Check Your Credit Scores First

Before making a major purchase, it’s a good idea to check your credit reports and scores at least three to six months prior to your planned purchase.

The credit score needed to qualify for a loan will vary depending on the lender, since they will each have different criteria to grant you a loan and may use different credit scoring models, such as the FICO® Auto Score 8, which has a score range between 250 and 900.

Some lenders specialize in approving loans for those with lower credit scores. These can come with higher interest rates and less favorable terms. For example, if you wanted to purchase a car for $30,000 with an interest rate of 11% on a five-year loan, you’d pay $9,140 in total interest. With the same loan amount and term length, but with an interest rate of 4%, the total amount of interest you’d pay would be $3,150just over a third of what you would pay at the higher rate.

The Easy Confidential Way To Apply For An Auto Loan

Use our fast, easy and totally confidential online form to apply for a no-obligation quote on a personal auto loan. You are under absolutely no pressure to commit to any loan or car purchase and your information is kept strictly confidential, simply use this tool to help you make a decision.

Buying a car shouldnt be a hassle, so let our Hayward Honda Financial Advisors help you get the best deal for you.

Not quite ready to apply for your loan but want to know how much you might be able to borrow? Use our Loan Pre-Qualification form. Its quick, easy, and wont impact your credit history.

Review Your Credit Report

Your financial institution will pull and review your to determine your , or how likely you are to pay an autoloan back on time. The better your credit score, the better your chances of getting approved for a loan at a lower interest rate. In general, its a good idea to check your report to make sure its in tip-top shape and that there are nosuspicious activities reported on it once a year. We recommend getting a free copy of your report at annualcreditreport.com.

Don’t Miss: What Is The Lowest Car Loan Rate

Protect Your Credit With Payment Protection

is designed to payoff the insured balance on your loan if you or the co-borrower pass away.

is designed to pay your loan payments if you become ill or disabled and are unable to work.

Payment Protection is optional and is available on new installment loans…and we’ll ask you if you want it during the application process.

Determine How Much Car You Can Afford

Most people don’t have the cash required to buy a vehicle without financing, which is why when considering the cost of a car, the total monthly expense may be as important as the total price tag.

To determine how much car you can afford, consider the total monthly costs, including car loan payments, insurance, gas and maintenance. You also need to look at other monthly debt obligations you may have, such as credit cards, student loans and a mortgage.

The total amount of debt you have, compared with your income, is called your debt-to-income ratio, and it can be a factor in whether lenders agree to give you additional credit. Generally, a ratio below 40% is considered good. So if your monthly gross income is $4,000, for example, then your monthly debt expenses should be less than $1,600.

Recommended Reading: How Much Home Loan Can I Get On 70000 Salary

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Should I Consider A Personal Loan To Buy A Car

Why all this bother with car loans anyway? Why not just apply for a personal loan instead?

As it turns out, theres a very good reason: the interest rate. Because car loans are typically secured by an asset , lenders may offer lower rates than they do on unsecured loans, including unsecured personal loans.

How much lower? As of August 2020, the average 24-month personal loan from a commercial bank carried an interest rate of 9.34%, according to the Federal Reserve. A 48-month new car loan from a commercial bank? The average rates for those were just 4.98% but keep in mind that because the loan term is longer, youll be paying interest for longer.

However, if you get to the point where youre researching your options for refinancing a high-interest auto loan, a personal loan may offer certain advantages. For example, if youre underwater on your current high-interest auto loan, you may not be able to refinance to cover the amount you owe. In that case, you might be able to qualify for a personal loan that can help you to pay off your auto loan.

Don’t Miss: Are Quicken Loan Rates Competitive

What Does Preapproval Mean

An auto loan preapproval is a tentative loan offer based on your financial and personal information. Preapproval isnt a guarantee that youll get approved for the loan later, especially if your financial situation changes, but it can help guide your budget.

You can submit several preapproval applications to compare conditional offers from different lenders. You might get preapproved for different loan amounts, loan terms and interest rates.

The preapproval process often takes just a few minutes online. You may need to share your name, contact information, Social Security or tax identification number, mortgage or rent payments, information about your employer and salary, and the make and model of the vehicle if you have a particular one in mind. The lender may check your credit and contact your employer or landlord to verify your information.

Some lenders can preapprove you for a vehicle loan with only a soft credit inquiry, while others will make a hard inquiry, which could ding your credit. Check with the lender before submitting a preapproval application so youll know if your credit could be affected.

You may be able to shop around for the best loan without severely affecting your credit some credit-scoring models view multiple inquiries within a certain time period as just one inquiry.

