Is A Personal Loan Easy To Get With Bad Credit

Credit scores are a crucial factor when applying for a personal loan. If you have bad credit, youll find it more challenging to get a personal loan. Fortunately, there are lenders who cater to borrowers with bad credit, including those on this list. If you dont qualify for an easy personal loan, take time to improve your score before reapplying.

Find The Best Pre Approval Personal Loans Online

Emergencies happen and they rarely wait around for you to come up with the money to fix the mess. If youre stuck in a situation that , the best pre approval personal loans listed above may be what you need to save the day.

With the online lending networks listed above, you can apply to multiple lenders without damaging your credit and without leaving the comfort of your couch. That means no dressing up to impress a loan officer.

These lenders specialize in providing bad credit borrowers with a loan option that has a competitive personal loan rate and monthly payment requirement to fit your needs. And, even better, you can prequalify before you officially apply to help avoid being turned down and racking up inquiries on your credit report.

Get The Cash You Need

Never put your plans on hold with our multi-purpose, low-interest personal loan option with affordable payment terms. Consider a personal loan as your lifeline or a safety net in times when you need that financial boost. You can also use it for:

- Emergencies

- Home Improvements/ Lot Down Payments *

- Car Repair/ Car Purchase *

*As long as the secured portion is not financed by SB Finance

The Personal Loans offered by SB Finance Company, Inc., are not insured by the Philippine Deposit Insurance Corporation and are not guaranteed by Security Bank Corporation.

Also Check: What Kind Of Loan Can I Get For Home Improvements

Can You Prequalify For A Personal Loan With A 600 Credit Score

Although it will be hard, you can potentially prequalify for a personal loan with a credit score of 600. A credit score of 300-629 is considered bad. 630-689 is fair. 690-719 is good. 720-850 is excellent. You can see that a 600 credit score falls into the bad credit category. As a result, you may have to pay high interest rates or fees, but if you need to borrow money and have bad credit this may just be part of the deal. While you may have limited options its important to shop around and find the loan offer that makes the most financial sense. At Acorn Finance you can check personal loan offers without impacting your credit score. This can help you compare offers from top national lenders quickly, thus allowing you to make an educated financial decision.

What Makes A Loan Easy To Get

Personal loans are easy to get when they have flexible credit score and income requirements. While the best personal loan lenders often have high credit score requirements, usually between 600 and 680, some accept scores as low as 560like those on this list.

Qualifying will be significantly easier if you can find a lender with a lower credit score threshold that specializes in working with borrowers that have damaged credit.

Also Check: Can You Switch Your Car Loan To Another Bank

Best For Relationship Rewards: Citibank

- Time To Receive Loan:5 Days

- Loan Amount:$2,000 – $30,000

Citibank personal loans are available for a variety of purposes, and can help you earn more ThankYou points if you link to an eligible checking account.

-

Potential to earn ThankYou points

-

Discount for autopay

-

Relatively low annual income requirement

-

Only available to qualifying Citibank customers

-

No pre-qualification option

-

Slow funding time

Citibank offers its valuable ThankYou Rewards loyalty program to eligible customers, which allows you to earn points and redeem them for statement credits, gift cards, purchases, and travel expenses. Many Citi credit cards earn ThankYou points, but you can also earn points by linking an eligible Citi checking account to your Citi loan and performing certain activities.

Depending on the type of checking account you link to your loan, you can earn 50 or 125 ThankYou points per month for a direct deposit and bill payment. Youll also get 50 points per month for making a debit or credit transaction with the checking account.

Citis personal loans come in amounts of $2,000 to $30,000, with APRs ranging from 6.99% to 23.99% . Setting up autopay will get you a small rate discount. Repayment terms run from 12 to 60 months, with several options in between. You may receive loan funds as soon as the next business day if you choose direct deposit for the delivery method, while mailed checks generally take around five business days to arrive.

What Is Considered A Fair Credit Score

Whatâs considered a fair credit score depends on the score youâre looking at and the credit-scoring model that calculated it.

FICO® and VantageScore®, for example, are two common credit-scoring companies. Both companies calculate credit scores that range from 300 to 850. But FICO and VantageScore have slightly different criteria for whatâs considered a fair credit score.

- FICO considers a fair credit score to range from 580 to 669.

- VantageScore says a fair credit score ranges from 601 to 660.

Keep in mind that no matter the credit score, the same factors are generally used to calculate it. These are some of the factors that the Consumer Financial Protection Bureau says âmake up a typical credit scoreâ:

If youâre considering a personal loan, . The better your credit scores, the better your chances of qualifying for a personal loanâand the better your interest rate might be.

And remember: Itâs ultimately up to lenders to decide for themselves what credit score is needed for approval.

Read Also: How Do I Use My Va Loan

How To Get A Pre

Summary: Personal Loan provides easy access to money when you need it the most. Read our guide to know more about IDFC pre-approved personal loan and offers.

