What To Do When You Have Surpassed Your Lifetime Loan Limit

For some college students, tuition and costs associated with attending school exceed the total amount they are allowed to borrow. There are three main ways that college students can handle expenses that exceed student loan limits:

1. Keep loan limits in mind as you plan for college

Maximize your ability to get grants and scholarships, and tap savings before you take out loans. Talk with your financial aid office to identify sources of funding that you may not have previously known of. Ask about merit-based aid and institutional need aid. Find out whether you can get on a payment plan to take care of some of your tuition costs. Limiting your debt early in your college years can help you avoid reaching your lifetime loan limits before you finish school.

2. Consider PLUS loans

If it costs more to attend school than you can cover with direct subsidized loans or direct unsubsidized loans, parent PLUS loans and grad PLUS loans may help bridge the gap.

Borrowers who received loan funds on or after July 1, 2020, pay 5.3% interest, which is much higher than the 2.73% interest rate on graduate loans and the 4.3% rate on direct loans for undergraduates.

PLUS loan borrowers must have good credit, as defined by the Department of Education . Undergraduate students cant access PLUS loans without help from their parents. Many parents may be unable or unwilling to take on debt to pay for their childs education.

3. Shop around for private student loans or personal loans

How Student Loan Limits Are Calculated

When you take out a student loan, both the annual and aggregate loan limits are applied to the loan amount. Each type of loan limit represents a restriction on the amount you can borrow.

Sometimes, you may want to borrow an amount that satisfies the annual limit, but you will qualify for a lower amount because your total debt would exceed the aggregate loan limit. You will then be restricted to the lower loan amount.

For example:

The Direct Unsubsidized Loan has annual limits for dependent undergraduate students based on the students year in school. The 2021-2022 loan limits are:

- $5,500 for freshmen

- $6,500 for sophomores

- $7,500 per year for juniors, seniors, and any additional undergraduate years of study

The Direct Unsubsidized Loan also has an aggregate loan limit of $31,000 for dependent undergraduate students.

Suppose a dependent undergraduate student in a 5-year engineering degree program borrows the annual maximum for each of the first four years, for a total of $27,000. During the students fifth year the annual limit would be $7,500. However, as the next table shows, the remaining aggregate loan eligibility is only $4,000 after the end of the fourth year. So, the student cant borrow the $7,500 annual maximum as a fifth-year senior. Instead, this student can borrow no more than $4,000.

| Year |

|---|

| $0 |

Maintenance Loans In England 2021/22

| Household Income | Away from home | Away from home |

|---|---|---|

| £4,422 | £6,166 |

The household incomes in bold represent the upper earnings thresholds for the parents of students in each living situation. As the table shows, students with parents earning above the following thresholds will receive the minimum Maintenance Loan for someone with their living arrangements:

- £3,516 if you live at home and your household income is above £58,220

- £4,422 if you live away from home and outside London, and your household income is above £62,286

- £6,166 if you live away from home and in London, and your household income is above £70,004.

Bear in mind that the household incomes we’ve given in the table above are just examples the Maintenance Loan you receive will be calculated using your exact household income rather than a band .

What are the minimum and maximum Maintenance Loans in England?

The minimum Maintenance Loan on offer for students from England is £3,516, which is paid to students with a household income of £58,222 or more and who’ll be living at home during their time at uni.

The maximum Maintenance Loan is £12,382 and is paid to students who will be living away from home and in London, and whose annual household income is £25,000 or less.

And for more info on Student Loans in England, check out this guide.

For that reason, weve included Maintenance Grants amounts in these tables, starting with the amount on offer if youll be living with your parents:

| Household income |

|---|

| Household income |

|---|

You May Like: Usaa Rv Loans

So I Can Deduct $2500 Right Not Quite

To calculate the Student Loan Interest Deduction, follow 3 rules :

- If you make below the MAGI Phaseout Threshold, you can deduct up to the full $2,500

- If you make above the MAGI Phaseout Limit, you cannot deduct anything

- If you make between the MAGI phaseout threshold and the limit, follow the below steps:

Confused? Lets walk through some examples

Maximum Student Loan Amount For Undergraduate Students

The maximum amount of federal student loans an undergraduate can borrow per academic year is between $5,500 and $12,500. The exact annual limit depends on your year in school and dependency status.

