What To Watch Out For

- No private party purchases. You can only use a Chase auto loan to buy a car from a dealership.

- Long turnaround. It can take up to three days to get preapproved through Chase many lenders can preapprove you in minutes.

- Potentially more expensive. If you choose not to make a down payment, youll end up paying more in interest and could have higher monthly repayments.

- Little information online. Its hard to find basic information about rates, terms, loan amounts and eligibility without applying to prequalify.

- Doesnt offer short loan terms. The shortest term length for a Chase auto loan is 48 months, so interest can add up over four years if you make minimum payments only.

Case study: Adriennes experience

Adrienne FullerPublisher

I took out a Chase auto loan when I purchased a used 2011 Toyota Tacoma at a dealership. I applied for financing through the dealer not with Chase directly so my comments are limited to that experience.

I have an excellent credit score and the sales rep offered me an interest rate of 3.8%. When I mentioned this to him, he said, Well how does 3.2% sound instead?

It seemed really odd to me that he could modify the offer so easily and makes me wonder how much I left on the table by not negotiating further. It also makes me wonder about the size of the kickback the dealer gets. If I had applied directly through Chase, would my rate have been even lower?

Auto Loan Ontario Is The One Stop Auto Loan Company With Solutions For All Credit Situations

Once you complete ouronline credit application, youâll get personal attention from our Ontario financial experts so that they can understand your individual personal situation and work hard to get you the lowest interest rate available and ensure that you can have a comfortable and affordable monthly payment for the vehicle you want!Let Auto Loan Ontario, the automotive financing experts easily walk you through the vehicle loan process and all the options available to you for your next automobile purchase so that you make an informed educated decision. We know how to get you the most money and the best interest rates. Weâve helped people with:

| Ontario No Credit Car Loans |

| Bad Credit Vehicle Loans |

Read Also: Can You Use Va Home Loan Twice

Show Up With Financing

Financing is negotiable and can be confusing, so consider going with a pre-approved offer, like one through Chase Auto. With Chase Auto you can apply for financing and arrive at the dealership knowing exactly how much you can spend. A pre-approval is usually good for a specific amount of time for a certain amount of money.

Don’t Miss: Hard Money Loan Interest Rate

How To Apply For A Chase Auto Loan

There are two ways to use Chase to finance a vehicle purchaseâthrough Chaseâs digital car-buying tool or by applying directly through a network dealer.

The process varies slightly for each, but these are the general steps to follow when applying for a Chase auto loan:

Contact Us Subaru Motors Finance Chasecom

![[Warning Government Action] Chase Auto Loan Review (2020) [Warning Government Action] Chase Auto Loan Review (2020)](https://www.understandloans.net/wp-content/uploads/warning-government-action-chase-auto-loan-review-2020.png)

800-662-3325

Loan Customer Service 1-800-662-3325. Lease Customer Service 1-800-644-1941 or its affiliates and are licensed to JPMorgan Chase Bank, N.A. . Subaru is solely responsible for its products and services and for promotional statements about them, and is not affiliated with Chase or its affiliates. Auto finance accounts are owned by

See Also: Customer Service / Show details

Recommended Reading: How To Know If I Qualify For Student Loan Forgiveness

Where Does Chase Fall Short

- No personal loans. You cant use Chase to consolidate your debt or take out a loan for personal use. Instead, youll have to rely on Chases credit card options if you need personal credit.

- Potentially high rates. Not everyone qualifies for competitive rates. If you have poor credit, you likely wont receive the interest or terms you may be able to find elsewhere. And because of Chases requirements, you might not even qualify at all.

- Subprime reviews. Chase doesnt receive the type of glowing response wed expect from a bank thats been around for nearly 200 years. This likely has something to do with its involvement in the subprime mortgage crisis and its out-of-date customer service techniques.

- Limited state availability. Not all of Chases loan products are available in all states. And if you prefer applying for a loan in person, Chase only has branches in 31 states.

Where does Chase have branches?

