You May Already Have The Best Rate

If you purchased your car new, you likely got an attractive new car rate, especially if you took advantage of a special interest offer that can feature rates as low as 0% APR. The refinancing rates for some lenders, among them Bank of America, are higher than even their used-car rates. Also, interest rates have been at record lows due to COVID-19 experts predict rates will begin to rise in late 2022 to 2023.

Capital One Auto Loans Refinance Overview

If you are looking an offer for Capital One Auto Loans Refinance that gives you a price discount up to 53%, you can find through 20 results these are some of that, but if you want results with a specific discount, you can specify that in the search box that we created at the top on the left.

We’ve developed our engine to update all offers codes on October 18, 2021

More than 20 offers were found for Capital One Auto Loans Refin capital ance by checking 623 online stores, so this discount is usually in the form of a certain percentage or fixed partial amount for Capital One Auto Loans Refinance.

The promo codes that we provide in the form of results on our Lanark United website, users get from them by an average of 40% for Capital One Auto Loans Refinance, and this procedure can be performed on all offers for which you are looking for a discount, only easily use the search box at the top and then one filter the results at the top on the left.

Here Are Some More Details About Capital One Auto Finance

- Narrow vehicle and loan requirements Your vehicle must be no more than 7 years old, and the payoff amount must be between $7,500 and $50,000. While lenders often will consider refinance loans for vehicles up to 10 years old, Capital One Auto Finances maximum age requirement is more strict.

- Doesnt refinance its own loans If your current auto loan lender is Capital One, youll need to look elsewhere for a refinance loan.

- Ability to apply for prequalification To apply for prequalification, you must be at least 18 years old, live in the contiguous United States, and have a minimum monthly income of $1,500 to $1,800, depending on your credit.

Also Check: Stilt Interest Rates

Best Auto Refinance Loans For Bad Credit Applicants

When you refinance your existing loan, youre taking out a new loan to replace the old one. Youll use the proceeds of the refinance to pay off the existing debt and immediately begin making your monthly payment to the refinance lender.

The main reason to seek a refinance loan is to lower your existing interest rate or current loan fees. By shaving just 1% off of your APR, you can lower your monthly payment substantially and pay your loan off earlier.

Many of the lenders listed below are online lending networks meaning that they partner with several independent lenders who each review the single prequalifying application that you submit to each network. Since multiple lenders consider your request, you could receive more than one loan offer to choose from.

Most of the lenders associated with each network specifically finance applicants who have bad credit. That means you can possibly lower your interest rate and improve your credit standing with a new loan from one of our top-rated services below.

| 3 minutes | 9.5/10 |

Auto Credit Express has long been one of our favorite auto lending networks for bad credit because it partners with a massive group of lenders who each have flexible credit requirements. In fact, more than 1,200 partner lenders have combined to close more than $1 billion in bad credit loans since 1999.

To qualify for refinancing through Auto Credit Express, you must:

| 2 minutes | 7.5/10 |

From that point, youll begin making monthly payments to the new lender.

Can I Refinance A Car If Im Upside Down On My Loan

In most cases, the answer is no.

Being upside down on your auto loan means that you owe more than what the car is currently worth. This makes it incredibly difficult to refinance your loan because the new lender will use the cars value to determine how much he or she is willing to lend.

For example, a lender may consider lending $15,000 on a vehicle thats worth $17,000. If by some chance you default on the loan, the lender can repossess the vehicle, sell it, and recoup some of the money lost by your backing out of the deal.

But if the lender extends a $20,000 loan for a $17,000 vehicle and you default on the deal then he or she takes, at minimum, a $3,000 loss on the loan. Weve yet to find a lender who is OK with taking a loss.

The best way to obtain refinancing on a loan that youre upside down on is to make extra payments to your existing lender until your loan-to-value ratio improves and you owe less than the car is worth.

Once youre no longer upside down on your loan, the lenders listed above will be more likely to consider your application for refinancing.

Recommended Reading: Usaa Car Loan Interest Rates

Capital One Auto Loan Details

A Capital One auto loan can be secured to purchase a new vehicle, purchase a used vehicle, or refinance an existing loan. These loans can be applied for individually or jointly. A joint application is a smart idea for those with poor credit scores. A co-signer with good credit may even help you get a lower annual percentage rate offer.

| Capital One Auto Loan Details |

|---|

| Loan Amount Range |

| As low as 3.99 percent |

| Loan Term Length |

| None |

Certain brands and types of vehicles arent eligible for a Capital One auto loan. These include:

- Oldsmobile

- Vehicles with a history of chronic malfunctions

- Branded title vehicles

- Lease buyouts

There is also a vehicle age restriction for Capital One auto loans. For purchase loans, vehicles must be model years 2010 or newer with fewer than 120,000 miles. Refinancing loans are only available for vehicles up to seven years old that have an established resale value.

