Best For Bad Credit: Myautoloan

MyAutoLoan

- As low as 2.09%

- Minimum loan amount: $8,000

myAutoloan not only offers reasonable low rates, but it also has lenders that work with people who have a history of credit problems. The marketplace provides a great opportunity for borrowers with poor credit to shop deals from multiple lenders at once.

-

Accepts borrowers with poor credit

-

Offers new, used, and refinance loans

-

Higher minimum loan amount requirements

-

Not available in Hawaii or Alaska

myAutoloan is a marketplace that allows you to compare multiple offers from lenders based on your credit profile. This type of company can help you cast a wide net and get the best offer available. It offers new, used, refinance, private party, and lease buyout loans.

Speed is one of myAutoloan’s benefits. Its online form takes just a couple of minutes to fill out and, once submitted, matches you with up to 4 lender offers. After you choose a lender, you can receive an online certificate or a check within as little as 24 hours.

Requirements in myAutoloan’s market vary by lender, but they say they have lenders who work with borrowers with lower scores.

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Documents Required For Hdfc Bank Car Loan

One needs to submit a set of documents to the HDFC Bank when applying for car loan. These documents vary between salaried employees and self-employed professionals. However, theres a set of common documents between two, which include things like Aadhaar, passport, income documents and more.

| Types of Employee | Documents |

| Salaried Employees | Filled up loan application form2 Passport Size PhotoCopy of Income Tax PAN, Identity Proof Aadhaar, Passport/ Driving License/ Voter ID/ PAN/Quotation of car/Residential Address Proof Leave and License/ Registered Rent Agreement/ Utility Bill , PassportIncome Documents 3 months pay slip, 2 years Form 16, 3 months bank statement showing salary credit and any EMI debitR.C of Vehicle and Insurance of Car |

| Self-Employed | Filled up loan application form2 Passport Size PhotoCopy of Income Tax PANIdentity Proof Aadhaar, Passport/ Driving License/ Voter ID/ PANQuotation of carResidential Address Proof Leave and License/ Registered Rent Agreement/ Utility Bill , PassportIncome Documents 3 months pay slip, 2 years Form 16, 3 months bank statement showing salary credit and any EMI debitR.C of Vehicle and Insurance of Car |

Read Also: Parent Plus Loan Interest Deduction

Foreclosing A Car Loan

When you take a car loan, you can repay it in equated monthly instalments till the end of the repayment tenure. However, if you decide to pay off the outstanding loan amount before your tenure ends, you will be foreclosing or prepaying your loan. The foreclosure/prepayment facility is offered by most lenders for a penalty fee though some lenders may allow you to foreclose/prepay your car loan without charging you any penalty.

You can foreclose your car loan if your income has increased and you wish to clear off your liability. It also takes away your burden of having to make monthly EMI payments. Foreclosing a car loan will release the hypothecation on the car and give you full ownership.

As stated above, some lenders may charge you a penalty on loan foreclosure. Hence, before you decide to foreclose a loan, it is a good idea to go through the clauses associated with it carefully.