Chase only has branches in the following states:

What Is Chase Auto Finance

Chase Custom Finance is the service mark used by Chase Auto Finance Corp. , a subsidiary of JPMorgan Chase Bank, N.A., a wholly-owned subsidiary of JPMorgan Chase & Co.,to operate its third-party auto loan business. Chase Auto has received consumer complaints alleging problems with billing, collections, customer service, and improper credit reporting. If you have been contacted by Chase Auto, make sure you understand your rights before taking action.

According to public information from the Delaware Secretary of State website, Chase Auto Finance Corp. was incorporated in 1984 in Delaware. Although the Better Business Bureau established a profile page for Chase Auto Finance Corp. in 2007 and lists the company as a consumer finance company, it does not maintain complaints against Chase Auto Finance Corp. on that page. Instead, complaints against Chase Auto appear to be grouped within complaints against its parent company, JPMorgan Chase & Co. on the BBB profile page for the parent company, which the BBB established in 1923. The BBBs profile page for JPMorgan Chase & Co. also lists JPMorgan Chase-Auto Finance as one alternate business name for the company.

For car buyers, the Chase Auto website provides limited information only about payment options, electronic statements, payoffs and lien releases.

Recommended Reading: Where To Get Fast Loan Online

How Does A Monthly Car Payment Calculator Work

A monthly car payment calculator takes your loan details and turns them into projected monthly payments. Your monthly payment will be determined by the vehicle cost, loan term and which is highly dependent on your credit score. The APR for used cars is often higher than for newer cars, as well. Once youve entered these details into the calculator, itll automatically provide your estimated total monthly payment based on your loans term, APR, and loan amount. The result may also show the total amount of payments and total interest to be paid over the life of the loan.

Chase Auto Loan Details

Chase auto loans are available for purchases of new and used cars. Compared to the best loan providers, Chase auto loans come with slightly higher annual percentage rates , but one nice feature is that there are no fees for application, prepayment, or origination. A summary of key loan details is outlined in the chart below.

| Chase Auto Loan Details |

|---|

Also Check: Whatâs The Average Student Loan Interest Rate

Recommended Reading: How To Refinance An Avant Loan

Are Low Down Payment Car Programs Worth It

If youve been shopping around for affordable vehicles on the market, then you may have heard of programs such as $500 down payment cars. It may sound tempting to you, but its worth understanding the risks that that these types of programs sometimes carry.

Some lenders and dealerships provide special deals such as $500 down payments to entice car buyers on a limited budget. For those struggling to obtain a loan without committing to a hefty down payment, this could sound like an appealing option.

However, keep in mind that these lenders could also have assessment criteria to determine the risk of lending to you, or may have practices that could be considered harmful for consumers. For example, they may expect a higher credit score or impose very high interest rates.

Driving a car, in a lot of cases, is a necessity that can be used to justify taking economical risk, but it is always advisable to work with reputable lenders and dealerships. Additionally, beyond your capability to provide down payment, the long term consequences that this loan may have on your financial stability. More than often saving a bit more upfront to afford a higher down payment really pays off.

How Do I Qualify For A Car Loan

Answered by Jim Manelis, car enthusiast and Chase Auto Executive.

You’ve found your dream car and can’t wait to get behind the wheel. Now, you have to figure out how to pay for it. Most car shoppers need to finance the purchase. That’s when you borrow money from a dealership or a lender and pay them back over time, usually with interest, to purchase a new or used vehicle.

Don’t Miss: How Can You Refinance Your Car Loan

Should You Get An Auto Loan From A Bank Or Dealership

Itâs worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrowerâs credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

Itâs important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

Donât Miss: List Of Companies That Received Ppp Loans

Taking Action On A Car Loan

Hopefully, you found this Chase Auto Loan Review helpful because getting an auto loan can be complicated and a time-suck if done incorrectly.

Now that you know there are dealerships ready and willing to work with you there is no reason to go without a car.

Getting a car loan is also part of establishing a different type of tradeline which overtime, will help increase your credit score.

