What Is Included In The Debt

The debts that are included in this calculation may surprise you for instance, monthly rent payments are often counted as debt for this calculation, and so is alimony. For the purposes of a DTI ratio calculation, debt doesnt have to come from a loan.

If youre considering a loan of any kind, whether its a personal loan or a mortgage loan, youll want to have your DTI ratio calculated. You should factor in the following when calculating your DTI ratio.

- Minimum credit card payments

- Any other miscellaneous debts that you may carry

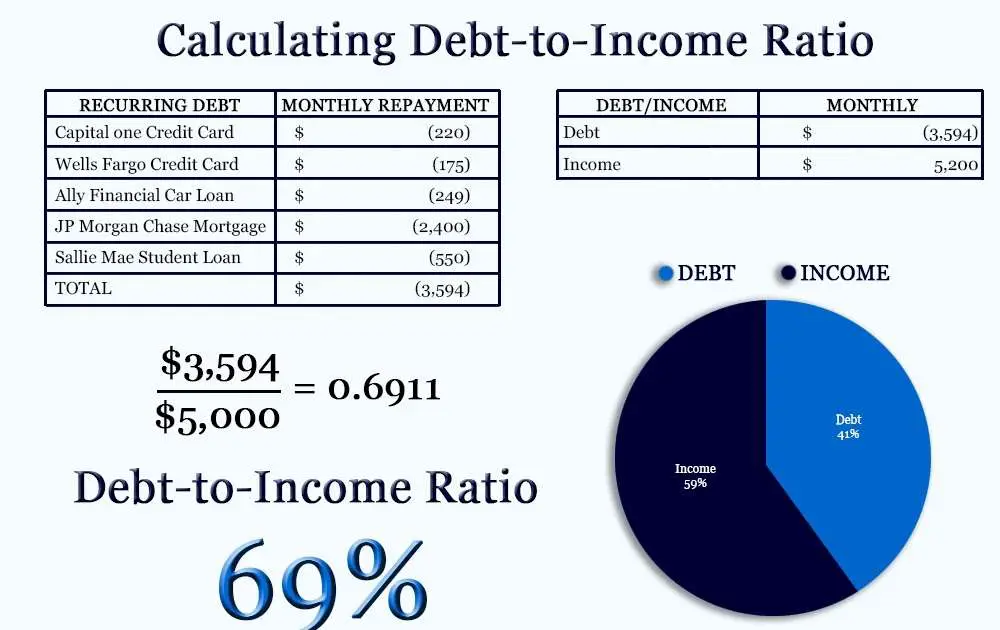

Add Up All Your Monthly Debt

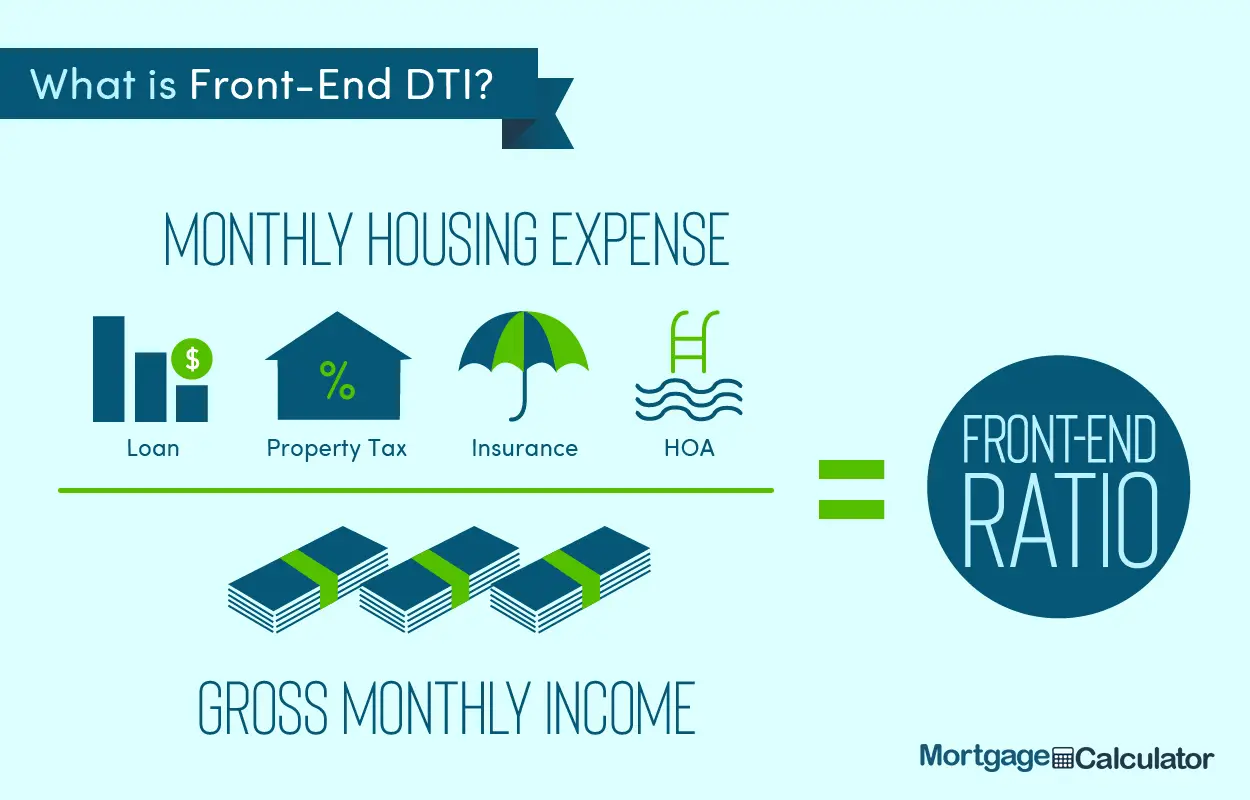

When lenders add up your total debts, they typically do it one of two ways these two methods of determining your DTI are called front-end and back-end ratios.

Your front-end ratio only takes into consideration your housing related debts, such as rent payments, monthly mortgage payments, real estate taxes, homeowners association fees, etc.

Your back-end ratio, however, includes those monthly payments as well as other debts that might show up on your credit report, such as , personal loans, auto loans, student loans, child support, etc.

Your lender might calculate your front-end or back-end ratio when determining your DTI and sometimes they may look at both to get a better idea of your financial situation. When calculating your own DTI, its a good idea to add all these expenses up as part of your monthly debt to be prepared. Keep in mind that when tallying up your debts, lenders typically only look at things that appear on your credit report so things like utility payments may not actually count toward your total.

How Can You Lower Your Debt

Since the formula for your debt-to-income ratio uses two different numbers, there are a couple of different ways to lower your DTI ratio. The first is to lower the amount of debt that you owe.

