Examples Of Unsubsidized Student Loans

Unsubsidized loans include the unsubsidized Federal Stafford Loan, the Federal Grad PLUS Loan, the Federal Parent PLUS Loan, private parent loans and loans that consolidate and refinance these loans .

Private student loans and parent loans give borrowers more options than unsubsidized federal loans for making payments on the student loans during the in-school and grace periods. The most common of these are full deferment of principal and interest, interest-only payments and immediate repayment of principal and interest. Slightly more than a quarter of the private student loans offer fixed payments per loan per month, with $25 as the most common monthly payment amount.

Federal student loans provide for full deferment during the in-school and grace periods. Immediate repayment is an option on federal parent loans. There are no prepayment penalties on federal and private student loans, so nothing stops a borrower from making interest-only or fixed payments on unsubsidized loans that dont offer these options.

About four-fifths of all student loans are unsubsidized.

You May Like: Usaa Personal Loan Approval Odds

Parent And Graduate Plus Loans

PLUS Loans for graduate students and parents are increasing from 6.38 percent to 7.54 percent. These loans are normally utilized after all federal subsidized and unsubsidized loans issued directly to students are exhausted for the year. The only reason to borrow them over private loans is if the borrower, parent or student, could qualify for income-driven repayment plans or Public Service Loan Forgiveness in the future.

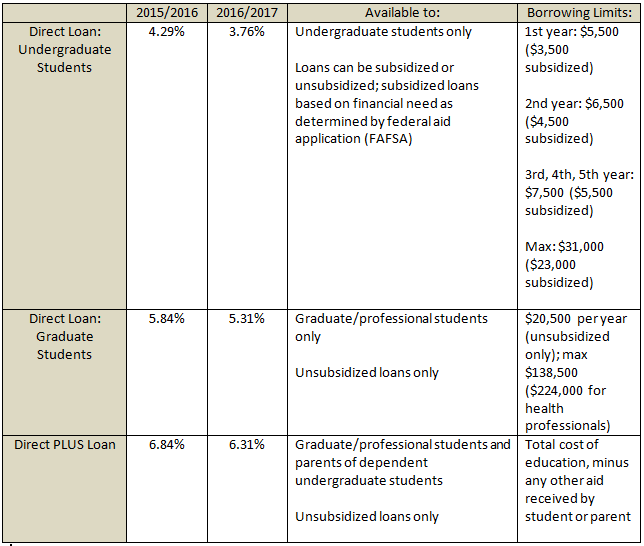

How Much Can I Borrow

The maximum amount you can borrow each academic year depends on your grade level and dependency status. See the chart below for annual and aggregate borrowing limits. You may not be eligible to borrow the full annual loan amount because of your expected family contribution or the amount of other financial aid you are receiving. To see examples of how your Subsidized or Unsubsidized award amount will be determined. Direct loan eligibility and loan request amount must be greater than $200 for a loan to be processed.

If you are a first-time borrower on or after July 1, 2013, there is a limit on the maximum period of time that you can receive Direct Subsidized Loans. This time limit does not apply to Direct Unsubsidized Loans or Direct PLUS Loans. If this limit applies to you, you may not receive Direct Subsidized Loans for more than 150 percent of the published length of your program. See your financial aid adviser or for more information.

Also Check: What Are Capital One Auto Loan Rates

Explaining Federal Direct Unsubsidized Loans

May 20, 2022 · 4minute read

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey. Read more We develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right. Read less

Most of us simply dont have the cash on hand to pay for college or graduate school out of our pockets. The College Board estimates it costs $37,650 on average annually to attend a private non-profit four year university and $10,560 for in-state students at a public four-year school.

That means you might need to take out student loans to fund your education.To make sure youre not in danger of defaulting on your loans or paying too much, you might want to understand some basics of student loans.

When you take out student loans, theyre either private or federalmeaning they either come from a private lender, like a bank, or are backed by the federal government.

But what are the differences in all those types of loans? When youre weighing your options, you might want to understand some of the differences between a Federal Direct Unsubsidized Loan vs. a Direct Subsidized Loan vs. a private student loan, so you can evaluate all of your options.

Student Loan Interest: Does It Accumulate During School

First, figure out whether your student loans accrue interest while youre in school or if interest doesnt accrue until after graduation. This depends on the type of loan you have.

| Will Your Student Loan Accumulate Interest During School? |

|---|

| Loan type |

| $29,790 | $30,398 |

Table created by the author with interest rates from the Federal Student Aid Office, Subsidized and Unsubsidized Loans.

You can do the math for your own loans by looking up the federal student loan limits, along with current and past interest rates at the Federal Student Aid website. We performed our calculations using Student Loan Heros Student Loan Deferment Calculator.

Recommended Reading: Is My Loan Owned By Fannie Mae

How Interest Works On Student Loans

Student loans vary from traditional, private sector loans like mortgage loans and auto loans in several ways.

For starters, you start repaying mortgage and auto loans within a month or two. Not so for student loans. With a college loan, you don’t start paying it back until after six months after your graduate.

Additionally, if you run into financial difficulties with a student loan, you can put the brakes on, and ask for forbearance, which allows you to suspend payments until you’re ready to start making payments again. While that is possible in rare circumstances with auto or mortgage loans, in general, you need to keep paying your non-student loans – no matter what.

Interest-wise, student loans can be complicated, and it’s up to student borrowers and their parents to know the ropes.

Basically, your interest terms are laid out in your student loan promissory notes, issued to the borrower along with the student loan disbursement.

When you get that note, read it carefully, and focus on these important contract items:

So, the earlier you start repaying your student loan, the lower our ultimate student loan costs.

A Guide To Subsidized And Unsubsidized Loans

As you explore funding options for higher education, youll come across many different ways to pay for school. You can try your hand at scholarships and grants, but you may also need to secure federal student loans. Depending on your financial situation, you may qualify for a subsidized loan or an unsubsidized loan. Heres the breakdown of subsidized and unsubsidized loans, along with how to get each of them.

Don’t Miss: Navy Federal Car Loan Rate

Current Private Student Loan Interest Rates

Federal and private student loans have different interest rates. Federal loans often have lower rates because theyre set by the federal government and are not dependent on a borrowers credit score or income. Private lenders will determine your rate based on your credit score and income , the total loan amount, and more.

Rates will also vary depending on if youre an undergraduate student, graduate student, or a parent. Undergraduate students often have the highest interest rates because they usually have no credit history or income.

Graduate students usually receive lower rates because they often already have a good credit history. Parents who have good credit scores and high incomes may qualify for low interest rates when theyre taking out loans on behalf of their children.

Below, you will find private student loan interest rates from several lenders in the industry.

Federal Direct Unsubsidized Stafford Loan

Students who are first-time borrowers of the Federal Direct Stafford Loans, must complete an electronic Master Promissory Note and on-line Entrance Loan Counseling to receive the funds. In most cases, the student will be required to complete the MPN and entrance counseling session only once during their years in college. Each year students will need to accept their loan on the Financial Aid To Do List page in MyUI.

Obtain information regarding grace periods and repayment plans from the Federal Student Aid website.

Lender: Federal Government

- Fixed at 4.99% for loans disbursed July 1, 2022 – June 30, 2023

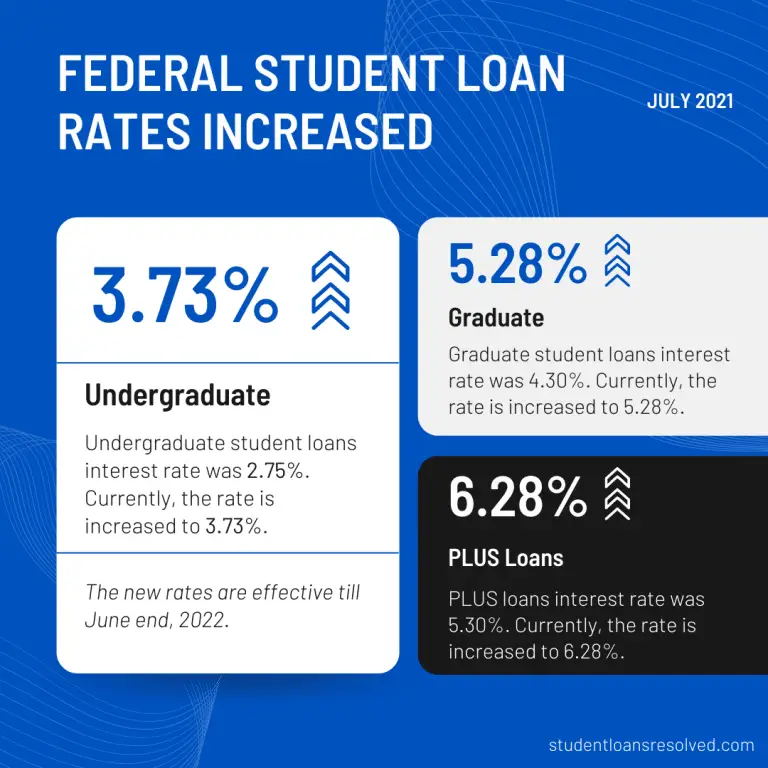

- Fixed at 3.73% for loans disbursed July 1, 2021 – June 30, 2022

- Fixed at 2.75% for loans disbursed July 1, 2020 – June 30, 2021

Interest Rate – Graduate Students:

