. U wasted ur time as well as mine. And I dont write reviews. Thanks for nothing

Date of experience:September 25, 2022

Reply from Best Egg Personal Loans

We’re sorry to hear that you are dissatisfied. The concept of pre-approval for a Best Egg loan is predicated on information we obtain from the credit bureaus and our credit criteria. If you’re pre-approved, according to information on your credit report, you look like someone who might benefit from and qualify for a Best Egg loan. Once one applies, we make credit decisions based on credit history and the information provided in the loan application such as income, employment and other key financial ratios. If you would like to discuss your concerns further or request to be removed from our mailing list, please feel free to give us a call at 855-282-6353.

Best Egg Rates Fees And Terms

Best Egg isnt a fee-free experience. APRs range from 7.99% to 35.99%, and you may be required to pay an origination fee of 0.99% to 8.99% which gets taken from your total loan amount before funds are disbursed. Just like with other lenders, the rates youre offered depend on your credit score and loan terms.

You May Like: Is Fha Or Conventional Loan Better For Seller

What To Do If You Are Rejected From Best Egg

Lenders may reject your applications due to a variety of reasons. Some of the most common reasons are low credit scores, large loan amounts, insufficient incomes and unverified or missing information in the application. Nevertheless, application denial shouldnt be a cause for worry.

If your application has been denied, its best to call your lender and ask for the specific reason for your rejection. Once you know the reason, you can improve on that aspect to avoid future rejections.

The lender may also allow you to modify some details of your loan. These modifications can include decreasing your requested loan amount or verifying some information in your application.

Applying for a loan with a different lender could be another option. However, doing so without working on the reason you were rejected may cause another application denial. Therefore, the best thing to do after an application denial is to improve on the factor that caused your rejection.

Best Egg Personal Loan Application Process

One of the benefits of applying for a Best Egg loan is that the full application process only entails a soft credit check. A soft inquiry on your credit report wont affect your credit score. Youll eventually have a hard credit check performed, but not until youve accepted the loan.

To apply online, enter your email address to get started. You can also input an offer code if youve received a pre-qualification offer in the mail. Next, fill out some basic personal information like your address, phone number, and social security number, which takes no more than a few minutes.

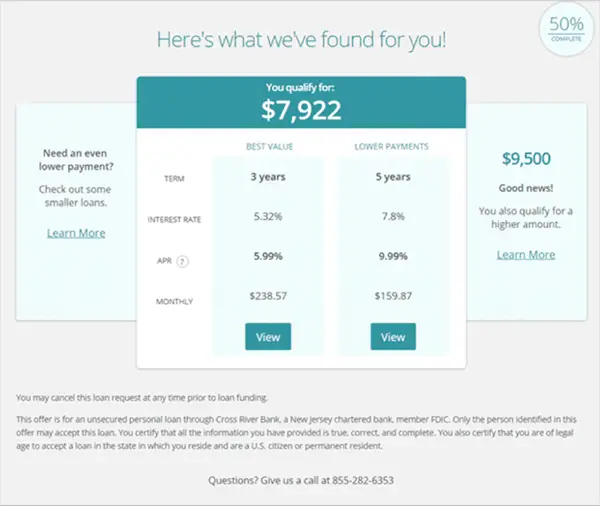

You can then compare loans offers with three-year and five-year terms, plus see the loan amount you qualify for. Once you select the loan you want and provide some additional documentation for verification purposes, you can sign the loan agreement. Finally, Best Egg runs a final credit check, and then youre ready to get funded.

Recommended Reading: Loans Online No Credit Check