When It Makes Sense To Take Hard Money Loans

Business owners take advantage of hard money loans to access quick capital. Its often used to aid business transitions, such as renovating commercial property or moving your company to a new location.

Borrowers also use hard money loans to bridge the gap between an investment property purchase and long-term financing. During the short term, they use hard money financing to acquire and renovate the property. Later on, they refinance the loan with a traditional commercial mortgage to pay off the hard money lender.

However, because it does not adhere to traditional processing, hard money loans shorten your funding frame a great deal. This makes it a risky option, most especially to borrowers with limited cash flow and funding sources for repayment.

Hard Money Loans and Bridge Loans

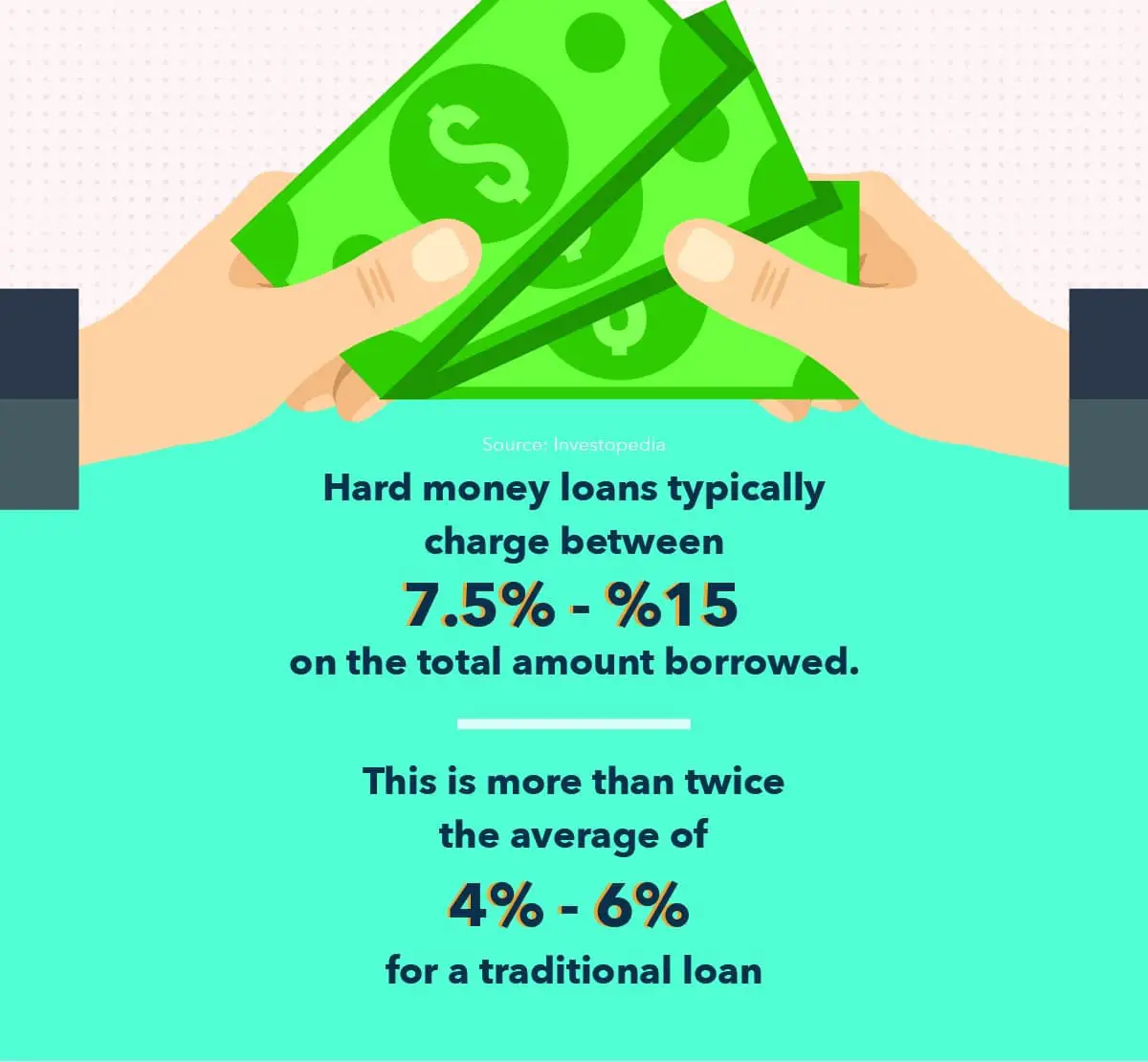

Technically, theres not much difference between hard money loans and bridge loans. They are both provided by independent investors such as companies and individuals. Both loans are also structured with short terms. Lenders also expect monthly interest-only payments and a balloon payment at the end of the loan.But when it comes to interest rates, bridge loans are slightly lower. The range is usually between 6% and 10% for bridge loans, while hard money loans range from 10% to 18%. This means bridge loan payments can be lower compared to hard money loans.

