How Much Can I Borrow If I Have Partial Entitlement

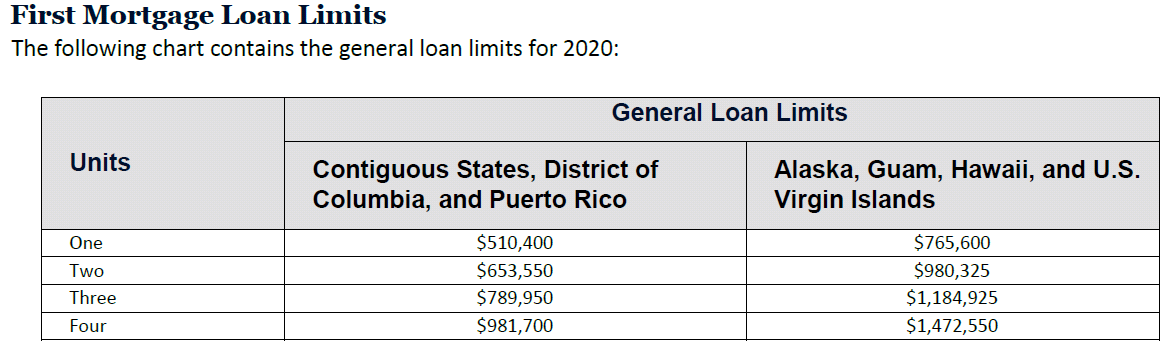

If you have partial entitlement, you will be subject to loan limits.

The VA loan limits are the same as the conforming loan limits. These are set each year by the Federal Housing Finance Agency . Loan limits depend on the property you buy and where youre buying, since the limits are based on home prices in a given area.

2022 VA loan limits for buyers with partial entitlement

| Property type |

|---|

| $1,867,275 |

You can look up the loan limits in your county on this FHFA map.

Keep in mind, though, that while its easy enough to find your countys loan limit, knowing how the limit affects your home loan isnt always so easy to measure.

Lenders use a complicated equation to determine whether you need a down payment on the new VA loan. If youd like to dig into that, see our guide to buying an additional home with a VA loan.

But if you just want to know how much house you can afford with a VA loan, talk to a VA lender. They can look up your COE and calculate your potential home price for you within a few minutes.

Jumbo Mortgage Requirements How To Qualify For A Jumbo Mortgage

Typically, a borrower must meet the following criteria to be eligible for a jumbo loan:

Lower Debt-to-Income RatioSince jumbo loans have more associated risk, the lender may require the borrower to have a lower debt-to-income ratio. Monthly mortgage payments may be larger than that of a conforming loan, so having less monthly debt obligations can help a lender determine your ability to repay the loan.

Higher Down PaymentIt is common for the down payment requirement to be higher than that of a conforming loan to mitigate the lenders risk. If you have more invested in the property, you may be less likely to default on the loan.

Higher Credit ScoreLenders may prefer that you have a higher credit score. A higher credit score may show a history of a strong ability to repay monthly debts on time and in full.

Higher Reserves & AssetsIt is common for lenders to require higher than usual reserves and assets for borrowers applying for a jumbo loan. The lender will review your reserves and assets to understand the strength of your financial profile overall.

Second AppraisalA jumbo loan may require a second appraisal on the subject property to evaluate the homes actual value and make sure it aligns with the anticipated loan-to-value.

When Va Loan Limits Apply

Although the VA doesnt limit how much you can borrow, your available VA entitlement does. In other words, if you dont have full entitlement, the current conforming limit of $647,200 will apply to any new VA loan you apply for.

Youll probably be subject to VA loan limits if:

- Youre still paying back your current VA loan

- You paid off a VA loan but still own the home it was attached to

- You had a short sale, foreclosure or deed in lieu of foreclosure on a prior VA loan that hasnt been paid in full

THINGS TO KNOW

VA entitlement is the dollar amount the VA will repay a lender if you fail to repay your mortgage. You can get a no-down-payment loan of up to four times your basic entitlement as long as you meet minimum mortgage requirements. You can check your current VA entitlement by requesting an online certificate of eligibility .

Also Check: Signing Loan Agent

What Are The Limits

While officially there is no maximum determined amount that someone can get through this form of financing, the agencies are using state regulations to set the maximum amount. Therefore, depending on the state, the limit can be between $550,000 and over $800,000. However, these are only basic models. In case that you are well-situated and have enough money, the agency can accept to provide you with a bigger loan as well. Also, there is a limit determined, and you can get it without any additional expenses.

On the other side, any amount that goes over that sum will require you to pay up to 25% in advance. Also, your income is playing a big role. For example, a wage of $6,000 with utilities and other monthly expenses of $2,000 provides you with a rating of 30, which is enough to apply for this model. However, the same expenses with the wage of under $5,000 per month are making the situation more complicated, with an increased chance of getting denied. Getting $300,000 will require you to pay around $2,000 each month. That is the main reason why agencies are using your other expenses as factors to be sure that you will be able to pay out the loan without any issues.

