Choosing Between A Fixed Or Variable Rate

If youve done a little car loan comparing already, you may have seen the terms fixed rate and variable rate scattered about. Dont just pick one at random though, as your choice can majorly influence how many dollars you end up paying back in interest or fees. Ultimately, the rate type you opt for should depend on how you intend to use your car loan.

Fixed rates

Lets look at fixed rate car loans first, where the interest rate is guaranteed to stay that way for the entire loan term. So long as you follow your loan repayment plan, you will know exactly how much money will go to your provider in interest. On the downside, most fixed rate loan providers charge a fee when the total loan amount is repaid early, and many have limits on how much extra you can repay. This is why, when choosing a fixed rate loan, its important to select a term that aligns with how many years you want to spend paying off your loan.

Variable rates

Unlike the stability that comes with fixed rate car loans, the interest rate with variable rate loans can change over the course of your loan term in or against your favour. Dont let that put you off, as they will rarely involve early loan repayment fees. So if your budget can handle a slight rate change, plus you want the opportunity to clear your debt whenever it suits, a variable rate car loan could right for you.

What Is A Car Loan And How Does It Work

A car loan is a personal loan that is used to purchase a vehicle preowned or new. Over time, you will pay back the amount you borrowed from the lender, plus interest.

The car serves as collateral for the loan, and if you are unable to make payments on time, the lender can seize the vehicle.

You can get a car loan from a bank, dealership, online lender, or credit union.

An online lender is convenient and you can easily compare rates without leaving your home. Online lenders like Canada Drives and Car Loans Canada have partnerships with dealerships which accelerates the process from applying for a loan to getting your new car.

The various terms you should understand when applying for a car loan include:

Principal: This is the amount you borrow to purchase a vehicle.

Interest rate: This refers to the effective interest rate you pay on your loan. The car loan rate you qualify for varies with your , vehicle age, down payment, and the lenders prime rate.

The interest rate can be fixed or variable. For most car loans, your monthly payments stay the same . When you make a payment, a portion goes to offset the principal amount owed and the remainder goes to interest.

Loan Term: This is the length of time you have to pay back the car loan. It can range from 1-8 years .

The combination of a lower interest rate and a shorter loan term can help you save money on your car loan. Use the car loan calculator below to test various scenarios.

Which Bank Has The Lowest Car Loan Interest Rate In India

Car loan interest rate of all banks in India are mentioned here in this article. So, you can get a car loan in India at lowest interest rate. Many people often looks for the minimum car loan interest rate in India. So, they can either get a new or used car loan in India.

A car in todays fast going life may be a choice for some and a necessity for others. Basically, it gets very hard to cope with this speedy life when you dont have one. But the problem is many of us cant afford to buy it exclusively from our salary. Looks like the distance between you and your car of dreams which will ease your and your loved ones life seems increasing? Today, when everything is getting more and more expensive, buying your dream car, may look like a big challenge. But dont worry you dont have to compromise on your dream ride. Here, the best option to fulfil your dream or need of buying a car is taking a car loan.

You May Like: Advantage Auto Loans Legit

What Is Conditional Financing

Conditional financing is a statement from your lender listing out conditions you must meet in order to receive your loan funds. If the financing is contingent or conditional, the lender can change your agreement later, leaving you with less advantageous terms. Never take a car from a dealer until the financing down payment amount, interest rate, length of the loan and monthly payments is finalized.

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

Don’t Miss: Usaa Car Loan Requirements

How To Apply For Low Interest Car Loans In Canada

You can follow these steps to apply for low interest car loans in Canada:

Eligibility criteria and documents to qualify

You may need to meet the following eligibility criteria to qualify for low interest car loans in Canada:

- Be at least 18 years of age or the age of majority in your province or territory

- Be a Canadian citizen or a permanent resident with a valid Canadian address

- Be employed and have a steady income

- Meet credit score and income requirements

Required documents

To apply for low interest car loans in Canada, youll usually need to provide the following documents:

- Identity documents. Personal identification such as your passport or drivers licence.

- Proof of income. Pay stubs, employment records, tax records and other documents.

- Debt-to-asset ratio. Lists of assets and debts to make sure you can qualify for funding.Credit score. Consent for your low interest car loan lender to run a credit check.