Is Getting A Hard Money Loan A Good Idea

Hard money loans make sense for a particular type of borrower. They benefit house flippers because they offer favorable terms for that investing strategy. But due to the high-interest rates and short repayment period, they aren’t the best product for the typical homebuyer unless you have no other options. So, while hard money loans can be suitable for investors and business owners, they carry certain risks. So, research the lender and read the fine print carefully before agreeing to a hard money loan.

Property And Investment Considerations

- Having a clear plan for the property being invested in

- Property that has value in the current market

- If the property is owner-occupied, a rental, or both

- If its for land, single-family, multi-family, commercial, or industrial property

- New construction or rehabilitation costs

- Potential rental income or profit from selling the property

Don’t Miss: Is My Area Eligible For Usda Loan

What Credit Score Is Needed For A Hard Money Loan

In almost all areas of financial life, your credit score plays a crucial role. We all know that if you’re buying a car, applying for credit cards, or refinancing your home, your lender is going to use your credit score to determine your interest rate or decide on whether they will work with you at all. But did you know your credit score can also affect other areas of your life? Credit can be used to set your insurance premiums, rent an apartment, or even determine whether you qualify for a cell phone plan.

Mistakes early in your adult life that adversely affect your credit can have a lasting impact through adulthood. Even after you’ve resolved the underlying issues, getting out of a credit hole can be painful and expensive. It takes years to improve your score, and it’s made increasingly difficult because low scores mean more expensive payments and fewer opportunities.

Bad credit sets up barriers to success in many parts of life, but there is one path where your credit has no impact.

Hard money loans through The Hard Money Co. do not require a credit check and have ZERO impact on your credit score moving forward. This means, that no matter where you are in your financial journey, The Hard Money Co. will work with you to move forward. We understand that your past is not always indicative of your future and that opportunity should be made available to those who work hard and are driven to succeed.

Best Hard Money Lender For Low

Groundfloor is genuinely in a league of its own when it comes to hard money lenders because they use crowdfunding to fund your fix and flip loan. Accredited investors compete to fund your projects, allowing you to access to the best interest ratesoften up to 2% lower than those offered by other hard money lenders.

Groundfloor also offers fix and flip loans for multi-family properties of one to four units in sizein 31 U.S. states. There are no payments during the term of the loans, and they allow you to roll your loan fees into the borrowed amount.

Groundfloor Rates & Terms

| Fix and Flip, New Construction, Condo, Townhome, Single Family, 1 to 4 Units |

Also Check: Loans To Family Members Irs Rules 2021

How Do Loan Interest Rates Work

Interest rates for hard money loans are a bit more simple to understand than traditional mortgage interest rates. This is because traditional mortgages use what is called an amortization schedule to determine what your monthly payments will be. Every month you make a payment, the ratio of loan principle compared to loan interest that you are paying will slightly change as the loan balance becomes smaller.

Hard money loans are often interest-only, which means you do not make payments towards the principle until you are ready to pay off the entire loan in full. Also, while not all hard money loans work this way, many require that you pay the interest at the end of the loan along with the entire balance.

Essentially, the interest rate is the percentage of the loan amount that you will pay the lender in addition to the loan itself. It’s often represented in yearly terms – meaning you pay that percentage every year the loan remains unpaid. If you have a hard money loan for $400,000 with an interest rate of 9%, you can expect to pay 9% of $400,000, or $36,000, in interest every year that you hold the loan. If you held this loan for two years, you would pay the lender $472,000 back at the end.

Borrower Requirements For Hard Money Loans

As discussed earlier, hard money lenders are primarily concerned with the amount of equity the borrower has invested in the property that will be used as collateral. They are less concerned with the borrowers credit rating. Issues on a borrowers record such as a foreclosure or short sale can be overlooked if the borrower has the capital to pay the interest on the loan.

The hard money lender must also consider the borrowers plan for the property. The borrower must present a reasonable plan that shows how they intend to ultimately pay off the loan. Usually, this is improving the property and selling it or obtaining long-term financing later on.

