How Does A Mortgage Calculator Help You

Taking out a home loan is an important step in the home buying process and your loan repayments will be one of your biggest living costs once you do by a home. So, it’s important to budget accordingly.

Were here to help you make an informed decision for your next home loan, and encourage you to use our mortgage calculator to compare different home loan options and calculate potential repayments.

Once you get an idea of your mortgage repayments you’ll know what property price range you can realistically afford.

Our calculator can also help you understand how different factors like changing interest rates, additional repayments and the frequency at which you make your repayments can impact the interest owed.

For example, lower interest rates, making additional repayments, and paying your mortgage off fortnightly, or even weekly rather than monthly can all help reduce the cost of the loan over time.

So what’s next? Now that you’ve estimated your repayments, see how much you can borrow with our borrowing power calculator.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

How Does Emi Calculation Help In Planning The Home Purchase

HDFCs Home Loan EMI calculator gives a clear understanding of the amount that needs to be paid towards the EMIs and helps make an informed decision about the outflow towards the housing loan every month. This helps estimate the loan amount that can be availed and helps in assessing the own contribution requirements and cost of the property. Therefore knowing the EMI is crucial for calculation of home loan eligibility and planning your home buying journey better.

Also Check: Can I Refinance An Upside Down Car Loan

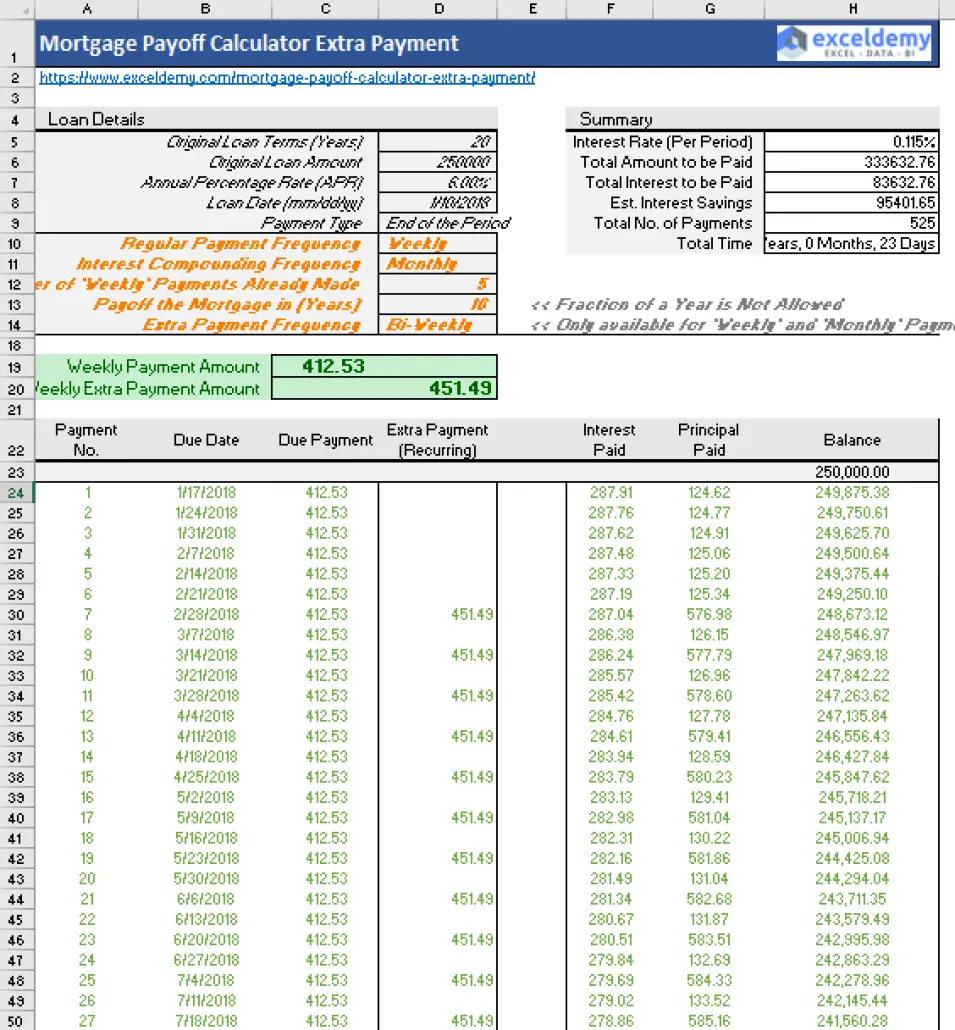

Benefits Of Making Extra Mortgage Payments

When you make extra mortgage payments, you can potentially tap into big interest savings. Although the exact savings will vary based on your unique loan, it is possible to save thousands of dollars in interest costs. Beyond the potential interest savings, making extra payments will help you pay off your mortgage more quickly and eliminate the mental and financial burden of a major, monthly debt payment.

How Making Extra Mortgage Payments Works

When you make an extra mortgage payment, you can choose to have the extra funds applied to the principal balance, which causes the loan balance to shrink faster. Since each interest payment is based on your principal balance, extra payments toward the principal will lead to lower interest costs over the course of your loan.

Recommended Reading: How Long Does It Take To Process Home Equity Loan

What Are The Tax Benefits Of Paying Home Loan Emis

