Interest Rates And Fees If You Borrow On Amounts You Prepaid

You pay either a blended interest rate or the same interest rate as your mortgage on the amount you borrow. A blended interest rate combines your current interest and the rate currently available for a new term.

Fees vary between lenders. Make sure to ask your lender what fees you have to pay.

You may not have to make any changes to your mortgage term.

What Is Home Equity

Home equity is the current market value of your home minus the remaining balance of your mortgage. Essentially, it’s the amount of ownership of a property you have built up through both appreciation as well as reductions in the mortgage principle made through your mortgage payments. So, as you pay off your mortgage and build equity in your home, a HELOC gives you the ability to reborrow a portion of these funds.

Qualify For A Home Equity Line Of Credit

You only have to qualify and be approved for a home equity line of credit once. After youre approved, you can access your home equity line of credit whenever you want.

Youll need:

- a minimum down payment or equity of 20%, or

- a minimum down payment or equity of 35% if you want to use a stand-alone home equity line of credit as a substitute for a mortgage

Before approving you for a home equity line of credit, your lender will also require that you have:

- an acceptable credit score

- proof of sufficient and stable income

- an acceptable level of debt compared to your income

To qualify for a home equity line of credit at a bank, you will need to pass a stress test. You will need to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate in your contract.

You need to pass this stress test even if you dont need mortgage loan insurance.

The bank must use the higher interest rate of either:

- 5.25%

- the interest rate you negotiate with your lender plus 2%

If you own your home and want to use the equity in your home to get a home equity line of credit, youll also be required to:

- provide proof you own your home

- supply your mortgage details, such as the current mortgage balance, term and amortization period

- have your lender assess your homes value

Youll need a lawyer or a title service company to register your home as collateral. Ask your lender for more details.

You May Like: Usaa Refinance Auto Loan

How To Compare And Apply For A Line Of Credit

Comparing home equity loans is a little different to comparing traditional mortgages. You need to look at:

- Interest rate. The lower your rate the lower your repayments.

- Fees. The fewer the fees, the better.

- Borrowing amount. The amount you wish to borrow is an important consideration. Some lenders have fairly low maximum loan amounts, while others could lend you enormous sums of money .

How do I apply for a line of credit equity loan?

If you’re applying for a line of credit you may need to satisfy the following criteria or supply the following information:

- Name and address for each borrower

- Purchase date and price of your home

- Employment income

- Outstanding balance and monthly payment on current mortgage

- Estimated market value of your home

- Requested loan amount

Check Out The Best Current Mortgage Rates

Take 2 minutes to answer a few questions and discover the lowest rates available

A home equity line of credit is one of the best ways to access the equity youâve built up in your home, and a low-cost alternative to other lines of credit like credit cards or personal loans. However, itâs important to know some details about HELOCs before you decide to take one out.

Here’s everything you need to know about getting a HELOC in Canada. When you’re ready, use the tools at the top of this page to receive personalized quotes from multiple providers.

Also Check: Fha Maximum Loan Amount Texas

Lower: Best Home Equity Line Of Credit For Quick Approval

Overview: Lower, a fintech company that was founded in 2018, analyzes data to recommend the best loan for each borrower’s financial situation. Lower offers mortgages, refinance loans, home equity loans and HELOCs.

Why Lower is the best home equity line of credit for quick approval: Lower gets its name from offering “lower” rates and promises a quick approval and closing process. The application process is completely online, and the application is streamlined and full of easy-to-understand language.

Perks: Lower lets you borrow up to 95 percent of your home’s value, while most other lenders cap LTV at 80 or 85 percent. Additionally, Lower does not charge an annual fee.

What to watch out for: Lower charges a 1 percent origination fee on all HELOC transactions, so you may want to limit your spending. Lower also has a relatively low line of credit limit at $350,000.

| Lender |

|---|

| There’s an origination fee of 1% on each HELOC transaction |

Flagstar Bank: Best Home Equity Line Of Credit For Good Credit

Overview: Flagstar Bank offers HELOCs that feature flexible withdrawal methods and affordable rates for those who can qualify. If youre looking for a HELOC that offers attractive terms and you have a solid credit rating, you should check it out.

Why Flagstar Bank is the best home equity line of credit for people with good credit: If you have strong credit, Flagstar may offer you some of the lowest rates in the business.

Perks: Flagstar has flexible loan amounts that range from as little as $10,000 to as much as $500,000.