Recommended Reading: Loan For Bad Credit Instant Approval

How Do Hard Money Loan Monthly Repayments Work

Hard money loans have become increasingly popular with real estate investors because they can facilitate highly profitable property flips without the usual waiting time, administrative hassle and possible rejection that one could face when approaching a normal bank.

Unlike a traditional home mortgage, hard money lenders typically only charge interest on a monthly basis, which means you dont actually pay any money toward the principal loan amount at each monthly payment cycle. However, you will have to pay back the full principal amount at the end of the loans life cycle.

To further illustrate how hard money loan repayments work, we will now:

- Provide a simple hard money loan repayment example

- Uncover all the additional costs that you can expect when using a hard money loan

- Answer a few frequently asked questions related to hard money repayments

Hard Money Loan Monthly Repayment Example

To further illustrate how hard money monthly repayments work, lets run through an example which compares a traditional mortgage repayment versus a hard money loan monthly repayment.

Please note For the sake of simplicity, we are only factoring in the principal and interest portions of the loan repayment in the example below.

| Standard Home Loan | |

| Loan Terms : 360 Months | Loan Terms : 24 Months |

| Holding Time: 360 Months | |

| Total Interest Paid: $20,000.04 |

At this point its worth pointing out some key observations:

Although the hard money interest rate is higher, the total interest paid over the course of the loans lifespan is typically lower than a normal consumer mortgage. There are two main reasons for this:

Reason 1 The lifespan of the hard money loan is significantly shorter than the lifespan of a normal home loan. In other words, instead of paying interest on the loan for 30 years, you are only paying interest for the number of months that you hold the property. In most cases, property flippers will sell the property before the loan term officially expires. The sooner you sell the property, the less interest you pay, meaning more total profit for the investor.

Reason 2 You only pay the interest portion of the loan on a monthly basis .

Recommended Reading: Can You Put 20 Down On An Fha Loan

Types Of Property For Hard Money Loans

You can use a hard money loan to purchase nearly any type of property. This includes but is not limited to:

- Single-family residence

- Retail building

- Office building

Some hard money lenders focus on specific types of real estate investments, such as residential. Others are open to lending you money for any type of investment, residential or commercial.

Once you have a list of hard money lenders, explain to them what type of investment you want to make. They can then explain what they offer and help you decide if youre a good fit.

What Are Typical Terms Of Hard Money Loans

Before you accept any type of loan, you must understand the repayment term.

This is the amount of time that you have to repay the lender. The term you choose will impact both the interest rate and the overall cost of the loan.

Hard money loans are backed by real estate.

For example, if youre purchasing a long-term rental property, it serves as collateral. Furthermore, it gives your lender something else to consider, such as rental income potential.

While rare, some lenders of hard money loans offer long term loans. But most hard money lenders offer loans of up to 12 months.

However, this can vary based on the type of loan you apply for.

Construction, fix and flip, and bridge terms are often shorter than long-term rental and DSCR loans.

You know what youre trying to accomplish. You also know how much in monthly payments you can afford. Keep this in mind when applying for a hard money loan and comparing whats offered to you.

Don’t Miss: What Are Payments On 30000 Car Loan

Hard Money Lending Faqs

This is a very broad topic and you may still have questions about hard money lending, including how to get a hard money loan, interest rates, and the differences between hard money lending and conventional home mortgage financing. We are here to help! Build off of the work I have done for you alreadybut dont stop there. Continue to ask questions of potential lenders and research their terms to find the right hard money lender for you and your next real estate investment project.

The Rates For These Loans Are Very Importantwhen Considering Using Hard Money Lenders

The hard money lender rates can vary from 12% to anything up to 25%. Various variables affect this, and this article will try and shed some light on how they are calculated.

Any loan from the bank will have low to medium interest. A hard money loan and rates are different.

A loan from a hard money lender will have extremely high rates of interest that most people cringe at.

This may vary greatly if you deal with a commercial or a private money lender.

Don’t Miss: How To Calculate Fha Streamline Loan Amount

Financing Preferred By House Flippers

Hard money loans have become a common financing option for house flippers who cannot access commercial loans from banks. This may be due to a low credit rating and a history of substantial debt. In other instances, a real estate deal may not pass strict guidelines from a traditional lender. For these reasons, house flippers turn to hard money loans.

House flippers are real estate investors who buy property to fix and sell for a higher profit. They need enough cash to fully fund a deal. Otherwise, their offer to purchase property wont be competitive. Once they purchase a house, they renovate it until it is ready for sale. This usually takes a couple of months to a year, making it ideal for short-term financing.

