How Does Mortgage Interest Work

Mortgages are amortizing loans, meaning:

- A portion of your monthly mortgage payment reduces your loan principal, and the remainder is an interest charge.

- For fixed-rate mortgages, the monthly payments remain the same throughout the loan term. The monthly amount may change if you have an adjustable-rate mortgage.

- The payment principal and interest proportions vary over time. In the first few years, payments overwhelmingly consist of interest charges, but, eventually, principal payments predominate.

- Your mortgage documents will include an amortization schedule specifying each payments principal and interest amounts.

The mortgage principal equals the homes purchase price minus your down payment. For example, suppose you purchase a home for $380,000 and put down 20% . If you take out a 30-year, fixed-rate loan for $304,000 with a 5% interest rate:

- Your monthly payment will be $1,631.94, plus any escrow amounts .

- Your total mortgage interest will be $283,497.58 if you pay off the mortgage in 30 years .

- Your total mortgage payments will be $587,497.58, almost double the original loan principal.

You must repay the entire loan principal to retire your mortgage. If you repay the mortgage ahead of time, youll save on interest charges, but the lender may impose a prepayment penalty fee to discourage you.

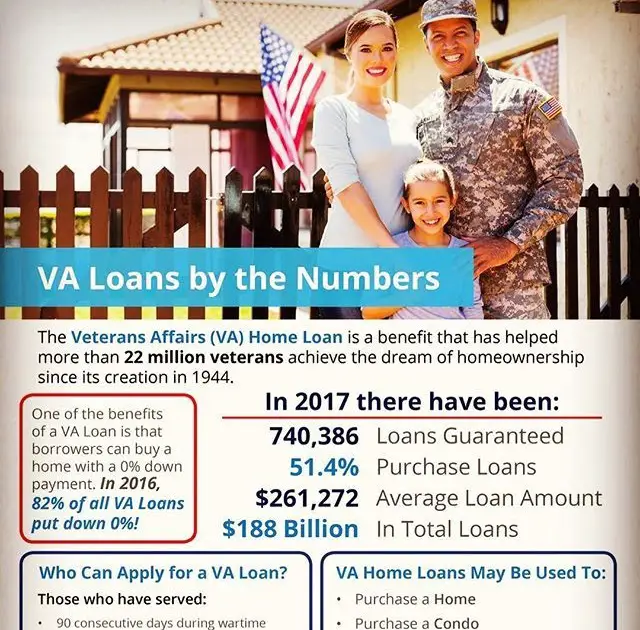

Veterans: See What You Can Afford In 2022

Veterans and service members can have what’s considered poor or bad credit and still ultimately land a VA loan. What’s important to understand is that the VA doesn’t set credit score requirements. In fact, the VA doesn’t mandate a minimum credit score at all.

But the VA also doesn’t make these loans. They’re made by banks and lenders like Veterans United, which will almost always have a that buyers need in order to qualify.

» MORE: See if you meet VA credit guidelines

Other Va Loan Options

When purchasing or refinancing a home with a VA loan, there are additional VA programs that you can use in conjunction with the mortgage. They must be closed simultaneously with your VA loan. Options include:

- Energy-Efficient Mortgage : Cover the cost of making energy-efficient improvements to your home

- Alteration and Repair Loan: Guarantee a loan for alteration and repair of an aging home

- Construction Loan: Construct a new home on the property you already own or are purchasing with a loan

- Farm Residence Loan: Purchase, construct, alter, or improve a farm residence

As you can tell, the VA has worked hard to provide former and active military members with the opportunity to thrive in homeownership, even if they have bad credit.

Don’t Miss: How To Remove Name From Home Loan

Can I Get A Mortgage With Poor Credit

Consumers with poor credit can access mortgage loans but may have to pay higher interest rates. Many mortgage lenders tolerate less than perfect credit, but only up to a point.

Federally sourced or guaranteed mortgages generally accept lower scores than do private ones.