Taking a loan to buy a house can be expensive, but it also has certain benefits, especially when it comes to taxes. The government offers tax reliefs via the Income Tax Act, 1961 on the EMIs you pay every year. These are as follows:

- Section 80C: You can claim a tax deduction of up to 1.5 lakh every year on the principal amounts paid towards your property loan.

- Section 24: Under this section, you can claim a deduction of up to 2 lakh on the interest component you pay each year.

- Section 80EE: Under this section, you can claim an additional interest amount of up to 50,000 per year. This is over and above the amounts mentioned in Sections 80C and 24. This deduction is subject to certain terms and conditions.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Also Check: How To Improve Credit Score Car Loan

Floating Rate Emi Calculation

We suggest that you calculate floating / variable rate EMI by taking into consideration two opposite scenarios, i.e., optimistic and pessimistic scenario. Loan amount and loan tenure, two components required to calculate the EMI are under your control i.e., you are going to decide how much loan you have to borrow and how long your loan tenure should be. But interest rate is decided by the banks & HFCs based on rates and policies set by RBI. As a borrower, you should consider the two extreme possibilities of increase and decrease in the rate of interest and calculate your EMI under these two conditions. Such calculation will help you decide how much EMI is affordable, how long your loan tenure should be and how much you should borrow.

Optimistic scenario: Assume that the rate of interest comes down by 1% – 3% from the present rate. Consider this situation and calculate your EMI. In this situation, your EMI will come down or you may opt to shorten the loan tenure. Ex: If you avail home loan to purchase a house as an investment, then optimistic scenario enables you to compare this with other investment opportunities.

Pessimistic scenario: In the same way, assume that the rate of interest is hiked by 1% – 3%. Is it possible for you to continue to pay the EMI without much struggle? Even a 2% increase in rate of interest can result in significant rise in your monthly payment for the entire loan tenure.

Think Before Filing Your Taxes

Finally, if you regularly take self-employed tax deductions on your annual returns, think carefully before next year’s filing day. Skipping some of those deductions might help you more easily qualify for a loan and buy a house.

“Plan ahead,” Hall says. “If you think that you may buy a house in the coming year or two, take off some of your tax deductions to show a little more income.”

