How Much Extra Should You Pay To Payoff Your Mortgage Early

You dream of paying off your mortgage early.

You long for the day when you are debt free.

But how do you do it?

How much must you pay each month to be out of debt by a certain date?

What if you wanted to pay off your mortgage in 15 years instead of 30? How much would you save?

The good news is this mortgage payoff calculator makes figuring out your required extra payment easy.

You choose how quickly you’d like to pay off your mortgage, and the calculator will tell you the required extra monthly payment to get it done. It will also tell you how much interest you’ll save!

However, before you start making your extra payments, there are a few factors you’ll want to consider first . . . .

What Is An Amortization Schedule

Initially, most of your payment goes toward the interest rather than the principal. The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term.

A mortgage amortization schedule is a table that lists each regular payment on a mortgage over time. A portion of each payment is applied toward the principal balance and interest, and the mortgage loan amortization schedule details how much will go toward each component of your mortgage payment.

How Extra Payments Pay Off Loans Faster

Say, for example, you borrow $20,000 in student loans with an interest rate of 5%. Your monthly payment for 10 years would be $212 and you would pay $5,440 in interest.

What if you paid $100 a month more toward that loan? Your monthly payment would rise to $312 but you would pay about $2,000 less in interest and be debt-free nearly four years earlier.

The more payments you can tack on, the less youll pay in interest and the closer youll get to freedom from student debt. If it feels like you have no cash to spare, try making biweekly student loan payments instead its a simple way to trick yourself into making one full extra payment each year.

The standard repayment plan takes 10 years to pay off a student loan. But repayment can last longer if you change your repayment plan for example, income-driven options can last up to 25 years.

You can pay off a student loan as quickly as you’re financially able to. There’s never any penalty for prepaying a student loan, and paying off your loan quickly will result in paying less overall.

You can calculate your student loan payoff date based on your current loan balance, the loan’s interest rate and the amount you pay each month. If you’re on an income-driven repayment plan, your student loan will be paid off when the amount you owe is paid in full or your repayment term reaches its end, whichever happens first.

Also Check: How To Remove Auto Loan Charge Off

How Do I Pay Off My Mortgage Early

One way to pay off your mortgage early is by adding an extra amount to your monthly payments. But how much more should you pay? NerdWallet’s early mortgage payoff calculator figures it out for you.

Fill in the blanks with information about your home loan, then enter how many more years you want to pay it. The calculator not only tells you how much more to pay monthly to pay down your principal faster it also shows how much you’ll save in interest.

Early Loan Repayment: A Little Goes A Long Way

One of the most common ways that people pay extra toward their mortgages is to make bi-weekly mortgage payments. Payments are made every two weeks, not just twice a month, which results in an extra mortgage payment each year. There are 26 bi-weekly periods in the year, but making only two payments a month would result in 24 payments.

Instead of paying twice a week, you can achieve the same results by adding 1/12th of your mortgage payment to your monthly payment. Over the course of the year, you will have paid the additional month. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest.

However, you don’t have to pay that much to make an impact. Even paying $20 or $50 extra each month can help you to pay down your mortgage faster.

Calculating Your Potential Savings

If you have a 30-year $250,000 mortgage with a 5 percent interest rate, you will pay $1,342.05 each month in principal and interest alone. You will pay $233,133.89 in interest over the course of the loan. If you pay an additional $50 per month, you will save $21,298.29 in interest over the life of the loan and pay off your loan two years and four months sooner than you would have.

You can also make one-time payments toward your principal with your yearly bonus from work, tax refunds, investment dividends or insurance payments. Any extra payment you make to your principal can help you reduce your interest payments and shorten the life of your loan.

Read Also: What Are The Requirements For An Fha Loan In Texas

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Effect Of Paying Extra Principal On Your Mortgage

Depending on your financial situation, paying extra principal on your mortgage can be a great option to reduce interest expense and pay off the loan more quickly. Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments.

Conforming fixed-rate estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down payment of 20% would result in an estimated principal and interest monthly payment of $1,058.04 over the full term of the loan with an Annual Percentage Rate of 3.946%.1

Amortization extra payment example: Paying an extra $100 a month on a $225,000 fixed-rate loan with a 30-year term at an interest rate of 3.875% and a down payment of 20% could save you $25,153 in interest over the full term of the loan and you could pay off your loan in 296 months vs. 360 months.

You May Like: How To Figure Out Student Loan Interest

Lender And Bonus Disclosure

All rates listed represent APR range. Commonbond: If you refinance over $100,000 through this site, $500 of the cash bonus listed above is provided directly by Student Loan Planner.