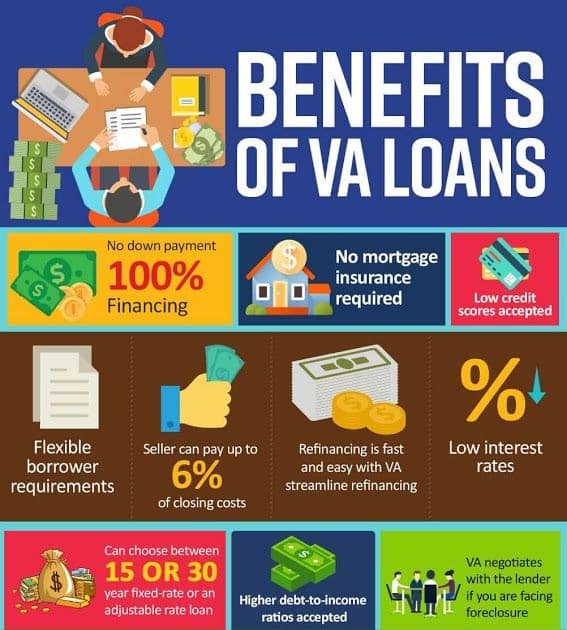

Private lenders also offer mortgages for folks with bad credit. Some have features unavailable from federal loans, including 100% financing , seller contributions, no income limits, and no mortgage insurance requirement.

When shopping for a bad credit mortgage, keep a few things in mind:

- Minimum credit scores vary among lenders.

- You must generally be two or more years past bankruptcy and three years from a home foreclosure.

- You wont be eligible if you owe back taxes to the IRS or are behind on your student loan payments.

Less than perfect credit, especially with outstanding debt, can limit the loan amount even the best mortgage lender will offer you. If your home shopping can wait, you can use the time to raise your low credit score by paying your bills on time and reducing your debt. Doing so will broaden your mortgage options and may lower the mortgage rate youll have to pay.

No Overlay Va Lenders

Lenders who offer lower credit scores many have overlays in exchange for accepting those lower credit scores.

What are overlays? Overlays are additional requirements imposed by lenders. Examples of overlays are lower DTI requirements, additional reserves, or even a down payment despite the fact that VA loans typically do not have one.

We do our best to partner with VA lenders who allow for lower credit scores without many overlays. .

Don’t Miss: How To Find Loan To Value

Auto Loan Ontario Is The One Stop Auto Loan Company With Solutions For All Credit Situations

Once you complete ouronline credit application, you’ll get personal attention from our Ontario financial experts so that they can understand your individual personal situation and work hard to get you the lowest interest rate available and ensure that you can have a comfortable and affordable monthly payment for the vehicle you want!Let Auto Loan Ontario, the automotive financing experts easily walk you through the vehicle loan process and all the options available to you for your next automobile purchase so that you make an informed educated decision. We know how to get you the most money and the best interest rates. We’ve helped people with:

| Ontario No Credit Car Loans |

| Bad Credit Vehicle Loans |

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Is The Best Online Loan For Bad Credit

How To Improve Your Credit Score For A Va Loan

- Manage your credit responsibly. The way borrowers use credit can impact their finances and ability to get a loan for a house. When you handle your credit responsibly by paying your bills on time or not exceeding your card limit you show lenders that youre a reliable borrower.

- Make sure your credit card balance is low. A high balance on your credit card can bring down your score, which is why its important to keep your balance reasonably low. We recommend you have a balance thats 30% or less of your cards limit.

- Pay outstanding debt and balances. When applying for a mortgage, lenders typically want to see your payment history and whether you have any outstanding debts. Because of this, you need to pay off your balances, and sometimes you cant move forward with the loan process until you do.

- Fix mistakes on your credit report. can sometimes include errors, leading lenders to reject your loan request. We recommend thoroughly reviewing your credit report and fixing any errors you may come across.