IDFC FIRST Bank

A personal loan is a helpful tool that can be availed to meet immediate personal expenses like medical emergency, sudden loss of a job, or a non-pre-planned event. In such cases, a pre-approved Personal Loan is a suitable option for quick credit. It requires zero documentation, has an online paperless process, and at times, can also have low processing fees and low personal loan interest rates.

To get a pre-approved personal loan, all you need to do is:

- Check your eligibility and documentation requirements

- Have a good financial profile and relationship with institutions

- Apply through the right channels

How Do Customers Rate Loanonlineph

Online loan service at LoanOnline.ph is extremely convenient. It only took me a minute or so to get a comparison table of loans from different loan companies.Borrowing money online with LoanOnline.ph is extremely easy and convenient, just with a phone connected to the internet. The loan experience at LoanOnline.ph is amazing!I needed to borrow some money urgently. Thanks to LoanOnline.ph, was able to quickly compare loans from many providers fast.

Recommended Reading: What Is The Best Personal Loan To Get

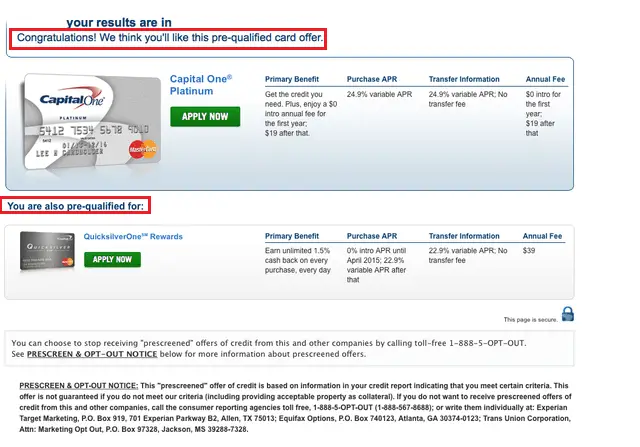

Alternatives To Capital One Personal Loans

If you’re looking for a personal loan and want a big name in finance, you might wonder if Capital One personal loans are an option. The short answer is no. There are no Capital One personal loans. There are, however, plenty of other options. It’s a matter of finding the personal loan that fits your situation best.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Convert Va Loan To Conventional

When Not To Use A Personal Loan

While a personal loan is a useful tool to finance larger or unexpected expenses, there are some situations where it may not be the best option:

- Your credit score is on the lower end. The lower your credit score, the higher your interest rate could be. If you have poor credit, shop around for bad-credit loans, which cater to borrowers with less-than-perfect credit scores.

- You cant afford the monthly loan payments. Assess your spending plan to determine how much you can afford to pay on a loan. If youre on a tight monthly budget, a personal loan may not make sense for you, says Lauren Anastasio, CFP at SoFi.

- You can qualify for better financing options. A personal loan also may not make sense if the loan is used for a purchase that would qualify for a better loan type, says Anastasio. This would apply to real estate, automobiles and education. Mortgages, car loans and student loans are all designed specifically to fund a particular expense and each comes with features and benefits that personal loans do not offer. Consider why youre applying for a personal loan and if youd be better off with a loan designed specifically for that purpose.

- The expense isnt necessary. While its a personal decision if you want to get a personal loan, getting a loan for something that isnt necessary can put your finances at risk.

Are You In Need Of A Personal Loan

Are you facing a sudden financial emergency, or struggling to pay down multiple high-interest debts? Do you have a big purchase coming up that you can’t afford to pay for all at once? A personal loan could help you meet the cost, giving you one or more years to pay back the money, with interest.

Unsecured personal loans tend to have lower interest rates than credit cards, making them a good option if you have an expense and need more than a few months to pay. If you have multiple credit cards with high balances, for example, a personal loan for debt consolidation could help you get a lower interest rate and the convenience of a single monthly payment.

Before applying for a loan, or any financial product, consider how the monthly payments will fit into your budget. Will you be able to repay it on schedule? If not, it could add to your debt and lead to a worse financial situation.

Recommended Reading: How To Get Loan Officer License In California

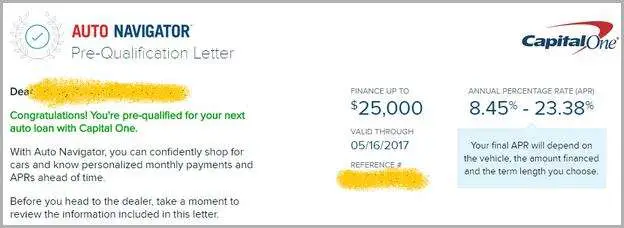

Capital One Application Process

Capital One has a three-step application process for borrowers before they can be approved for a new loan. The loan process is completed online and follows these steps:

If you want to wait to receive funds or shop around, your prequalification from Capital One auto refinance expires 30 days from when your initial application is received. After prequalification, youll have at least 15 days to submit your credit application and provide any required information or documents and sign your contract.

