Average Interest Rates By Term Length

Most banks and credit unions provide payment plans ranging from 24 to 72 months, with shorter term loans generally carrying lower interest rates. The typical term length for auto loans is 63 months, with loans of 72 and 84 months becoming increasingly common. The higher APRs of longer term auto loans, however, can result in excessive interest costs that leave borrowers upside downthat is, owing more on the auto loan than the car actually costs.

Heres a closer look at average interest rates across various loan terms for those with the strongest credit.

| Auto Loan Term | |

|---|---|

| 72 Month | 4.45% |

While longer term loans allow for a lower monthly payment, the extra months of accumulating interest can ultimately outweigh the benefit of their lower short term cost, especially for the consumer purchasing an older used car whose value will depreciate quickly.

Terms of 72 and 84 months are also usually available only for larger loan amounts or for brand new models.

For example, when paid over the course of 48 months, a $25,000 loan at a 4.5% interest rate will result in monthly payments of $570 and a total cost of $27,364. When paid over the course of 84 months in $348 monthly payments, this same loan at the same interest rate costs a total of $29,190 more than $1,800 pricier than at 48 months. For higher interest rates, the difference between short and long term payments will be even greater.

Simple Interest Car Loans

Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

On a simple interest loan, interest is front-loaded and amortized. With an amortized loan, part of your monthly car payment goes to the principal, which is the amount you borrowed, and part of your payment goes to the interest charges. Because the loan is front-loaded, a larger portion of each car loan payment applies to interest at the beginning of the loan term and at the end of the term more applies to the principal balance.

For example, If you have a $25,000 car loan with a 48-month term and a 4% interest rate, youll pay an estimated $83 in interest and $481 in principal during the first month of the loan term. By the last month, youll only pay an estimated $2 in interest, and $563 will apply to the principal amount.

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

You May Like: Becu Auto Smart

Maintain Good Credit For Future Auto Purchases

While improving your credit for your next car purchase can save you money in the short term, maintaining good or excellent credit can provide even more savings in the long run, on future auto purchases as well as other financing options.

Make it a goal to monitor your credit regularly to keep an eye on your credit score and the different factors that influence it. Keeping track of your credit can also help you spot potential fraud when it happens, so you can address it quickly to prevent damage to your credit score.

The Internet Has Changed Automotive Shopping

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It’s your leverage in the negotiating process. If you don’t have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don’t worry, the dealer still makes a profit. There is something called holdback which the manufacturer gives the dealer for each vehicle. It’s usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn’t hit his quota.

Get a Free Online Quote

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

You May Like: Refinance Avant Loan

False Car Accident Claim What To Do

Category: Cars 1. How To Deal With A False Auto Accident Claim Against Me Jul 14, 2020 You Need to Defend Yourself if Uninsured · Investigating your case, including contacting and interviewing witnesses · Obtaining key pieces of Vehicle dumping, aka owner give-up · False registration · Exaggerated repair

How To Calculate Car Rental

Lease prices are made by subtracting the MSRP or negotiated price, minus the residual value The dealer will provide you with the rest of the value. For example, if you want to rent a car worth US$30,000 over a period of three years, then at the end of the lease, the value of the salvage can be US$15,000.

Recommended Reading: Va Manufactured Home 1976

Does Elements Offer An Extended Warranty Or Other Loan Or Asset Protection Coverage

Yes. As your financial wellness providers, we want to make sure that youre covered, no matter what may happen. Thats why we provide loan and asset protection programs. Its just one more way that we look out for your best interests.

To protect your purchase, the following programs are available and can be wrapped into your monthly payments:

- Mechanical Breakdown Protection , also known as extended warranty, is automobile protection that extends beyond the manufacturer’s factory warranty and covers repairs of unexpected mechanical breakdowns. For the period of time the contract is in effect, you are assured that covered components of your vehicle will be repaired in the event of failure. This includes labor, subject to any applicable deductible. Learn more.

- Guaranteed Auto Protection is protection designed to eliminate your unpaid net loan or lease balance in the event your vehicle is stolen or damaged beyond repair. Learn more.

- Debt Protection protects your credit rating during uncertain and stressful times. Your loan payment will be cancelled or suspended for a period of time without penalty, added interest, or being reported as delinquent to the credit bureau when a covered event occurs. Covered events include death, disability, involuntary unemployment, family leave and hospitalization. Learn more.

What Theyre Screening Pt 2 Your Choices

Whom you approach

The following statement may seem like a newsflash for you the institution you approach can impact your car loan interest rate. Thats the reason why people get their loans from different places. Its all about the offer, and that varies from lender to lender.