What Is A Good Used Car Loan Rate

Loan rates for used cars are higher than rates for new cars. For a 48-month term, a good used auto loan rate from a bank is 5.16% or lower. A good used car rate from a credit union is 3.16% or lower.

Below is a chart with NCUA data for average credit union and bank rates for both new and used vehicles.

| New or Used Vehicle Loan | Loan Term |

|---|---|

| 5.16% |

Recommended Reading: What Kind Of Car Loan With 600 Credit Score

Check Latest Car Prices In India

With the automobile industry expanding at a rapid pace and with more and more car manufacturers establishing their bases in India, buying a car has become a hassle-free procedure. Car prices in India vary depending on the segment of the car purchased and with the additional features provided by the manufacturer. BankBazaar offers a comprehensive list of car prices across various models of cars sold in India. Be it a hatchback, sedan, luxury sedan, SUV or MUV, we equip you with the necessary pricing information to help you decide on the right car suited for your needs and current financial situation.

Other Parts Of A Car Loan

The main two parts of a car loan are the principal and interest rate. Beyond that, there are a few more aspects of a car loan you need to know.

The monthly payment is the amount of money youll need to pay to the lender every month. Several factors affecting this payment include the APR, the loan amount, and its length. You will need to adjust each of these to find a monthly payment that fits within your budget.

The loan term refers to the amount of time it will take you to repay your loan. Most auto loans come in three, four, five, or six-year loan options, with some lasting longer than six years. A longer loan term will reduce your monthly payment, but it will end up costing you more interest.

Most penalties and fees are avoidable if youre aware of them. Many will charge you a processing fee when processing and fulfilling your loan application.

Other auto loans may have prepayment penalties for paying your loan off sooner than the agreed terms. Most lenders will add penalties and fees for late or missed payments. Youll need to check the terms of your loans and ask your lender about any potential fees and penalties.

Don’t Miss: Usaa Personal Loan Approval Odds

Whats The Difference Between Peer

Direct lending means that you get your business loan directly from a financial institution, like banks or alternative lenders. With peer-to-peer lenders, on the other hand, your lender is really a platform that connects you with investorsand those are the people actually giving you money.

For more nitty-gritty details, you can take a look at our explanation of peer-to-peer lending.

How To Get A Motorcycle Loan

Work with your bank or credit union to get a secured loan for a new or used motorcycle. The process is a lot like getting a loan for a car or truck, in that the motorcycle serves as collateral for the loan. Whether youâre buying a new or used motorcycle will determine what information youâll need for the loan.

U.S. Bank offers loans for motorcycles up to $25,000, with terms of up to 60 months. To apply youâll need personal identification and income information, along with details about the motorcycle you want to buy. For a new motorcycle, have the MSRP Window Sticker handy so you can provide the MSRP value, color, make, model and VIN number. For a used motorcycle, youâll also need the odometer reading. Lastly, youâll need your insurance information prior to loan closing.

Read Also: Usaa Rv Loan Rates Calculator

How To Find The Best Low Interest Car Loan

Compare the following factors to find the best low interest car loan:

- Interest rates. Rates can be fixed or variable, and tend to fall between 0% and 6% for low interest car loans in Canada. Look for the loan that comes with the lowest interest rates and monthly payments that fit your budget and lifestyle.

- Loan amounts. Low interest car loans usually range between $500 and $25,000. Only apply for a loan amount that you can afford to repay, and cut down on how much you owe by putting down a bigger deposit.

- Turnaround time. Youll usually get a decision on a low interest car loan in a couple of hours or days with most lenders. Settle on a lender that offers a quick turnaround and gives you the money you need in a reasonable timeframe.

- Loan terms. Loan terms range from 1 to 8 years. Youll usually pay higher monthly payments and less interest overall when you choose a shorter term loan. The opposite is true for long-term low interest car loans.

- Fees. Some private loan lenders charge fees that youll need to factor into your overall loan cost. These can include origination fees, late fees and early repayment fees. Pick a lender that offers the fewest fees with the lowest interest rates.

Keep Your Loan Term Short

Signing up for the shortest auto term possible when buying a car reduces the interest paid over time. Keeping your loan to 60 months or less if you can afford it is optimal. Theres no way around that fact that the longer the term of your loan, the more interest youll pay. Instead of just looking at monthly payments, make sure you understand the total cost of the car in various scenarios: the 60-month loan versus the 72-month loan, for example. A shorter term will save you money over the life of the loan.