You can do this by paying off your credit cards or loan balances ahead of schedule. Even if youre having trouble paying beyond your minimums, look at refinancing options to lower your monthly debt payments with a lower interest rate.

Read Also: What Credit Bureau Does Usaa Use For Auto Loans

An Acceptable Debt To Income Ratio

- 100% or higher DTI â these prospective borrowers represent a huge risk and do not show an ability to make regular mortgage payments. Almost all lenders will reject an application in this instance.

- 75% to 99% DTI â borrowers who are very high risk. A select few specialist lenders will be willing to look at the application and make a positive decision where other factors are given more weight, such as credit score and a clean credit history or substantial deposit.

- 50% to 74% DTI â high risk borrowers. Some specialist lenders are willing to accept applications at this level, but terms are less favourable and larger deposits are required.

- 40% to 49% DTI â moderate risk borrowers. Specialist lenders will want to see good credit history and may ask for larger deposits.

- 30% to 39% DTI â acceptable risk. Most specialist lenders will offer a mortgage at this level at standard terms.

- 20% to 29% DTI â good borrower. Almost all lenders are happy to approve mortgage applications at this level.

- 0% to 19% DTI â very low risk borrower. All lenders will consider an application.

Lowering Your Debt Balances

You can improve your debt-to-income ratio either by increasing your income or by reducing your debt. For most people, the first option is not viable however, everyone should have a plan to get out of debt.

- Build a budget and create a debt repayment plan

- Consolidate debt to lower interest costs and pay off balances sooner

- If you are struggling with too much debt, talk with a licensed debt professional about options that can help you eliminate debt sooner.

To ensure that youre making progress, recalculate your debt-to-income ratio every few months. By seeing your DTI fall, you are more likely to remain motivated to bring it down further.