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you’re having trouble getting approved or finding acceptable rates, try taking these steps:

- Improve your credit: Before applying for an auto loan, pay down as much debt as you can and avoid opening new accounts, like credit cards.

- Make a large down payment: Making a larger down payment will lower your monthly payment, but it could also help you qualify for better rates.

- Consider a co-signer: A co-signer with good credit will take on some responsibility for your loan if you default, but they can also help you qualify.

You May Like: Do Loan Officers Get Commission

Capital One Auto Loan Refinancing Terms

The outstanding balance of your existing car loan needs to be between $7,500 and $30,000. The car cant be older than 7 years old, and it needs to have under 70,000 miles on it. The length of the loan may also be a factor as it can really benefit those people who have over a 5 year repayment term.

Unlike most lenders and banks that offer refinancing products, there are no fees and charges that a potential borrower will need to pay as part of the refinancing. While currently the application process is free and there are no documentation charges, and you can receive a free quote from Capital One, there are some other charges that are imposed by the borrowers state. But these are state charges and you will need to pay them no matter which lender or bank you use, so they are not specific to Capital One.

As an example of an expense that applicants will occur, almost all states impose a title transfer fee that will range anywhere from $5 to $65 depending on the state in which the borrower resides. So this will always need to be paid regardless. That is usually it as far as fees go.

Even better, if you are approved for a car loan refinancing from Capital One and decide to proceed with them, you will not be charged a prepayment fee. This will also help consumers save money if they decide to prepay the car loan at some point in the future.

Capital One Car Loans Q& a

Get answers to your questions about Capital One Car Loans below. For more general questions, visit our Answers section.

- Most Upvotes

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer.

You May Like: Specialized Loan Servicing Settlement

Here Are Some More Details About Penfed Credit Union

- Membership required You must be a member to qualify for an auto loan from PenFed Credit Union. Joining is easy, and you dont necessarily have to be a member of the military.

- Large loan range PenFed Credit Union offers auto loans ranging from $500 to $100,000, depending on your loan term.

- Doesnt refinance its own loans If you got your current car loan from PenFed Credit Union, it wont refinance your loan. The lender only refinances auto loans from other lenders.

Must Buy A Car From A Participating Dealer

Capital One only finances auto loans with participating dealers in its car dealership network.

Although there are over 12,000 eligible dealerships across the country, this may be a limiting factor for customers who prefer to shop at dealerships that fall outside of the Capital One Network.

However, there are benefits to shopping within the Capital One Network because you know that you will be working with one of the most reputable banks on the market since the dealership has an existing relationship with them.

Read Also: Mountain America Credit Union Refinance Rates

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Types Of Auto Loans Available Through Capital One Auto Finance

Capital One provides auto financing for both new and used vehicles that you can use only at participating dealerships. While choosing from a participating dealer can limit your car-shopping choices, Capital Ones network consists of 12,000 dealerships nationwide. You can find a participating dealership online.

You can easily get pre-qualified for a new or used car loan with Capital Ones Auto Navigator. The process takes just a few minutes, and you dont need to have already identified the vehicle you want to buy.

Instead, you just need to have an idea of how much youll want to borrow. If youre approved, your pre-qualification letter can help you to bargain with a dealership. Plus, since theres no hard credit inquiry required upfront, getting pre-qualified with Capital One can be a great option when youre comparison shopping for the best auto loans.

Recommended Reading: Fha Loan Refinancing Options

Using Capital One Auto Navigator

Auto Navigator® is a useful tool that helps check for pre-qualifying eligibility, and it helps find cars that are within your budget and desired make and model.

Customers can search for cars they may be interested in test-driving and purchasing by inputting specifications such as make, model, and mileage so that they can see their options.

Auto Navigator® also provides estimated monthly payments and interest rates using the data compiled for loan prequalification, which enables customers to see what types of cars are in their budget and an accurate depiction of their monthly payments if they choose that vehicle.

Compare Auto Refinance Loans

Before applying for an auto refinance loan, you should be sure to compare quotes from multiple different providers. Some factors to take into consideration include:

- Loan amounts: Most lenders have minimum and maximum loan amount requirements, usually somewhere between $7,000 and $100,000. Make sure that the loan you want to refinance is in between these limits.

- Rates: One of the main goals of refinancing an auto loan is to lock in lower rates. Make sure to compare rates from multiple different providers to ensure youre getting the best possible deal.

- Repayment terms: Whether you want to pay off your loan faster, or need a longer term length with smaller monthly premiums, look for an auto refinance loan with repayment terms that meet your needs.

