Lending And Mortgage Servicing Practices That Can Hurt You

You could lose your home and your money if you borrow from dishonest lenders. Certain lenders target homeowners who are older or who have moderate means or credit problems and then try to take advantage of them by using deceptive, unfair, or other unlawful practices like these:

- Loan flipping happens when the lender encourages you to repeatedly refinance the loan, which often leads you to borrow more money. Each time you refinance, you pay additional fees and interest points. That increases your debt.

- Insurance packing happens when the lender adds to your financing credit insurance or other insurance products that you may not need.

- Bait–and-switch happens when the lender offers one set of terms when you apply, then pressures you to accept higher charges when you sign to complete the deal.

- Equity stripping which involves practices that reduce the value in your home, can happen when the lender offers financing based on the equity in your home, not on your ability to repay. If you cant make the payments, you could end up losing your home.

- Non-traditional products include home equity loans that

- have monthly payments that increase either because they have variable interest rates, or because the minimum payment doesnt cover the principal and interest due

- have low monthly payments, but a large lump-sum balloon payment due at the end of the loan term. If you cant make the balloon payment or refinance, you face foreclosure and the loss of your home.

Which Gets Me Money Faster: A Heloc Or A Home Equity Loan

If you need money as quickly as possible, a HELOC will generally process slightly faster than a home equity loan. Multiple lenders advertise home equity loan processing time lines from two to six weeks, whereas some lenders advertise that their HELOCs can close in less than 10 days. The actual closing time will fluctuate based on the amount borrowed, property values, and creditworthiness of the borrower.

How Does A Home Equity Loan Work

A home equity loan works like a mortgage, personal loan, or any other installment loan. Youll take out a lump sum when you apply for the loan, then pay it back with fixed monthly payments over a predetermined period of time.

Most home equity loans have five- to 30-year terms and fixed interest rates. The average interest rate on a home equity loan is currently around 6%, according to Bankrate, which shares an owner with NextAdvisor. Be sure, however, to base your calculations on the annual percentage rate , which factors in fees and the interest rate, rather than the interest rate alone.

Although the money from a home equity loan can be used for almost anything, home equity loans are commonly used to finance home improvement projects. Interest on home equity loans, and on HELOCs as well, is tax-deductible if the funds are used to substantially improve your home and total debt related to the house including all other mortgages and home equity loans does not exceed $750,000.

Don’t Miss: What’s The Best Online Loan Lenders

How Do I Shop For A Home Equity Loan

Consider contacting your current lender to see what they offer you as a home equity loan. They may be willing to give you a deal on the interest rate or fees. Ask friends and family for recommendations of lenders. Then do some research into the lenders offerings and prepare to negotiate a deal that works best for you. Use the Shopping for a Home Equity Loan Worksheet.

Can You Have A Heloc And A Home Equity Loan

Theoretically, there is no limit to the number of home equity loans or lines of credit you can hold simultaneously. But itll be harder to qualify with each new application because youll have less and less equity to tap with each loan.

For instance, if you have a home valued at $500,000 and two home equity loans totaling $425,000, youve already borrowed 85 percent of your homes value the cap for many home equity lenders.

Lenders may also charge higher interest rates on additional loans or lines of credit, especially if you ask for a second loan from the same lender.

