Student Loan Forgiveness For Public Servants

Get student loan forgiveness if you work for a qualified government or non-profit employer. Youll need to meet certain requirements such as working full-time, making 120 monthly payments, and enrolling in an income-driven repayment plan. You can get total student loan forgiveness for all your federal student loans. . Biden announced major changes to student loan forgiveness, which helps more student loan borrowers get student loan forgiveness.

Apply:Heres how to apply for limited student loan forgiveness.

What Qualifies As A Low

You can use the Teacher Cancellation Low Income Directory to determine whether your place of employment is considered a low-income school or educational service agency.

Youll need to click on the Directory Search and select the academic year and the state you live in. To narrow your search, you can also type in the name of your school or educational agency.

If youre thinking about refinancing your student loans, you can use Credible to compare student loan refinance rates without affecting your credit score.

Who Qualifies For Teacher Loan Forgiveness

As with other student loan forgiveness programs, there’s a lot of fine print you’ll want to understand before you submit your application. Here’s how to tell if you meet the basic eligibility requirements:

- You have an eligible direct subsidized Loan, direct unsubsidized loan, a subsidized federal Stafford loan or an unsubsidized federal Stafford loan.

- You work in an elementary school, secondary school or educational service agency that serves low-income students.

- You must not have held an outstanding balance on direct loans or any Federal Family Education Loans as of October 1, 1998. Additionally, teacher loan forgiveness candidates must not have held a direct loan or FFEL before October 1, 1998. In order to qualify for forgiveness, you must first pay off loans borrowed before this date.

- You must meet the qualifications of a qualified teacher, which include attaining at least a bachelor’s degree and receiving full state teacher certification. Plus, you cannot have had certification or licensure requirements waived on an emergency, temporary or provisional basis.

Note that if you’ve defaulted on a college loan, you won’t be eligible for teacher loan forgiveness until arrangements have been made to repay the loan, suitable to the approval of the student loan provider.

If you’re a teacher who did not complete a full school calendar year of instruction, the year may ultimately count toward your teacher loan forgiveness program under the following conditions:

Read Also: Used Car Loan Calculator Usaa

Can You Receive Both Teacher Loan Forgiveness And Public Service Loan Forgiveness

You may be able to take advantage of both Teacher Loan Forgiveness and Public Service Loan Forgiveness. But youll need to have separate periods of teaching service to do so. For example, if you receive Teacher Loan Forgiveness after five years of teaching, you wont be able to count any of those payments toward Public Service Loan Forgiveness. You must make 120 additional qualifying payments beyond that teaching period if you want to qualify for PSLF.

How Much Can Be Forgiven

The Teacher Loan Forgiveness Program offers up to $17,500 in forgiveness. You may receive the full $17,500 if youre a highly qualified special education teacher at the elementary school or secondary school level, or a highly qualified mathematics or science teacher at the secondary education level.

You might be eligible for up to $5,000 in loan forgiveness if you work in a different subject area, as long as you meet the other requirements.

You May Like: How Long Does Sba Loan Take To Get Approved

Income Driven Repayment Plans

This one isnt specific to teachers, but its certainly applicable here.

The standard repayment term for federal student loans is 10 years. If you have difficulty making payments, you have four main options within an income driven repayment plan for lowering them that take your income and expenses into account:

-

Income-Based Repayment Plan

-

Pay as You Earn

-

Revised Pay as You Earn

We cover each of these repayment plans in more detail in this article, but know that these plans arent actually forgiveness programs. Theyre repayment programs with a forgiveness option at the end. Youll need to resubmit your income and family size every year to determine eligibility and the forgiven portion is subject to federal taxes.

You Must Be A Highly Qualified Teacher

There are two requirements to be a highly qualified teacher. First, they must have attained a bachelors degree. Second, they must have received full state certification as a teacher. Additionally, this certification or license must never have been revoked, waived or suspended.

If youre new to the teaching field, work for a nonprofit private school, or teach at a public charter school, you need to prove youre highly qualified. Youre required to have completed and passed rigorous state testing in your specific subject knowledge area or demonstrate a high level of competency for all subjects if you teach K-8.

Also Check: Do Loan Officers Get Commission

How To Make Repaying Education Debt Easier

Student loan forgiveness programs can make repaying education debt on a teacher’s salary easier. There are several programs that offer federal student loan forgiveness just for educators.