Get Current Auto Loan Rates And Choose A Loan Thats Right For You

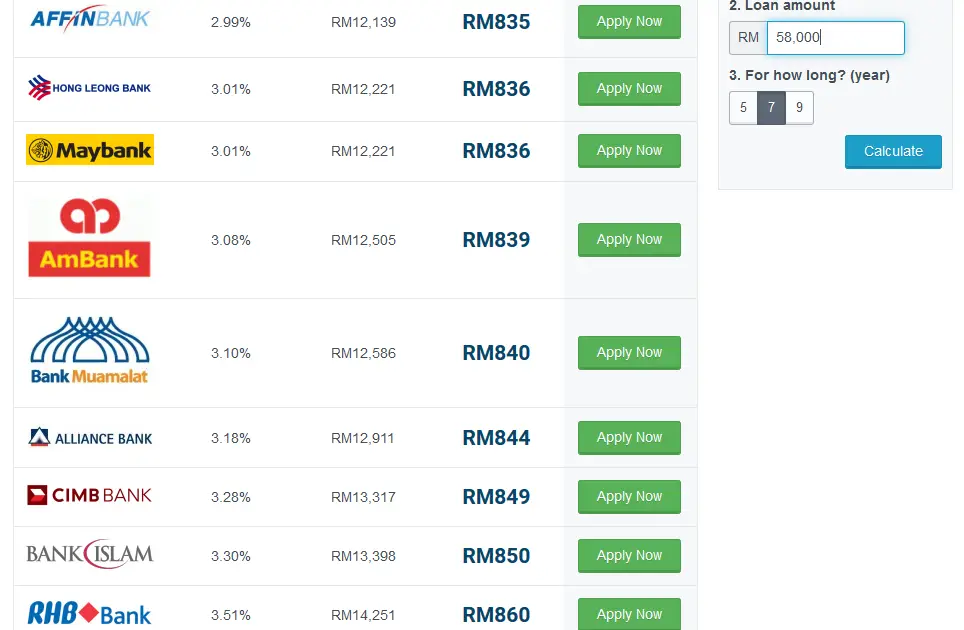

Car loan interest rates change frequently, so its important to keep track of them. Your loans interest rate influences how much youre going to pay for month to month. And a lower interest rate can mean thousands of dollars in savings. Our rate table can help you know the best time to buy a new or a used car.

Current auto loan interest rates| 4.40% |

Don’t Miss: Capital One Subprime Auto Loan

Penfed Credit Union Reviews

PenFed is not accredited by the Better Business Bureau , but it does carry an A+ rating from the organization.

Customer ratings for PenFed Credit Union are among the highest in our research. The organization has an impressive 4.7-star rating out of 5.0 on Trustpilot. Customer ratings are considerably lower on the BBB website, however, where reviewers give PenFed 1.2 out of 5.0 stars.

Positive reviews consistently mention a smooth and easy loan application process and low rates. Customers reporting negative experiences tend to mention slow processing times for loan applications.

Our team reached out to PenFed Credit Union for a comment on these reviews but did not receive a response.

Best For Refinance: Autopay

- As low as 1.99%

- Minimum loan amount: $2,500

AUTOPAY offers several different refinance options, competitive rates, and has flexible credit requirements. Borrowers can easily compare offers from different lenders on AUTOPAY’s site and choose the best deal.

-

Considers all credit profiles

-

Excellent credit required for the best rates

While AUTOPAY’s rates start at 1.99%, only those with excellent credit will qualify. According to AUTOPAY, they can, on average, cut your rate in half on a refinance.

AUTOPAY offers more refinance options than many lenders. In addition to traditional auto refinancing, borrowers can choose cash-back refinancing and lease payoff refinancing.

AUTOPAY is a marketplace that makes it easy to shop around for the best deal. It caters to individuals who are rebuilding credit or improving their credit.

Read Also: Fha Loan Limits Texas 2016

What Are Good Interest Rates & Aprs For Car Loans

When it comes to purchasing a vehicle, theres a lot to consider, such as what make and model youd like, what gas mileage you need, and so on. But figuring out how to finance your next vehicle purchase is one of the most important steps in the process. When youre comparing car loan options, youll see two terms interest rate and APR. These both give you an idea of how much it costs to take out a car loan. Well show you the difference between APR and interest rate and share some tips to help you get better rates next time you buy a vehicle.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

You May Like: How Do Mortgage Loan Officers Make Money

Best For Bad Credit: Oportun

Oportun

- Capped at 35.99%

- Minimum loan amount: $300

Opportun is our choice as the best for bad credit since it offers personal loans with limited credit score requirements and an easy online application, and funds available within 24 hours.

-

Wide range of credit situations accepted

-

Easy online application with instant approval

-

Pre-qualify with a soft credit check

-

Only available in 35 states

-

High interest rates

Having less-than-perfect credit shouldnt keep you from getting the car you need. While you shouldnt expect the low rates those with great credit receive, you can avoid overpaying with Oportun. Through this online lender, you can get a loan for a car that you purchase from an auto dealer or a private party. Since buying through a private party can be cheaper, this can save you big bucks over dealerships.

Oportun will lend to people with limited or no credit history. You should have proof of income to apply. Loan amounts can range from $300 to $10,000, so you can get the car you want. Best of all, Oportun does not require a hard credit check when prequalifying and checking rates. So, looking around wont hurt the score youre trying to fix. The application takes only a few minutes, is completely online, and results in an instant decision. If you live in one of the states where Oportun is available, this is an excellent choice.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. As of October 6, 2021, the average APRs according to a Bankrate study are the following.