Any contractual offers made to you by Capital One are subject to change upon verification of the information entered in your application.

Lenders Can Check Your Credit Scores When You Apply For A Personal Loan

May 13, 2021 |9 min read

Ever thought about applying for a personal loan? Personal loans can sometimes be useful for making big purchases or consolidating high-interest debts. Before you take that step, it may help to understand how your credit scores could affect your loan application.

While there might not be a minimum credit score required, your credit scores can really affect your chances for approval. Thatâs according to the Consumer Financial Protection Bureau . Many popular credit scores range from 300 to 850. And when it comes to approvals, the CFPB says the higher the better. Keep reading to learn why.

Before you dig into the details of personal loans, it may help to understand some basics first. While definitions can vary, personal loans generally refer to a kind of small loan that borrowers can spend as they see fit. Many personal loans are unsecuredâthat means you donât have to put down money or collateral first to be approved.

Your credit scores are just one of the factors that could impact your ability to get a personal loan. In the end, the decision is ultimately up to the lender.

Also Check: How To Find Out How Much Student Loan You Owe

What Loans Does Capital One Offer

Capital One offers bank accounts, lines of credit, auto loans, and small business and commercial financing, but it doesnt offer personal loans anymore.

- Auto Loans: Through the Auto Navigator program, the company helps you find the right loan terms through personalized options, it helps you choose a car from thousands of dealers nationwide, and it optimizes the loan process, all without even hitting your credit report with a hard credit check.

- Commercial Lending: Capital One also offers a wide variety of commercial financing solutions, including real estate, asset-based lending, and more.

- Small Business Lending: In certain U.S. locations, Capital One offers limited small business banking and lending products as well, including loans and lines of credit.

In addition, Capital One also continues to service any previously existing loans, even if they no longer offer that particular loan product. If you already have a Capital One personal loan, then you can continue to log in and manage that loan online.

How To Spot A Legitimate Loan Company

Even if you have below-average credit, many companies offer legitimate loans you could be eligible for. When searching for a good lender, start with these steps:

- Check for contact information. A lenders phone number, email address and physical address should be readily available on the website, even if its an online-only lender.

- Investigate online reviews. Customers posting on Google and Yelp will have the best insight into the experience of working with a lender.

- Make sure its registered. Legitimate lenders must register with state agencies before giving out loans. Contact your states attorney general if youre unsure if a lender is safe.

Read Also: Where To Check How Much Student Loan Balance

Lightstream: Low Rates On Personal Loans

Why you may want to consider LightStream: LightStream is the online consumer lending division of SunTrust Bank. LightStream offers personal loans with low interest rates to qualified applicants, with a discount for people enrolled in automatic payments.

Here are some more details about LightStream personal loans.

- Good credit required LightStream personal loans are geared toward people with strong credit histories, and applicants who have excellent credit receive the lowest rates.

- Rate-matching program LightStream promises to beat competitor interest rates by a small percentage if certain conditions are met. Just remember, its a very small difference.

- Multiple repayment terms LightStreams repayment options range from 24 to 144 months, depending on the size and purpose of the loan, and loan amounts range from $5,000 to $100,000.

- No fees LightStream doesnt charge origination or late fees. But we dont recommend making your monthly payments late because it can hurt your credit scores. The lender also allows you to pay off your loan early without being charged a prepayment penalty.

Read our full review of LightStream personal loans.

What Lenders Can Potentially Prequalify A Personal Loan For Bad Credit

Some of Acorn Finances lending partners have been called the best lenders for bad credit. Lenders such as Upstart, OneMain financial, and Lending Point can help borrowers with bad credit. Upstart has a minimum credit score requirement of 580. You can access these lenders and more at Acorn Finance.

Closing thoughts

In conclusion, Acorn Finance is a secure place to discover the best personal loan options. Remember to submit accurate and honest information on your application to increase your chances of approval. On approved loans, you can borrow up to $100,000 and take as long as 12 years to pay it back .

Searching for the best personal loan? Check offers online today!

Don’t Miss: When To Refinance Car Loan

What Is An Installment Loan

When people mention personal loans, theyâre often talking about a type of installment loan where you borrow a certain amount of money up front and agree to pay it back a little by little over a set period of time.1

Each payment is usually called an installment. For example, you might have a monthly payment, or installment, of $300. Youâll typically owe that amount each month for a certain number of years until you pay back the full amount.

How Do I Prequalify For A Loan

Most banks, credit unions, and online lenders offer personal loans. In some cases, you may be able to apply online to prequalify. You may already have a preferred financial institution. If you do, you should see if you can qualify for a loan through them and what they can offer. However, you should always compare personal loan offers.

If you want to prequalify for a personal loan from the comfort of your home, you should check offers at Acorn Finance.

Read Also: Can Student Take Over Parent Plus Loan