What to watch out for: Theres an annual fee of $75, though its waived in the first year. And while most banks let you convert some or all of your balance to a fixed-rate loan, Flagstars APR remains variable for the life of the loan. That means you may pay more in interest. Flagstar’s loan offerings also vary by ZIP code the details here are presented for the 49546 ZIP code.

| Lender | |

|---|---|

| $10,000 to $500,000 | |

| Fees | The annual fee is $75 , and borrowers may have to pay back closing fees if the account is closed within 36 months. Some loans require title insurance, government taxes and fees at closing. |

Don’t Miss: How To Apply For A Second Loan With Upstart

When Is A Good Time To Use A Home Equity Loan

A home equity loan may be a good option if you’ve been planning a large home renovation or if you need to consolidate debt and you spot a good rate. If youve been considering a home equity loan, now is the time to lock in your rate. Rates are lower than historical benchmarks, but many banks have tightened approvals, and some have even temporarily suspended their home equity products.

How To Find The Best Home Equity Interest Rates

Posted by The Lazy Admin | Dec 27, 2021 | | 0 |

Youre interested in getting a home equity loan, but youre not sure where to start. Theres no one best rate, and your interest rate will vary depending on your location. For example, Boston has the lowest average home equity loan rate, while D.C. has the highest average. Bankrate obtains rate information from the largest banks in each of the ten largest U.S. markets. They then use the prevailing interest rates to determine the best home equity loan rates. Generally, the APR, loan amount, and fees are all based on the same standard.

The interest rate for a home equity loan is typically variable and tied to the prime rate of the commercial bank. The prime rate affects mortgage rates, small business loans, and personal loans. In addition, HELOC rates are generally 1%-2% higher than the prime rate. The best place to find the current home equity interest rates is online. You can also check Bankrate.com for updated rates. This site collects information from the 10 largest banks in major U.S. markets. All rates are calculated based on a $30,000 loan with a combined loan-to-value ratio of 80 percent.

Don’t Miss: Best Mortgage Companies For Fha Loans

Best Home Equity Loan For Home Improvement

TD Bank was our top pick for the best home equity lender for home improvement projects, thanks to its high maximum loan balance, competitive rates and wide selection of loan terms. Homeowners who need to finance large expensive projects at cheap rates may find attractive terms with TD Bank, where fixed-rate home equity loans start at 4.49%.

Highlights: The lender offers one of the largest permitted loan balances of any lender, allowing borrowers to cash out on up to $500,000, making it ideal for homeowners in high-cost areas like New York and New Jersey.

Drawbacks: Borrowers who live on the West Coast or outside the vicinity of a TD branch will not be able to obtain a TD home equity loan. If you’re looking for a more accessible lender, we recommend U.S. Bank, which offers similar terms and operates branch locations pretty much everywhere outside the east coast.

- Terms: 5, 10, 15, 20 or 30-yr

- Max Loan Size: $500,000

- Rates: 4.49% – 10.26%

How to Get a TD Home Equity Loan: If you’re interested in obtaining a home equity quote from TD Bank, you’ll need to live in a state with a TD Bank branch. The lender operates primarily on the East Coast, with branches strewn across 15 states along the Atlantic seaboard. Visit your local TD Bank for a home equity rate quote, or click the link above to start a free rate quote online.

What Can A Heloc Help You Do

In life, you often face major home improvement projects,

unexpected costs, education expenses, or the need to consolidate debt.

A home equity line of credit, or HELOC,

could help you achieve your life priorities.

At Bank of America,

we want to help you understand

how you might put a HELOC to work for you.

A HELOC is a line of credit borrowed against

the available equity of your home.

Your home’s equity is the difference between

the appraised value of your home

and your current mortgage balance.

Through Bank of America,

you can generally borrow up to 85%

of the value of your home

MINUS the amount you still owe.

For example,

say your homes appraised value is $200,000.

85% of that is $170,000.

If you still owe $120,000 on your mortgage,

youll subtract that, leaving you with the maximum

home equity line of credit

you could receive as $50,000.

Much like a credit card,

a HELOC is a revolving credit line that you pay down,

and you only pay interest on the portion of the line you use.

With a Bank of America HELOC,

there are no closing costs,

no application fees, no annual fees,

and no fees to use the funds!

Plus, Bank of America offers rate discounts

when you sign up for automatic payments,

as well as discounts

based on the funds you initially use when opening the HELOC.

AND there’s Preferred Rewards,

which extends benefits to you

as your qualifying Bank of America balances grow.

The interest rate is often lower

than other forms of credit,

but you should consult a tax advisor.