Don’t Miss: How Do I Refinance An Auto Loan

What Makes Them Different

The Chase Car Loans website offers a comprehensive financial education library to help you make an auto purchase.

The focus is on the entire auto purchase process, starting with multiple articles and worksheets to determine if you should purchase a new or used automobile.

You can jump around from section to section or go through the entire process to best prepare you for making your car purchase and obtaining Chase Car Financing.

Most of Chases auto loan competitors provide education more towards choosing the best auto loan and the factors that determine what you can afford.

Chases car loan education resources stand out as much more comprehensive than other lenders websites we have reviewed.

Of course, these resources are available to anyone whether you obtain a loan from Chase Auto Financing or not

Another nice feature Chase offers is a free credit score through Chase Credit Journey whether you are a customer or not.

You May Like: When Can You Use Your Va Loan

Should I Consider Paying My Car Loan Off Early

As you can see, there are potential benefits to paying off a car loan early but before you make any changes, consult your lender. Things may not be as straightforward as sending your bank a big check to call it a day. Some loan agreements have early payment penalties which would derail the whole purpose of paying off your loan early.

Read Also: What Percent Down For Conventional Loan

Contact Us Home Lending Chasecom

800-342-3736

Phone: 1-800-342-3736 or www.dfs.ny.gov Chase isnât registered with the NY Superintendent of Financial Services. Email You can send us a secure message or question about your mortgage when you sign in to your Chase tà i khon. Well respond within 24 hours. Not enrolled? Sign up now. Sign in Mail

See Also: Phone Number / Show details

What Is A Chase Auto Loan

Chase offers auto loans to buy either a new or used vehicle from a dealership. Terms range from four to eight years with APR rates as low as 2.59%. However, your creditworthiness will affect the rate you ultimately get.

What types of auto loans does Chase offer?

- New car loans. Borrow to buy a new vehicle through a dealership.

- Used car loans. Borrow to buy a used car from a dealership.

- Auto loan refinancing. Trade in your current car loan for more favorable rates and terms.

How do Chase auto loan rates work?

The rate you get ultimately depends on the car youre wanting to buy and your overall creditworthiness. Use Chases online Payment Calculator to estimate your monthly payments and total interest over the life of the loan.

Recommended Reading: How Do I Pay My Student Loans

Tips For Getting The Best Financing

- Know your credit score this plays a key role in the interest rate you’ll pay for your loan. A high credit score can help you get a low interest rate on your loan and save you money.

- Pick your payment how much can you realistically afford to spend each month without straining your budget?

- It’s important to remember that your monthly costs will include more than the car payment you make to your lender. Calculate your total Cost to Own using pencil and paper or one of the many online calculators available. Your total Cost to Own should include your car payment, insurance, maintenance and gas. You should also factor in yearly registration renewal and miscellaneous items.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How Can I Get My Cosigner Off My Car Loan

Understanding Down Payments On A Car

Purchasing a car often involves making several important decisions. You may need to decide which lender to use, the amount you need to borrow, the cost of ownership, and whether youre prepared to make that financial commitment. Among these many decisions lies the question of making a down payment.

Is it worth putting a down payment on a car? The answer is usually yes. This is because it could often provide specific benefits to a borrower. For example, a higher down payment can help you secure a lower interest rate and better loan terms. In the long run, you can enjoy a more affordable cost of borrowing.

Another thing to remember is that cars depreciate like most other assets. A new car could depreciate by as much as 20% during the first year, so you might want to consider making a larger down payment to help you have more equity in your car than you would with a low or no down payment.

So, the case for making a down payment on a car is certainly compelling. However, there are several factors to consider before deciding on the amount you pay.