Once they are able to make a sale, they can pay back the loan. On the other hand, if a house flipper defaults, the hard money lender can foreclose or take ownership of the property. They can also sell it profitably in the market. However the deal turns out, it can still be a profitable outcome for the lender.

You Have A Foolproof Plan

If youre new to the process of house flipping, make sure you cross all your ts and dot all your is. And even if you arent new to investing in real estate properties, the hard money lender is going to want to know enough about you before approving you for a hard money loan.

We ask them what their experience is, how many properties theyve flipped in the past. They need a budget for the rehab that looks normal, and the repair value needs to be accurate with what were seeing. We try to validate that they know what theyre doing, Howard says.

So make sure youre being as precise as possible when coming up with the initial plan. If youre more experienced, you know how to use properly, Tayne says. If youre less experienced, you can get jammed. You could overestimate or underestimate what your expenses will be on the flipand end up with a challenging situation.

A hard money loan may also come with a draw schedule, which indicates the times youll be able to withdraw parts of the full loan. Itll be negotiated during the underwriting process and ultimately determined by the lender, based on when remodeling projects are initiated during the plan. There are few circumstances in which youll receive the full loan amount upfront. Functionally, a hard money loan is more like a line of credit than a loan.

Recommended Reading: How To Pay Off Equity Loan

Special Considerations For Hard Money Loans

The cost of a hard money loan to the borrower is typically higher than financing available through banks or government lending programs, reflecting the higher risk that the lender is taking by offering the financing. However, the increased expense is a tradeoff for faster access to capital, a less stringent approval process, and potential flexibility in the repayment schedule.

Hard money loans may be used in turnaround situations, short-term financing, and by borrowers with poor credit but substantial equity in their property. Since it can be issued quickly, a hard money loan can be used as a way to stave off foreclosure.

What Costs Are Involved In A Hard Money Loan

In addition to your down payment, be prepared to pay 1% to 5% in upfront fees. These fees are typically called the Origination Fee, Upfront Fee, or Points. While some lenders charge only one of these fees, others may charge all three, so be sure to ask.

Additional closing fees from the hard money lender may include a Documentation Prep Fee, Underwriting Fee, or Closing Fees.

Be sure to inquire if your loan has any Extension Fees youll be required to pay should your fix and flip take longer than expected to renovate. Also ask about any Prepayment Penalty in the event you decide to pay off the property early.

Other costs you must account for are property insurance, transfer taxes, and Title/Escrow Fees.

Don’t Miss: How To Qualify For Fha Loan First Time Home Buyer

Interest Only Hard Money Loans Require A Down Payment

Interest-only hard money loans are easy to qualify for if you have collateral. The application process is fast and straightforward, and you’ll find out whether you’re approved in a few days. However, you’ll have to find a real estate deal that appeals to a lender, and have a significant amount of savings to make the down payment.

When comparing interest-only hard money loans, you should consider the time it takes to pay off the loan. Some lenders offer interest-only periods, which are beneficial to lenders because it means the borrower doesn’t have to pay back the full loan amount at the end of the loan term.

The down payment for hard money loans varies, but is typically between 30% and 10% of the total loan amount. The actual amount depends on the lender and the borrower’s credit score and track record. Long-term relationships with lenders can lead to a lower down payment. You should always make sure to consult with your lender before signing any documents. What Are Hard Money Loans

Depending on the lender, interest-only hard money loans may have flexible income and credit requirements. If the deal looks strong, the lender may even not check the borrower’s credit score or income. Another benefit of interest-only hard money loans is that they can close fast. Lenders can usually determine the value of the collateral quickly, which means the loan can close in as little as two to 14 days. In contrast, a mortgage can take 30 to 45 days to close.

Hard Money Loan Rates Will Vary

Hard money lending rates may fluctuate based on the requested loan to value . Loans with a higher loan to value ratio generally will have a higher interest rate in order to compensate for the increased amount of risk for the lender. A hard money lender is more likely to offer better hard money loan interest rates for a lower LTV than for a high LTV loan.

A borrower with a strong financial standing with many assets may be able to qualify for a lower interest rate as the risk that this borrower will default on the loan is lower. A property in a less desirable or remote area may have a higher interest rate.

The reason hard money loan interest rates are higher is due to the higher risk the lender is taking on by providing financing for the loan. Full documentation of the borrowers income and credit history are not always required for hard money loans, which can be seen as an increased risk factor. The higher interest rates for hard money is often considered as a convenience fee for quick access to capital that isnt available elsewhere.

Also Check: How To Sell Car With Loan Still On It