Read Also: Capital One Subprime Auto Loan

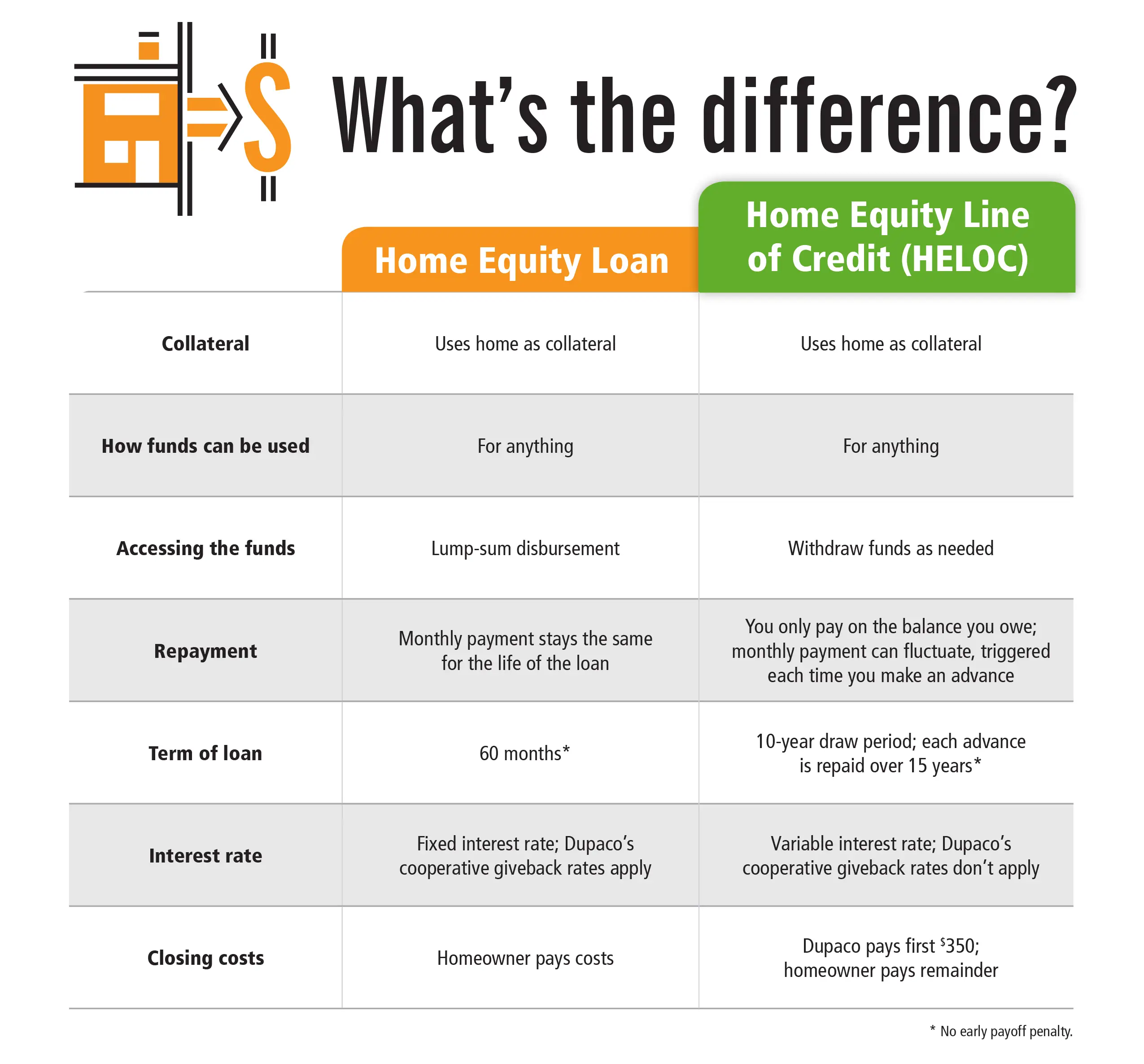

Home Equity Loan Vs Heloc For Bad Credit

Because home equity loans and HELOCs both use your home as collateral, they are both viable options if you have poor credit it will likely be easier to qualify for a home equity product than, say, an unsecured personal loan.

However, it’s still important to consider which option is right for your financial situation, especially if your poor credit is a result of missed payments. If you know that you would benefit from a structured monthly budget, a home equity loan is the right option. If you would rather focus on keeping your debt low, a HELOC will allow you to take out only as much as you need and pay it back on a more flexible timeline.