Undergraduate students can receive both Direct Subsidized and Direct Unsubsidized federal loans. There is an annual and total limit of how much can be borrowed in Direct Subsidized loans.

This chart shows the annual and total limits an undergraduate student can borrow based on their year and dependency status.

| Year | |

| $31,000 no more than $23,000 subsidized | $57,500 no more than $23,000 subsidized |

Also Check: Is Flex Modification Program Legitimate

Your Nationality And Residency Status

Nationality and residency status is undoubtedly the murkiest of all the eligibility criteria, and it’s the one that tends to catch students out the most.

As a general rule, you should be eligible to receive a Maintenance Loan if you’re a UK national , normally live in the UK and have done so for the three years prior to the start of your course.

But it’s worth noting that all three of those things must apply to you to guarantee your eligibility. There are countless stories of students who were born and raised in the UK but moved to, say, the USA at 11-years-old and assumed that they’d be eligible for a Maintenance Loan as a British citizen. No dice.

In some instances, you may be able to successfully appeal and receive a Maintenance Loan anyway to do this, you’ll often need to prove that you’ve retained economic ties to the UK in your absence , or that one/both of your parents had to move abroad for work.

There are also special exceptions made for specific groups, including refugees and stateless people.

As we said earlier, it’s best not to let these eligibility criteria confuse you too much.

We stand by our statement that the majority of students at the majority of universities will be eligible to receive a Maintenance Loan especially if you’ve been studying at a school in the UK and will be attending a relatively well-known university.

But, as ever, if you’re unsure, it’s best to contact your funding body and ask them to clarify things for you.

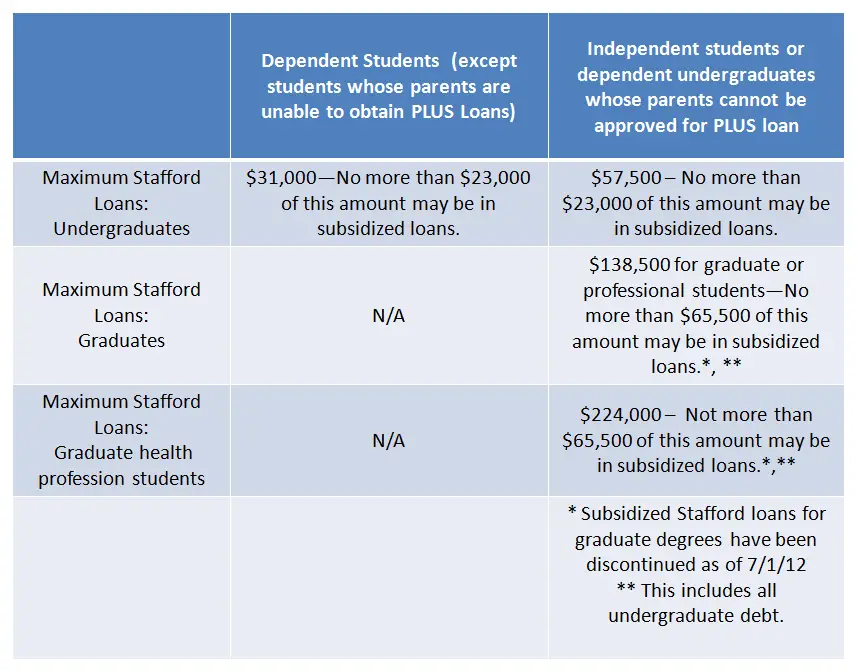

Federal Borrowing Limits For Graduate Students

| $138,500 | $65,500 |

Your federal borrowing limits are higher if youre working on a masters or doctorate program, including an M.A., MBA, M.D., J.D., or Ph.D.

The annual borrowing limit for grad students is $20,500 a year, and you can borrow up to $138,500 in total, including the loans you took out as an undergraduate. Since July 1, 2012, grad students arent eligible to take out subsidized loans anymore. But its possible for grad students who took them out before then to have up to $65,500 in subsidized loans.