Also Check: Usaa Certified Dealers List

Who Has The Best Rates For Car Loans

Automakers, credit unions, banks and online lenders could all potentially provide a low rate. Youll never know what you qualify for until you apply. Applying to multiple lenders within a two-week window will not hurt your credit score any more than applying to one lender. Any drop to your credit score will be slight and temporary.

Penfed Credit Union: Top Credit Union

Starting APR:0.99% for new vehicles, 1.99% for used vehiclesLoan amounts:$500 to $100,000Loan terms: 36 to 84 monthsAvailability:50 statesMinimum credit score:610

Pentagon Federal Credit Union, or PenFed, is a military credit union that offers some of the best auto loan rates on the market. We named it Top Credit Union for auto loans because of its availability and fantastic rates.

While PenFed is primarily for military members and their families, it is also open to people who work for certain government agencies and nonprofit organizations. Even if you dont fall into any of these groups, you can join by making a donation to an approved charity.

At 0.99%, PenFeds starting APR for new vehicles is the lowest of any of the auto loan providers we researched. To get that rate, however, youll need to buy a new car through PenFeds car buying service. If you shop for a car on your own, the APR starts at 1.79%. Like with most credit unions, PenFed members are eligible for special deals, such as discounts and reimbursements for shopping at partner dealerships.

However, qualifying for a PenFed auto loan might be hard for some. The credit union only accepts borrowers with credit scores of 610 or higher. In addition, PenFed has a steep $29 charge for late loan payments.

Also Check: Chfa Loan Colorado

Can You Negotiate Apr On A Car

Yes, you can negotiate APR the same way you negotiate the cars price by showing the dealer that your own lender gave you a lower rate. You can also ask the dealer what it would take to get a tier bump. Dealers sort borrowers into tiers by credit score the higher the tier, the lower your APR. They may say that you need to put more money down or get a cosigner in order to reach a higher tier.