“Teachers have more loan forgiveness opportunities than almost any other occupation and taking advantage of these easy-to-enroll-in programs can save hard-working teachers hundreds to thousands of dollars,” says Robert Farrington, founder of The College Investor. “Ignoring these opportunities is essentially passing over free money.”

Qualifying for student debt relief can be tricky, however. If you’re looking for student loan help as a teacher, here’s what you need to know about forgiveness programs.

Student Loan Forgiveness For Doctors And Nurses In Canada

Eligible family doctors, residents in family medicine, nurse practitioners, and nurses can get Canada Student Loan forgiveness through the federal government. However, only the federal portion of the loan can be forgiven .

Eligibility For Student Loan Forgiveness For Doctors and Nurses in Canada

To qualify for this type of Canada Student Loan forgiveness, you must:

- Have a Canada Student Loan thats in good financial standing

- Be working as an eligible medical professional in an under-served or remote region with a lack of proper healthcare .

- Have been employed for at least one consecutive year in an underserved or remote community and provided at least 400 hours of in-person service.

- Submit an this application

Eligible Medical Professionals

To qualify for Canada Student Loan forgiveness, you must be one of the following medical professionals :

- Family

- Nurse Practitioner

- Family Medical Resident

You may get Canada Student Loan forgiveness for nurses and family doctors and if you are:

- Enrolled in full-time studies

- Repaying a student loan

- In your non-repayment period

If your loan is in its repayment period, your monthly payments are still mandatory. That said, youre allowed to work as an eligible medical professional in more than one remote or under-served community and with multiple employers if you perform at least 400 in-person hours over a maximum period of 12-months.

Check out what happens to your student debt when you die.

Recommended Reading: Bayview Loan Modification

Public Service Loan Forgiveness

Public Service Loan Forgiveness is a loan forgiveness program for public service workers, like those in government and nonprofit sectors, as well as teachers.

After youve made 120 monthly qualifying student loan paymentswhich translates to at least 10 yearsthe government will forgive the remaining balance on your student loans. To qualify, you must:

- Work full-time at a government institution or a nonprofit organization

- Have eligible federal student loans that are in an income-driven repayment plan

- Make 120 qualifying payments toward your loans.

Federal direct loans are eligible for PSLF. If you have a Federal Family Education Loan or Perkins loans, youll have to convert them into a direct consolidation loan to qualify for PSLF. Your loans must also be enrolled in an eligible repayment plan.

However, if youve been making payments using the wrong loan type or repayment plan, all is not lost. The Department of Education announced temporary changes that allow borrowers to count many of these payments. As long as you were working for a PSLF-eligible employer, any payments made during that time can be counted toward the 120 payments necessary to gain forgiveness.

To make sure all your payments are counted, some borrowers may need to submit a PSLF form by Oct. 31, 2022. Borrowers with ineligible loans may also need to consolidate their debt by the same date. You can find full details of the action steps you must take on the Student Federal Aid site.

Student Loan Forgiveness For Perkins Loans

Perkins Loans are eligible for partial student loan cancellation to complete student loan cancellation. You could get student loan forgiveness for Perkins Loans based on your employment or volunteer service. Its also possible to get Perkins Loans discharged. .

Apply: To get student loan forgiveness for Perkins Loans, you must apply to the school that issued your student loan or to your schools student loan servicer for Perkins Loans.

Recommended Reading: Upstart Second Loan

How To Qualify For Public Service Loan Forgiveness

Everyone wants their student loans forgiven. The perception is that very few qualify. But did you know that there is one broad, employment-based forgiveness program for federal student loans? Let me break down some key points of PSLF to help you figure out if you could qualify.

Work in Qualifying Employment

First, you need to work for the right employera public service employer. What does that mean? Everyone has a different definition. Ours is based on who employs you, not what you do at work. Heres what qualifies:

- Governmental organizations Federal, state, local, Tribal

- 501 organizations

- A not-for-profit organization that provides specific public services, such as public education or public health

Heres what doesnt qualify:

- Labor unions

- For-profit organizations

Qualifying Employment Status

If you work at one of these types of organizationsgreat! Next, you need to work in a qualifying employment status, which means that you must be a full-time employee. For us, full-time means that you meet your employers definition or work at least 30 hours per week, whichever is greater.