Best Va Loan Lenders Of September 2022

Fernando García DelgadoClaudia Rodríguez HamiltonFernando García Delgado27 min read

Offering a wide range of VA Loans for active-duty service members, veterans, or their family

Offering a wide range of VA Loans for active-duty service members, veterans, or their family

- Free credit consulting service

- The minimum credit score required is 620

- Loan terms: 15 and 30 years

- Minimum down payment required: 0% for qualifying buyers

- Provides extensive customer service hours

- The minimum credit score required is 620

- Loan terms: 15, 25, and 30 years

- Minimum down payment required: 0%

- Discloses the latest rates online with daily updates

- The minimum credit score required is 580

- Loan terms: 30 years

- Minimum down payment required: 3%

- Waives origination fees on all VA home loans

- The minimum credit score required is 680

- Loan terms: information unavailable

- Minimum down payment required: 0%

- Easier qualification compared to conventional loans

- Rates as low as 2.750% APR

- Quick, easy application process

- Get the best rates by letting banks compete for your business

- Calculate what you can afford with VA Loan Calculator

- Free personalized mortgage rates in minutes

- 100+ years serving military members

- $0 down VA loan options

- USAA Bank is an Equal Housing Lender

- Membership not required for a loan inquiry, but is for a preapproval or application

See our VA loan guide to learn more about the type of loans available and the Veterans Affairs s service requirements.

You May Like: Does The Va Home Loan Cover Closing Costs

The Best Va Mortgage Lenders Of September 2022

Insiders experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our our partners, however, our opinions are our own. Terms apply to offers listed on this page.

VA mortgages are a really valuable benefit for those who qualify for them. These home loans are available to active military, veterans, and their spouses. You can buy a home without making a down payment, and the VA doesnt limit how much you can borrow. Youll also probably pay a lower interest rate than you would on a conventional mortgage.

The best VA mortgage lenders have low minimum credit score requirements. Most have strong customer satisfaction and trustworthiness scores. And many have special features such as live online chat or digital closing options.

Consumer Beware: Va Mortgage Scams

VA loans are a great deal that gets many people excited, and those looking to make a quick buck on the wrong side of the law know it. Those with a VA loan are often the target of mortgage refinance scams. Beware of any communication that says you should stop making payments to your current mortgage servicer and send payments elsewhere or anything requesting money in the form of gift cards or vouchers. Additionally, no lender can make a claim that they represent the VA or another part of the government.

If a deal looks too good to be true, it probably is. Of course, you can always do a quick internet search to see if the entity reaching out to you is real.

If youve received suspicious communications, you can report them to your state attorney general or the Federal Trade Commission.

Read Also: What Are Some Good Loan Companies For Bad Credit

Va Home Loan Fico Score Requirements

As mentioned above, the VA does not set or regulate FICO score requirements. Borrowers who have bad credit will need to first assess their FICO scores and credit history before deciding to apply for a mortgage loan.

In general, you may find that participating lenders require FICO scores in the mid-600 range for the most favorable rates and terms.

How To Qualify For A Va Loan

The VA home loan program and its military benefits are available for:

- Active-duty military members

- Past and present members of the National Guard

- Surviving spouses of military personnel who died in combat

A VA home loan does not have a minimum credit score requirement, but most participating VA loan lenders require a minimum credit score of 620. Our advice? Always check your credit report and debt-to-income ratio before applying for a loan and improve it if you can.

For more information, read our 5 tips for getting a VA loan, as well as our guide on how to dispute your credit report.

Service requirements

Veterans and active-duty service members must have served at least 90 days during wartime or 181 days during peacetime. National Guard members must have served at least 90 days of active-duty service during wartime or six years of creditable service in the Select Reserves or Guard.

Once deemed eligible, you must apply for a Certificate of Eligibility . The COE proves to the VA mortgage lender that you meet the VAs eligibility requirements.

Don’t Miss: Can You File Bankruptcy For Student Loan Debt

How To Qualify For A Va Home Loan

To qualify for a VA home loan, you must be active duty military, an honorably discharged veteran, or a military service member of the reserves or National Guard. Eligible surviving spouses of service members may also apply for a VA loan. To get approved, you must purchase a primary residence and obtain a valid Certificate of Eligibility from the VA. This form confirms your VA loan eligibility.

Who Is Eligible For A Va Loan

Before you apply for a VA home loan, youll need to obtain a Certificate of Eligibility. With this, youll be able to prove to your lender that you are in fact able to obtain a VA home loan.