Get Preapproved For A Loan

Once you land on a lender with terms youre comfortable with, another good step is to get preapproved for the loan. This just means that the lender has given you a quote for the loan, which typically includes the loan amount up to a certain dollar amount. But remember a preapproval is not a guarantee. Note that when you get a preapproval letter, the lender will usually check your credit, which can result in a hard inquiry.

If youre preapproved for a loan, the lender will typically give you a preapproval letter to take with you when you go car shopping. Then when you settle on a car, you may be able to use that preapproval as a bargaining chip. Ask the dealer: Can you beat this financing? If it cant, then at least you know youve got another loan to consider.

If getting preapproved for a loan makes you leery, know this: Car loan preapproval doesnt actually mean youve signed up for the loan. You can choose to apply for the car loan or not its your choice.

Similarly, you dont have to take out a loan for the full amount your preapproved for. If you find a car youre happy with for a lower price, then by all means you can apply for a smaller loan.

Read Also: Will I Qualify For Fha Loan

More Lenders To Choose From

When you shop in-person for auto loans, you are limited to lenders in your area. When you opt for an online auto loan, you can choose from any lender in the country. Some online lenders are more willing to work with individuals with bad credit than lenders in your area. If you want more options, consider checking out the online auto loan market to see what is available for borrowers with your credit history, according to Consumer Reports.

Current Auto Loan Rates For 2021

Auto loans are secured loans that help borrowers pay for a new or used car. They are available from dealerships and a variety of lenders, so it’s important to shop around in order to find the best interest rates and terms for your vehicle. The lenders profiled on this page are a great place to start.