- Some lenders have minimum credit score requirements for borrowers. If your credit score isnt where you want it to be, consider holding off on applying until you raise your score.

- Car requirements: Not all lenders will issue auto refinance loans for all cars. Make sure that your car meets the requirements for any lenders that youre interested in.

Don’t Miss: Prosper Credit Requirements

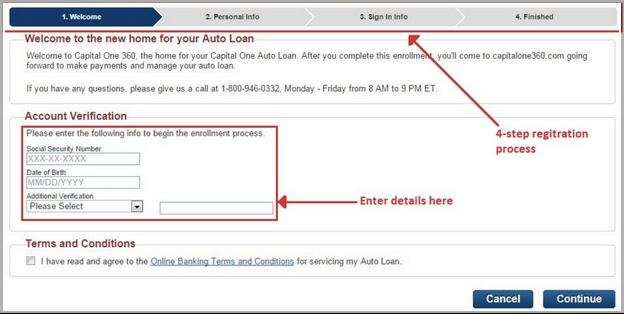

How The Application Works

Capital One allows you to apply as an individual or with a coapplicant. To get prequalified, youll need to submit some information about yourself and your finances, including your income and Social Security number.

If youre prequalified, you can use your finances to shop at participating dealerships for up to 30 days. The dealership will present you with a final loan contract.

Advantages Of Auto Refinancing

The biggest advantage of refinancing an existing auto loan is that you can lower your monthly payment by choosing a refinance loan with a lower APR than your current one or a longer payoff period. In some cases, you can lower the overall cost of your vehicle loan.

Just remember that extending your repayment window can lower your monthly payment, but add several months of interest charges that make the overall loan cost greater.

Some lenders, such as RoadLoans.com, offer cash back refinancing options that allow you to tap into your current auto loans equity and borrow your cars full Blue Book value. That means that you can use part of the refinance loan to pay off your existing debt and use the remainder of the loan in any way you choose.

Before you pick a loan and lender especially one that touts that it can save you money check for any processing costs or closing fees that can make the loan as expensive than your current loan.

Recommended Reading: Fha Loan Maximum Texas

Apply For Your Auto Refinance Loan

There are a few steps youll need to take to apply for an auto refinance loan. Once youve decided on a lender, youll need to gather all required documents before applying. This can include information about yourself, like your name, address, and social security number, as well as information about your vehicle and your previous loan.

If youre interested in applying for an auto refinance loan, its a good idea to wait to apply until your finances are in order. For example, if your credit score is near a threshold, you might want to take steps to raise your score before applying to qualify for lower rates. Once your application is accepted, youll need to begin repaying your new loan. Its a good idea to set up automatic payments each month to make sure you never miss a payment.

Best Trusted Name: Bank Of America

Bank of America

-

Minimum monthly income requirements

AutoPay specializes in auto loan refinancing, so itâs no wonder they offer great deals for many individuals. They often cater to clients who have improved their credit score in the time since they took out their original auto loan, and because of this, they are usually able to offer steeply discounted loans. On their site, you can compare offers for loans from many different lenders without having to fill out more than one application. They also pull your credit with a soft check, which is easy on your credit score and a great option if you are not seriously considering refinancing your loan right this second . AutoPay makes it easy to shop around and often partners with credit unions. The lowest rate offered by AutoPay is 1.99% but this is only available if you have a top-tier credit score. The average customer sees their interest rate reduced by 6.99%. Knowing your credit score ahead of time makes a big difference in estimating what your APR will be on refinancing a car loan.

You May Like: Mortgage Originator License California

How To Verify External Bank Account After Linking It

After adding your external account information, you can follow the given steps to verify it for transfers:

- Within two business days subsequent to linking your account on the web, Capital One will put aside two little test installments into your external account, trailed by one withdrawal for the aggregate sum of the two test deposits.

- Survey the activity on your external financial records, and distinguish the little test deposits.

- When you know the sums, sign in to capitalone.com, and select the Capital One account you are connecting your external account to.

For Capital One 360 accounts, select your client profile at the upper right corner of the screen, and then select Settings, and go down to the External Account segment. In the External Account segment, select Verify Account to affirm your link.

For every other account, click on the Account Services and Settings link under your balance data, and afterward go to Manage External Accounts to affirm your link.

It would be ideal if you keep in mind that if this is a joint external account, with a similar shared account holder, you should both sign in to capitalone.com with your individual sign in details and complete the steps mentioned above.

When you affirm the link, you will have the option to move cash between accounts. When you verify your external account, any cash you booked to be stored to a Capital One account that was recently opened, will be transferred.

Recommended Reading: Prosper Loan Denied After Funding