Fill out the form below and receive a No-Obligation Consultation

Don’t Miss: Do Mortgage Loan Officers Get Commission

How To Lower A Debt

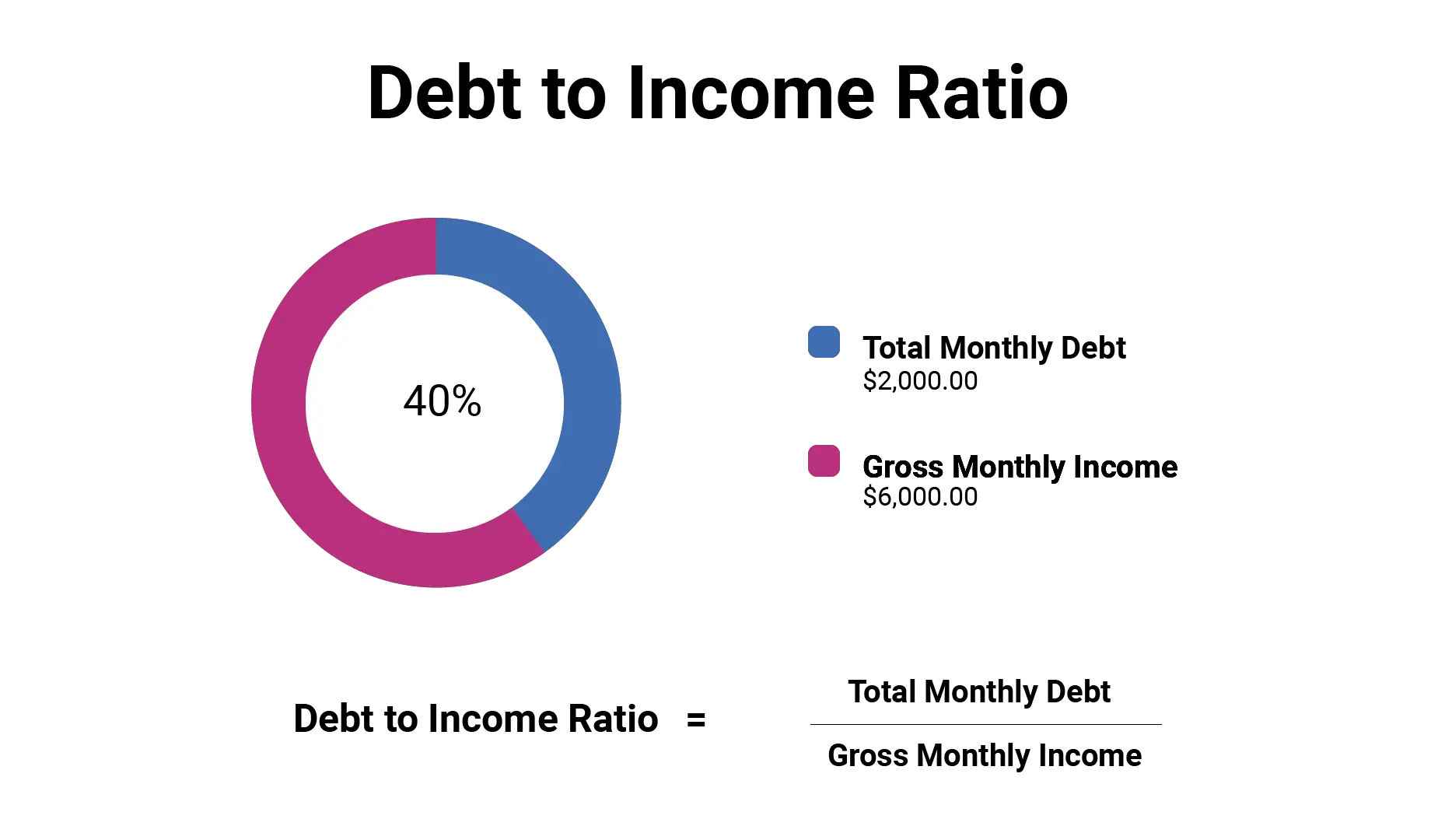

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johns income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

What Income Is Included In Your Debt

The second portion of the DTI involves your income. Lenders want to see solid, reliable, regular income if they are going to use it to predict whether you can afford your future monthly payments on a new loan. Consequently, the most common forms of monthly income included in your DTI are:

-

Alimony Received

-

Supplemental Security Income

-

Tips and Bonuses

Lenders are looking for income that the borrower can count on receiving throughout the life of the debt repayment term.