You May Like: How Can I Get Out Of My Auto Loan

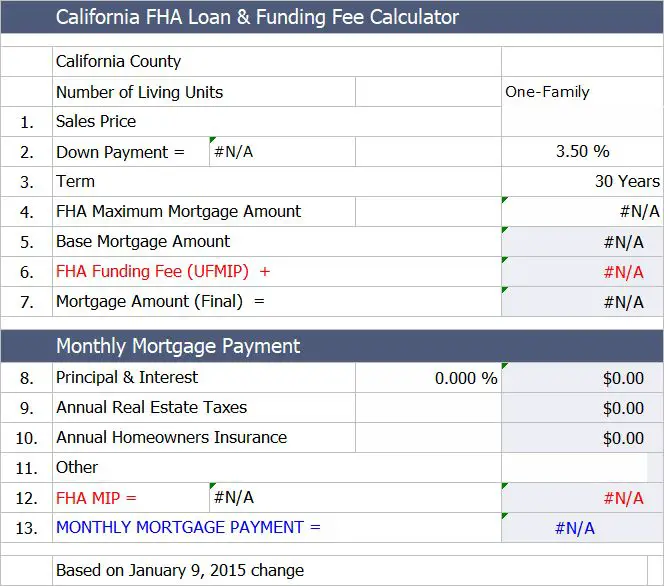

Fha Loan Vs A Conventional Loan

HA-backed loans have easier requirements than conventional loans, according to Bankrate, particularly when it comes to credit scores.

But another key difference between the two loan types has to do with down payments and mortgage insurance.

Paying less than 20% down on a conventional loan requires mortgage insurance, but you can always remove it once your home gains enough equity. On an FHA loan, however, you need mortgage insurance no matter what you put down, and it cant be removed even if your home gains equity. It would stay until you either pay off the mortgage or refinance with a conventional loan.

Bond: Predetermined Lump Sum Paid At Loan Maturity

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer when the bond matures, assuming the borrower doesn’t default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond’s value at maturity, a bond’s market price can still vary during its lifetime.

Recommended Reading: Does Va Loan Cover Down Payment

Mortgage Options For Self

Self-employed borrowers have the same loan options as traditionally employed people. The thing to keep in mind is that government- and agency-backed mortgages will require tax returns, so if your taxable income is too low to meet the loan’s requirements , you’ll need to look at a non-QM loan.

One popular non-QM option is the bank statement loan, which uses only bank statements not your tax returns to assess your income.

“Self-employed borrowers with good to excellent credit, large down payments, and the income to afford a higher-priced home are oftentimes turned away from their bank or other financial institution simply because they can’t qualify using tax returns and that lender does not have another loan option to help them,” says Mac Cregger, a senior vice president and regional manager at Angel Oak Home Loans, a non-QM lender. “That same borrower can qualify very easily and quickly with a bank statement loan.”

Here’s a look at the four loan options you might use as a self-employed borrower:

Note: Just like you would with a traditional mortgage, be sure to shop around for a bank statement loan. You should compare several lenders on interest rates, fees, and loan structure to ensure you get the best deal.

Make A Larger Down Payment

While it’s not possible for everyone, making a larger down payment is another strategy to consider. When you make a bigger down payment, you reduce the amount of money you need to borrow.

Ideally, you should aim for at least a 20% down payment, as this will typically help you avoid mortgage insurance, which makes your monthly payment more expensive.

“Increasing your down payment can also help lower your loan-to-value ratio, and hence show lenders that you’re a lower-risk borrower,” Heck says. “As a person with a non-traditional source of income, you’ll have an easier time securing a mortgage if you have significant savings put away, or if you’re able to put at least the traditional 20% down.”

Read Also: When Can You Apply For Parent Plus Loan

Deferred Payment Loan: Single Lump Sum Due At Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

Which Home Mortgage Option Is Right For You

With so many mortgage options out there, it can be hard to know how each would impact you in the long run. Here are the most common mortgage loan types:

- Adjustable-Rate Mortgage

- Federal Housing Administration Loan

- Department of Vertans Affairs Loan

- Fixed-Rate Conventional Loan

We recommend choosing a 15-year fixed-rate conventional loan. Why not a 30-year mortgage? Because youll pay thousands more in interest if you go with a 30-year mortgage. For a $250,000 loan, that could mean a difference of more than $100,000!