Medical school students can take out up to $224,000 in federal loans before turning to grad PLUS or private student loans. For most medical school students, the annual borrowing limit on the more affordable federal student loans is $40,500.

Learn More: Graduate Student Loan Limits: How Much Can You Get?

You May Like: How Long Does It Take Sba To Approve Ppp

What Is The Maximum For Private Loans

The maximum amount that students can borrow with a private student loan will depend on the lender. Usually, they wont lend students more than it costs to attend school. Heres a list of some private loan lenders and the maximum amounts they lend.

The cost of attendance is an estimate of tuition and fees, books and supplies, living expenses, transportation, and other miscellaneous expenses. The estimate can also include dependent care, study-abroad programs, and costs related to disabilities.

Choose More Affordable Options

If youve maximized your scholarship and grant potential and dont qualify for work-study, consider more affordable options. Some small-scale changes include opting to rent or buy used textbooks instead of new, living off campus or getting roommates. You can also consider transferring to an in-state school, trying out an online program or dropping to half-time enrollment while you work a part-time job.

Also Check: Usaa Vehicle Loan Rates

How Much Can You Borrow

In addition to private loans, there are three main types of federal student loans: Direct Subsidized, Direct Unsubsidized, and Direct PLUS.

First, consider a Direct Subsidized Loan. Subsidized federal loans are simple to obtain, usually less expensive than PLUS or private loans, dont require a or cosigner, and have built-in protections and repayment options that unsubsidized, PLUS, and private loans don’t have. Subsidized federal loans are available for undergraduate students only. Unsubsidized federal loans can be taken out by both undergrads and graduate/professional students.

What Is The Maximum Amount Of Student Loan Money You Can Borrow

Student loans can be used to fund your education, but they are not limitless. For federal and private lenders, there is a maximum student loan amount. The maximum amount that can be borrowed depends on a variety of factors. Continue reading to learn more about student loan borrowing limits!

Read Also: Usaa Used Auto Loan

Subsidized Vs Unsubsidized Loans

Undergraduate students loans are classified as either subsidized or unsubsidized. Heres how they differ:

- Subsidized loans dont accrue interest when youre enrolled in school at least part-time, during periods of deferment and during your six-month grace period after you leave school. When you start to repay your loans, youll be responsible for your loan plus the interest that starts accruing after you leave school.

- Unsubsidized loans accrue interest even while youre in school. The good news is that you dont have to start making payments until your grace period ends. The bad news is that your payments will be higher compared to subsidized loans since your interest started accruing immediately upon disbursement, not graduation.

Federal Student Loan Limits

Federal student loan limits adjust based on whether your parents or guardians can claim you as a dependent, the type of loan youll use and what year youre in school. For instance, both independent and dependent first-year students can borrow $3,500 in subsidized loans. But dependent students are limited to $2,000 in unsubsidized loans, while independent students can borrow up to $6,000 in unsubsidized loans.

You May Like: Usaa Loan Credit Score Requirements

What Is The Maximum Student Loan Amount For A Lifetime

What is the maximum student loan amount for a lifetime? Depending on your dependency status, it can be as low as $5,500.

Kat Tretina

The cost of higher education has been steadily rising over the past few decades. With increased tuition and other costs, more and more students are using student loans to pay for some of their education. However, you may be surprised to find out that there are limits on how much you can borrow.

What is the maximum student loan amount for a lifetime? It depends on the types of loans you qualify for and your dependency status. If you exhaust the limit, dont get discouraged there may be other financial aid options available.

Studying At A Private Institution

If you study at a private institution, you should be aware that that you may not receive the full tuition fee loan support to cover your tuition fees.

You will be responsible for funding the difference in the additional cost of your tuition fees. You should find out what tuition fees are charged by the private institution and what tuition fee loan support is available from your local Student Finance NI office before you start the course.

Read Also: Advance Auto Parts Loaner Tools

What Is The Maximum You Can Borrow In Federal Student Loans

you can indeed get a limited amount of a lot, since the central government has a most extreme student loan measure of $31,000 for subordinate college students and $138,500 for graduate students. This is what to think about federal student help limits and what to do if you hit the roof

With regards to obtaining for school, federal student loans ought to, as a rule, be your first step. However, you can indeed get a limited amount of a lot, since the central government has a most extreme student loan measure of $31,000 for subordinate college students and $138,500 for graduate students.