Don’t Miss: Usaa Loan Credit Score Requirements

Get Your Documents And Information Ready

This list relates to applying for conditional approval the first stage of getting a Westpac Car Loan.

If youre already a Westpac customer, youll need to:

- Apply as an Existing Customer in the application form and log in to your account

- Once logged in, double-check that your personal details are up-to-date. If not, log in to internet banking to update them and allow 24 hours for the records to update before you apply.

Whether or not youre already with Westpac, before starting your application, make sure you have everything in the list below:

- Current employers name, address and phone number

- Your income information from the last 3 months, such as payslips, bank statements and rental income

- Recent tax information if youre self-employed

- Asset, savings and investment details

- All existing liabilities that are in your name

- All your regular monthly expenses

Savings Account Vs Chequing Account

Chequing and savings accounts are two of the many products offered by financial institutions. While they share some similarities, there are a few differences. Generally speaking, chequing accounts are used for everyday banking transactions while savings accounts are designed to help you reach longer-term goals by offering interest on your deposits without monthly fees. As a third option, hybrid accounts are an increasingly popular choice for those seeking the perks and features of chequing and savings accounts in a single package. Lets take a closer look.

You May Like: When Do I Pay Back Student Loan

Also Check: Using Va Home Loan For Investment Property

Banks Giving Loans For Electric Vehicles At Very Low Interest See Details

New Delhi. The government is making many efforts to promote electric vehicles in the country. The government aims to become a 100% electric vehicle nation by 2030, for which various incentives are being given. In this episode, banks are also giving loans for electric vehicles at attractive and low interest rates.

The countrys largest public sector bank State Bank of India has come up with a green car loan scheme to buy electric vehicles. Through this, car loan is being given at very low interest. A few days ago, SBI had given this information on Twitter. The bank had said, SBI is offering green car loans to achieve Indias goal of zero emission and to enable people to opt for electric vehicles.

Also read- Electric car with 528 km range launched in India, all models sold out

See what is the interest rate?In the Green Car Loan Scheme for Electric Vehicle, a loan can be taken at an interest rate ranging from 7.25% to 7.60%. This loan can be taken for a minimum of three years and a maximum of 8 years. The age of the borrower should be between 21 years to 67 years. SBI has divided customers into three categories for giving green loans. A further relaxation of 20 basis points may be available in the interest rate applicable for a normal car loan. Its margin is up to 90% of the on-road price.

Charging Indias Green Future! SBI provides Indias first Green Car Loan to encourage people to reduce their carbon footprint and opt for electric vehicles.

Check Which Lenders Offer Best Interest Rates On New Car Loans

1 min read.Livemint

- Before you sign up for the loan with the lender who has partnered with your new car’s dealer, check if you can get a cheaper rate elsewhere

MUMBAI: When you are negotiating the price of a car, the dealer is bound to ask you whether you want a loan? If you do, the dealers representative will take you to the loan desk, where, typically, you can get a loan from two-three different lenders.

Most buyers end up taking a car loan from a lender which has partnered with the dealer. Its convenient that all services that a buyer is seeking are available under one roof. However, before you sign up for the loan with the lender who has partnered with the dealer, check if you can get a cheaper rate elsewhere.

Even a 1% difference in the loan can help you save. Suppose you want a 7 lakh loan. The dealer offers it at 8% for five years. Your equated monthly instalment will work out to be 14,194, and the total outgo will be 8,51,609.

If your loan is 0.5% cheaper, your EMI will be 14,027, and the total loan outgo will be 8,41,594.

If the loan is 1% cheaper, the EMI and total loan outgo will be 13,861 and 8,31,650, respectively.

Interest rates are one part the processing fee added to the total outgo can make a more significant difference.