CommonBond Disclosures: Refinancing

Offered terms are subject to change and state law restriction. Loans are offered by CommonBond Lending, LLC , NMLS Consumer Access. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, the loan term selected and will be within the ranges of rates shown. If you choose to complete an application, we will conduct a hard credit pull, which may affect your credit score. All Annual Percentage Rates displayed assume borrowers enroll in auto pay and account for the 0.25% reduction in interest rate. All variable rates are based on a 1-month LIBOR assumption of 0.15% effective Jan 1, 2021 and may increase after consummation.

CommonBond Disclosures: Private, In-School Loans

Student Loan Planner® Disclosures

Other Ways To Pay Off A Mortgage Early

Paying off a mortgage early requires you to make extra payments. But there’s more than one way to pay off the mortgage early:

-

Add extra to the monthly payments, as discussed in this article.

-

A structured way to add extra: Divide your monthly principal payment by 12, then add that amount to each monthly payment. You end up making 13 payments, instead of the required 12 payments, every year.

-

A variation of the above tip: Deposit one-twelfth of the monthly principal payment into a savings account each month, then use that money to make a 13th payment.

-

Pay half a mortgage payment every two weeks. You make 26 half-payments, equivalent to 13 full payments a year. If you want to try this, first make sure your mortgage servicer is set up to receive biweekly payments.

-

Make a lump-sum payment toward the principal. You might do this after receiving a bonus, inheriting money or winning a lottery prize any time a large sum lands in your checking account. Coordinate with your servicer to ensure that the money goes toward reducing principal.

-

Refinance to a shorter term. If you can refinance with a lower interest rate, for a shorter term, it’s a win-win. For example, you could refinance a 30-year mortgage into a 15-year loan. The monthly payments will almost certainly be higher, and you’ll pay closing costs, but your overall interest expense will be dramatically lower.

You May Like: How Do I Find My Student Loan Lender

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Calculating Your Mortgage Overpayment Savings

Start Paying More Early & Save Big

Want to build your home equity quicker? Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you’ll save.

Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage. Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

Read Also: How Much Deposit For Fha Loan

How To Calculate Extra Mortgage Payments

Using our Mortgage Payment Calculator, you can crunch the numbers and discover how much you could save in interest, or how much you would need to pay each month to pay your loan off sooner.

For example, according to the calculator, if you have a 30-year loan amount of $300,000 at a 4.125% interest rate, with a standard payment of $1,454, if you increase your monthly payment to $1,609, you could pay your loan off five years and one month earlier while saving $43,174 during the loan’s lifetime.