Read Also: How Long It Takes For Sba To Approve Loan

Why Is A Good Debt

A low DTI ratio shows a lender that you have a good handle on your debt and income. If you have a DTI ratio of 10%, this means that you dont spend a large majority of your gross monthly income on debt payments each month.

On the other hand, your lender might decide you have too much debt for the amount of income you earn if they see a high DTI ratio. You may want to consider improving your DTI ratio for this reason.

How To Reduce Your Debt

Really, there are only two ways to reduce your debt-to-income ratio: increase your income or reduce your debt.

If your day job makes for a full schedule, it might be tricky to increase your income, but people do pick up side hustles for additional income.

Reducing debt might be a better option for bringing down your DTI, particularly if you carry a lot of . That means reviewing your spending and cutting back where you can.

A third option is to downsize either your house or your car to a less expensive choice. Moving house isnt easy, but it might be worth exploring.

Consolidating your unsecured debts can be a way to reduce your monthly payments without having to qualify for a loan. Following a debt management plan, such as MMIs option, is one way to bring down your monthly payment.

Also Check: Fha Refinance Mortgage Calculator

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

Importance Of Debt To Income Ratio

The Debt to Income ratio is the measure of the percentage of the income of a person that is being used up for debt repayment and servicing. This measure is important as it affects your Credit score and credit rating. This is an important criterion when you wish to borrow a loan. A low debt-to-income ratio shows repayment capacity and creditworthiness of the borrower and a high debt-to-income ratio shows a potential inability to pay new EMIs. Since this is the criterion also checked by lenders, a low debt income ratio increases your chances of being eligible for loans at the best interest rates.

Its a prudent move to keep checking your debt to income ratio when any of the parameters such as income or debt, change so that you can make informed decisions about how to maintain a low ratio.

This may happen if your income increases or decreases or a past debt is paid off in full thus reducing the gross monthly debt.

Also Check: Usaa Used Car Loan

How Does A High Or Low Debt

A high debt-to-income ratio directly affects a consumers ability to secure a loan. A debt-to-income ratio of around 6 is generally considered high. Different institutions have different rules around what they consider, but if you have a debt-to-income ratio of 9 or above you likely wont be considered for a loan with the major institutions.

A low debt-to-income ratio is generally under 3.6, and is often viewed favourably by lenders. Having a low debt-to-income ratio can help show an ability to successfully manage debt. Consumers with a low debt-to-income ratio may be more likely to be offered lower fees and rates by prospective lenders and may also have more loan options to choose from.

Related article: Interest rate ranges: How is your rate determined?

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Also Check: Usaa Auto Loan Rates

What Is Your Credit Rating

Your credit rating is based upon your history of monthly payments , your low balances when compared to your credit limits , and how long you have had credit, among other factors. It attempts to predict your future loan payment behavior based on your recent loan payment history.

The higher your credit score, in many cases, the higher DTI a lender will consider acceptable.

What Is The 28/36 Rule Of Thumb For Mortgages

When mortgage lenders are trying to determine how much theyll let you borrow, your debt-to-income ratio is a standard barometer. The 28/36 rule is a common rule of thumb for DTI.

The 28/36 rule simply states that a mortgage borrower/household should not use more than 28% of their gross monthly income toward housing expenses and no more than 36% of gross monthly income for all debt service, including housing, Marc Edelstein, a senior loan officer at Ross Mortgage Corporation in Detroit, told The Balance via email.

Its important to understand what housing expenses entail because they include more than just the raw number that makes up your monthly mortgage payment. Your housing expenses could include the principal and interest you pay on your mortgage, homeowners insurance, housing association fees, and more.

Read Also: Usaa Pre Approval For Mortgage

Read Also: Autosmart Becu

What Should You Do To Improve The Dti Ratio

- You can increase your EMIs toward a personal loan that you have availed. Though this will temporarily increase your DTI ratio , it will, in the long run, bring down your total debt considerably. This, in turn, will reflect well on your DTI ratio.

- Do not acquire more debt.

- Postpone a few large purchases if you can. This will give you more time to save and help you make a larger lump sum payment in time.

- Dont forget to keep track of the debt-to-income ratio every month. This will make it easier for you to notice deviations if any, and take corrective measures.