Read Also: Va Home Loan Benefits 2020

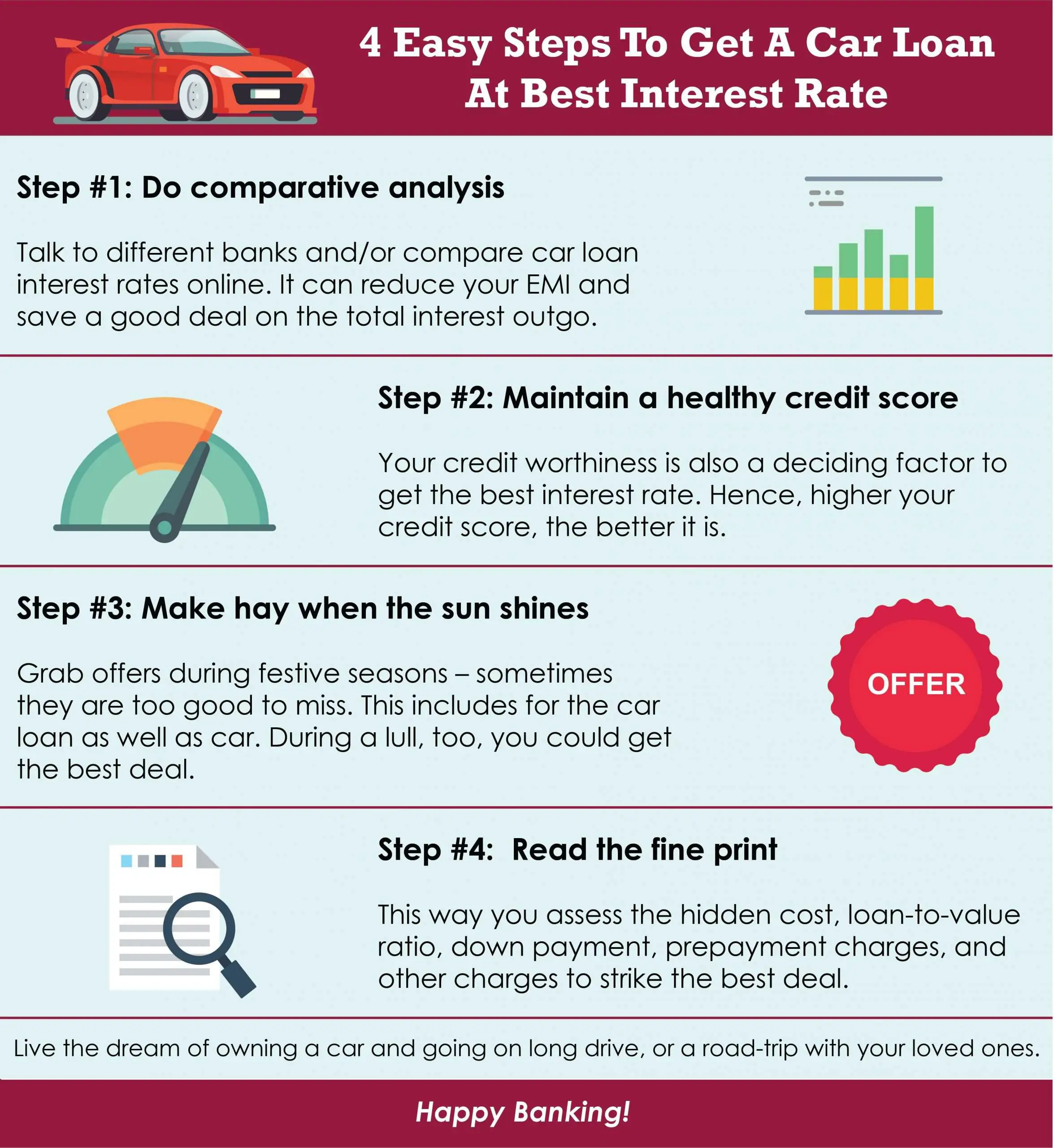

How To Get Best Interest Rate Car Loan

To get the best interest rate car loan you must follow the tips as mentioned below:

- Check the best discount and offers : Always check current offers and cheapest car loan interest rates offered to employees of large reputed companies.

- Compare car loan rates based on loan amount : Some banks offer the lowest interest rate for car loans for high loan amounts. Loan amount can vary by the value of the car used for calculating LTV.

- Do not apply for a loan amount more than what you are eligible for : Applying for an amount higher than your eligibility may lead to rejection of your loan application.

- Do not apply with multiple banks : Simultaneous loan applications get recorded in your CIBIL report and can hurt your chances of getting a loan.

- Carefully decide on which type of insurance would be necessary : Check and compare the cost, coverage and claim settlement ratio of car insurance. You must avail of comprehensive, third Party, or zero dep insurance.