How Do I Qualify For An Sba 7a Loan

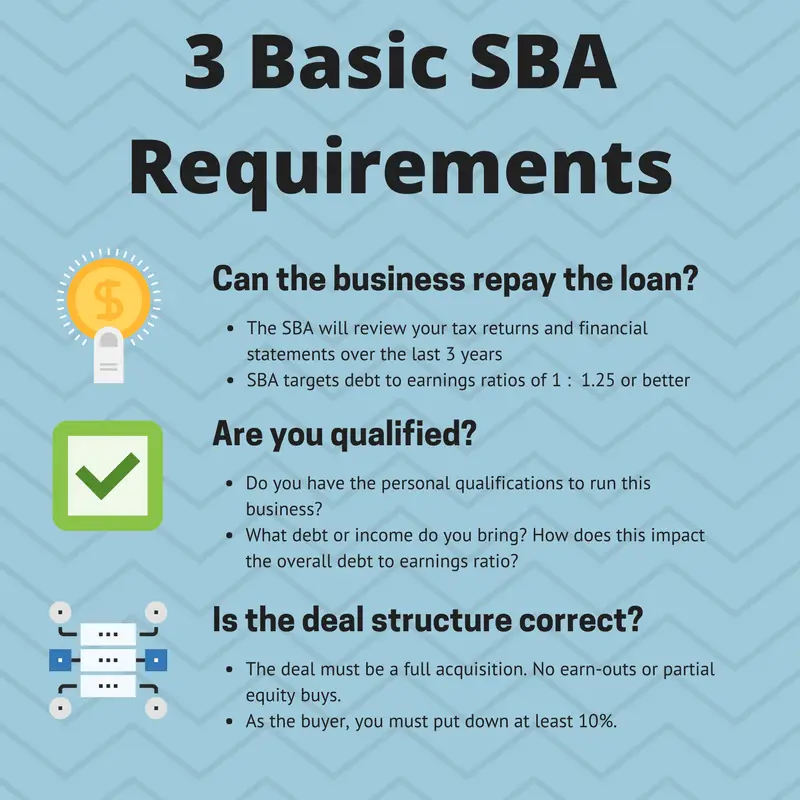

To be eligible for the SBA 7 loan, you must meet several preliminary requirements. Your company must be officially registered as a for-profit business that wishes to do business in the United States or its possessions. Youve got to have a reasonable amount of invested equity and be small, as defined by SBA.

The SBA also likes to see that youve invested personal assets in the business, proving your commitment to being vested and successful. Last but not least, dont be delinquent on any U.S. government debt.

Do Sba Loans Actually Work

Next, you need to decide if these are the right choice for you. If youre an entrepreneur looking for the best way to fund your growing business, you might be wondering if an SBA loan will help you get where you want to be.

Do SBA loans work? Have they helped others? For many businesses, the answer is yes.

We went right to the source for more information and exchanged emails with the SBA Office of Communications and Bill Manger, associate administrator for the SBAs Office of Capital Access. Manger relayed a few impressive true SBA loan success stories:

-

Chobani Yogurt, which had a valuation as high as $5 billion in 2016, used a 504 loan to start the company, according to Manger.

-

Vidalia Denim Mills, a denim manufacturing company located in northern Louisiana, recently got a $25 million loan from the United States Department of Agriculture and a $5 million loan from the SBA to grow their operations. The company will be exporting its denim and employing more than 300 full-time workers thanks to its product and the partnership between the USDA and SBA, Manger says.

-

Laundry City, a laundry pickup and delivery service based in Baltimore, benefited from a $3.5 million SBA 504 loan. The loan allowed to company to grow and increase the number of its employees, Manger explains.

