What Is A Vehicle Loan

You can borrow the money from a lending institution if you dont have the financial resources to pay cash for a new or used car. You agree to pay back the original loan amount plus interest via a set annual percentage rate over a predetermined length of time. Youll make payments monthly until youve paid the loan off in full. When determining the terms of your loan, lenders consider several factors, including:

- Amount financed

- Down payment amount, if any

The lender will also consider the vehicles age and mileage as well as the requested finance amount when determining the length of your car loan. Most lenders wont finance vehicles in excess of 125,000 miles or 10 years of age, so youll need to keep that in mind when shopping.

Current Market Interest Rates And Key Factors That Affect Apr

As you may know, the current interest rate is always fluctuating. Think of it like the stock market. Economic factors and happening across the globe can have a huge impact on the interest rates. Depending on the type of loan you take out, your interest rate may or may not change as the federal rate changes. Along with the federal interest rate, there are lot of the components to the constantly changing APR and competitive rates. Finding a lower monthly payment can require real effort.

test

What are current used car loan rates?

Used car loan rates have historically always been higher than loans for new cars. With a good credit score, rates start as low as 4%. Those with a poor credit score can expect to pay well over 10%.

What car loan rate based on credit score?

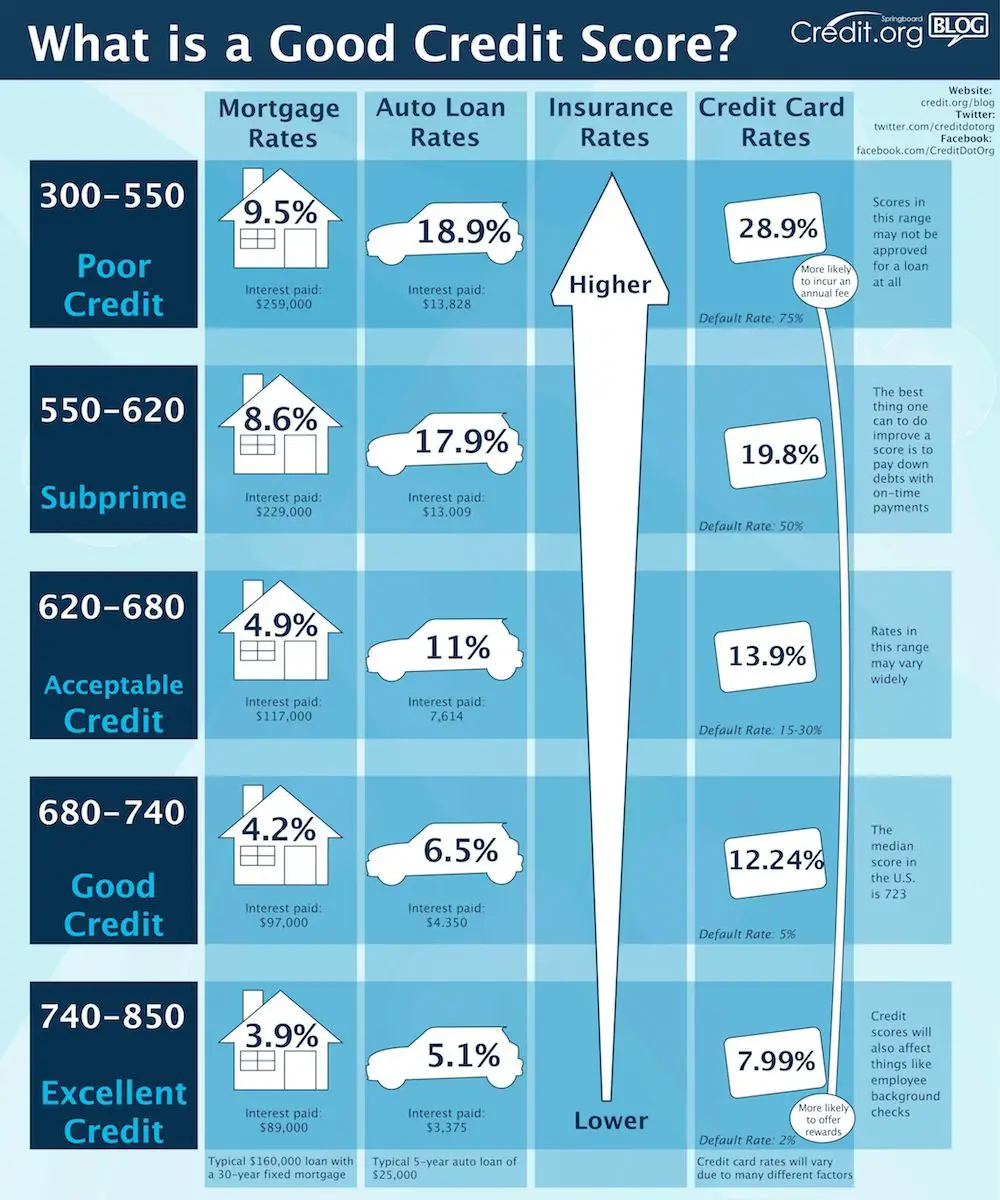

The annual percentage rate is based off your credit score. Lenders use your FICO score to determine the risk when issuing you a loan and your likelihood to pay it back.

What is good interest rate on an 84-month auto loan?

A good interest rate on an 84-month auto loan is 5%. Since the term length is longer than most other car loans, you can handle an interest rate slightly higher than a short-term loan due to the already low monthly payments.

When feds raise interest rates, does it affect car loan rates?

Yes, when feds raise the interest rates lending becomes more expensive for everyone. An increase in the interest rate wont affect you if you have a fixed auto loan.

What auto loan rate can I expect after ch.13?

What Determines Average Car Loan Interest Rates

The most important factor that decides your car loan interest rates is your credit score. The better your score, the lower your APR will be. The best rates are reserved for those with credit scores above 800, but according to Equifax, any score above 670 makes you a low-risk borrower and opens the door to lower average auto loan rates.

To give you an idea of what average auto loan rates you can expect based on your credit score, see the table below. These outline average auto loan rates for new and used cars based on information from the second quarter 2022 Experian State of the Auto Finance Market report.