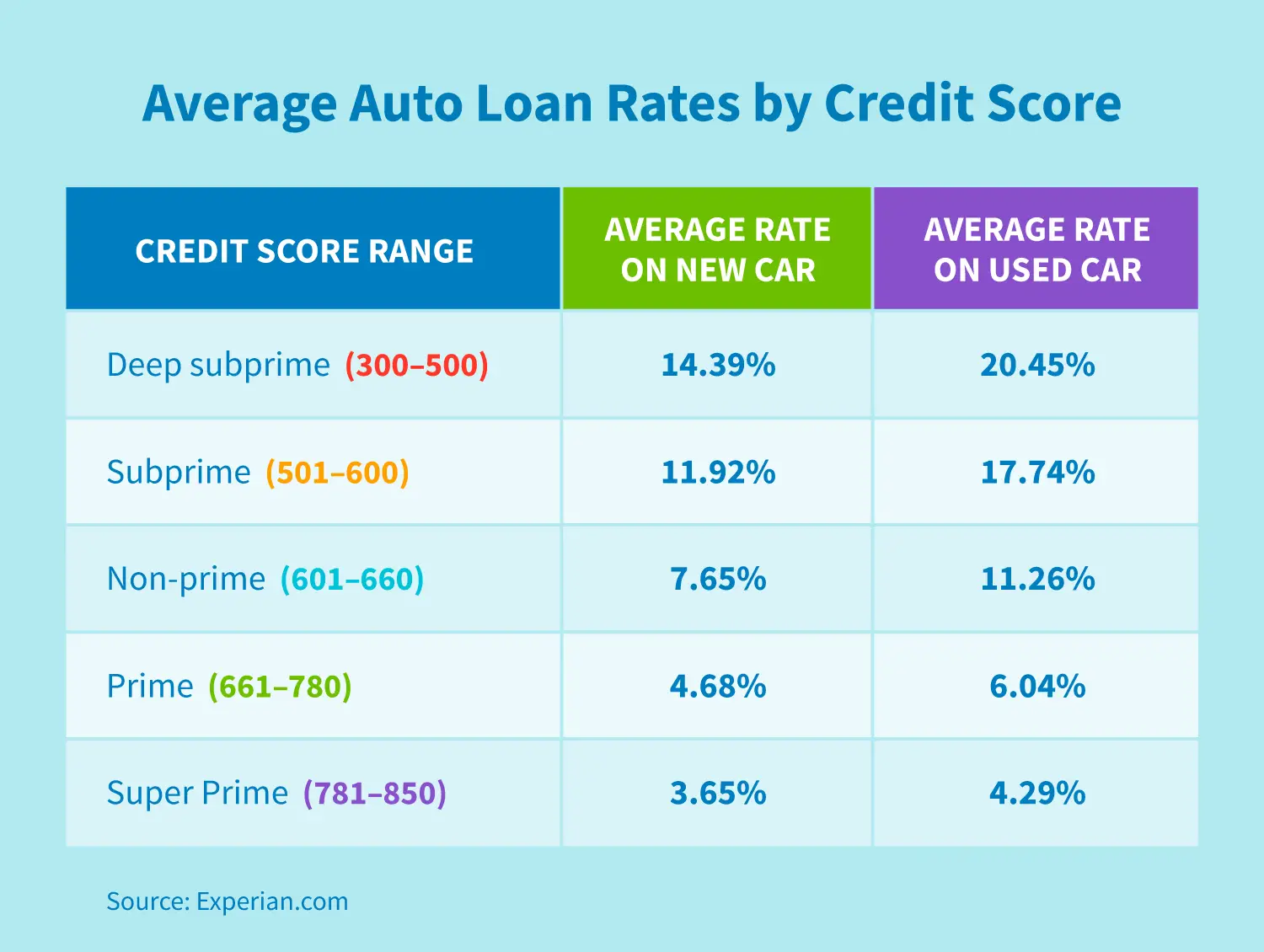

What Affects Loan Interest Rates

The rates above are average APRs based on information reported to the NCUA. You may find different rates based on a number of factors, including:

- A low score will require a higher interest rate, and vice versa. Credit score is perhaps the single most important factor lenders use to determine rates.

- Loan term: Shorter terms have lower interest rates. Consider making higher monthly payments to get a shorter-term loan with a lower overall cost.

- Lenders look at your entire credit report, so two people with the exact same score can find different rates based on how their score is calculated.

- Income: Lenders can have minimum income requirements for borrowers to qualify and also to secure the best auto loan rates.

- Down payment: A higher down payment not only reduces the total amount of the loan, but it shows that you are committed to purchasing the vehicle, and this can also reduce your interest rate.

- Interview process: If you impress a loan officer with professionalism and supporting documentation in discussing your financial situation, you may have a better chance of getting the best auto loan rates for your situation.

- Negotiation: If you get multiple pre-qualification offers, you can use those when negotiating interest rates from lenders.

- Autopay: Many lenders offer discounts for making automatic payments. Credit unions can also offer a discount if you pay for the loan with an account at that same credit union.

Recommended Reading: Average Interest Rate For Commercial Real Estate Loan

Best Big Bank Lender: Capital One

Capital One

Capital One gives car shoppers the peace of mind of working with a major secure lender, placing it in the top spot as the best big bank lender.

-

Pre-qualify with a soft credit check

-

Big bank lender provides security

-

Must contact dealer directly to confirm vehicle is in stock

-

Loans only available through the lenders network of dealers

Understandably, some people aren’t as comfortable using lesser-known or niche lenders for something as crucial as an auto loan. If you want the backing of a major financial institution with a household name, Capital One may be your best bet. If you’re in the market for a new or used car, you can submit a request to get pre-qualified for auto financing through the bank’s Auto Navigator program. This early step does not affect your credit since it is a soft pull.

The pre-qualification is then valid at more than 12,000 dealers throughout the nation, each of which you can find on Capital One’s website. Just present the qualification note at a participating dealership and begin the full application process once you find the perfect ride.

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

You May Like: Rv Payment Calculator Usaa

Best For Used Cars: Chase Auto

Chase

Chase Auto offers the security of a stable financial institution with competitive rates, high loan amounts, and a concierge car-buying program that makes it easy to get the best rates and financing options for a used car.

-

Pre-qualify with a soft credit pull

-

Car-buying and car-management services

-

0.25% discount for Chase Private Clients

-

Must finance from a Chase network dealer

-

New application needed when switching dealers

Chase Auto is the car financing arm of J.P. Morgan Chase & Co., the largest bank by assets in the U.S., and allows users to shop for, finance, and manage their vehicle all from one account.

Although Chase Auto doesnt list rates online, it has a calculator that will allow you to get an idea of your potential rate. Chase also offers generous loan amounts ranging from $4,000 to $600,000 and 12 to 84 months flexible repayment terms.