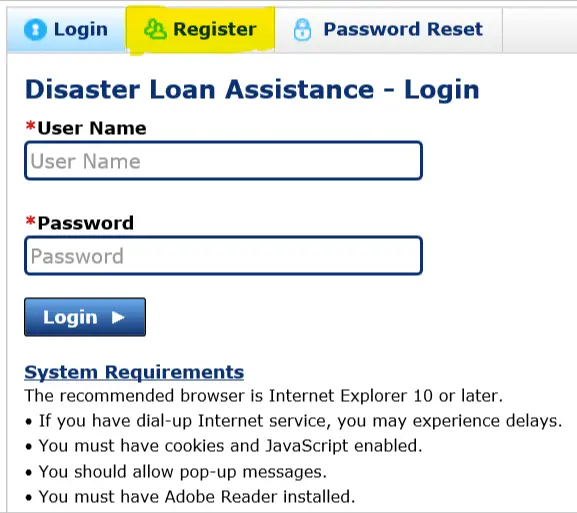

How To Apply For An Sba Loan In 4 Steps

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

If your small business needs capital to grow, then you may look to Small Business Administration loans. You apply for these loans with private financial institutions but theyre backed by the SBA and offer unique benefits to both the borrower and lender.

With multiple parties involved in these big transactions , knowing how to apply for an SBA loan is a bit complicated. Youll need to find an SBA-approved lender and undergo an extensive application process that can last several months. But the rates and terms are competitive, and the loans can be a lifeline for businesses.

Recommended Reading: Interest Rate For Mortgage Loans

Sba 7 Loan Application Process

While there are a few moving parts, the process for applying for an SBA 7 loan is relatively straightforward. All you need to do is worked through an approved SBA lender, and your lender can coordinate with the SBA. In this sense, the 7 application process is actually far simpler than some other SBA loans, like 504 loans, that require you to work with an SBA-approved lender and a certified development company.

Here are the steps for securing a 7 loan:

Write A History And Overview Of Your Business

An important item for your loan application is helping your lender understand your business and the project for which you seek financing. You can do this by writing a history of your business. Here, youll explain when and how you founded the business, how the business has grown over the years and what major challenges and competition youve faced. Your narrative should also explain why youre seeking an SBA loan and what business goals the SBA loan will help you accomplish. It should specify how much money in loan proceeds you seek along with details on how the funds will be spent.

Recommended Reading: Can Va Loan Buy Foreclosure

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Sba 7 Loan Eligibility

To utilize a loan through the SBAs 7 program, you need to meet the qualifying criteria. However, the requirements to participate in the 7 program are actually less stringent than many other SBA programs:

- The business must operate in the United States, or be planning to do so

- It must be a for-profit business

- It needs to fit the SBAs definition of a small business, which requires that it have no more than 250 to 1,500 employees, depending on the industry

- The company cant be borrowing to engage in speculation

- The owners need to be able to make an adequate down payment usually 10%

- The business owners need to have tried to secure financing from another source

Unlike some other SBA loan programs, there are no job-creation or retention requirements for the 7 program. In fact, the criteria to qualify for a loan through the 7 program are far broader than many other programs.

You May Like: What Debt To Income Ratio For Car Loan

How To Apply For Sba Business Loans

Applying for an SBA business loan? Use this complete guide to get ready. Presented by Chase for Business.

SBA loans help business owners access funding at a crucial early stage in their companies. Once youve decided which type of Small Business Administration loan youre ready to apply for, its time to assemble the right documents and materials to submit. The business loan application process is like that for other bank loans, with a few additional forms. This article will explain step by step the nuances of SBA loans.

Attach Sba Personal History Forms

All business partners, who own 20% or more of the business, need to complete a Personal Financial Statement which is used to evaluate creditworthiness. In situations where you have an employee managing the day-to-day operations of the business they should complete the form as well. If any of the applicants has a previous criminal charge the SBA Form 912, the Statement of Personal History is required about your background and any criminal record . You and your partners will need to provide a detailed accounting of your personal assets and liabilities, including real estate, stocks and bonds, and outstanding debts or tax liens.

Also Check: How To End Student Loan Debt

Choose An Sba Loan Program

Youve determined that you fit all of the requirements for obtaining an SBA loan. Now, the next step is to understand the SBA loan programs that are available and which works best for you. Each program has specific rates, terms, and maximum loan amounts, as well as requirements for how the money is used.