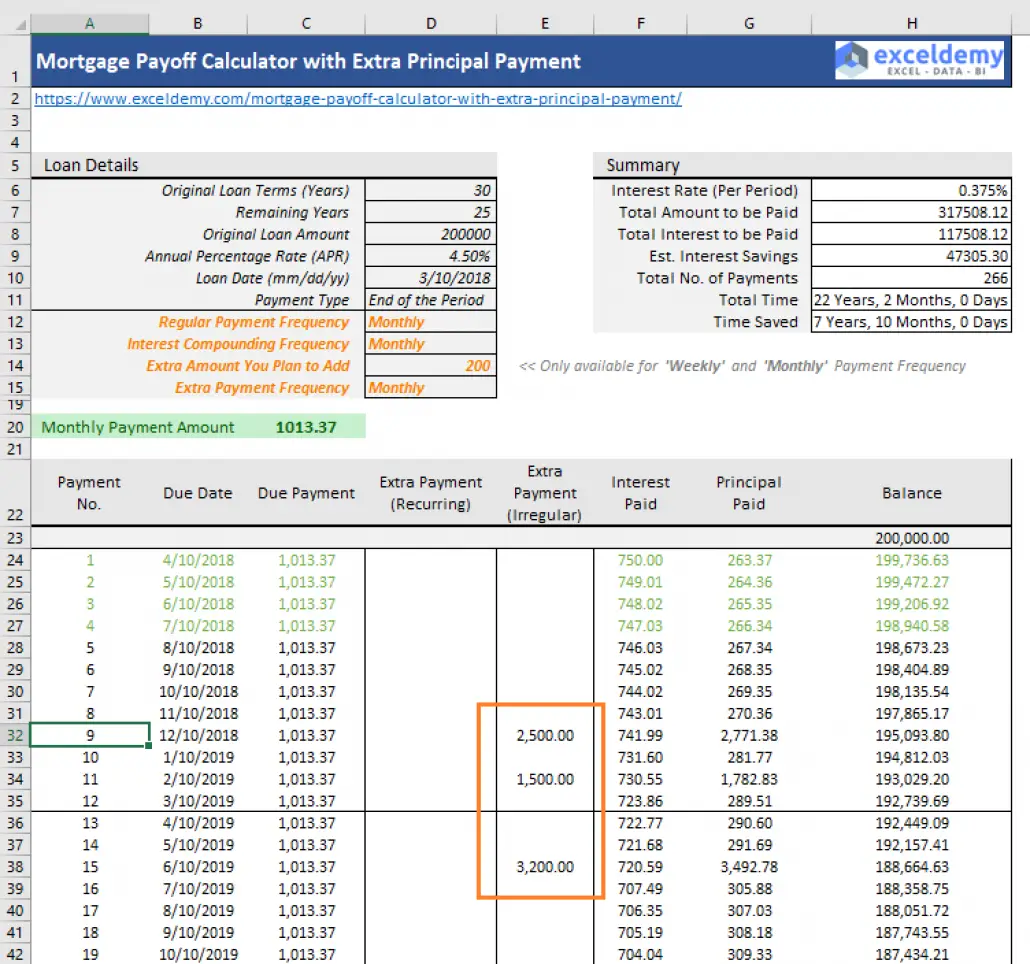

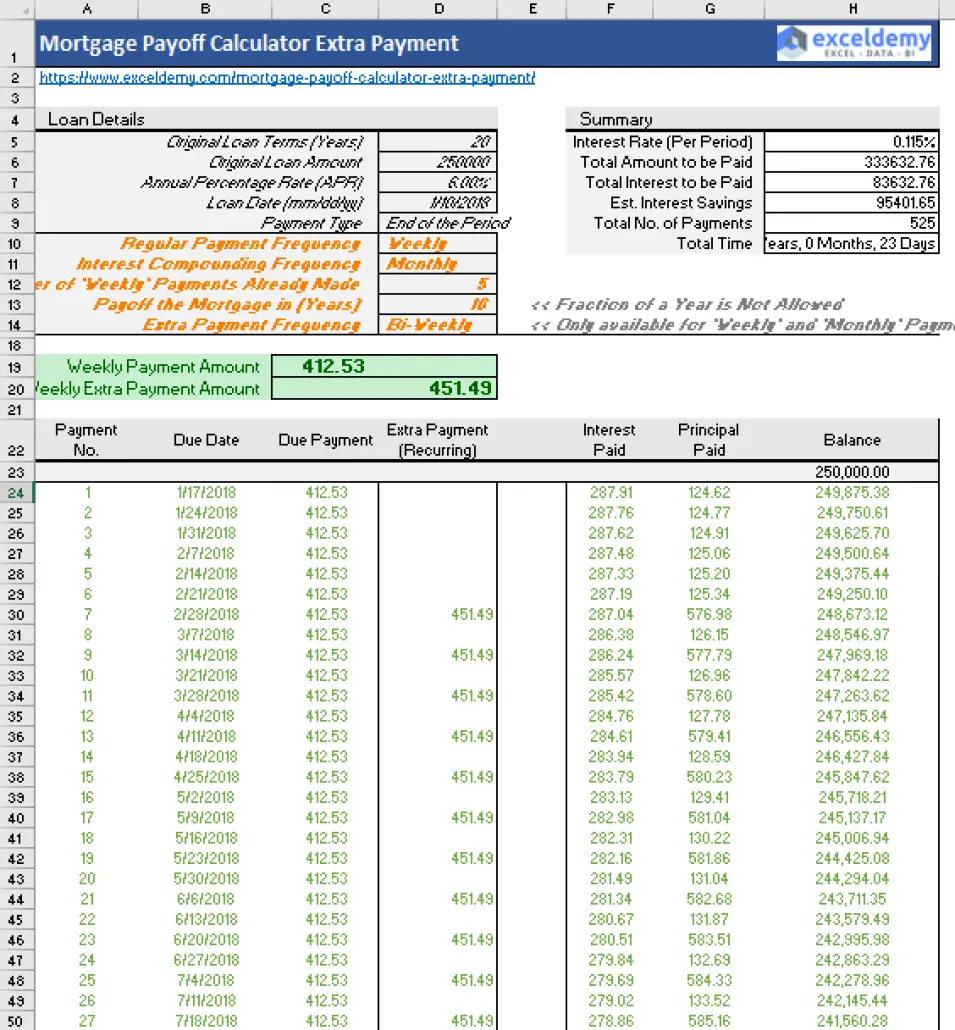

Mortgage With Extra Payments Calculator

If you are looking for a mortgage with extra payments calculator , you’ve found the right place. This tool gives you excellent support to find out how paying extra on amortgage, in the form of extra principal payment, would affect yourinterestcost andrepaymentterm. You can also apply the tool to see how to pay off a mortgage faster by making extra mortgage payments by, for example, making one extra mortgage payment a year or by switching to an accelerated bi-weekly mortgagepayment option.

