Which Loan Type Provides Interest Subsidy Meaning

Direct Subsidized Loans have lower interest rates because the Department of Education pays the interest for the borrowers while they are in school, during grace periods, and during deferment. Direct Subsidized Loans are also less expensive than Direct Unsubsidized Loans because the interest does not accrue during specific time periods. Here is a breakdown of the advantages of each loan type.

What Types Of Loans Provide An Interest Subsidy

While all loans come with some degree of risk, there are a few types of loans that offer an interest subsidy to help offset this risk. The most common type of loan with an interest subsidy is the Stafford Loan, which is available to both undergraduate and graduate students. Other types of loans that may offer an interest subsidy include the Perkins Loan, the Direct PLUS Loan, and the Direct Consolidation Loan.

Subsidized And Unsubsidized Loans

Subsidized Loans are loans for undergraduate students with financial need, as determined by your cost of attendance minus expected family contribution and other financial aid . Subsidized Loans do not accrue interest while you are in school at least half-time or during deferment periods.

Unsubsidized Loans are loans for both undergraduate and graduate students that are not based on financial need. Eligibility is determined by your cost of attendance minus other financial aid . Interest is charged during in-school, deferment, and grace periods. Unlike a subsidized loan, you are responsible for the interest from the time the unsubsidized loan is disbursed until its paid in full. You can choose to pay the interest or allow it to accrue and be capitalized . Capitalizing the interest will increase the amount you have to repay. See for more important information on the capitalization of interest.

| Loan Type |

|---|

| Requirement | |

|---|---|

| Deferment | You may receive a deferment if you are enrolled in school at least half-time or for unemployment or economic hardship |

| Repayment | There is a 6 month grace period that starts the day after you graduate, leave school, or drop below half-time enrollment. You do not have to begin making payments until your grace period ends. |

More information regarding student loans, program requirements, and managing repayment can be found at .

Read Also: How Many Affirm Loans Can I Have

What Is A Plus Loan

A PLUS Loan is a type of federal student loan that is available to the parents of dependent undergraduate students and to graduate or professional degree students. PLUS Loans help pay for education expenses up to the cost of attendance minus all other financial aid.

The parent borrower must not have an adverse credit history . If the parent borrower has an adverse credit history, the student may become eligible for an additional Unsubsidized Stafford Loan.

Understand Your Repayment Options

Before you decide which loan is right for you, its important that you understand all of your repayment options.

The first thing to consider is whether you want to repay your loans in full or make interest-only payments while youre in school. If you choose to make interest-only payments, the interest will accrue on your loan while youre in school and during your grace period. The amount of interest that accrues on your loan will depend on the type of loan you have and the current interest rate. You can check the current rates for Direct Subsidized Loans and Direct Unsubsidized Loans on the Interest Rates page.

Another repayment option that may be available to you is called an income-sensitive repayment plan. With this plan, your monthly payment will be based on your annual income. There are several different income-sensitive repayment plans, so its important to ask your loan servicer about which one is available for your loans.

If neither of these repayment options is right for you, dont worry there are other options available as well. You can read more about all of the repayment plans that are available to Direct Loan borrowers on the Repayment Plans page.

You May Like: What Is An Rv Loan

Loan Limits On Unsubsidized Student Loans

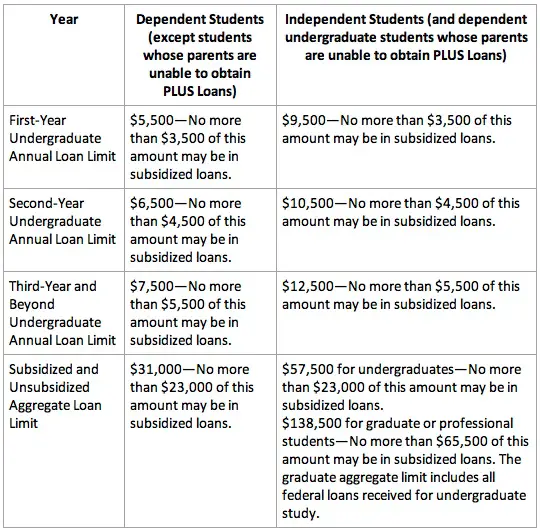

Unsubsidized loans generally allow higher loan limits than on subsidized loans, letting students borrow more money.

An independent undergraduate student will qualify for a higher loan limit than a dependent undergraduate student on an unsubsidized federal student loan. Dependent undergraduate students may qualify for the same limits as independent students if their parent was denied a Federal Parent PLUS Loan due to an adverse credit history.

Federal student loans have an annual loan limit per academic year, and an aggregate loan limit, which is the total amount a student can borrow for their education.