Youll need to evaluate your business needs to decide which program is the best fit.

| Loan Program |

|---|

| Review |

7 Loans

SBA 7 loans are the most popular among small business owners. This is primarily because of the extremely favorable terms and the flexibility with how funds can be used. With the 7 program, loan proceeds can be used toward just about any business expense. This includes purchasing equipment or inventory, acquiring a new business, renovating new facilities, working capital, or even refinancing old, high-interest debt. Standard 7 loans have a maximum loan amount of $5 million.

Through the Community Advantage program, underserved communities can receive financing when traditional lending isnt a good fit. The Veterans Advantage program offers the same great benefits along with reduced guarantee fees. Express loans offer less funding but guarantee an approval response within 36 hours. Its important to note that loans through the Express program come with a slightly higher but still competitive interest rate than other 7 loans.

| Loan Amount |

|---|

|

Base rate + 2.75% |

Microloans

504 Loans

| SBA 504 Loans |

|---|

|

10% – 30% |

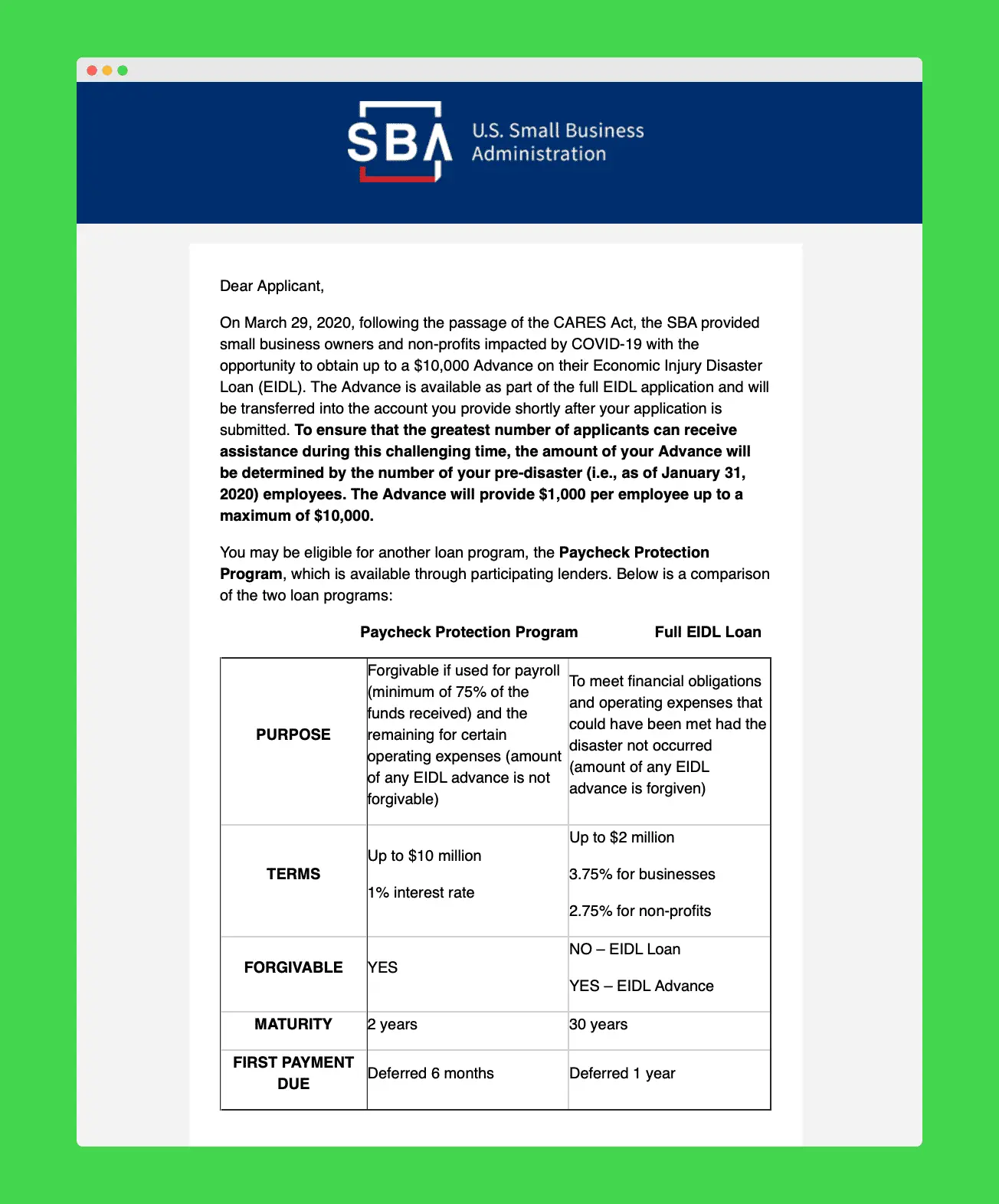

SBA Disaster Loans

Shopping Around For The Best Loan

Small business owners frequently state that challenges with lenders include a difficult application process, long wait for credit decisions or funding, high interest rates, and unfavorable repayment terms, according to the 2022 Fed Small Business report. Compare interest rates, repayment terms, fees, and penalties of all the loans you find, so you can borrow the ideal product. Ensure you can fit new loan payments into your monthly budget.

Also Check: How Much Loan We Can Get

Small Business Investment Company

Small Business Investment Companies are investment firms that are privately owned and operated but are governed by SBA regulations. They make equity and loan investments in SBA-eligible small businesses using their own assets and monies acquired with an SBA guarantee. Research SBICs to check if your company meets the criteria.

Sba Loans For Established Businesses

Discover all the benefits that SBA lending can offer!

SBA loans offer convenient financial options for almost any business purpose. These programs offer long terms, low down payments and reduced collateral requirements.

As a U.S. Small Business Administration Preferred Lender, we can show you how to put these SBA programs to work for your business.

You own and operate a for-profit business. Your business is legally organized as a sole proprietorship, corporation, partnership or LLC

- You own and operate a for-profit business.