Don’t Miss: How Much Is My Student Loan Payment Going To Be

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

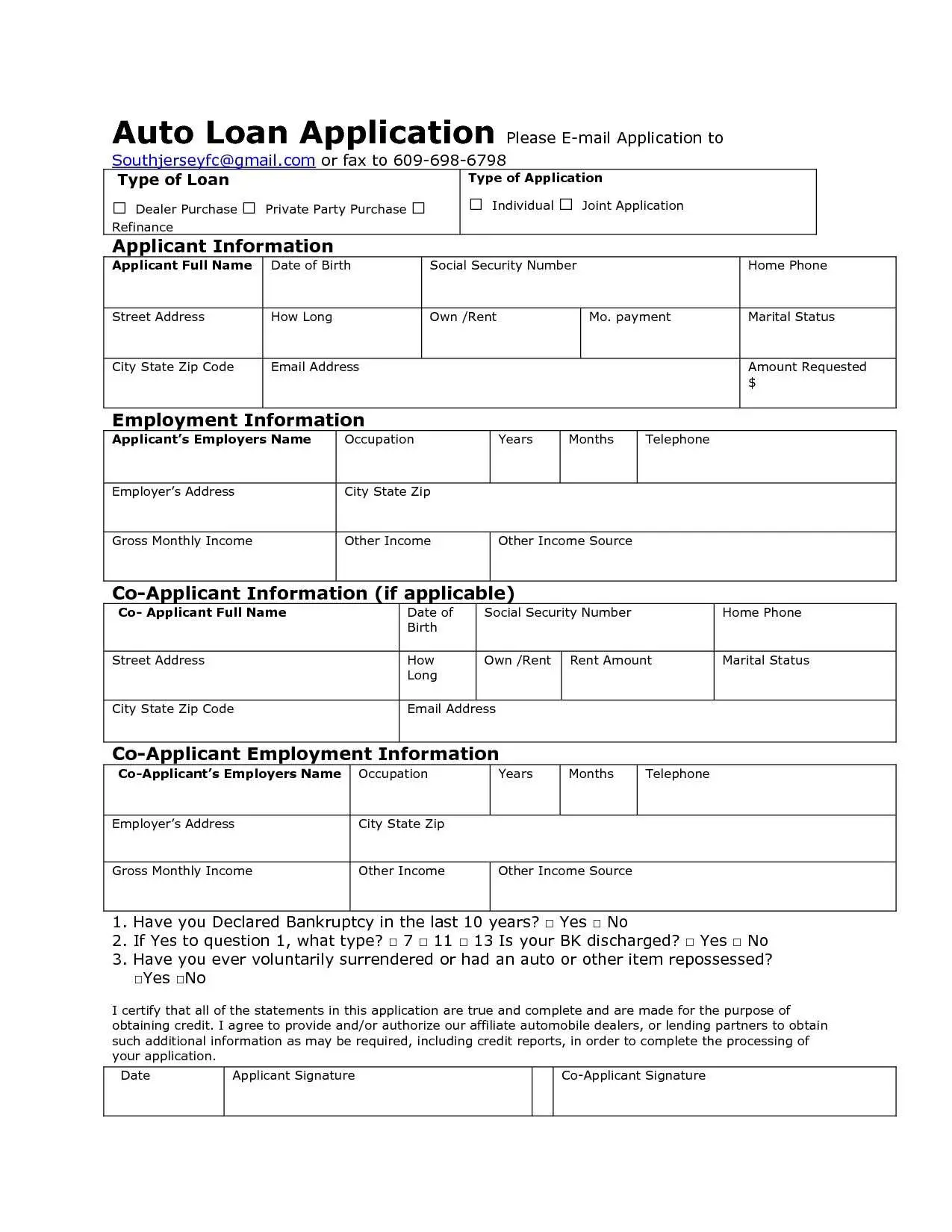

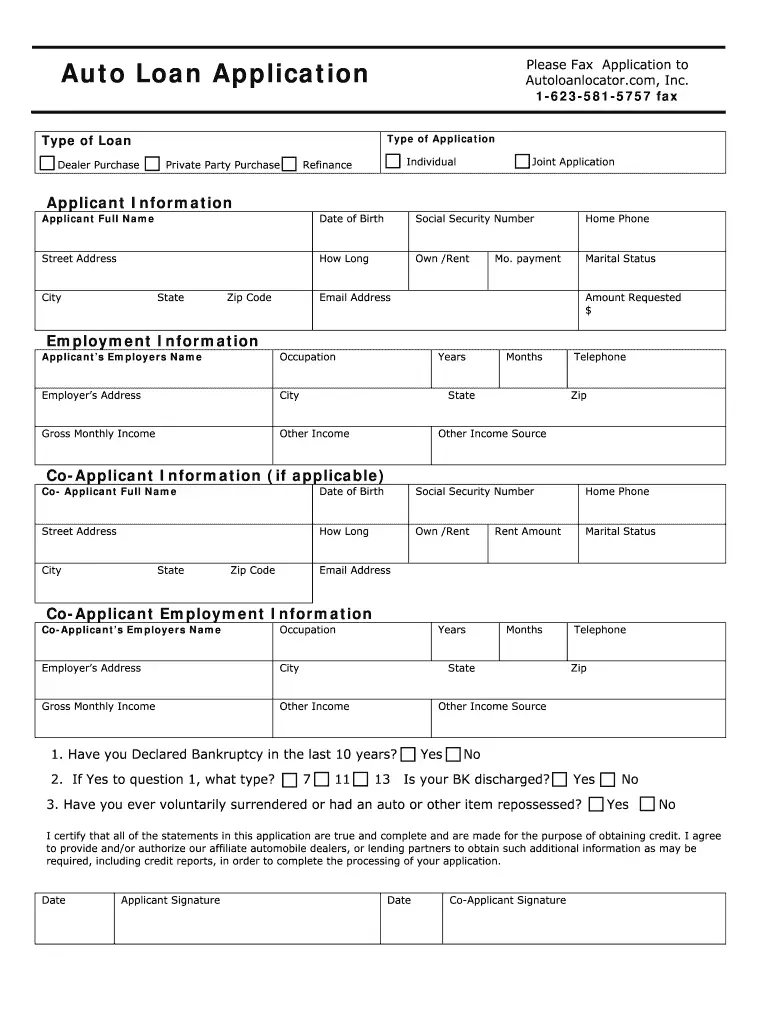

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

What Paperwork Is Involved With The Auto Loan Process

You may be able to complete the auto loan process over the phone or online, but sometimes youll need to send documentation or bring it with you to the dealership when you purchase a vehicle. The required information varies by lender, but typical documentation required with a loan application includes paycheck stubs, proof of residence and a valid drivers license.

During the final stage of the car-buying process, you may also need to send the purchase agreement, registration, title and lease buyout instructions to the lender. Youll probably also need proof of auto insurance if you plan to drive the vehicle off the lot.

Read Also: How To Get An Rv Loan With Bad Credit

How Much Would You Like To Borrow:

Please review and adjust your amounts for down payment, trade-in and cash incentive. Their current total is equal to orexceeds the vehicle purchase price.

Reminderthe minimum borrowing amount is $7,500. Therefore the total price of the vehicle less any down payment, trade-in, and cash incentive cannot be below this amount.

Interest Rate

Make Loan Payments On Time

Credit scoring models take into account how reliably you pay all your bills, including auto loans. In fact, payment history is the most important factor in determining credit scores. By paying your car loan on time every month, you can help build positive credit history.

What’s more, when you finish repaying the loan, the lender will report the account as closed and paid in full to credit bureaus, and that will remain on your credit report and benefit your credit for 10 years from the closed date. That paid-up loan tells future lenders you know how to manage credit and repay your debts.