Luckily, the process is not very complicated and almost every member or veteran of the military is eligible. Additionally, members and veterans of the reserve and National Guard are usually eligible. Finally, spouses of military members that died on active duty or from a service-related injury may be eligible for the VA loan.

If you are an active-duty military member, then you will need to serve approximately 6 months before you are eligible.

Keep in mind, you will need to use this home as your primary residence and move into the new home within 60 days of purchase. Sometimes exceptions are made to this general rule, but it will require a case-by-case evaluation. If you do not plan on using this home as your primary residence, then the VA home loan is not a good option.

Recommended Reading: Loans Online No Credit Check

Personal Loans For Students

A college loan be it federal or private doesnt necessarily cover all the costs of college, and this is where personal loans for students can come in handy.

In 2018, the average cost per year for a 4-year degree reached $26,593, and at private institutions it was a staggering $41,468, according to the National Center for Education Statistics. These costs reflect only the price of tuition, fees, room, and board, and dont take into consideration all the other costs that can come with being a college student.

A growing number of students are turning to personal loans as a way to cover the costs in college, and are taking to the internet to find the right loan for them.

Recommended Reading: Loans With Bad Credit Same Day

Why A Local Mortgage Company Is So Valuable

If you are a Veteran or Active Duty Military, national Military connected mortgage companies have large volumes of mortgage applicants and stricter guidelines. As a result, they dont have the ability or desire to work with people looking to get a VA Loan with bad credit. Local companies will give more time and attention to people who may have some credit challenges. Additionally, local companies usually have more flexibility with Underwriting Guidelines when it comes to people looking to get a VA Loan with bad credit. So, if you have questions or need personalized attention in getting a VA Loan, call the Cain Mortgage Team today!

Recommended Reading: How To Sell Car With Loan Balance

Loans Backed By The Va Can Be Used For Refinancing

A lesser-known use for VA-backed home loans is to refinance an existing loan into a new VA home loan. The VA supports two main types of refinancing options, with the particular option you need dependent on your goal for refinancing.

Homeowners with a current VA home loan who wish to lower their interest rates and, thus, lower their monthly payment or reduce the length of their loan can apply for an Interest Rate Reduction Refinance Loan , also called a VA Streamline Refinance loan. Refinancing with an IRRRL is simple and straightforward, requiring no appraisal or credit underwriting package. Additionally, IRRRLs can often be completed with no out-of-pocket expenses.

The other type of VA refinance loan is called a Cash-Out Refinance Loan, which can be used to obtain cash for home improvements, paying off debt, or other financial needs. Qualified homeowners can refinance up to 100% of their homes value as mortgage debt, with the equity available as cash.

In contrast to home-equity loans, Cash-Out refinance loans replace your current mortgage loan rather than augment it. VA-backed Cash-Out refinance loans can also be used to turn a conventional mortgage loan, USDA loan, or FHA loan into a VA home loan .

Va Home Loans For Borrowers With Low Fico Scores

Not all borrowers will be eligible for a VA mortgage some credit scores are just too low for the lender to take a risk on. Others, who may have FICO scores at or near the low 600s may find the lender willing to work with them, especially those with marginal FICO scores who are willing to make a down payment, agree to a higher interest rate, etc.

Also Check: What Credit Score Is Needed For Sba Loan

Tips To Improve Your Credit Report Before Home Buying

Bad credit doesnt necessarily mean you wont qualify for a mortgage. But borrowers with good to excellent credit have the most loan options. They also benefit from lower rates and fees.

If you can polish up your credit report before shopping for a mortgage, youre more likely to qualify for the best loan terms and lowest interest rates. Here are a few tips to improve your credit report and score before applying:

Removing inaccurate information can increase your credit score quickly. Developing better credit habits will take longer to produce results.

If youre looking to buy or refinance and know you may need to bump your credit score, it can be helpful to call a loan advisor right now even if youre not sure youd qualify.

Most lenders have the ability to run scenarios through their credit agency providers and see the most efficient and/or cost-effective ways to get your scores increased. And this can be a much more effective route than going it alone.