Lets give you an example. Three people need cars Sarah, Steve and Sally.

Sarah is a 33 year-old administrative assistant with good credit, and is in desperate need of a car she cant stand traffic anymore and wants to reach her kids faster. She goes directly to the bank for a loan. She walks out with a healthy 4.21% interest rate on her car loan.

Sally on the other hand is a 19 year-old university student, with virtually no credit to her name. Shes not bad with money per se, but shes very young and hasnt had many opportunities to build her credit. Encouraged by her dad, she goes to a used car dealership. She walks out with a 6.3% interest rate.

Steve is 56 years-old engineer, who is an automobile aficionado, and spent much of his younger years working on cars. Hes got stellar credit. And since hes owned a few cars in his life, he knows the process of buying a car as if he were a salesperson himself. For Steve, getting a loan through a manufacturer serves him best, and hes rewarded with a killer 1% interest rate.

Used dealerships tend to offer a wider range of interest rates, some of which are higher than what banks or manufacturers provide.

Recommended Reading: How To Get Loan Officer License In California

How To Apply For An Auto Loan

You can apply for an auto loan online, at a financial institution, or at the dealership when purchasing a car. Some lenders allow you to browse the inventory of participating dealerships after your loan is preapproved. Because most loan applications require vehicle information, you may need to have a particular car in mind before applying.

When you apply for a car loan, be sure to have the following information handy, as it may be required to prequalify and will certainly be required before you submit your formal loan application:

- Personal details such as name, address, and age

- Social security number

- Gross annual income information

- Vehicle information such as age, mileage, and vehicle identification number

While not required during prequalification, before you can secure your loan, you may need additional documentation such as your driver’s license, pay stubs, and personal references.

If you plan to have someone cosign your loan, that person will also need to supply the information and documents mentioned above.

To start comparing the best auto loan rates from multiple lenders, visit AutoCreditExpress.com.

How Do I Calculate Apr On A Car Loan

To calculate the estimated APR on a car loan, weve put together a method using computer spreadsheet software. To go that route, youll need the following information:

- Loan amount The total amount you plan to finance, typically the price of the vehicle, minus any down payment or trade-in

- Loan term The length of your auto loan

- The loans interest rate

- Certain fees, like origination fees

The first step in calculating APR yourself is calculating your estimated monthly payment.

You May Like: Usaa Auto Loan Approval Odds

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Also Check: Can You Buy A Mobile Home With A Va Loan

To Lower Your Interest Rate

It is understandable that many people often get carried away by the excitement of seeing a new vehicle they have always dreamed of. This can make one not shop around for the best interest rates and accept whatever financial institution they are referred to by a dealership.

Sometimes, the interest rates from that financial institution can drop from the time you financed your car loan. If you have made payments for at least six months, then you can ask the lender if it is possible to refinance your auto loan to lower your interest rates.

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

Don’t Miss: Can You Use A Va Loan To Buy Land And A Manufactured Home

How Can I Lower My Car Loan Interest

- Check Your Credit Before Shopping. Pull your credit report from each of the three major credit bureaus before approaching a lender for an auto refinance.

- Cleaning Up Your Score.

How Do Auto Loan Rates Work

Auto loan interest rates are determined through risk-based pricing. If a lender determines you’re more at risk of defaulting on your loan because of your credit score and other factors, it will typically charge a higher interest rate to compensate for that risk.

Factors that can impact your auto loan interest rate include:

Whatever auto loan interest rate you qualify for, it’ll be represented in the form of an annual percentage rate , which may include the cost of both interest and fees. The lender uses your interest rate to amortize the cost of the loan. This means that you’ll pay more interest at the beginning of the loan’s term than at the end.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. It’s like a grade for your borrowing history ranging from 300 to 850, and includes your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be, and therefore how much they want to charge you for the privilege.

