How To Calculate Home Equity

1. Get an estimate of your homes value

Your homes value is the most important factor in calculating your homes equity. You can get a rough idea of how much your home is worth from an online home value estimator. However, you may get a more precise figure through other avenues, such as:

- Requesting a comparable market analysis . Your real estate agent typically prepares this detailed report. The CMA compares your home to similar properties nearby that have recently sold to give you a more educated guess about your homes value.

- Ordering a home appraisal. For an unbiased, third-party opinion of your homes value, a home appraisal might be worth the $300 to $400 price tag. A licensed home appraiser does a deeper dive into all the characteristics of your home. Appraisals are normally required for mortgage financing.

2. Check your loan balance

Your monthly mortgage statement is the best place to find current information about your loan balance. It also breaks down how much principal and interest you pay each month.

Your payoff amount and principal balance are slightly different. The principal balance doesnt include interest due since your last payment. Mortgage interest is paid in arrears, meaning each monthly payment covers interest from the previous month. If you decide to pay your loan off, the lender will calculate your payoff balance, which includes your remaining principal balance plus interest.

3. Subtract your loan balance from your homes value

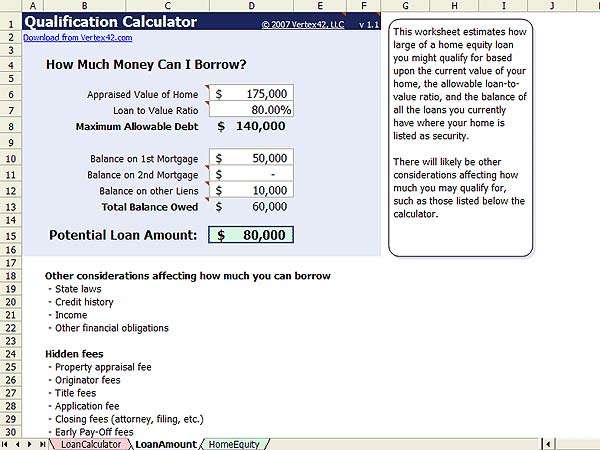

Using The Home Equity Line Of Credit Calculator

This home equity loan calculator makes it easy to determine what you can borrow, as well as showing how that amount would vary if the appraised value of your home is more or less than you expect.

To use it, enter the estimated value of your home, the amount owed on your mortgage and any second liens, and the maximum loan-to-value ratio allowed by your lender in the boxes indicated. The line of credit available to you will be displayed in the blue box at the top.

Notice that you can vary these figures using the sliding green triangles on the chart if you want to explore a range of values.

The chart with the three colored lines shows you how your available line of credit would vary across a range of appraised home values, given the figures you entered into the calculator. The lines correspond to the loan-to-value ratio your lender will allow.

The home equity line of credit calculator automatically displays lines corresponding to ratios of 80%, 90% and 100% it can also display one additional line based on any value you wish to enter. For example, if your lender will allow a 95% ratio, the calculator can draw that line for you, in addition to the other three.

The range of home values are listed along the bottom and are centered on the value you entered the figures for the available line of credit are listed at left on the vertical axis.

How To Use Your Home Equity

Borrowing against your home equity converts its cash value into debt. However, owning a debt-free home should be the ultimate goal of homeownership. Besides the financial benefit, having a mortgage-free home eliminates the possibility of losing your home to foreclosure if you fail to repay the loan.

The financial goals you can accomplish using your home equity include:

- Making home improvements

- Paying off high-interest credit cards

- Paying for a college education or a wedding

- Building a real estate investment portfolio or buying a vacation home

Recommended Reading: 1800 946 0332

How To Cancel Private Mortgage Insurance

If your down payment was less than 20 percent of your homes purchase price, your lender may have required private mortgage insurance on your original mortgage, but that requirement exists only while your loan-to-value ratio is above a certain threshold. The Homeowners Protection Act requires lenders to automatically cancel PMI when a homes LTV ratio is 78 percent or lower .