A 15-year loan does come with a higher monthly payment, so you may need to adjust your home-buying budget to get your mortgage payment down to 25% or less of your monthly income.

But the good news is, a 15-year mortgage is actually paid off in 15 years. Why be in debt for 30 years when you can knock out your mortgage in half the time and save six figures in interest? Thats a win-win!

Don’t Miss: How To Get Approved For Investment Property Loan

Mortgage Calculator Helps You Work Out If Re

- 14:07, 28 Sep 2022

HOMEOWNERS face soaring mortgage bills if interest rates hit 6%, but a calculator can help you work out if fixing early will save you cash.

Households face paying as much as £7,500 more a year on their home loan as the cost of borrowing is expected to jump.

The Pound fell sharply in value after last weeks mini-Budget, which included £45billion of tax cuts to be paid for by additional borrowing.

The Bank of England yesterday gave a very strong signal it would raise interest rates to try to prevent the weaker Pound fuelling higher inflation.

It could mean interest rates could hit 6% next year – and it could add thousands onto your home loan.

Anyone in a fixed deal won’t pay more now, but will do when their deal comes to an end as rates are already higher.

Home Loan Emi Calculation

The loan amount required to buy or construct your dream home is offered at an attractive home loan interest rate provided you fulfil the eligibility criteria laid down by the respective lender. Here, we have compiled a table wherein the lowest interest rate and the home loan EMI payable by you for every lakh is calculated with above home loan interest calculator.

| Loan Amount |

Recommended Reading: What Is The Largest Student Loan I Can Get

Payments On Home Equity Loans Vs Helocs

A home equity loan is a lump sum of money with a fixed interest rate, so your monthly payments stay the same for the loans lifetime. Its best if you need a large sum with predictable payments.

A HELOC is a line of credit you can draw from as needed, so your monthly payment fluctuates based on how much you borrow. Its best if you want the option to borrow small amounts over time.

With most HELOCs, you make interest-only payments during the draw period, but you are free to add to that as you are able. Once the repayment period starts, your loan amount is amortized to include interest and principal so that you can pay it off within the term.