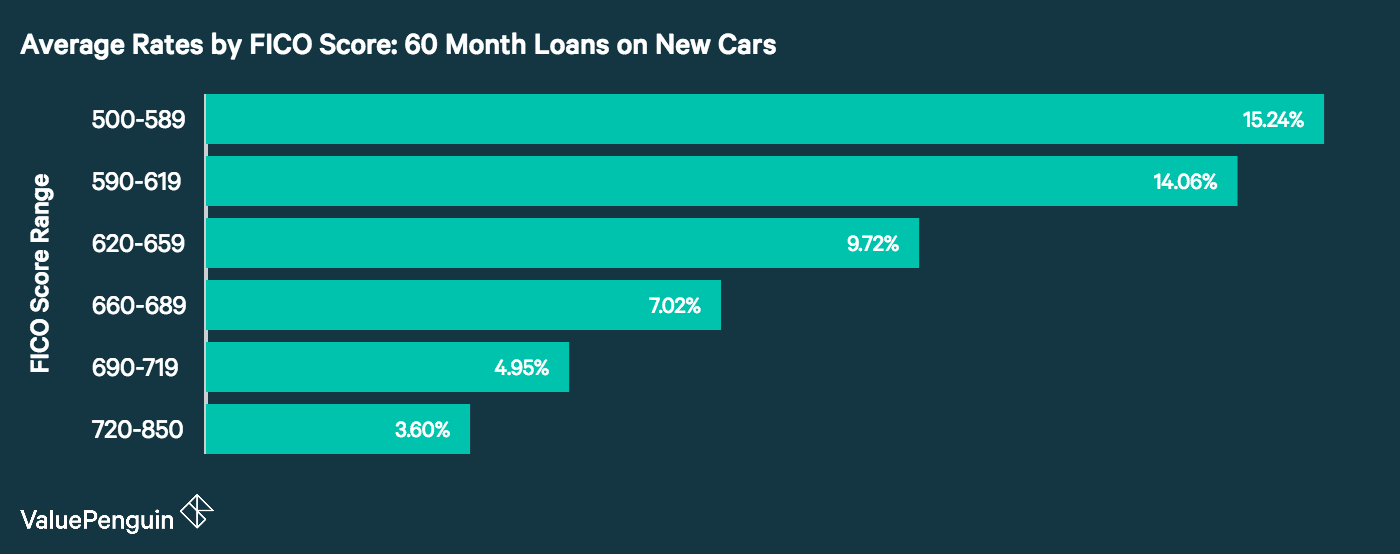

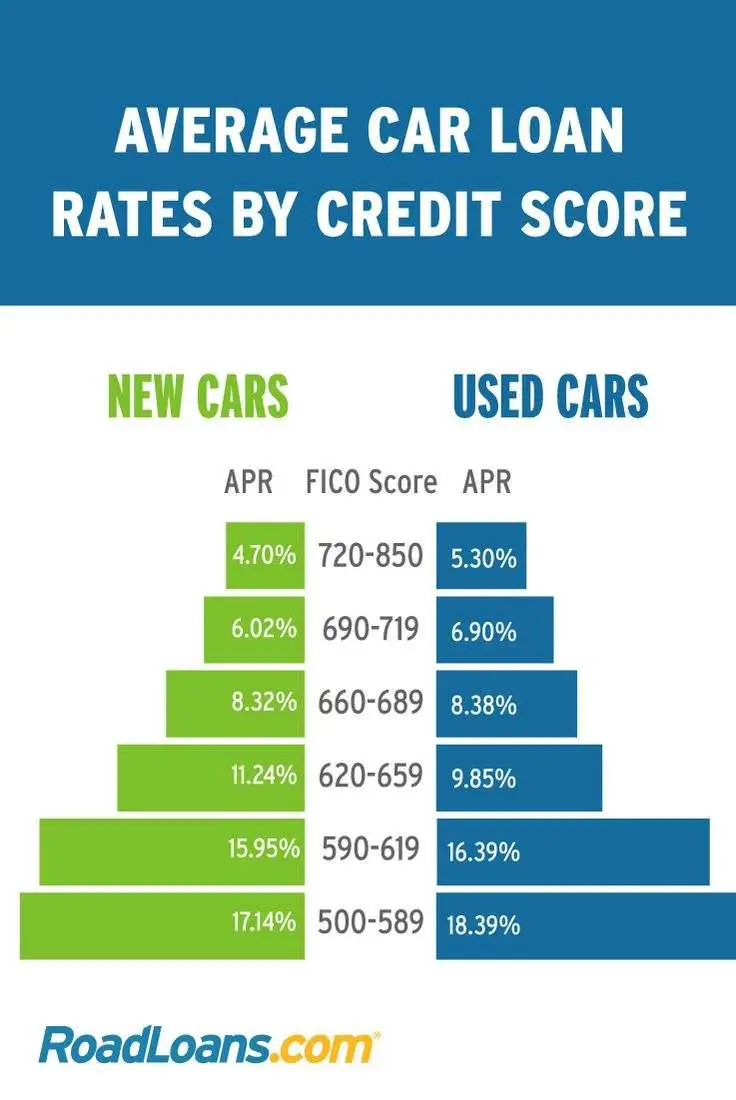

Auto loans are no exception to the longstanding rule that having a lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.34% | $655 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $655 a month, while a person with a score in the lowest category would pay $829 a month, or $174 more for per month for the same car.