Chase Auto doesnt require you to make a down payment for a loan, though putting money down can reduce the total amount you need to borrow and your monthly payments. You can also get a 0.25% interest rate discount as a Chase Private Client, which requires you to have a minimum average daily balance of $150,000 in qualifying personal, business, and investment accounts or a Chase Platinum Business Checking account.

Average Rates For Auto Loans By Lender

Auto loan interest rates can vary greatly depending on the type of institution lending money, and choosing the right institution can help secure lowest rates. Large banks are the leading purveyors of auto loans. , however, tend to provide customers with the lowest APRs, and automakers offer attractive financing options for new cars.

Also Check: Refinance Student Loans Usaa

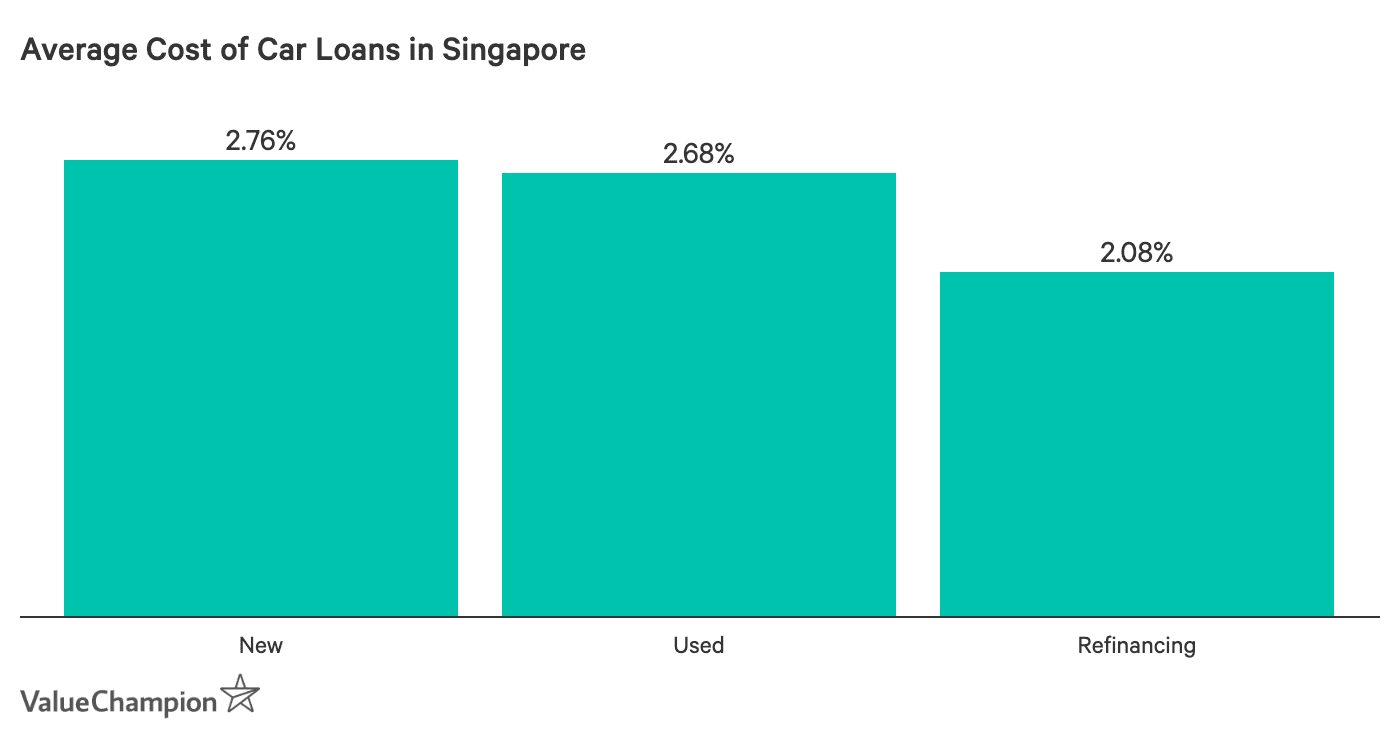

Whats The Difference Between New And Used Car Interest Rates

Loans for newer cars tend to have lower interest rates than those for used cars. Lenders see newer cars as less of a risk theyre less likely to break down, and lenders can identify exactly how much theyll depreciate over time. Newer cars have more predictable resale value down the line than newer cars, and that predictability results in a lower interest rate.

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Also Check: Va Partial Entitlement Worksheet