This cancellation is often preplanned for when your loan balance reaches 78 percent of your homes original appraised value. However, if your LTV ratio drops below 80 percent ahead of schedule due to extra payments you made, you have the right to request your lender cancel your PMI.

Where Can I Get A Home Value Estimate

Our home value estimator page the perfect online tool to help homeowners get a professional online valuation. Just enter the address of your home, your name, your email so the agent can send you the results.

Within minutes you will have one of our agents contacting you to begin planning your next steps. You can expect to receive information about comparable properties including low, a mid-range estimate and a high range for your home. As well as rental value to expect if you decide to rent your house out, and a historical record of homes that have recently sold in your area.

Go to our valuation tool to obtain an estimate of the value of your home in todays market. Determining your homes value is more complicated than people think. Many different elements can affect your home market value. The best ways to check your home value or to get as close as possible to how much your house is worth is to start by utilizing free online valuation tools. There are some other tools that you should check out like Zillows Zestimate and redfin estimate as well.

Recommended Reading: Can You Refinance Fha Loan

How Much Is Your Home Worth

One of the first things that consumers want to know when they are contemplating selling their home is how much their house is worth. For a first time home seller, this is an important question to address for several reasons. Every home seller wishes to attract the highest price they can for their home. With this complete guide, you will understand the steps to calculate home value.

Home sellers also need to plan how much capital gains they will have to make the next home purchase. With the homes equity or capital gains, they can increase their down payment. Hence, they can buy a larger house perhaps or arrange for lower monthly payment, and also leaving funds available to spend on home improvements for the new house.

Knowing how much they can expect to obtain when the homes sales are completed is going to help them focus on new price ranges for the new house. Home buying in different neighborhoods might be an option, and they can prepare for house hunting as soon as their home is ready to sell. Using a mobile app for home buying has become very popular nowadays.

Tip: Try to use the saved searches options from different real estate mobile apps on the market.

Find Accurate Comparable Homes

The first step is to find accurate comparable homes that are very similar to your home. If you have a cookie cutter home that is just like many other homes around it, this is not a big deal. On the other hand, if you have a unique home with many different features than the surrounding homes, it might be harder to find those comparable homes to use for your value. In addition, if you live in an area where not very many homes have sold lately, there is not as much data to use as far as determining the value of your home.

Read Also: Upstart Prequalify

How Much Can You Borrow On A Heloc

Among the factors that combine to determine the amount that you can borrow are your credit score and the amount of equity that you have in your home at the time of the HELOC application. Depending on your credit profile, Figure may be able to approve you up to 95% combined loan-to-value . To calculate your CLTV, subtract your existing mortgage and your desired HELOC amount from the value of your home.

Should I Get A Comparative Market Analysis From A Realtor

A Comparative Market Analysis or CMA is a little different than what an appraiser might provide. A CMA establishes a market price for your home based on the current market condition, competition from other houses, features and size of your home, the shape of your home and whether it is a buyers or sellers market.

A local real estate agent is always on the loop with regards to the current market conditions and will guide the seller in deciding the sales strategy for the home once they have arrived at a price. Your homes listing price is the most crucial part of selling a house. Also, use estimated market values from different sources to come up with the best selling price possible, analyzing all the recent sales utilizing the best platforms that provide the latest estimated market values.

Before pricing your home consider the following:

- If you price it too high, few buyers may look at it.

- Priced too low and you may lose money.

- The goal should be the right price in a sellers market.

- If you price your home at the right price, you might find yourself in the middle of a bidding war!

A realtor in the business can help sellers with all of these considerations. They can help you sell your home quickly at a price that is very competitive. Your realtor will also make suggestions regarding which improvements will enhance the value of your home.