How Does The Plus Loan Work

The PLUS loan is a federal loan that allows parents to help pay for their childs education. Parents can borrow up to the full cost of their childs education, minus any other financial aid that the child receives.

The PLUS loan has a fixed interest rate and repayment begins 60 days after the last disbursement of the loan. The repayment period is 10 years, but can be shorter if you choose to make higher payments. Similar to other federal loans, parents can qualify for a deferment or forbearance if they experience financial hardship.

PLUS loans are not need-based, which means that your credit history will be taken into account when you apply for the loan. If you have an adverse credit history, you may still be able to get a PLUS loan if you get an endorser who does not have an adverse credit history.

Recommended Reading: State Farm Bank Auto Loans

Faqs On Home Loan Subsidy By The Government

National Housing Bank and Housing and Urban Development Corporation Limited are the central nodal agencies which are operating the disbursal of subsidy under CLSS.

First an advance subsidy is disbursed at the start of the scheme by the central government. The remaining subsidy will be released after 70% of the earlier amounts are utilised on a quarterly basis or based on claims raised by the CNA.

Yes, they will be required to enter into an MOU with one of the central nodal agencies if they want to claim benefit under CLSS.

Yes, you can avail the subsidy as under the definition of a new construction, the resale of a new construction house is included.

Yes, it is covered. However, repairing work can be undertaken only in kutcha and semi-pucca houses. In case it is a semi-pucca house the benefit can be availed only if extensive renovation needs to be carried out to make it a pucca house.

Are Subsidized Loans Better Than Unsubsidized Ones

Subsidized loans offer many benefits if you qualify for them. While these loans are not necessarily better than unsubsidized ones, they do offer borrowers a lower interest rate than their unsubsidized counterparts. The government pays the interest on them while a student is in school and during the six-month grace period after graduation. However, subsidized loans are only available to undergraduate students who demonstrate financial need.

Also Check: Can You Pay Off Your Car Loan Early

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

American Medical Association Educational Research Foundation Loan

The American Medical Association-Educational Research Foundation Loan is a 5% interest loan for students pursing a Doctor of Medicine degree. The award is based on a student’s financial need.

Eligibility requirements for the AMA Loan:

- be a Texas resident and a U.S. citizen or eligible non- citizen

- Must be in good standing and making satisfactory progress

- Must be a full-time medical student

To apply for the AMA Loan:

Students must complete the Free Application for Federal Student Aid to be considered for this loan.

Repayment information:

- Repayment period maximum is ten years

- Repayment period begins nine months after graduation or after the borrower ceases to pursue a full-time course of study at the Institution

- Interest shall accrue from the beginning of the repayment period

- Borrower may prepay all or any part of the principal and accrued interest at any time without penalty

- Deferment may be granted for certain situations. Contact the Office of Student Financial Services for more information.

Also Check: How To Get Fixer Upper Loan

Need Money For College

What is a subsidized loan?

A subsidized loan is a type of federal student loan. With a subsidized direct loan, the bank, or the government is paying the interest for you while youre in school , during your post-graduation grace period, and if you need a loan deferment.

Youre effectively getting your responsibility to pay that interest back waived with a subsidized loan during those time periods. Once you start repayment, the government stops paying on that interest, and your repayment amount includes the original amount of the loan, and the interest, accruing from that moment.

What is an unsubsidized loan?

Another type of federal loan is an unsubsidized loan. With a federal unsubsidized loan, you are responsible for the interest from the moment the loan money is disbursed into your account. Theres no help on the interest youre responsible for the whole amount.

When you start paying back your unsubsidized loans, youre paying on the original amount and the interest that accrued since the unsubsidized student loan was paid to you. This can, of course, add up to thousands of dollars more to repay over the life of the loan.

So why would anyone ever take out an unsubsidized loan?

The FAFSA is key

How To Apply For A Federal Student Loan

If youve run the numbers and determined that you need to borrow money for college, the process of applying for a federal loan is fairly simple:

Recommended Reading: Which Bank Is Better For Personal Loan

Ella Kate Wallace Ralston Loan

The Ella Kate and Wallace Ralston Nursing Student Loan is an institutional loan fund administered by the Office of Student Financial Services for students enrolled in the Doctor of Medicine or Nursing program. This loan has a 7.5% interest rate and is awarded based on a student’s financial need.

Eligibility requirements for the Ralston Loan:

- Must be a Texas resident and a U.S. citizen or eligible non-citizen

- Must be in good standing and making satisfactory progress

- Must be a medical student or enrolled at least half-time in the Nursing school

To apply for the Ralston Loan:

Students must complete the Free Application for Federal Student Aid to be considered for this loan.

Repayment information:

- Repayment begins three months after graduation for students enrolled in the Nursing program and twelve months for students enrolled in the Doctor of Medicine Program.