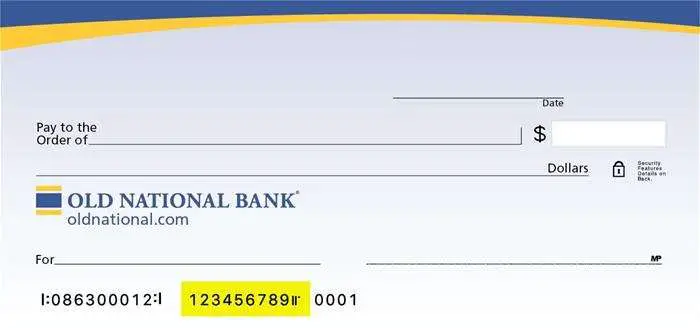

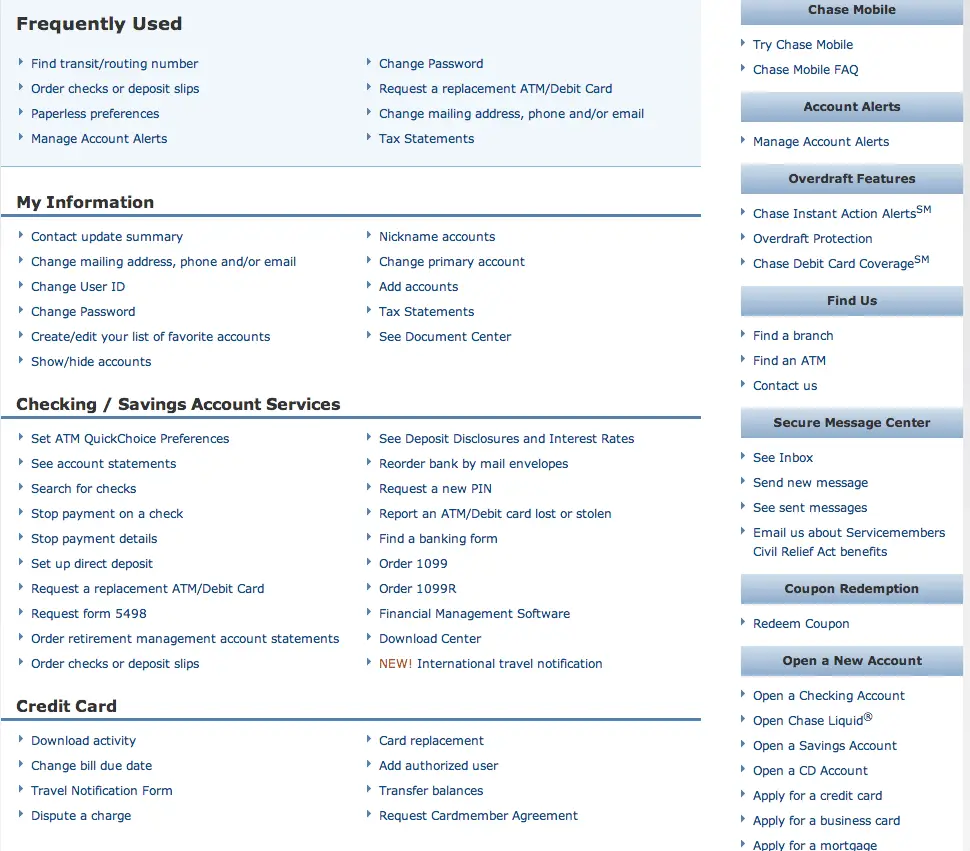

How To Print The Check Image On Chase Bank

Get prequalifiedopens in the same window. 1 To finance a new or used car with your dealer through JPMorgan Chase Bank, N.A. , you must purchase your car from a dealer in the Chase network. The dealer will be the original creditor and assign the financing to Chase. All applications are subject to credit approval by Chase. How financing withChase works. 1. Apply. Fill in a few details including car choice and dealer to get a credit decision. Donât worry, you can update your car later, if needed. 2. Get financing. Once approved, weâll send the details directly to you and your chosen dealer, saving you time and paperwork. 3. Chase Freedom Unlimited îCredit Card. $200 bonus plus 5% gas station cash back offer. Earn 1.5% cash back on all other purchases. No Annual Fee. Sign in to apply faster Opens in a new window. Apply Now. Opens in a new window. Learn more.

Also Check: How To Apply For Sba Express Loan

Recommended Reading: Will I Qualify For Fha Loan