Also Check: Is Freddie Mac An Fha Loan

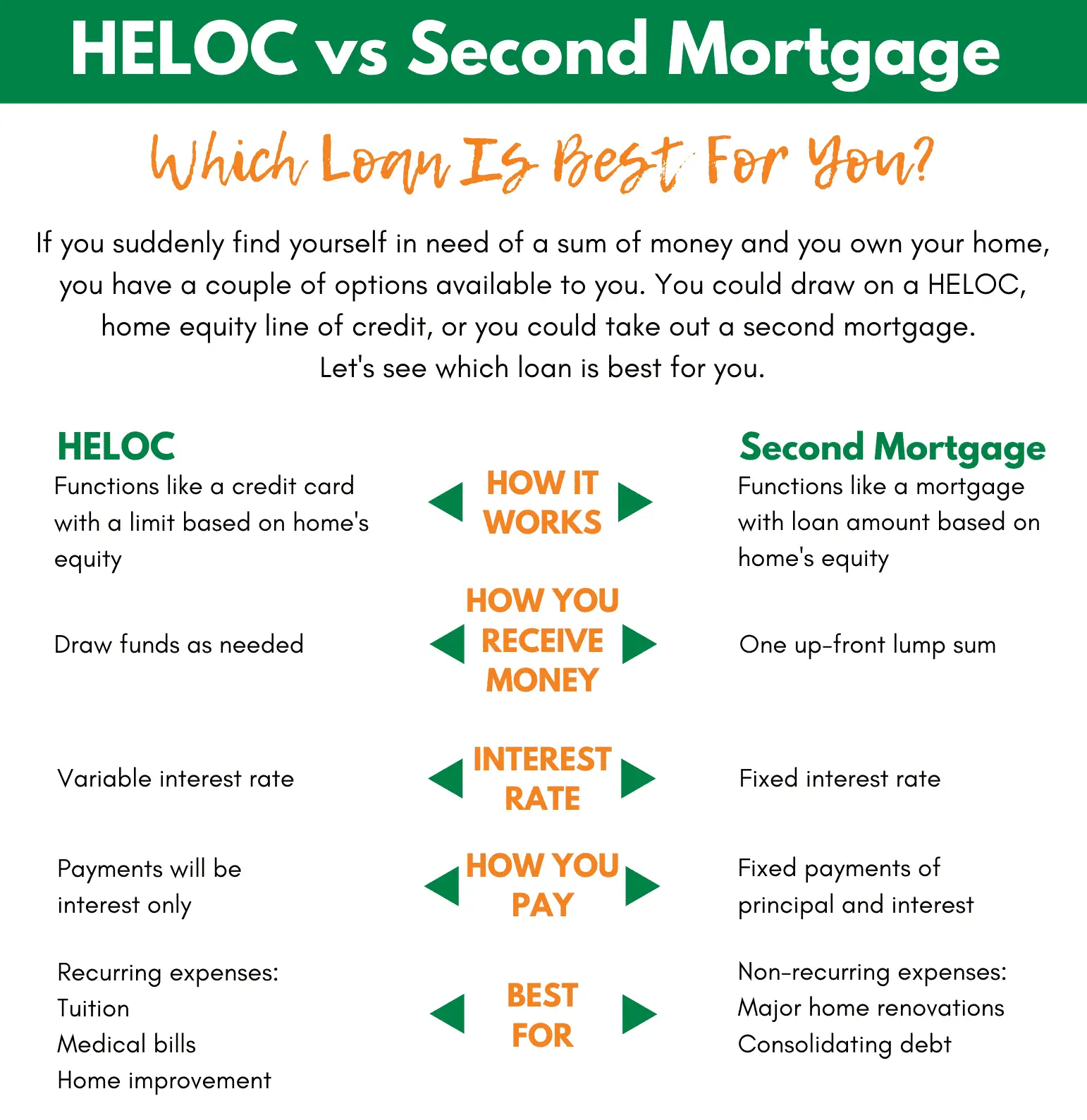

Heloc Vs Home Equity Loan

A home equity loan and a HELOC are both second mortgages. That means youre taking on additional debt and putting your home up as collateral as a guarantee that youll pay back your loan.

But home equity loans and home equity lines of credit differ in important ways that can make one more advantageous than the other. It all depends on your situation.

Read More: Heres What You Need to Get a Home Equity Loan or HELOC

Which One Is Right For You

Between all these options, no product is objectively better than the other. It all comes down to your personal finances and what best suits your situation. If your family operates on a strict budget and you need to know your exact payment every month, then an improvement loan or Home Equity Loan may make more sense for you.

Some finance gurus may discourage homeowners from taking out HELOCs and home improvement loans, unless they plan to use it to add value to their existing home. However, there are other excellent reasons to consider HELOCs. Some people use the funds to start a business, fund a college degree, or pay of medical bills. In contrast, lenders typically require home improvement loans to be used specifically for home renovations and improvements. Be sure to confirm usage restrictions with your lender.

Also Check: Can I Lower My Student Loan Interest Rate

Helocs Vs Home Equity Loans

HELOCs are known as revolving credit. You can draw what you need against the line of credit, pay interest only on what youve used and then pay it back. HELOCs typically have terms that allow you to repeat that process over a 10-year period.