Also Check: Usaa Home Loan Credit Score Requirements

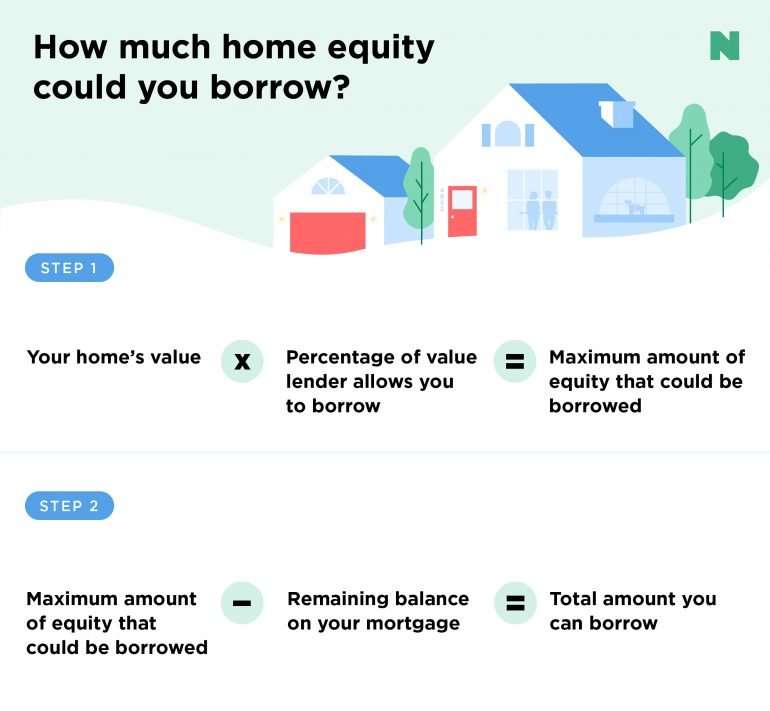

Start With A Baseline Calculation

You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. This includes your primary mortgage as well as any home equity loans or unpaid balances on home equity lines of credit. In a typical example, homeowner Caroline owes $140,000 on a mortgage for her home, which was recently appraised at $400,000.

Should I Hire A Professional Appraiser

Typically, an appraiser is engaged by the lender to appraise the home to ensure that the appraised value is the same or close to the purchase price. The results obtained when hiring an appraiser will serve as a support to the mortgage amount that is being applied for. Appraisers charge a fee for their services. Most of them often will turn to local real estate agents to obtain recent sales data to support their appraisal.

Both buyers and lenders often will not trust the sellers paid appraisal. They prefer to use their own trusted appraiser to assess the value of a home.

The vast majority of sellers will arrange for a comparative market analysis to be completed by their local real estate agent. Every agent offers a CMA as part of the services, and they are a handy way to estimate your homes value. Remember that appraising is an opinion of value.

You May Like: Are Student Loan Forgiveness Programs Legit

How Is The Loan

The lender determines this amount by dividing the appraised value of the house by the amount remaining on your mortgage. Take the example of a home that is appraised at $500K, with $125K remaining on the mortgage. The balance of the mortgage is divided by the appraised value, producing a loan-to-value ratio of .25, or 25%. A combined loan-to-value rate also takes into account the amount of the loan that you have requested. Suppose, for example, that you have aksed for a loan of $75K. The balance of the mortgage and the new loan total $200K, producing a combined loan-to-value ratio of .4 or 40% .

Whats The Difference Between A Home Equity Loan And A Home Equity Line Of Credit

As mentioned above, a home equity loan is paid out in a lump sum and repaid in fixed monthly installments over a set term. On the other hand, a home equity line of credit , works much like a credit card. You can use the credit line up to the established limit, but you pay only for what you use plus interest. HELOCs have a set draw period, during which you can use the credit line. When the draw period ends, the HELOC goes into repayment and you cant tap any more equity from the credit line.

Recommended Reading: Usaa Auto Loans

Importance Of The Appraisal Before You Apply For A Home Equity Loan

If youre looking to tap some cash to fund a home improvement project, consolidate debt, or cover an emergency expense, the financial reprieve you need could be at your front door. Thats because the average homeowner has $140,000 in available home equity, according to Black Knight, which could be accessed to fund financial goals you have on the horizon.