However, paying late or missing payments altogether can hurt your credit scores and make it harder to get credit in the future. Late or missed payments appear as negative information on credit reports, and remain for seven years. On the positive side, as the late payment ages over time, the less impact it will have on your credit score.

Missing too many payments may cause the lender to turn your debt over to collections or even repossess your vehicle. Both collections and repossessions remain on credit reports for seven years from the initial date of delinquency, and can negatively affect credit scores throughout that time.

Don’t Miss: How To Take Loan From 401k To Buy House

Getting Preapproved For A Car Loan

If you decide to get a loan from a bank or credit union, you can get preapproved. Getting preapproval for a car loan involves completing a preliminary application with a lender who will review your credit and other financial information. They’ll let you know the size of the loan they’ll finance and the interest rate they’re likely to offer.

Preapproval can help you find the best interest rate, make it easier to know how much you can spend, and give you bargaining power with a dealership. It doesn’t, however, obligate you or the lender to actually enter into a loan agreement.

Remember to complete your preapproval and actual loan application within a short time period to minimize the possible impact of hard inquiries on your credit score.

Legal Disclosures And Information

75. OFFER/GIFT: Ascend Federal Credit Union will award one $100 deposit to each eligible prospective or current member who refinances an auto loan from a competitor at a value of $10,000 or more during the Offer Period.

OFFER PERIOD: The 2021 Auto Refinance Special begins at 12:00 AM Central Daylight Time on September 13, 2021 and ends at 11:59:59 PM CDT on October 22, 2021 . Entries received prior to or after the Offer Period are not eligible for the offer.

ELIGIBILITY: The Offer is open to prospective and current members of Ascend who refinance an auto loan from a competitor at a value of $10,000 or more during the Offer Period. Registration or participation from any corporation or other entity shall not be accepted or considered valid. Prospective members that wish to enter must qualify for membership, complete the account opening process and deposit and maintain a minimum of $5 in a savings account. If eligible, the $100 deposit will be made 90 days after the loan is opened. The loan must be in good standing at the time incentive is processed to receive bonus.

Don’t Miss: How Do I Make Sure My Ppp Loan Is Forgiven

How Do I Check My Credit Report And Credit Score

There are multiple providers that you can obtain your credit score from. Every year, you can get free credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. And some credit card providers, including Chase and Discover, provide a free credit score on your monthly billing statement.

Look At The Big Picture

As we mentioned above, calculate not how much your auto loan costs overall, but how much youll pay per month. Remember that a lower down payment may mean you pay less now, but it will increase your interest rates, and ergo, the total cost of your vehicle. Run the details of your loan through an auto loan calculator to get a better understanding of what your bills would like for each specific vehicle that youre interested in purchasing.

You May Like: What Does It Mean To Refinance Your Car Loan

Wells Fargo Auto Loan Calculator

One of the best things about wells Fargo auto loan refinance is its flexible terms. New and used car financing is available through your dealer. Also, Wells Fargo Online is a useful tool making it easy and convenient to manage your auto loan. Before you visit the dealership, the lender allows you to learn more about vehicle financing using their online resources.

And thats not all. Take advantage of the Wells Fargo auto loan calculator to expediently calculate your monthly car payments. In this way, youll be able to tell whether the loan you want to take is affordable.

Here are some of the different wells Fargo auto loan rates if you are looking to finance or refinance your vehicle with the banking behemoth. Note that these are only sample rates for a buyer with excellent credit. Individual rates will vary by loan amount, terms, and credit score.

| Wells Fargo 72-, 60-, 48-, and 24-Months Loan Terms |

| 72-Month Vehicle Loan |

Applying For The Car Loan

When you secure a car loan, the lender agrees to lend you the purchase price of the vehicle, and you agree to repay that principal with interest over a set period of months. It’s important to understand that the finance company technically owns the car until you pay off the loan.

As you’re applying for a car loan, you’ll encounter some important financial terms, including:

Don’t Miss: What Is The Average Auto Loan Interest Rate

Continue To Monitor Your Credit

While it’s important to know where your credit history stands before buying a car, it’s crucial to continue building and maintaining a good credit score afterward. Experian’s can help by providing you with free access to your FICO® Score powered by Experian data.

You’ll also get insights into your spending habits and customized alerts about new inquiries and accounts added to your Experian credit report.

When Is The Best Time To Buy A Car

The best time to buy a car is when you need one. If your current vehicle is no longer reliable or has been totaled, you likely don’t have the luxury of timing your purchase.

However, if you have some flexibility with buying your next car and want to get the best deal, some times of the year are better than others. And ultimately, it’s important to feel financially ready. Here’s what to consider before you buy your next vehicle.

Recommended Reading: What Is An Sba 504 Loan