Have a Qualifying Loan

A qualifying loan is a Direct Loan. Its that simple. Of course, its the government, so nothing is actually that simple. There are three big federal student loan programs:

- The Direct Loan Program

- The Federal Perkins Loan Program.

Have a Qualifying Repayment Plan

You can apply for an income-driven repayment plan on StudentLoans.gov.

Make 120 Qualifying Payments

Definition Of A Low Income School

- The school must be a public or other non-profit private elementary or secondary school located in the school district of a local educational agency that is eligible for assistance under Title I of the Elementary or Secondary Education Act of 1965, as amended.

- A low-income school is one in which more than 30% of its total enrollment is economically disadvantaged students.

- All elementary and secondary schools operated by the Bureau of Indian Affairs or operated on reservations by Indian tribal groups under contract with the BIA qualify as low-income schools.

Read Also: 650 Credit Score Auto Loan Interest Rate

What Does It Mean To Be A Highly Qualified Teacher

According to the U.S. Department of Education, youre a highly qualified teacher if:

- You hold at least a bachelors degree.

- You have full state certification as a teacher.

- You havent had any certifications or license requirements waived, revoked, or suspended for any reason.

Unfortunately, you wont qualify for Teacher Loan Forgiveness if youre a school administrator, school counselor, school librarian, or other staff member in the education field. You must be a teacher working in a classroom setting for a qualifying employer.

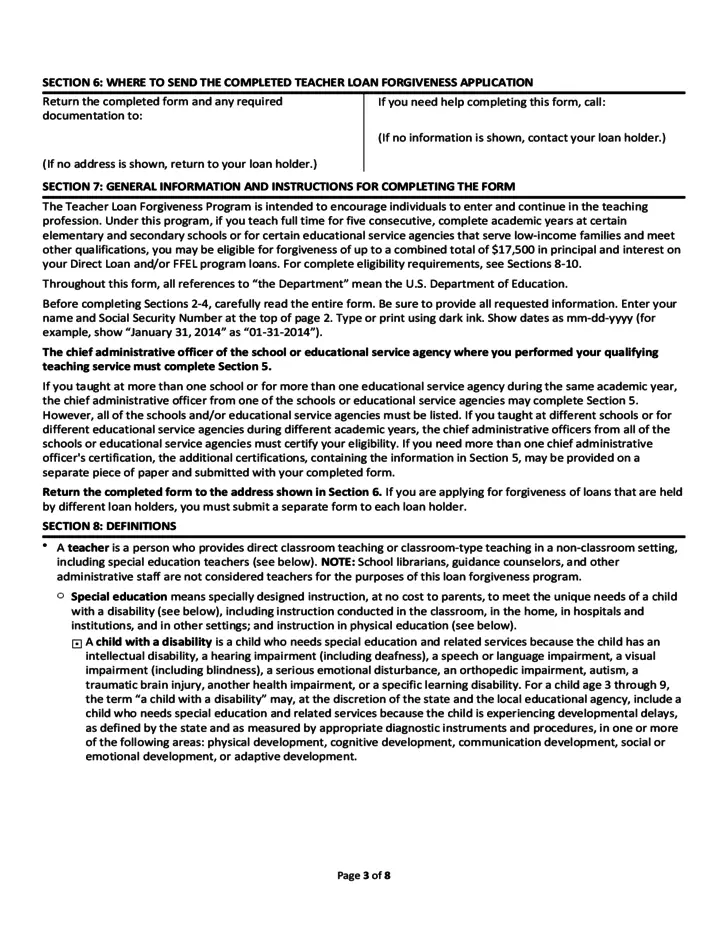

Welcome To Teacher Loan Forgiveness

What are the eligibility requirements?

- You must not have had an outstanding balance on Direct Loans or Federal Family Education Loan Program loans as of Oct. 1, 1998, or on the date that you obtained a Direct Loan or FFEL Program loan after Oct. 1, 1998. If you are in default on a subsidized or unsubsidized loan, you are not eligible for forgiveness of that loan unless you have made satisfactory repayment arrangements with the holder of the defaulted loan. The loan for which you are seeking forgiveness must have been made before the end of your five academic years of qualifying teaching service. Any time you spent teaching to receive benefits through AmeriCorps cannot be counted toward your required five years of teaching for Teacher Loan Forgiveness. You must have been employed as a full-time teacher for five complete and consecutive academic years, and at least one of those years must have been after the 199798 academic year. You must have been employed in a public elementary/secondary school or a non-profit school that

Who is considered a teacher?