In contrast, a home equity loan is a lump-sum fixed amount that you borrow and pay it back in set installments.

The other major difference between HELOCs and home equity loans is that HELOCs have variable interest rates while home equity loans have fixed rates. That may make a home equity loan a better option for someone who has a particularly large project where they need one-time funding. A line of credit, however, may offer more flexibility because you can draw funds as needed however, it could come at a higher interest cost down the road due to its variable interest rates.

Keep in mind that while HELOC rates may be lower than those on home equity loans now, the Fed is likely to raise interest rates several times over the next year or two, meaning repaying a HELOC will likely be more expensive in the future.

Another Option: A Home Equity Line Of Credit

A HELOC, though also secured by your home, works differently than a home equity loan. In this type of financing, a homeowner applies for an open line of credit and then can borrow up to a fixed amount on an as-needed basis. You only pay interest on the amount borrowed.

Typically, a HELOC will remain open for a set term, perhaps 10 years. Then the draw period will end, and the loan will be amortized â which means you begin making set monthly payments â for perhaps 20 years.

The main benefit of a HELOC is that you only pay interest on what you borrow. Say you need $35,000 over three years to pay for a child’s college education. With a HELOC, your interest payments would gradually increase as your loan balance grows. If you had instead taken out a lump-sum loan for the same amount, you would have been paying interest on the entire $35,000 from day one.

Also Check: What Are The Current Interest Rates For Home Loans

Home Equity Loan Pros And Cons

-

Cant take out more for an emergency without another loan

-

Have to refinance to get a lower interest rate

-

May lose your home if you cant make payments

A home equity loan provides you with a one-time lump sum payment that allows you to borrow a large amount of cash and pay a low, fixed interest rate with fixed monthly payments. This option is potentially better for people who are prone to overspending, like a set monthly payment for which they can budget, or have a single large expense for which they need a set amount of cash, like a down payment on another property, college tuition, or a major home repair project.

Its fixed interest rate means borrowers can take advantage of the current low interest rate environment. However, if a borrower has bad credit and wants a lower rate in the future, or market rates drop significantly lower, they will have to refinance to get a better rate.

What Are The Requirements For A Heloc Or A Home Equity Loan

Generally, borrowers for either a HELOC or a home equity loan need:

- More than 20% equity in their home

- A credit score greater than 600

- Stable, verifiable income history for two-plus years

It is possible to get approved without meeting these requirements by going through lenders that specialize in high-risk borrowers, but expect to pay much higher interest rates. If you are a high-risk borrower, it may be a good idea to seek out a service for advice and assistance before signing up for a high-interest HELOC or home equity loan.

Also Check: How To Apply For Student Loan Deferment

What Is The Three

This federal rule says you have three business days, including Saturdays but NOT Sundays, to reconsider a signed credit agreement that secures your principal residence and cancel the deal without penalty. The Three-Day Cancellation Rule applies to many home equity loans .

You can cancel for any reason, but only if youre using your main residence as collateral. That could be a house, condominium, mobile home, or houseboat. The right to cancel doesnt apply to a vacation or second home.

What Are The Differences Between A Heloc And Home Equity Loan

If you have equity in your home and want to borrow money, you may choose a HELOC or home equity loan. Below are some of the major differences between these options.

| Home equity loan | |

| Starts as soon as the loan is disbursed | Interest-only payments during draw period repay principal and interest afterward |

Recommended Reading: Can You Get An Auto Loan Online

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Safeguards And Protections For Helocs

What federal safeguards apply to HELOCs?

Under federal law, lenders must tell you:

- about the terms and costs of the line of credit in most cases when you get an application

- the APR and payment terms

- the charges by the creditor to open, use, or maintain the account, like an application fee, annual fee, or transaction fee

- the charges by other companies to open the line of credit, like an appraisal fee, fee to get a credit report, or attorneys fees

- about any variable-rate feature

Lenders must give you a brochure describing the general features of HELOCS.

If you decide not to take the HELOC because of a change in terms from what you expected, the lender must return all of the fees you paid.

Lenders also must give you three business days, including Saturdays, but not Sundays, to cancel a HELOC, which usually starts to run from when you opened the plan, or when you received all material disclosures, whichever occurs last:

- You may cancel the HELOC for any reason.