Also Check: How To Know If I Qualify For Student Loan Forgiveness

Average Auto Loan Interest Rates: Facts & Figures

The national average for US auto loan interest rates is 5.27% on 60 month loans. For individual consumers, however, rates vary based on credit score, term length of the loan, age of the car being financed, and other factors relevant to a lenders risk in offering a loan. Typically, the annual percentage rate for auto loans ranges from 3% to 10%.

What Should You Consider When Choosing An Auto Loan

In a recent interview with Kathryn J. Morrison, consumer affairs expert and instructor at South Dakota State University, she said “When shopping for an auto loan, one needs to consider more than just the interest rate. Are there any additional fees that you will be charged? Do you need to have a down payment to qualify for this rate? What is the total loan amount, and how much interest will you be paying over the life of the loan?”

There’s a lot to take into account when choosing an auto loan. Your credit score, for example, has a major impact on the rates you get. The best rates typically go to those with excellent credit. At the end of Q2 2021, the average credit score was 732 for a new-car loan and 665 for a used car loan, according to a report from Experian.

In Q2 2021, borrowers who received the lowest rates had a score of 781 or higher. Those borrowers, also known as super-prime borrowers, received an average APR of 2.34% for new cars and 3.66% for used cars. Prime borrowers with a credit score between 661 and 780 received an average APR of 3.48% for new loans and 5.41% for used loans, while nonprime borrowers with credit scores between 601 and 660 received an average APR of 6.61% for new car loans and 10.49% for used.

It’s also important to consider what term fits your financial situation. Longer terms generally have lower payments but cost more over the life of the loan.

Read Also: What Is The Cheapest Student Loan Repayment Plan

Will I Get The Lowest Auto Loan Rates From A Dealership Or The Bank

Dealerships usually offer higher rates than banks. However, dealership lending is an easy way to secure loans if you have already decided on the vehicle you want to buy.On the other hand, direct auto loans from banks give more control to the buyer and allow you more flexibility in choosing auto loan rates.The best course of action would be to ask for a quote from the dealership and, comparing rates, terms and other factors. You can also compare the different rates and car loan monthly payments using an auto loan finance calculator before buying.

Tips For Reducing Average Car Loan Rates

The best way to reduce the average auto loan rates you find is to improve your credit score. This can be done by paying your bills on time and keeping your credit card balances low. Paying your monthly payments in full can also help. Outstanding debts or collection notices can impact your credit score, so paying these off will improve your credit.