How long must I teach?

Service completed before Oct. 30, 2004

Don’t Miss: Usaa Auto Refinance Phone Number

You Work For The Government Or A Nonprofit Organization

There are three options to get your loans forgiven after working in public service for at least 10 years. The Public Service Loan Forgiveness Program is the main pathway to apply for forgiveness, but few borrowers met the programâs complicated requirements.

Federal lawmakers tried to fix PSLF by temporarily expanding it to count payments made under the wrong repayment plan. But the TEPSLF program helped only a handful more people. It didnât help people with government-backed bank loans known as Federal Family Education Loans.

In October 2021, the Biden Administration temporarily fixed the âwrong loanâ issue by expanding PSLF once more to count payments toward FFEL Loans. The PSLF Waiver offers a limited opportunity to get credit for FFEL Loan payments, late payments, and payments made under an ineligible repayment plan.

- Whose eligible: Youâre eligible if you work full-time for the government or a nonprofit company that provides a qualified public service.

- How to apply: Submit the PSLF & TEPSLF Employment Certification form to FedLoan Servicing.

- When to apply: You can submit the PSLF form to check how many payments youâve made or after youâve made 120 qualifying payments.

- Application:

Learn More:Guide to the Public Service Loan Forgiveness Program

You Must Be Employed At A Low

You need to have worked at a school or educational service agency that serves low-income students. All Title 1 schools qualify as low-income schools.

Even if you only worked some of your five years in a low-income school, you can still qualify. If youre not sure your school qualifies, search the Teacher Cancellation Low Income directory. The TCLI directory serves as an annual directory of designated low-income schools.

You May Like: Usaa Auto Loan Approval

The 6 Keys To The Teacher Loan Forgiveness Process

Although President Joe Bidens recent announcement extending the pause on student loan payments until May 1 provides temporary financial relief for teachers, loan cancellation is still the ultimate goal. Even when teachers are eligible for forgiveness, the application process to get those loans forgiven is so tedious and difficult that many hardworking, deserving teachers give up in despair.

People!

All I have to say is this: The struggle to get student loan forgiveness is real! It took me YEARS of multiple rejections, disappointing phone calls, and straight hustlin‘ to ultimately get my loans forgiven. If that process taught me anything, it is that the U.S government really has no love for teachers.

And for that reason, I want to drop some gems of information for those of you going through the struggle right now or preparing to start the loan forgiveness application. I learned so many lessons through my ordeal that it would be a crime to keep them all to myself.

Your School Lied To You

Over the years, government officials have shut down many for-profit institutions that defrauded students. The borrower defense loan discharge program allows you to file a claim to have your debt forgiven if you believe your school misled you and broke state fraud laws.

The relief program has not worked smoothly since first being used under the Obama administration to help people who attended Corinthian Colleges. When President Trumpâs education secretary, Betsy DeVos, took office, the process for approving applications slowed to a crawl. The Education Department focused its efforts on defending litigation rather than finding ways to quicken the process and grant borrowers the relief they were entitled to under the law.

The new education secretary, Miguel Cardona, has announced the department was scrapping his predecessorâs policy and replacing it with a simplified, fair path to relief when a schoolâs misconduct has harmed them.

In June 2021, the department announced it would wipe out $500 million for 18 thousand borrowers who attended ITT Technical Institute.

- Whose eligible: Youâre eligible if you attended a school that misled you or engaged in other misconduct, or you can show the school violated state law related to your loan or the educational services provided.

- How to apply: You can apply online anytime or submit a paper application to the Department of Education.

- When to apply: You can apply anytime after your schoolâs misconduct.

- Application:.

Don’t Miss: Va Business Loan For Rental Property

Loan Forgiveness And Cancellation

The Teacher Cancellation Low Income Directory lists schools and educational service agencies that are eligible for the purposes of the William D. Ford Federal Direct Loan and Federal Family Education Loan teacher loan forgiveness program, Federal Perkins Loan/National Direct Student Loan teacher cancellation, and the Teacher Education Assistance for College and Higher Education Grant Program