But first you need to find out how much equity you have in your homewhich, in part, relies on getting your home appraised. To get an idea beforehand, try this quick back-of-the-envelope calculation: Your Home Value minus Your Current Mortgage Balance. Most lenders will let you borrow up to 85% of that equity. With Discover Home Loans, you are able to borrow less 90%.

So, how quickly and easily can you access your cash? One of the biggest holdups is often the appraisal for home equity loans. This fact may leave you wondering: Do all home equity loans require an appraisal? And, perhaps more important, are all home appraisals the same? What comes next are answers to all your appraisal questionsand maybe even a way to speed up the process.

Pay Down Your Principal

Every time you make a mortgage payment, you gain a little more equity in your home. In the beginning years of your mortgage, you gain equity slowly. This is because most of the money you pay in the first few years of your loan goes toward interest instead of principal.

As you pay down your balance, a higher proportion of your monthly payment goes toward principal instead of interest. This process, called amortization, means that you build equity faster toward the end of your loan term.

If you want to build equity faster in the first few years of your mortgage, you can pay more than your minimum monthly payment. Just tell your lender that the extra money should be applied to your principal.

Read Also: Can Other Than Honorable Discharge Get Va Loan

To Calculate Your Equity Start With A Home Value Estimate

Well provide you with a real-world home value estimate in 2 minutes that you can use to ballpark your home equity over time.

Local real estate agent

For a more precise calculation of your homes worth, ask a real estate agent to provide you with a comparative market analysis , which uses comparable sales as a benchmark for your property value and then makes dollar adjustments based on competitive differences. Agents typically perform a CMA when they list a home, but may be willing to help you even if you arent selling right away.

Appraisal

A lender is typically going to require a professional home appraisal if you want to use a home equity loan, though methods like drive-by valuations or automated valuations models have become more common. Contact your lender for details about what your loan requires.

How much do you still owe?

The best way to determine how much you still owe on your mortgage is through your loan servicer. Many lenders today provide online tools to access the most recent details about your mortgage, including your payment history and copies of your monthly mortgage statement, in a secure online portal.

Look for a callout like unpaid principal which may be located next to instructions for getting an official payoff quote, which is the total amount of principal and interest you must pay to satisfy your loan obligation.

Got those numbers?

Time to see how much equity you have:

How Much Equity Do I Need To Sell My House

To sell your house, youll want at least enough equity to cover closing costs, commissions and any liens on the property. Liens include any outstanding debts on your property, like if you neglected to pay a contractor or are behind on your property taxes or HOA dues.

Without this equity, youll have to bring money to the closing table to settle up your debts. Remember, closing costs can reach 8% to 10% of the sale price, which includes 6% in agent commission and 2% to 4% for other charges.

| Home sale price | |

|---|---|

| $625,000 | $50,000-$62,500 |

If you have negative equity and are at risk of foreclosure due to missed payments, you might consider a short sale, but it can be a challenging process. Your lender will have to agree to it, since theyll be accepting less for the home than theyre owed. And it can have a significant negative impact on your credit score.

Read Also: Does Capital One Do Auto Refinancing

How Your Home Equity Can Increase

One way you can increase your home equity is by making mortgage payments. Part of this payment goes towards paying down the principal, which is the amount of money you owe for your home.

In the early years of homeownership, more of your monthly bill goes to paying for the interest than paying down the principal. That means your mortgage payments are likely to make only modest contributions to your home equity. You may be able to build equity faster by paying more than you owe each month, by making an extra mortgage payment each year, or by moving to bi-weekly mortgage payments. Making additional payments also helps save on interest because you are paying off your loan faster.

The other way your home equity can increase is when the value of homes in your community increases. As housing prices around you go up, your home’s value will probably go up too.

For example, if you bought your house five years ago for $250,000 and the current fair market value of your house is $300,000 — that extra $50,000 becomes part of your home equity. This is great because rising home prices can help you build equity.

Remember that when home prices in your community fall, the amount of your home equity can go down as well. If the fair market value of your home declines from $300,000 to $280,000 then your equity will decline by $20,000.