- If the student fails to complete their medical or nursing training, the loan becomes immediately due and payable

- Interest accrues from the beginning of the repayment period

- The maximum repayment period is ten years

- Borrower may prepay all or any part of the principal plus accrued interest any time without penalty.

Federal Direct Plus Loans

Federal Direct PLUS Loans are loans that parents and graduate or professional students can use to help pay for college or career school. PLUS loans can also be used to consolidate other educational debt. The maximum loan amount that can be borrowed is the cost of attendance minus any other financial aid the student may receive.

To get a PLUS Loan, the borrower must pass a credit check. If approved, the borrower will receive the loan in two disbursements: one when classes begin and another when they are halfway finished.

The repayment period for PLUS Loans begins 60 days after the final loan disbursement. However, borrowers can choose to defer payments while the student is enrolled at least half-time and for an additional six months after graduation or after they drop below half-time enrollment. Interest accrues during deferment, so borrowers should consider making interest-only payments or having their payments automatically deducted from their paycheck to reduce their total loan cost.

You May Like: Is Heloc Loan Interest Tax Deductible

Definition And Example Of A Subsidized Loan

When a lender applies a subsidy to the interest portion of a loan on behalf of the borrower, it’s defined as a subsidized loan. The lender generally pays the interest charges on the loan during certain periods. The subsidy has the effect of reducing the borrower’s periodic loan payment in periods during which it is applied, thereby making loan repayment more manageable, lowering the total cost of the loan, and saving the borrower money.

Governmental agencies at the federal, state, and local levels, as well as non-profits, may offer subsidized loans, but federal agencies most commonly extend subsidized loans. When they do, they tend to be reserved for low-income borrowers, meaning that borrowers often have to demonstrate financial need to obtain them. One common example of subsidized loans is a federal student loan through the Department of Education.

Interest On Subsidized And Unsubsidized Loans

Federal loans are known for having some of the lowest interest rates available, especially compared to private lenders that may charge borrowers a double-digit annual percentage rate :

- For loans disbursed on or after July 1, 2021, and before the July 1, 2022, school year, direct subsidized and unsubsidized loans carry a 3.73% APR for undergraduate students.

- The APR on unsubsidized loans for graduate and professional students is 5.28%. And unlike some private student loans, those rates are fixed, meaning they donât change over the life of the loan.

There’s also one other thing to note about the interest. While the federal government pays the interest on direct subsidized loans for the first six months after you leave school and during deferment periods, youâre responsible for the interest if you defer an unsubsidized loan or if you put either type of loan into forbearance.

Income-driven repayment plans can mean lower monthly payments, but you might still be making them 25 years from now.

Don’t Miss: How To Calculate Mortgage Loan Payoff

Make Sure You Know When Your First Payment Is Due

Many loans have a grace period, which is a set period of time after you graduate, leave school, or drop below half-time enrollment before you have to begin repaying your loan. The grace period gives you time to get financially settled and usually lasts 6 months. If you have a Direct Subsidized Loan or Subsidized Federal Stafford Loan, the government pays the interest on your loan during your grace period. If you have a Direct Unsubsidized Loan or Unsubsidized Federal Stafford Loan, youre responsible for paying the interest on your loan during your grace period. Its important to know when your first payment is due so that you dont inadvertently damage your credit rating by missing a payment.

How Do Loans With Interest Subsidy Work

The payable interest on a loan with interest subsidy is calculated on the outstanding principal amount at the beginning of each month. The amount of interest subsidy that accrues during a month is determined by multiplying the subsidy rate with the outstanding principal loan amount at the beginning of that month. The subsidy is applied first towards payment of interest, and any balance is added to the outstanding principal. The effect is that your EMI each month will reduce, as the total loan tenure will not change.

Assuming that you have taken a home loan of Rs 30 lakh at an interest rate of 10% per annum for 20 years, with an annual interest subsidy of 4%, your monthly instalments would be as follows:

YearLoan amountInterestSubsidyPrincipalTotal Subsidy Received130,00,00025,0001,20024,80014,400229,75,20024,8011,18823,61328,800329,51,81324,6041,17622,42843200429,28,241

Recommended Reading: How Much Is The Average Student Loan Interest Rate

Subsidized And Unsubsidized Loan Examples

Example 1:

Alberta Gator is a first year dependent undergraduate student. Her cost of attendance for Fall and Spring terms is $17,600. Albertas expected family contribution is $10,000 and her other financial aid totals $9,000.

Because Albertas EFC and other financial Aid exceed her Cost of Attendance, she is not eligible for need-based, Subsidized Loans. She is, however, eligible for an Unsubsidized Loan. The amount she would be awarded would be $5,500. Even though her cost of attendance minus other financial aid is $8,600, she can only receive up to her annual loan maximum .