This is what to think about government student help limits and what to do on the off chance that you hit that roof.

Maximum Lifetime Limit For Student Aid

There are lifetime limits on the number of weeks you can receive student aid. This includes interest-free periods while you are in school. Once a lifetime limit has been reached, interest starts to accumulate. You will also have to start paying back the loan 6 months after you graduate or finish your studies.

Full-time students can receive student aid for no more than 340 weeks, except:

- students enrolled in doctoral studies can receive student aid for up to 400 weeks

- students with permanent disability can receive student aid for up to 520 weeks

Also Check: Usaa Loan Approval

Student Loan For Maintenance

The Student Loan for Maintenance is there to help towards your accommodation and other living costs while youre studying.

All eligible full-time students can get a Student Loan for Maintenance, but the exact amount you can borrow will depend on several factors, including your household income, where you live while youre studying and whether youre in the final year of your course. Its also affected by any help you get through the Maintenance Grant .

The basic student loan for Northern Ireland students is:

- £3,750 if you’re living and attending college in Northern Ireland

- £6,780 if the course is in London

- £5,770 if youre overseas

- £4,840 if you live elsewhere

You can take out around 75 per cent of the maximum Student Loan for Maintenance regardless of your household income – this is called the ‘non income assessed’ part of the loan. Whether you get the remaining 25 per cent – the ‘income assessed’ part of the loan – depends on your household income.

To qualify for a Student Loan for Maintenance, you must also be aged under 60 when you start your course.

Your Education Authority will assess your application and decide which rate you are eligible to receive.

Student Finance NI will usually pay the money into your bank account in three instalments – one at the start of each term.

What Happens If You Hit Federal Loan Limits

If your cost of attendance exceeds what you can borrow in federal student loans, you may not have enough cash on hand to cover the extra costs. If youre worried about not having enough money to pay for school, you have a few options, including:

Working part-time. Find a job that lets you work non-traditional hours so you can pay for school. You can look on- or off-campus, depending on your living situation and transportation options. Consider a side-hustlelike delivering groceries, tutoring or freelancingto cover your extra schooling costs.

Requesting payment assistance. Many schools require payment in full, whether that comes from your lender or you. If you cant pay your outstanding bill, talk to your schools financial aid office about a payment plan, like making monthly payments instead of one lump-sum payment. Also inquire about emergency grants or interest-free loans, which vary by school but might be available based on your need.

Switching schools. Cost of attendance varies by each school. Since every institution has different service fees, you might pay more at a private or big-name school compared to community colleges, which tend to have fewer fees. If you can, consider attending local colleges for the first couple years and then transferring to your school of choice to complete your bachelors degree.

You May Like: Is Loan Lease Payoff Worth It

Student Loan Rates Are Rising

Apply for a private student loan and lock in your rate before rates get any higher.

This chart from the Pennsylvania State University student aid office breaks down the limits depending on your situation:

| Dependent Undergraduate Student | Dependent Undergraduate Student with a Parent PLUS Loan Denial | Independent Undergraduate Student | Graduate or Professional Degree Student | |

|---|---|---|---|---|

| First Year | $5,500. A maximum of $3,500 may be subsidized. | $9,500. A maximum of $3,500 may be subsidized. | $9,500. A maximum of $3,500 may be subsidized. | $20,500 |

| $6,500. A maximum of $4,500 may be subsidized. | $10,500. A maximum of $4,500 may be subsidized. | $10,500. A maximum of $4,500 may be subsidized. | $20,500 | |

| Third, Fourth, and Fifth Years | $7,500. A maximum of $5,500 may be subsidized. | $12,500. A maximum of $5,500 may be subsidized. | $12,500. A maximum of $5,500 may be subsidized. | $20,500 |

| $31,000. A maximum of $23,000 may be subsidized. | $57,500. A maximum of $23,000 may be subsidized. | $57,500. A maximum of $23,000 may be subsidized. | $138,500. The graduate debt limit includes Direct Loans received for undergraduate study. |

Besides these student loan limits, there are two other limitations to be aware of: