Should I Get An Auto Loan From The Dealership Or The Bank

Choosing between a dealership and a bank for an auto loan is complicated. In general, dealerships may offer higher rates than banks but this may not be the case for used cars. Regardless, it is important to get quotes from a few banks or online lenders first that way you can come to the dealership prepared. Ask for a quote from the dealership as well, comparing rates, terms and any additional fees.

When Should I Not Refinance My Car Loan

While refinancing a car loan can be a smart opportunity to save money, there are some situations in which refinancing is not financially sound:

Best Bank For Auto Refinance: Bank Of America

Bank of America

- Minimum credit score: Not stated

- Loan terms : 48 to 72 months

Bank of America is a good option if youre looking to refinance your auto loan at a big bank. The lender features multiple refinance options and an easy online application process.

-

Transparent rates and terms online

-

Established financial institution

-

Minimum finance amount of $7,500

-

Must have fewer than 125,000 miles

-

Car can’t be valued at less than $6,000

Among big banks, Bank of America offers competitive refinance rates and an easy overall process. It’s open to borrowers throughout the nation and scored slightly above average in J.D. Power’s 2021 U.S. Consumer Financing Satisfaction Survey.

You May Like: How Long Does Ppp Loan Take To Be Approved

Things To Consider Before Refinancing

How Can I Refinance My Car Loan

The process of refinancing an auto loan isnt that different from taking out an auto loan in the first place. Here are the steps you can take to refinance:

Recommended Reading: How To Get Cash Loan Same Day

Bank Of America Car Loans Q& a

Get answers to your questions about Bank of America Car Loans below. For more general questions, visit our Answers section.

Bank of America doesn’t charge an auto loan origination fee.

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer.

Best Auto Refinance Companies Of September 2022

Jhoni JacksonClaudia Rodríguez HamiltonJhoni Jackson27 min read

| Best for Fair Credit | Best for Low Credit Score | Runner-Up for Best for Fair Credit | ||

| Caribou | ||||

|

Compare rates without a credit check or inputting your SSN |

About 200 lenders in its marketplace |

Specializes in borrowers with bad credit |

Average monthly savings of $150 |

|

| Maximum Loan Amount | ||||

|

All scores can apply, but best for 640 and up |

Varies by lender |

Compare rates without a credit check or inputting your SSN

About 200 lenders in its marketplace

All scores can apply, but best for 640 and up

Specializes in borrowers with bad credit

Average monthly savings of $150

The best auto refinance companies offer transparent, reliable service to consumers looking for competitive rates from a variety of lenders, including banks, credit unions and non-depository financial lenders.

Your potential savings will be determined by multiple factors , annual income and the outstanding amount of your current loan and the importance of each will depend on the individual auto refinance company.

Read on to see our top picks of 2022 and learn how to get the best loan terms that fit your needs.

Don’t Miss: Loans For Bad Credit Ohio

How We Chose The Best Auto Refinance Companies

When looking for the different auto refinance companies in the industry, we considered several criteria.

- Financial stability – We looked at each companys financial stability to make sure theyd be able to meet their refinancing obligations.

- Loan options – We looked for auto refinancing companies that offered competitive interest rates, zero to no upfront fees and flexible or reasonable vehicle restrictions.

- Customer experience – We looked at each companys complaints with the Consumer Financial Protection Bureau or the Federal Trade Commission . We also checked whether each company was transparent regarding its partners, underwriters and fees.

- Financial products – We also took into account each companys array of financial products and interviewed representatives from some companies.

We also interviewed representatives from companies as part of our research process. Still, though we always try to include accurate and up-to-date information on regulatory and legal actions, we dont claim this information is complete or fully up to date. As always, we recommend you do your own research as well.

Can You Refinance A Car Loan

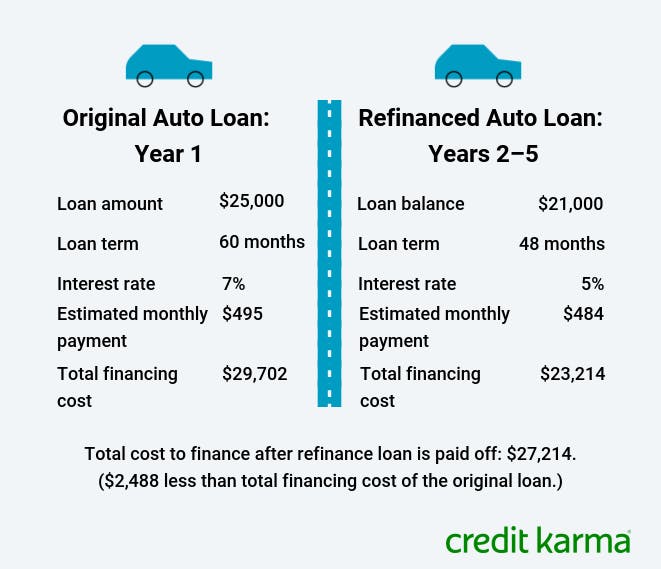

If you aren’t happy with your current car loan, you can refinance into a loan with a different interest rate and new terms. Refinancing a car loan means taking out a new loan that replaces your existing loan. It’s a brand-new loan that you often get from a different lender. Depending on the new lender’s requirements, you might be able to keep the length of the loan the same, shorten it, or extend it.

When you refinance, your new loan amount will generally be the balance you have left on your current loan. However, some lenders allow for a cash-out refinance. Just keep in mind that taking out cash on a car with limited equity could cause you to owe more on the vehicle than it’s worth.

You May Like: How To Get Business Loan With No Money

What Is Required To Refinance A Car Loan

Every lender determines eligibility differently, but there are some documents and information they typically require to refinance your auto loan.

- Personal information: Youll need to prove you are who you say you are, so be prepared with a copy of your drivers license or proof of residence, phone number and Social Security or another identity number. Lenders want to know that youll be able to repay your loan, so theyll ask about your income, current debt and your employers information. They might also ask for a paycheck stub, a tax return or your employment history.

- Vehicle information: The lender will need to make an accurate valuation on the vehicle under consideration for financing, so theyll want to know the VIN, make, model, mileage, year and registration number. You might also be asked to provide evidence of active auto insurance.

- Current loan information: Be prepared to provide the name of your current auto lender, loan number, current balance, monthly payment and payoff amount. Typically, lenders like to see an on-time payment history of at least two years before theyre willing to approve you for refinancing. But check with your lender since it can vary.

Bank Of America Auto Loan Rates And Fees

Multiple factors will affect your interest rate, including your credit score and income. As of the writing of this article, Bank of America car loan rates start at:

- New car dealer loan: 2.59% APR

- Used car dealer loan: 2.79% APR

- Auto loan refinancing: 3.49% APR

Bank of America Preferred Rewards members can get an interest rate discount on their car loans:

- Gold: 0.25% discount

Joining the Preferred Rewards program is free. Youll need:

- A Bank of America personal checking account thats eligible for the program

- Combined balances from three months that average $20,000 or more

There are no application or origination fees for these loans.

Don’t Miss: How To Increase Loan Amount

Bank Of America Auto Refinance Reviews

based on its streamlined application process and customer services. BOA receives a 9.3 for reputation, 8.1 for rates, 8.5 for availability, and 6.2 for customer experience.

The pros of a BOA auto refinance loan include competitive rates, an easy online loan application process, and transparent APR by phone and online. BOA is also an established financial institution with a strong customer service reputation. Cons include the minimum loan amount requirement, needing to have fewer than 125,000 miles on your vehicle, and a minimum vehicle value of $6,000.

When considering an auto refinance, take the time to research your options for terms and APR. Youll also want to do the math to determine whether an auto refinance is financially sound. A Bank of America auto refinance can save money by lowering your monthly payment or decreasing your interest rate.

Requirements For Bank Of America Auto Refinance

U.S. citizens age 18 and older are eligible for a Bank of America auto refinance. For a vehicle to qualify, it must have fewer than 125,000 miles and be less than 10 years old. Your vehicles value must be a minimum of $6,000 for a BOA auto refinance loan. Bank of America will not refinance the following types of vehicles:

- Recreational vehicles, boats, motorcycles, and aircraft

- Delivery or conversion style

- Lemon law or gray market

- Salvaged or branded-title

- Business or commercial use

Bank of America does not have a minimum income or credit score requirement however, applicants with good to excellent credit scores are more likely to receive approval. Those with poor credit might be denied an auto refinance.

You May Like: How To Pay Capital One Auto Loan Online

Types Of Bank Of America Auto Loans

Bank of America offers a wide variety of auto loan and refinancing options:

- Dealer purchase loans for new or used cars

- Refinancing for current auto loans

- Lease buyout loan

- Private party loans for when you buy a vehicle from an individual

- Access loans specifically for new or used accessible cars, vans, or light-duty trucks

- Business auto loans for cars, vans, and light trucks for small business use

Auto loans are available in all 50 states. The minimum loan amount starts at $7,500, or $8,000 in Minnesota. Bank of America doesnt offer auto loans for vehicles that are more than 10 years old or that have 125,000 or miles on them. Vehicles must be worth at least $6,000 and cannot be used for commercial purposes. Loans are not currently available for motorcycles or RVs.

If youre buying a car from a dealer, Bank of America loans are only for franchise dealerships rather than independent dealers. BofA provides loans for approved independent dealers, including online dealerships, Carvana, Enterprise Car Sales, Hertz Car Sales, and CarMax.

Loan terms range between 12 and 60 months.

When Should You Refinance A Car

When to refinance depends on your circumstances and needs. Refinancing could make sense if your credit score has recently improved, if car loan rates have fallen, or if you need a lower monthly payment. Overall, consider refinancing when you can get a better deal on your car loan and it wonât cause you to pay more for the vehicle.

Also Check: How To See My Loan Balance

Bank Of America Reviews

- BBB: 1 out of 5 stars and 5,510 complaints

- Wallethub: 3.1 out of 5 stars from 46 reviews

- Glassdoor: 3.7 out of 5 stars from 22,249 reviews

- and a few more.

- and a few more.

Bank Of America Car Loans Q& A

Get answers to your questions about Bank of America Car Loans below. For more general questions, visit our Answers section.

Bank of America doesnât charge an auto loan origination fee.

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation âSponsoredâ, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer.

Also Check: What Does Usda Home Loan Stand For

Recommended Reading: What Kind Of Loan Is Rise Credit

How Do Bank Of America Auto Loans Work

Bank of America Auto loans work the same as most banks, today. You will have the option of speaking with your local banks loan officer, or you can get approved for car financing online.

They offer a quick three step process and claim that they can give you a decision on your next auto loan in 60 seconds.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Auto Loan Calculator With Credit Score

Recommended Reading: Emi Calculator Home Loan Usa

How Do I Choose The Best Auto Loan For Me

To find the best auto loan for your personal situation, look at several key factors. Many borrowers prioritize the lowest interest rate, but also consider any fees, the minimum credit score needed, and the accessibility of the lender’s customer service.

You also need to take into account what type of cars the dealer will finance, how much money they will finance, and the loan term length.

Guides like this one will help you compare multiple lenders in the same place to weigh their pros and cons. Make sure to also read individual reviews of any lenders you’re considering.

Which Lender Is The Most Trustworthy

We’ve reviewed each institution’s Better Business Bureau score to help you make the best decision possible when choosing an auto loan. The BBB measures businesses based on factors like truthfulness in advertising, honesty about business practices, and responsiveness to consumer complaints. Here is each company’s score:

| Lender | |

| PNC Bank | A+ |

A majority of our top picks are rated A or higher by the BBB, with the exception of Clearlane by Ally. Keep in mind that a high BBB score does not guarantee a good relationship with a lender, and that you should keep doing research and talking to others who have used the company to get the most helpful information you can.

The BBB currently rates Clearlane by Ally a D- because of 53 complaints filed against the business, including one unresolved complaint. Due to the lenders’ BBB scores, you might prefer to use a different auto loan company on our list.

Recommended Reading: Can I Use Va Loan To Buy Rental Property