- To cancel, you must inform the lender in writing within the three-day period. Then the lender must cancel its security interest in your home and must also return fees you paid to open the plan.

- If the required notice and disclosures are not provided, you may have up to three years after opening the plan to rescind the HELOC.

- For more information, see The Three-Day Cancellation Rule.

How can I avoid possible pitfalls with a HELOC?

Read Also: Where Can I Loan 30k

How Do I Qualify For A Heloc

To qualify for a HELOC, youll need to go through many of the same steps you go through to get a mortgage. In general, youll typically need a maximum debt-to-income ratio of 43% a minimum credit score of 620 at least 15% to 20% equity in the home and a history of making on-time mortgage payments, if you have a home loan.

Youll generally also have to get an appraisal so that your lender has a third-party assessment of your homes value. As a reminder, the amount of equity you have is determined by the value of the home minus any amounts owed to lenders.

Home Equity Lines Of Credit

A home equity line of credit, or HELOC, is a form of revolving credit, which means you can take out money once there is money available, similar to a credit card but usually with lower interest rates. It can be set up for a specific amount and you only repay what you use. With this program some lenders can go up to 90% of the propertys value. Once approved, you will be able to borrow up to that loan limit. Some lenders will charge membership or maintenance and transaction fees every time you draw on the line. At Tropical Financial Credit Union, we do not charge fees every time you borrow. Thats just part of the credit union difference.

As with any home loan, income, debts, other financial obligations, and credit history also determine up to how much anyone can borrow. This option is best if you are interested in having access to funds when needed.

The advantage of a HELOC is that you can periodically take out whatever you need at the time and interest will only be charged on the outstanding balance. The disadvantage is the temptation to charge indiscriminately.

Home Equity can be used for various projects, including paying for repairs to your home, lowering debt, paying for college, or a much-needed family vacation. Before applying for a Home Equity Loan or HELOC, it is best to ensure you have everything necessary to get approved. We have put together this checklist to help with the application process.

You May Like: What Does It Mean To Refinance An Auto Loan

What Is A Home Equity Loan

If a HELOC resembles a credit card, a home equity loan is more like the original home mortgage. You borrow a specific amount, and then you make regular payments during a fixed repayment period.

- With a home equity loan, you apply for the amount you need.

- Most charge a fixed interest rate that doesnt change during the life of the loan.

- Each payment, the same every month , includes interest charges and a portion of the loan principal.

When A Heloc Is Better Than A Home Equity Loan

You should pick a HELOC if:

- The amount of money you need isnt set in stone.

- Youre a disciplined spender and want the freedom of funds that are easily accessible.

- You know you have big expenses coming up but dont know exactly when youll need the money. With a HELOC, you can borrow the money when youre ready.