However, building your credit score can take time and the advice above may not be practical for everyone, especially those with a limited income struggling to pay minimum balances each month.

There are a few other things that can reduce your auto loan rates:

- Have someone cosign: Many lenders allow you to have another person cosign a loan. A cosigner with strong credit can reduce your interest rates.

- Buy a new car instead of a used one: While new cars are more expensive, lenders typically offer lower auto loan rates for new car purchases.

- Place a bigger down payment: A bigger down payment can reduce your interest rate as well as the amount of time it takes to pay off your loan.

You might also consider trying to pay your loan in a shorter time frame. While this may not reduce your loan interest rate, it will mean that you pay off your loan sooner and will have to pay less interest. However, be sure to read your loan contract language carefully. Some lenders charge a prepayment penalty an extra fee for paying down your auto loan too early.

Don’t Miss: How Many Times Can You Get Va Loan

Which Company Has The Best Auto Loan Interest Rates

The best auto loan interest rates available to you depend a lot on the state you live in, your credit score, your employment history, payment history, and many other factors. However, its good to check out several loan providers before zeroing in on your best option.

| Will only finance your loans if you buy from one of their participating dealerships | Will be able to sanction your loan on the same day you apply. However, you will have to sign up for autopay to get the best benefits. | You can get up to four quotes from multiple lenders through myAutoLoan. However, a poor credit score will not give you many options to choose from. | Does not accept co-signers for financing. |

*As of January 2022

Pros And Cons Of A 72 Month Car Loan

If you are in the market for a car the 72 month car loan is a popular choice, but you need to be sure its right for you. Below you can compare the advantages and disadvantages of a 72 month car loan.

Pros

-

The longer the loan term, the smaller your monthly payments will be.

-

Lower monthly payments mean more financial flexibility.

Cons

-

Longer-term loans typically have higher interest rates than shorter-term car loans.

-

You can end up owing more on the car than it is worth due to .

-

On a new car, the warranty will likely expire long before the loan is paid off adding car maintenance to your transportation bills.

Also Check: How Do I Pay My Unsubsidized Student Loan

Auto Loan Rates By Credit Score

As mentioned, lenders use credit score as the primary determinant of a potential borrower’s ability to pay off a loan. So, the better your credit score is, the more competitive interest rates you will receive. Below are the average APRs for new and used vehicles in the second quarter of 2022 according toExperian.

| 20.43% |

The Higher Your Credit Score The Less It Will Cost To Borrow

are a numerical representation of your credit history. They function as a grade for your borrowing history ranging from 300 to 850, and include your borrowing, applications, repayment, and mix of credit types on your credit report. Companies use credit scores to determine how risky they think lending to you would be.

A lower credit score makes borrowing more expensive. In the data above, the cheapest borrowing rates went to people with the best credit scores. Meanwhile, those with the lowest credit scores paid about 10 percentage points more to borrow than those with the highest scores.

The interest rate also has a big effect on monthly payment. Using Bankrate’s auto loan calculator, Insider calculated how much a borrower paying the average interest rate would pay for the same $30,000, 48-month new car auto loan:

| Super Prime | 2.40% | $656 |

With the interest rate as the only factor changed, a person with a credit score in the highest category will pay $656 a month, while a person with a score in the lowest category would pay $831 a month, or $175 more for per month for the same car.

Don’t Miss: Loan Officer Vs Loan Processor

How To Choose The Best Auto Loan Lender

Choosing the right lender comes down to financing a vehicle you can afford. It is recommended that you get quotes from at least three lenders outside of a car dealership before deciding which is right for you. Pay special attention to the following factors:

1. Approval requirements. Every lender has different requirements to receive approval. Lenders will consider aspects like your credit history, income and debt-to-income ratio. Your credit serves as the primary determinant of potential rates. Keep in mind that typically, the worse your credit score is, the less competitive your rates will be.

2. Annual percentage rate. The APR represents the amount of interest that you will have to pay during the loan. Pay close attention to this number a higher APR means more interest and thus a larger monthly cost. Also remember to shop the total loan amount, not just the monthly payment.