- Fixed at 6.54% for loans disbursed July 1, 2022 – June 30, 2023

- Fixed at 5.28% for loans disbursed July 1, 2021 – June 30, 2022

- Fixed at 4.30% for loans disbursed July 1, 2020 – June 30, 2021

Interest Free in School: No

Loan Fee:

- 1.057% for loans disbursed October 1, 2020 – September 30, 2023

- 1.059% for loans disbursed October 1, 2019 – September 30, 2020

Annual Maximums – Dependent Student :

- $5,500 freshman

- $6,500 sophomore

- $7,500 junior and senior

Annual Maximums – Self-Supporting Student :

- $9,500 freshman

- $10,500 sophomore

- $12,500 junior and senior

- $20,500 graduate and professional

Read Also: How To Remove Auto Loan Charge Off

Who Qualifies For Federal Direct Loans

Federal subsidized and unsubsidized loan borrowers must meet the following requirements:

- Enrollment at least half-time at a school that participates in the Federal Direct Loan Program

- U.S. citizenship or eligible non-citizenship

- Possession of a valid Social Security number Satisfactory academic progress

- Possession of a high school diploma or the equivalent

- No default on any existing federal loans

Direct subsidized loans are only available to undergraduates who demonstrate a financial need. Both undergraduates and graduate students can apply for direct unsubsidized loans, and thereâs no financial need requirement.

If you qualify for a subsidized loan, the government pays your loan interest while you’re in school at least half-time and continues to pay it during a six-month grace period after you leave school. The government will also pay your loan during a period of deferment.

To apply for either type of loan, you will need to fill out the Free Application for Federal Student Aid . This form asks for information about your income and assets and those of your parents. Your school uses your FAFSA to determine which types of loans you qualify for and how much youâre eligible to borrow.

The Biden administration extended federally-held student loan forbearance through Dec. 31, 2022. The White House also announced plans for debt relief for certain borrowers, changes to the student loan system, and plans to cut the costs associated with higher education.

Can Graduate Students Get Subsidized Loans

With subsidized federal student loans, the Department of Education pays your interest charges while youre enrolled or in deferment. That means you pay less for the student debt you take on.

But the federal student loan interest subsidy is available only to undergraduate students who have demonstrated financial need.

Unfortunately, the office of Federal Student Aid no longer offers subsidized loans for graduate school.

| In the past, FSA offered subsidized loans for graduate school | |

|---|---|

| Subsidized Stafford Loans for graduate students | Also called Direct Loans, these Subsidized Stafford Loans were offered to graduate students with a demonstrated financial need until July 2012. Then they were cut to free up funding for other forms of federal student aid. |

| Federal Perkins Loans | The Federal Perkins Loan Program created funds that allowed colleges to offer additional loans to low-income students. Federal Perkins Loans came with a federal interest subsidy and were available to both undergraduate and graduate students. Unfortunately, the Federal Perkins Loan Program expired in 2017 and wasnt renewed by Congress, so this subsidized student loan option is no longer available. |

Recommended Reading: How Much Can You Borrow Home Loan

Recommended Reading: What Is The Average Auto Loan Interest Rate

Alternatives To Direct Unsubsidized Loans

All college students qualify for Direct Unsubsidized Loans, regardless of their financial situation. If these loans will not cover all of your college expenses for the year, you do have other options to consider. You may, for example, be able to borrow private student loans, though these will typically be more expensive.

The parents of dependent undergraduate students may qualify to borrow Direct Parent PLUS Loans to cover any gaps that still exist. Additionally, graduate students for whom Direct Unsubsidized Loans do not cover all of their college expenses may qualify to borrow Direct Graduate PLUS Loans.

Direct Unsubsidized Loan: What Borrowers Need To Know

The Direct Unsubsidized Loan is one of the most common federal student loans available to borrowers. While not as valuable as a Direct Subsidized Loan, these loans can still be incredibly helpful in empowering you to afford your college education.

Here, we explore Direct Unsubsidized Loans so that you will have enough information to make an informed decision when applying for and accepting your financial aid.

Don’t Miss: Bank Of The West Boat Loans

Should You Borrow Private Student Loans

There are cases where private student loans can be beneficial. For example, private loans typically come with higher borrowing limits, so if you max out your federal loan options you can still secure money for college by applying for private student loans.