Recent Posts

You May Like: What Does Usda Home Loan Stand For

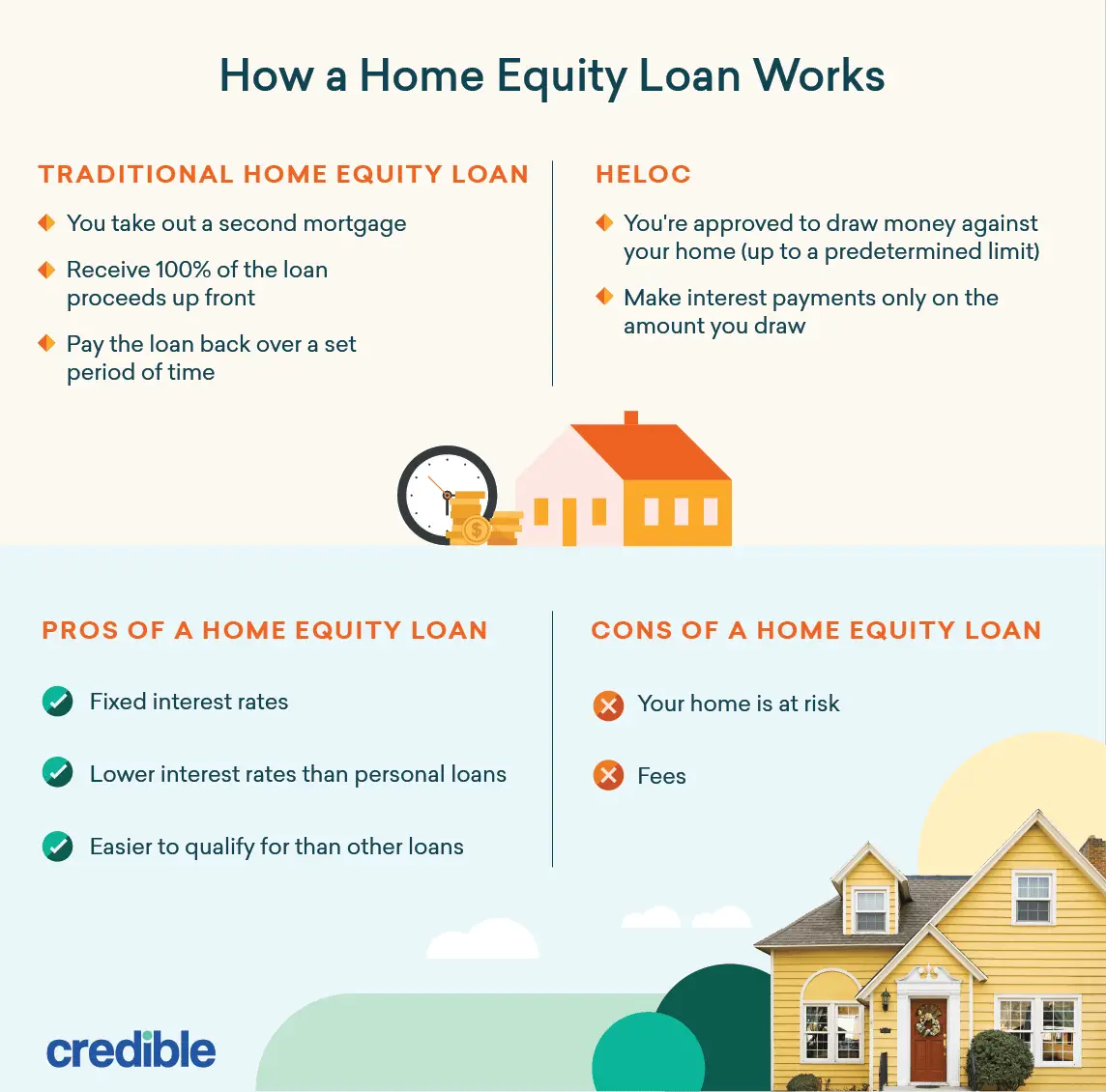

Home Equity Loan Vs Heloc: An Overview

Home equity loans and home equity lines of credit are loans that are secured by a borrowers home. A borrower can take out an equity loan or credit line if they have equity in their home. Equity is the difference between what is owed on the mortgage loan and the homes current market value. In other words, if a borrower has paid down their mortgage loan to the point that the value of the home exceeds the outstanding loan balance, the borrower can borrow a percentage of that difference or equity, generally up to 85% of a borrowers equity.

Because both home equity loans and HELOCs use your home as collateral, they usually have much better interest terms than personal loans, , and other unsecured debt. This makes both options extremely attractive. However, consumers should be cautious of utilizing either. Racking up credit card debt can cost you thousands in interest if you cant pay it off, but becoming unable to pay off your HELOC or home equity loan can result in losing your home.

Home Equity Loans Explained

A home equity loan is a lump sum of money you can borrow from a bank, credit union or other home equity lender. Home equity loans often have fixed interest rates and fixed repayment periods. In those respects, they’re essentially like second mortgages on your home.

Home equity loan pros:

- Typically have low, fixed interest rates.

- You receive a lump sum of money all at once with predictable monthly payments

- You have flexibility in how you can use loan proceeds

Home equity loan cons:

- There are limits to how much you can borrow

- A low credit score or high debt-to-income ratio could make it difficult to qualify

When considering a home equity loan, it’s important to know what lenders look for. For instance, you may need to have a certain amount of equity in your home first before you can borrow against it. And you may be limited on the total amount you can borrow between your first and second home loans.

Aside from that, you’ll also want to consider other requirements, such as:

- Minimum credit score needed for approval

- Any origination fees or points the lender may expect you to pay

- Repayment terms

Comparing rates, fees, repayment terms and credit requirements can help you narrow down which lender may be the best fit for a home equity loan.

Also Check: How To Calculate Loan Payments In Excel