3. Loan terms. While a lower monthly payment may seem appealing, pay close attention to available terms, and consider how the lifetime of your loan will impact your overall cost. A longer loan term will lower your monthly cost, but you will pay more interest. Conversely, a shorter loan term means a higher monthly cost but a lower cost over the life of the loan.

Auto loans let you borrow the money you need to purchase a car. Since car loans are typically secured they require you to use the automobile you are buying as collateral for the loan.

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Read Also: How Can I Find My Student Loan Number

Richmond Hill At A Glance

- Average HI is $101,000.

- Based on the latest independent research, an average consumer debt in Richmond Hill is at $36,600. In this Richmond Hill is below Ontarios average.

- Employment rate: 60%.

- Based on the most recent independent research, an average Richmond Hill inhabitant makes $52,200 per month.

- Richmond Hills key hiring areas are professional, scientific and technical services, mining, quarrying, and oil and gas extraction, retail trade.

Our online portal helps you select local Payday Loan providers in Richmond Hill for your borrowing needs.

Check our catalogue of Payday Loan lenders to find the latest Payday Loan rates in Richmond Hill

Average Interest Rate For Car Loan: Conclusion

Average interest rates for car loans are determined by a variety of factors, the most impactful thing being your credit score. Depending on your credit score and if you are buying a used or new car, auto loan rates can vary. Before financing a car, we recommend that you look at all of the providers available so you can get the best rates possible.

Read Also: Interest Rates For Personal Loans

How To Calculate Auto Loan Interest

Its smart to determine your expected auto loan interest rates prior to signing off on your next loan. Not only will it put you in control of your finances, but it can ensure that you dont end up paying more interest than you should. Here are a few ways that you can calculate your car loan interest rate.

- Calculate on your own. You will need the interest rate, term and loan amount, just as you would for any other method. Divide your interest rate by the number of payments in a year, then multiply it by your loan balance. The resulting number will be how much your interest payment for the month is.

- Use an auto loan calculator. If you are looking for a simpler route to avoid any mental math, an auto loan calculator will handle all the calculations. Bankrates auto loan calculator will present you with your estimated monthly payment, total interest paid and a full amortization schedule.

- Speak directly to a loan officer. Finally, connecting directly with a loan officer will provide you with a more tailored experience. This way they can tell you expected rates with your credit history in mind. Speaking directly to a loan officer is also a great way to gather and compare a few options.

Auto Loan Ontario Is The One Stop Auto Loan Company With Solutions For All Credit Situations

Once you complete ouronline credit application, you’ll get personal attention from our Ontario financial experts so that they can understand your individual personal situation and work hard to get you the lowest interest rate available and ensure that you can have a comfortable and affordable monthly payment for the vehicle you want!Let Auto Loan Ontario, the automotive financing experts easily walk you through the vehicle loan process and all the options available to you for your next automobile purchase so that you make an informed educated decision. We know how to get you the most money and the best interest rates. We’ve helped people with:

| Ontario No Credit Car Loans |

| Bad Credit Vehicle Loans |

Don’t Miss: Can You Pay Off Sallie Mae Loan Early

What To Know Before Applying For An Auto Loan

When looking for a car loan, it is best to shop around with a few lenders before making your decision. Each lender has its own methodology when reviewing your application for a loan and setting your interest rate and terms.

Generally, your credit score will have the biggest effect on the rates offered. The higher your credit score, the lower APR you will receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms, but there are still ways to finance a car with bad credit. Choosing a longer repayment term will lower your monthly payments, although you will also pay more interest overall.

If you find a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without affecting your credit score.

How The 2022 Fed Hikes Impact The Cost To Finance A Car

The July meeting of the Federal Open Market Committee raised the benchmark rate to 2.25-2.5 percent, this is up from the June meeting and is working towards the goal of controlling growing inflation. For drivers already dealing with new vehicles costing an average of over $48,000 in July 2022, according to Kelley Blue Book, and the price to fill up at the pump hitting record highs, the added burden of higher rates feels daunting.

The benchmark rate doesnt directly shift auto rates, but it affects the number that auto lenders base their specific rates on. This means that it is possible you will be met with steeper costs to borrow money for vehicle financing due to the Fed hike, but the hike itself is only one part of that increase.

Even with higher costs across the board, there are still a few ways to prepare and save money, regardless of movements made by the central bank.

Recommended Reading: What Loan Is Best For First Time Home Buyers