- Your business is legally organized as a sole proprietorship, corporation, partnership or LLC.

Get a fixed rate secured term loan with a 2.99% introductory interest rate for the first 12 months, plus fee waivers on appraisals and originations.. Loans from $100,000. Apply by and close and fund by .

- Get a fixed rate secured term loan with a 2.99% introductory interest rate for the first 12 months, plus fee waivers on appraisals and originations.

- Loans from $100,000.

- Apply by and close and fund by .

Take advantage of a 25% discount on loan administration or origination fees.Offer valid for veterans of the U.S. Armed Forces on new credit facility applications submitted in Small Business.

- Take advantage of a 25% discount on loan administration or origination fees.

- Offer valid for veterans of the U.S. Armed Forces on new credit facility applications submitted in Small Business.

Read Also: Should I Get An Unsubsidized Student Loan

What Do You Need To Be Eligible For An Sba Loan

To get an SBA loan, youre required to provide extensive financial documentation about your company to both the bank and the SBA. This allows the SBA to determine your eligibility and to see if the loan is a good fit for both the agency and your business.

The SBA has different qualifications for each of its loans. While there are numerous loan types available from international trade loans to veteran-focused lending programs the most common SBA loans are the 504 and 7. Regardless of which loan you decide to pursue, there are some major benefits to getting an SBA loan.

What Is An Sba Loan

Before we get into the nitty-gritty about applying for an SBA loan, lets briefly recap what an SBA loan is. An SBA loan is a type of loan businesses can receive that is partially guaranteed and backed by the SBA.

The SBA does not pay out small business loans. Instead, the SBA partners with lending agents to provide the loans and sets strict guidelines for the loans through the partners. Lending partners include traditional lenders, community lenders, and micro-lending institutions.

In general, you can use SBA loans for most business purposes, and you can apply for up to $5 million. Some lenders set limits on what you can use funds for, so check with the specific lender before applying.

Recommended Reading: How To Calculate Mortgage Insurance On Fha Loan

Get Ready To Take That Next Big Step

When you’re launching a new business or growing an existing one, the hardest part can be wading through a complicated loan process. At Ameris Bank, our goal is to make the SBA loan application process as simple and streamlined as possible. After you provide your contact information, a member of our SBA team will reach out to you directly.