We designed a payment summary to provide you with a better insight by comparing the results with the original schedule and learning the differences between the two options. You can also follow the mortgage balance’s progress in the dynamic graph and read all of the payment details in the amortization table with extra payments.

In the following, we show you how to pay off a mortgage faster, explain different ways for accelerated mortgage payments, and tell you what options you can find in the present mortgage calculator. With extra payments and a lump sum you can, for example, accelerate your mortgage remarkably. You can also turn to an accelerated bi-weekly or weekly payments, which might also be a feasible way of paying less on the mortgage.

Because of all of the features in the additional mortgage payment calculator, you can apply our calculator as a:

Recommended Reading: How Can I Lower My Car Loan Interest Rate

Add A Free Extra Payment Calculator Widget To Your Site

You can get a free online extra payment calculator for your website and you don’t even have to download the extra payment calculator – you can just copy and paste! The extra payment calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the “Customize” button above to learn more!

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage The remaining number of years until you want your mortgage paid off.

- Principal The amount of money you borrowed to buy your home.

- Annual Interest Rate The percentage your lender charges on borrowed money.

- Mortgage Loan Term The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required The extra amount of money you’ll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings How much you’ll save on interest by prepaying your mortgage.

You May Like: How To Apply For Loan Consolidation

How Much Can You Save By Making Bi

Do you want to pay off your mortgage early?

Not sure where you will find the extra funds to make it happen?

Thankfully, you can significantly reduce your debt without feeling pinched by making biweekly mortgage payments.

This Bi-Weekly Mortgage Calculator makes the math easy. It will figure your interest savings and payoff period for a variety of payment scenarios.

You can make biweekly payments instead of monthly payments, and you can make additional principal payments to see how that also accelerates your payoff.

Each of these payment alternatives will take you closer to being debt free.

Here’s everything you need to know to get started . . . .

Student Loan Payoff Faqs

When youre exploring various ways to manage your debt payments and budget, its normal to have a lot of questions. Take one what-if or how-to question at a time and get the information you need to make an educated decision. Here are the answers to several frequently asked questions about paying off student loans.

Paying your student loans off early can save you money, but it may not be the best option for everyone. As a general rule, consider making extra payments if your debt-to-income ratio is below 1.5 to 1.0 and you make at least $50,000 annually. If you owe more than 1.5 times your salary, you may benefit more by taking advantage of income-driven repayment plans that offer loan forgiveness.

Yes, there is no prepayment penalty for federal or private student loans. But you could run into issues with being put into paid-ahead status if youre on a federal student loan IDR plan. Paid-ahead status can affect which payments are counted as qualified payments toward loan forgiveness. If youre planning on making extra payments, contact your loan servicer directly to ensure your qualifying payments are applied correctly to your tally for your loan forgiveness application.

If you want a private copy of our most powerful student loan calculator, enter your name and email below and well send it over to you so you can see how much money you could save.

Also Check: Apply For Fha Loan Bad Credit

What The Early Mortgage Payoff Calculator Does

Do you want to pay off your mortgage early? Maybe you have 27 years remaining on your home loan but you would rather pay it off in 18 years instead. The early payoff calculator demonstrates how to reach your goal.

The mortgage payoff calculator shows you:

-

How much more principal you would have to pay every month so you can pay off the loan in a certain number of years.

-

How much interest you would save by paying off the loan early.

There are many reasons you might want to accelerate the mortgage’s payoff, but the motivation usually boils down to either or both of these:

-

You want to own your home free and clear by a milestone in life, such as your retirement or the beginning or end of your kids’ college years.

-

You want to reduce the total interest you pay over the life of the loan.

To steadily pay off the mortgage early, you need to know how much more to pay toward the principal balance every month to accomplish that goal. This calculator lets you do that.

When paying down the principal on a mortgage faster, keep in mind that each servicer has its own procedures for assuring that your extra payments go toward the principal balance instead of toward future payments. Contact your servicer for instructions.