Qualifying For A Va Home Loan

VA home loans offer military service members and veterans the opportunity to buy a home with a lower credit score and even sometimes a better ratewhile avoiding the upfront costs of down payments and private mortgage insurance.

Applying for a VA loan is different from applying for a regular mortgage. But once you secure your COE and compare the best VA lenders, youll have a better idea of what you can affordand which loan is the right fit.

Recommended Reading: Transferring Auto Loan To Another Bank

What To Do If Your House Costs More Than Your Va Home Loan Limits

There are four things you can do if the cost of the home exceeds your mortgage limits.

- You can make up the difference by paying a downpayment, OR,

- You can ask the seller to negotiate the price, OR

- You can walk away from the deal and search for a house that is under your budget, OR

- You can ask the VA to conduct the appraisal again and reconsider the cost of the home.

But, whats an appraisal?

A VA loan appraisal is an assessment conducted by the US Department of Veterans Affairs to evaluate the propertys value.

It also ensures that the house meets all the Minimum Property Requirements defined by the VA.

Does The Va Limit The Quality Of Homes That Qualify For Va Loans

This is the other kind of VA loan limit, the kind that doesnt have to do with dollars and cents. The VA likes to make sure that the homes people finance with their loans arent too run down. Homes financed with a VA loan need to be safe, structurally sound and sanitary. Youll be hard-pressed to get a VA loan on a tear-down, in other words.

You May Like: Fha Refinance Mortgage Calculator

What Is A High

A high-balance loan is one that exceeds the national baseline conforming loan limits, but falls within the local conforming loan limits for your high-cost county. High-balance loans are considered conforming loans with respect to Fannie Mae and Freddie Mac . Lending requirements for conforming loans include:

- You must have a credit score of at least 620 depending on your down payment size and cash reserves.

- You must make a down payment of at least 5% of the homes appraised market value.

- Your debt-to-income ratio the percentage of your monthly pretax income required to cover the mortgage payment and other debts cannot exceed 45%.

Qualifying for a high-balance loan from Fannie Mae comes with a couple of extra stipulations that dont apply to standard conforming loans:

- All loan applicants must have credit scores. Standard conforming loans allow for a process known as manual underwriting, which evaluates an applicants creditworthiness even if they lack credit reports needed to obtain a credit score. Fannie Mae uses an automated system that requires all high-balance loan applicants to have credit scores.

- High-balance loan borrowers dont have access to Fannie Maes 3% down-payment loans.

May I Borrow More Than The Value Of My House

The short answer is no, Hopkin said. You can only borrow up to 100 percent of the value of the home you purchase, which is based on the VA loan limit amount for the county in which the property is located. So, if you’re looking at a property that needs significant remodeling and you’re hoping to roll the cost of that work into your VA loan, it’s not an option even though you may know people who have done just that with a conventional loan. In some cases, you may be able to fund some energy-efficient improvements, like thermal windows or solar panels that cost no more than $6,000, with your VA loan amount and potentially some closing costs and fees associated with the transaction.

Recommended Reading: Can I Use A Va Loan For An Investment Property

Va Loan Limits: The Basics

There are technically no limits to VA loans. There are only limits to how much the VA will guarantee. The VA will guarantee up to 25% of the loan amount for lenders in the event that you default on your loan. The amount the VA will guarantee is dependent on the amount of your VA entitlement.

For the purposes of this discussion, VA loan limits can be defined as the amount you can borrow without having to make a down payment.

Most people getting a VA loan are going to have whats referred to as full entitlement. If you have full entitlement, as of 2020, you dont have a loan limit. The VA will guarantee 25% of whatever a lender is willing to approve you for.

You have full entitlement under any of the following four scenarios:

- Youve never used your VA loan entitlement.

- Youve used your entitlement to buy or refinance a property previously, but youve since sold and fully paid off your VA loan.

- You had a previous VA loan that wasnt fully paid off because of a foreclosure or short sale, but youve since fully repaid the VA.

- You paid off a VA loan without selling the property. You can have your entitlement restored this way one time.

If your COE says that you have some number greater than zero, but less than $36,000, you have remaining entitlement, but not full entitlement. This is also referred to as impacted entitlement. If thats the case, you are subject to a loan limit if you want to buy a home without a down payment.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Rv Loan Usaa

Recommended Reading: Bayview Loan Servicing Foreclosure Listings

What No Va Loan Limits Means To You

Eliminating a max VA loan limit doesnât mean a spending spree is on your horizon. But he Is make it easier to buy a larger house or a house in a more expensive market.

More importantly, you will be able to buy this more expensive property without putting in a lot of money .