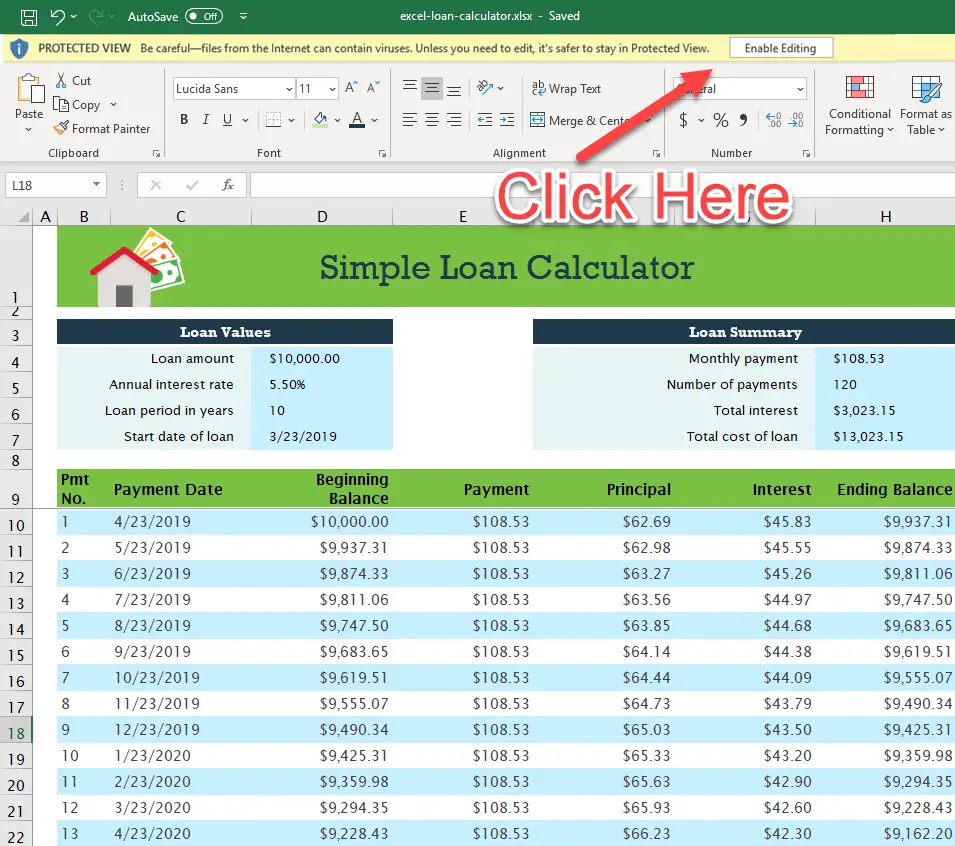

How Do You Calculate A Loan Payment

The Bankrate loan payment calculator breaks down your principal balance by month and applies the interest rate you provide. Because this is a simple loan payment calculator, we cover amortization behind the scenes. If you would prefer a loan payment calculator that delves into the granular details , use our more robust calculator.

In the context of a loan, amortization is when you pay off a debt on a regular, fixed schedule. Often, within the first few years, the bulk of your monthly payments will go toward interest. For example, if you have an auto loan with a monthly payment of $500, your first months payment might break down into $350 toward interest and $150 toward the principal.

You May Like: How Can I Get Rid Of School Loan Debt

Explanation Of Mortgage Terms

Mortgage terminology can be confusing and overly complicatedbut it doesnt have to be! Weve broken down some of the terms to help make them easier to understand.

Learn about

Home Price

Across the country, average home prices have been going up. Despite the rise in home prices, you can still find a perfect home thats within your budget! As you begin to house hunt, just make sure to consider the most important question: How much house can I afford? After all, you want your home to be a blessing, not a burden.

Learn about

Down Payment

The initial cash payment, usually represented as a percentage of the total purchase price, a home buyer makes when purchasing a home. For example, a 20% down payment on a $200,000 house is $40,000. A 20% down payment typically allows you to avoid private mortgage insurance . The higher your down payment, the less interest you pay over the life of your home loan. The best way to pay for a home is with a 100% down payment in cash! Not only does it set you up for building wealth, but it also streamlines the real estate process.

Learn about

Mortgage Types

15-Year Fixed-Rate Mortgage

30-Year Fixed-Rate Mortgage

5/1 Adjustable-Rate Mortgage

Learn about

Interest Rate

Learn about

Private Mortgage Insurance

Learn about

Homeowners Insurance

Learn about

Homeowners Association Fees

Learn about

Monthly Payment

Learn about

Property Taxes

Mortgage Calculator Uses

What Is A Pre

HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. A pre-approved home loan is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position.

Apply for a home loan online with HDFC, click Apply Online

In case you would like us to get in touch with you, kindly leave your details with us.

to know more about home loans.

Recommended Reading: What Is Conventional Loan Amount

What Happens When You Qualify For A Loan

To begin the mortgage process, youll need to meet with a lender and be prepared to provide proof of:

- How much you plan to put down on your home

Its likely your lender will approve you for more money than you should borrow. Just because you qualify for a big loan doesn’t mean you can afford it!

A good lender will clearly explain your mortgage options and answer all your questions so you feel confident in your decision. If they dont, find a new lender. A mortgage is a huge financial commitment, and you should never sign up for something you dont understand!

If youre ready to get prequalified for a mortgage loan, we recommend talking with Churchill Mortgage.