Availing of the financial assistance you need is easier with pre-approved offers on personal loans from Bajaj Finserv. All you need to do is share a few details and get your pre-approved offer.

*Terms and conditions apply

What Is Your Dti Ratio

A debt-to-income ratio may be a measurement of your monthly income compared to your debt payments. Lenders often use this ratio to work out your creditworthiness. When you have much extra income monthly, youre more likely to qualify for a loan.

Learn how the debt-to-income ratio works, and how to calculate the ratio.

You May Like: How To Calculate Va Loan Amount

How To Improve Dti Ratio For A Better Chance Of Car Loan Approval

If you have a high debt-to-income ratio, its better to improve it first to increase your chances of getting approved for a car loan. Here are some tips:

- Review Your Expenses

Check your expenses first. Create a list of all your monthly debt payments. For example, your rent or mortgage, credit card debt, student loans, and property taxes. Evaluate all your monthly expenses including your gym memberships, groceries, Netflix subscription, internet, and cable bills those that have automatic deductions are worth your careful review. Decide which ones you can do without and be disciplined enough to take the corrective action required. .

- Lower Your Debt

There are different ways to pay down your debts. You can use the snowball method wherein you concentrate your payment efforts toward your smallest debt first or the avalanche method where you make minimum payments on all your debts, including your mortgage, except the one that has the highest interest rate.

- Increase Your Gross Monthly Income

You can increase your gross monthly salary by finding a job that pays more or asking for a raise if you think you deserve it. But if these options are not possible, you can also get a part-time job.

- Create A Budget And Stick To It

Budgeting helps you avoid overspending and making unnecessary purchases. It will also allow you to set aside money for debt repayments.

- Consider Refinancing Your Loans

Donât Miss: Usaa Auto Loan Requirements

What Are The Limitations Of Dti Ratio

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Don’t Miss: Can You Use A Va Loan For Investment Property

Weigh Your Monthly Debt Payments Against Your Income To See If Youre Overextended

A debt-to-income ratio is a key factor that lenders use to determine if youll be approved for a loan. During the underwriting process after you apply for a loan, the underwriter will check your debt-to-income ratio to see if you can afford the loan payments. If your DTI is too high, you wont get approved for the loan.

For consumers, debt-to-income is an easy way to measure the overall health of your finances. You can check your DTI to see if you have too much debt for your income. If your debt ratio is too high, then you know to scale back and focus on debt repayment. If you need help, call to speak with a trained credit counsellor for a free debt and budget evaluation.

What Are The Other Expenses To Consider When Buying A Car

Owning a car goes beyond the monthly loan payments. Youll have to consider other expenses, which include the following:

- Regular insurance premiums

- Auto maintenance and repair costs

- Taxes and registration

- Parking fees

You will find several car repayment calculators online to help in your calculation of how much mortgage youre going to be paying every month for the amount of money that would like to borrow.

How much can I borrow for a car? Thats a fairly common question for car buyers. You can also find free car loan calculators that could give you an estimate on how much fund you can get from lenders based on your credit, gross income a month, and debt factors.

Recommended Reading: Can A Va Loan Be Used For An Investment Property

Read Also: Rv Payment Calculator Usaa

Lower Your Debt Payments

For most people, attacking debt is the easier of the two solutions. Start off by making a list of everything you owe. The list should include credit card debts, car loans, mortgage and home-equity loans, homeowners association fees, property taxes and expenses like internet, cable and gym memberships. Add it all up.

Then look at your monthly payments. Are any of them larger than they need to be? How much interest are you paying on the credit cards, for instance? While you may be turned down for a debt consolidation loan because of a high debt-to-income ratio, you can still consolidate debt with a high DTI ratio with nonprofit debt management. With nonprofit debt management, you can consolidate your debt payments with a high debt-to-income ratio because you are not taking out a new loan. You still qualify for lower interest rates, which can lower your monthly debt payments, thus lowering your ratio.

Remember that improving your DTI ratio is based on debt payments, and not debt balances. You can lower your debt payments by finding a debt solution with lower interest rates or a longer payment schedule.Other alternatives worth considering to lower your expenses and pay off debt:

Most important, make a realistic budget designed to lower your debt and stick with it. Once a month, recalculate your debt-to-income ratio and see how fast it falls under 43%.