But before you do that, itâs important to remember that skipping the down payment â while allowed â will result in a higher loan balance and, therefore, a larger monthly payment. For example:

| Purchase price | |

| 3.75% | $ 1,250 |

For these reasons, you will have to be smart to buy within your means. Use a mortgage calculator to figure out what you can afford and let it guide your home search.

Catching Up On Changes To Va Loan Limits

From the moment the VA home loan program was first created in 1944, service members were limited in the amount they could borrow. The tradeoff was twofold: You didnt need a down payment and your interest rates were usually lower than a conventional mortgage. At times, those loan ceilings could make it more difficult for eligible veterans and active duty members to buy their dream home, especially in high-cost real estate markets.

You May Like: Mlo Endorsement

Jumbo Loans: Requirements Limits And Rates

Jumbo loans are designed for higher-priced properties and usually come with more stringent qualifying requirements.

Edited byChris JenningsUpdated January 4, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

Jumbo loans are a type of mortgage product designed for higher-priced homes. Theyre typically reserved for buyers with good credit, steady income, and a good amount of cash reserves.

Heres what you should know about jumbo loans:

You May Like: What Car Can I Afford With My Salary

The Maximum Amount Of The Va Loan No Longer Exists

If you are lucky enough to qualify for a VA loan, you get some serious benefits.

With no down payment requirements, no mortgage insurance, and some of the lowest interest rates on the market, a VA loan is one of the best mortgage products you can find.

More, VA loan changes adopted earlier this year introduces another advantage: there is no longer a maximum amount of VA loan.

Now, to be clear, that doesnât mean you can get a VA loan for whatever amount your heart desires.

There are still limits to what you can buy â they just depend more on your unique financial situation, rather than a national limit.

Recommended Reading: How Long Does It Take Prosper To Approve A Loan

Va Loan Limit Questions & Answers

VA loans are valuable home financing tools for veterans, but they can be confusing for first-time home buyers and even seasoned home owners. Alexandra Hopkin, a financial planner for MilitaryPlanners.com who specializes in financial guidance for military members and their families, offers straightforward answers to some commonly asked questions about VA loans and what they mean for their borrowing options.

What Va Loan Limits Mean For You

VA loan limits dont limit how much you can borrow to finance a home thats up to your mortgage lender, and could be based on your credit and other factors. Rather, the VA loan limit describes how much the VA will guarantee for the lender. If youre approved for a bigger mortgage , youre free to borrow beyond these limits, but without full entitlement, you might need to make a down payment to do so. In other words, with a down payment, you could be able to borrow more than the county loan limit.

Now that VA loans no longer have limits for borrowers with full entitlement, first-time borrowers have no cap on the size of a zero-down payment VA loan. The VA funding fees, which most borrowers have to pay in order to obtain a VA loan, remain in place, however.

Remember, even if you have full entitlement and arent subject to loan limits, that doesnt necessarily mean you can get any size VA loan you want. Your lender will still need to evaluate your credit history, income and assets to approve you for a loan, and for a specific amount.

Read Also: Usaa Auto Loans Rates

Can You Reject A Va Loan

VA lenders make money by approving loans, not denying them, so they will do what they can to get your approval. When they can not, they send what is called an alert for unwanted action. To see also : Why do sellers hate VA loans?. This is an official form and required by law to give you a written explanation of why your loan was not approved.

Can you discriminate against a VA loan?

If you want to buy a home with a VA loan, you can not be discriminated against because of your disabilities at any stage of the process, including viewing, inspecting or otherwise having access to the property as a potential buyer or tenant.

Why would a VA home loan be denied?

The most common reason why VA applications for mortgages are rejected is due to errors in the application itself. Lenders cannot issue loans unless they are sure that your personal and financial details are correct. Before submitting your application, take the time to review each claim you make and the numbers you enter.

What Is The Jumbo Limit Minimum Credit Score Required

This varies from lender to lender. However, most lenders like to see a credit score higher than 700. In some cases, as high as 720. The minimum credit score a lender would most likely accept for a jumbo loan is 680. Keep in mind, these requirements are different for each lender, make sure you research several lenders qualifications to see where you can get approved.

You May Like: Fha Vs Conventional 97

When Do Va Loan Limits Apply

VA loan limits are applied to those with no or partial VA loan entitlement.

How do you know if someone has full or partial entitlement? Luckily, we have the answer to this frequently asked question.

You have full entitlement if any one of the following is true.

- You have never used your VA loan benefits before.

- You have paid the previous VA loan fully and have sold the property.

- You borrowed a VA loan and had a foreclosure but repaid the amount in full.

An applicant will be subject to loan limits if any one of the following is true.

- Your VA loan is still active, and youre paying it back.

- You have paid the previous loan amount in full but still, own the house.

- You refinanced a non-VA loan into a VA loan and still own the home.

- You had a short sale on your previous VA loan and didnt repay it completely.

- There was a foreclosure on a previous VA loan you failed to repay.

- You filed a deed in place of foreclosure for an earlier VA loan.