Highly qualified borrowers may also find better deals on the private market. Graduate students and parents of undergrads face the highest interest rates and origination fees on federal loans. If you have a healthy financial history, you could potentially qualify for lower rates and fees with private student loans.

But be sure to weigh any savings with the loss of federal student loan perks. If you later have trouble repaying your loans, a private lender may not do as much to help you.

Federal Direct Subsidized/unsubsidized Loan

The terms of the need based Federal Direct Loan Program require that the student borrower repay, with interest, this source of financial assistance. Additional terms, subject to revision by federal regulation, include:

- Maximum annual limit varies by year in school

- 3.73% fixed interest rate for undergraduate students during repayment for loans first disbursed from July 1, 2021 through June 30, 2022

- 4.99% fixed interest rate for undergraduate students during repayment for loans first disbursed from July 1, 2022 through June 30, 2023

- 5.28% fixed interest rate for graduate students during repayment for loans first disbursed from July 1, 2021 through June 30, 2022

- 6.54% fixed interest rate for graduate students during repayment for loans first disbursed from July 1, 2022 through June 30, 2023

- 1.057% origination fee for student loans with a first disbursement date from October 1, 2020 through September 30, 2022

- Repayment on both principal and interest begins six months after the student ceases to be enrolled in school on at least a half-time basis, generally extending over a 10-year period

- $23,000 maximum base aggregate undergraduate borrowing limit for “Subsidized” loans. $31,000 maximum aggregate undergraduate borrowing limit for combined subsidized and unsubsidized loans for dependent students

- $138,000 maximum aggregate graduate borrowing limit for “Unsubsidized” loans.

| $0 | $138,500 |

You May Like: How To Give Loan Online

How Is Student Loan Interest Calculated

Federal student loans and most private student loans use a simple interest formula to calculate student loan interest. This formula consists of multiplying your outstanding principal balance by the interest rate factor and multiplying that result by the number of days since you made your last payment.

Interest Amount = × Number of Days Since Last Payment

The interest rate factor is used to calculate the amount of interest that accrues on your loan. It is determined by dividing your loans interest rate by the number of days in the year.

Recommended Reading: Bayview Loan Servicing Charlotte Nc

How To Earn Money To Pay Down Unsubsidized Loans

We know finding flexible work isnt always easy. The following is a list of some common ways students can make a little extra money to start paying down unsubsidized student loans:

- Work-study. Students receiving financial aid may qualify for flexible on-campus employment in dorms, dining halls, or student unions.

- Tutoring. If you excel in math, science, Spanish, or any other subject, consider tutoring other students in your spare time. Youll earn some extra cash and make some new friends.

- Become a tour guide. If you love your school, why not convince other students to attend? Plus, youll get essential public speaking skills.

- Ride-sharing. If you have a car, consider driving for Lyft or Uber every once in a while. You can work more in slow periods and ease off during finals.

- Research assistant. Teaming up with a professor in your field as a research assistant can help you earn a little money on the side while developing your skills and expertise.

- Internships. Getting a summer internship is an excellent way to start making connections with potential employers and build your resume.

If you can work even a few hours per week during the school year, youll be able to start paying down interest on your unsubsidized loans. Youll be grateful when you become debt-free faster than your peers.

Read Also: How Does Co Signing For An Auto Loan Work

Public Service Loan Forgiveness & Income

-

Borrowers with a Direct Loan, who work full-time for a qualifying employer during the suspension, will receive credit toward PSLF for the period of suspension as though on-time monthly payments were made.

NOTE: Borrowers will be required to submit a Public Service Loan Forgiveness & Temporary Expanded PSLF Certification & Application to certify employment for the suspended payments to qualify toward the 120 payments needed for forgiveness.

- Borrowers currently on an IDR plan will have suspended payments count toward IDR forgiveness.

NOTE: When reviewing communications received or your PSLF progress in Account Access online, please note that Estimated Eligibility Dates provided currently do not account for remaining months of the COVID-19 suspension that would typically be projected as eligible to qualify. Please refer to your Qualifying Payment count to monitor progress towards PSLF.

Federal Direct Graduate Plus Loan Limits And Terms

You may borrow up to the full student budget less total financial aid from all sources. The interest rate is fixed at 7.543% for 2022-2023 loans. There is a 4.228% loan origination fee deducted from the loan by the U.S. Department of Education for loans with a first disbursement date prior to October 1, 2023 . The Grad PLUS Loan is credit-based and requires credit approval by the U.S. Department of Education.

Refer to the Federal Student Aid website for additional information regarding Direct Grad PLUS Loans.

Also Check: Which Loan Is Interest Free