If you’ve shopped around at different lenders, have considered getting a co-signer and still aren’t sure if you’ll get approved due to your credit score, you still have options. Consider why you’re interested in taking out a loan. Do you need the funds immediately? Will this help you or hurt you in the long run by racking up more debt?

If you’re having trouble getting approved, take some time to improve your credit score. It’s also important to decide how a loan could impact your credit score in the future because you’ll be taking on more debt with both a home equity loan and a HELOC.

Is A Heloc Tax Deductible

Interest paid on a HELOC is tax deductible as long as its used to buy, build or substantially improve the taxpayers home that secures the loan,according to the IRS. Interest is capped at $750,000 on home loans . So if you had a $600,000 mortgage and a $300,000 HELOC for home improvements on a house worth $1.2 million, you could only deduct the interest on the first $750,000 of the $900,000 you borrowed.

If you are using a HELOC for any purpose other than home improvement , you cannot deduct interest under the tax law.

Read Also: California Loan Officer License

Summary Of Our Top Picks

For a quick comparison, we summarized the best companies for home equity loans below. We selected each provider based on a specific set of criteria, as explained in the methodology section. The lenders were selected from a collection of banks, credit unions and non-bank mortgage lenders.

| Best for⦠|

|---|

| PNC |

Where Can I Get A Home Equity Loan

A variety of banks and credit unions offer home equity loans. If you have an existing relationship with a bank, it may be best to start your search there, but its always a good idea to shop around with a few lenders to compare rates, fees and loan terms.

A good way to do this is by taking advantage of prequalification forms, which let you see your potential rates and eligibility with a lender without impacting your credit score.

You May Like: Usaa Refinance Car

A Guide To Home Equity Line Of Credit

A home equity line of credit is one of the best ways to access the equity youve built up in your home. Its a low cost alternative to other lines of credit like credit cards or personal loans, backed by the equity you’ve built in your home. Despite the benefits, its important to know some details about HELOCs before you decide to take one out.

Advantages And Disadvantages Of A Home Equity Line Of Credit

Advantages of home equity lines of credit include:

- easy access to available credit

- often lower interest rates than other types of credit

- you only pay interest on the amount you borrow

- you can pay back the money you borrow at any time without a prepayment penalty

- you can borrow as much as you want up to your available credit limit

- its flexible and can be set up to fit your borrowing needs

- you can consolidate your debts, often at a lower interest rate

Disadvantages of home equity lines of credit include:

- it requires discipline to pay it off because youre usually only required to pay monthly interest

- large amounts of available credit can make it easier to spend higher amounts and carry debt for a long time

- to switch your mortgage to another lender you may have to pay off your full home equity line of credit and any credit products you have with it

- your lender can take possession of your home if you miss payments even after working with your lender on a repayment plan

These are some disadvantages of a home equity line of credit that are common to other loans:

- variable interest rates can change which could increase your monthly interest payments

- your lender can reduce your credit limit at any time

- your lender has the right to demand that you pay the full amount at any time

- your credit score will decrease if you dont make the minimum payments as required by your lender

Recommended Reading: Is The Loan Forgiveness Program Legit

How Does A Heloc Work

With a HELOC, youre given a line of credit thats available for a set time frame , usually up to 10 years. While most HELOCs have an interest-only draw period, you can make both interest and principal payments to pay off the line of credit faster.

When the line of credits draw period expires, you enter the repayment period, which can last up to 20 years. Youll pay back the outstanding balance that you borrowed, as well as any interest owed. A lender may allow you to renew the credit line.

How Do You Pay Interest On A Heloc

With a HELOC mortgage, the entire line of credit available is not advanced upfront. Rather, you have the freedom to use as much or as little of the HELOC as you choose, and you only pay interest on the amount you have withdrawn.

Interest is calculated daily at a variable rate attached to Prime. However, HELOC rates are often higher than variable mortgage rates, and the relationship to Prime can technically change anytime at the discretion of your lender.

For example, a variable mortgage rate is often Prime +/- a number, like Prime 0.35%. HELOC rates, however, are set at Prime + a number and your lender can technically change that number anytime.

You May Like: Usaa Car Loan Refinance Rates

When You Cant Pay Back Your Loan

Sometimes, even if youre granted a loan, you may encounter financial problems later on that make it difficult to pay it back. Though losing your home is a risk if you cant pay back your home equity loan or line of credit, it isnt a foregone conclusion. However, even if you can avoid losing your home, you will face serious financial consequences.

If the real estate market takes a dip, those with higher combined loan-to-value ratios run the risk of going underwater on their loan.