Defaulting On An Sba Loan

As long as you consistently make the required payments on your loan, the topic of default isnt even relevant. But if you fall behind on your payments, its helpful to know what to expect.

First, the lender would contact you to discuss the situation and offer possible solutions. If youre unable or unwilling to make the necessary payments, the lender will initiate the collection process as described in the SBA loan agreement.

After the lender has exhausted their recovery options, they will submit a claim to the SBA. This stage is when the federal governments guarantee comes into play, and the SBA will repay a significant portion of the loan for you.

At this point, the lender will move on to greener pastures, and youll be dealing directly with the SBA. The agency will contact you and request the remaining balance. They will also allow you to make an offer in compromise, which means you suggest an amount smaller than what is owed. If your financial situation is compelling enough, they may accept your offer.

Even if the SBA rejects your offer, youll typically have the chance to submit another offer in compromise. Be aware, however, that the SBA also has the right to send your account to the Department of the Treasury. Unlike the SBA, the Treasury has the power to begin collection through actions such as wage garnishments and claiming your tax returns.

Read Also: How To Overcome Student Loan Debt

Include The Required Financial Statements

All SBA loans require you to submit a profit and loss statement or earnings report thats been updated within 120 days for 7a / 504 of the date of your loan application. This gives the lender and the SBA a snapshot of your business, so youll also want to include a balance sheet with detailed breakdowns of assets or liabilities.

Youll need to provide projected financial statements, which should include a full accounting of your expected income and finances for the coming year. The SBA also asks that you attach a written explanation for how you arrived at those projections and how you expect to meet them. If you use accounting software, you can use it to generate these statements. Accounting professionals also can provide the necessary statements and schedules.

Small Business Technology Transfer Program

This program provides financing options for federally funded innovative research and development. Small enterprises that are eligible for this program collaborate with nonprofit research organizations during their initial and developmental phases. Determine whether the STTR program is appropriate for your company.

Also Check: Who Pays Appraisal Fee For Va Loan

What Can An Sba 7 Loan Be Used For

The SBA is designed to be a lender of last resort not a first-choice lender. Before applying for a loan, businesses should have looked elsewhere for funding. But, once you get a loan through the 7 program, you can use the proceeds for lots of different business-related expenses many more purposes than some other SBA programs.

Should You Get A Business Loan

The versatility of business loans might benefit you in several situations. For example, If youre a new business, a small business loan can:

- Build business credit

- Help manage cash flow

- Fund startup costs such as equipment and inventory

If youre an established venture with plans to expand, a small business loan can help you or quickly build an emergency fund to cover unexpected expenses.

Avoid using a small business loan to pay for a depreciating asset that wont increase in value or generate income. You should also avoid small business loans with high fees, interest rates, and unfavorable loan repayment terms. A small business loan should help increase the future value of your business rather than decrease it.

Recommended Reading: Where Can I Get Personal Loan With No Credit

Frequently Asked Questions When Applying For A Business Loan

Do I need collateral to get a small business loan?Some lenders, including many traditional lenders like the bank, do require specific collateral for a small business loan, meaning many potentially good borrowers could struggle to access the capital they need because their business doesnt have the needed collateral to secure a loan. We do not require a specific type of collateral, but do require a general lien on business assets along with a personal guarantee to secure an OnDeck loan.

Can I get a business loan without being a corporation? Can a sole proprietor get a business loan?You do not need to be incorporated to get a small business loan provided you are a registered business with a business checking account and have a business tax I.D. number. You must also use your business loan strictly for business purposes. However, there may be potential benefits to incorporation and you should consult with an attorney or other trusted legal advisor to determine if changing the nature of your business entity makes sense for your business objectives.

Can I get a business loan after a bankruptcy?Qualifying for a business loan following a bankruptcy will be more difficult during the 10 years after the bankruptcy appears on your credit report, but there are lenders that will work with your business if the bankruptcy has been discharged for at least two years.

See also, What do I need for an SBA loan?

Read what our customers say about us on Trustpilot