Home Loan Interest Rates In India 2022

Home loan is a great financial product for those who dream of buying a new house but do not have enough funds. However, most borrowers are skeptical when it comes to availing a home loan as it is a huge long-term financial responsibility. With proper planning, you can avail a home loan to buy a property and repay it without being burdened.

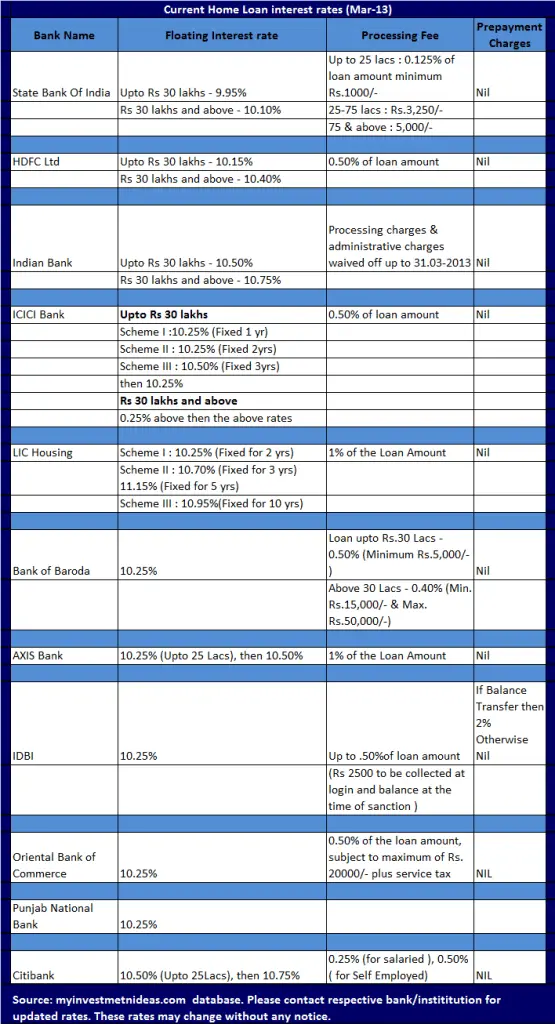

If you are planning on applying for a home loan, you should compare various features and benefits offered by different lenders before choosing one. One of the most important factors you must be checking the home loan interest rates. A low interest rate home loan will help you save in the longer run. As interest rate is the first thing you will be checking when availing a mortgage, we are going to list out the home loan interest rates offered by some of the popular banks to help you make the right decision.

Home Loan Interest Rates

Punjab national bank offers interest rate between 6.80- 8.05 percent, with RLLR 7.50 percent. Bank of India offers interest rate between 6.90 to 8.60 percent, RLLR stands at 7.25 percent. Axis bank RLLR is 7 percent, and it offers interest rates between 7 to 7.30 percent. Canara Bank offers interest rate between 7.05 to 9.25 percent, with RLLR at 7.30 percent. Indian Overseas Bank offers home loans between 7.05 percent to7.30 percent, while RLLR at 6.85 percent.

Floating Home Loan Interest Rates*

The home loan interest rate is a major factor to consider when paying monthly installments on a home loan. The advantage of a floating home loan interest rate is that when the interest rate falls, so does the home loan interest rate, and subsequently, the home loan EMI. The interest rates applicable on the home loans furnished by KMBL are listed here.

You May Like: How To Find The Loan To Value Ratio

Home Loans From Axis Bank

The interest rate offered by this bank is 11 per cent per year. The monthly installment is Rs.38, 233. The loan processing fee is Rs.38, 000. The prepayment penalty for both self and refinance is zero. The loan to value ratio is 80 per cent.

A large number of banks & housing finance companies are offering home loans at attractive interest rates. The rates will vary according to each loans terms & conditions. There will also be differences in interest rates for the same kind of home loan in various banks. To get the best deal, it is important to take the time to research and compare different rates. This will prevent heavy financial burden in the future.

How To Apply For A Home Loan

A home loan product is best chosen after considering loans offered by banks and lending institutions.

- When comparing banks, take into account the interest rate, loan-to-value ratio, processing fees, and loan tenure.

- Calculate your EMI using an EMI calculator.

- Use this method to compare monthly payments across different mortgage companies.

- Additionally, some lenders offer home loan offers with reduced interest rates from time to time.

- Keep a close eye on that as you search for a loan.

- Make sure you know your loan requirements beforehand.

Now that you have learned about the top home loan lenders and some helpful hints for selecting a bank, keep in mind that not every loan program is accurate for each individual. Every person or bank has different criteria, so you have to analyze them deeply before applying for a home loan in India.

You should select a home loan that is appropriate for you based on your loan requirements, repayment ability, and cash flow. The expenses that will be paid by the loan should be stated explicitly by your lender. Registration and stamp duty payments, annual maintenance charges, and clubhouse fees are typically not financed by lenders. As a result, it’s critical to find a lender that will finance the amount you require while also offering simple loan approval and repayment alternatives

To contact the Express Deals team, please drop an email to – We will reach out to you in the next 48 business hours.

Recommended Reading: Can You Pay Off Sallie Mae Loan Early

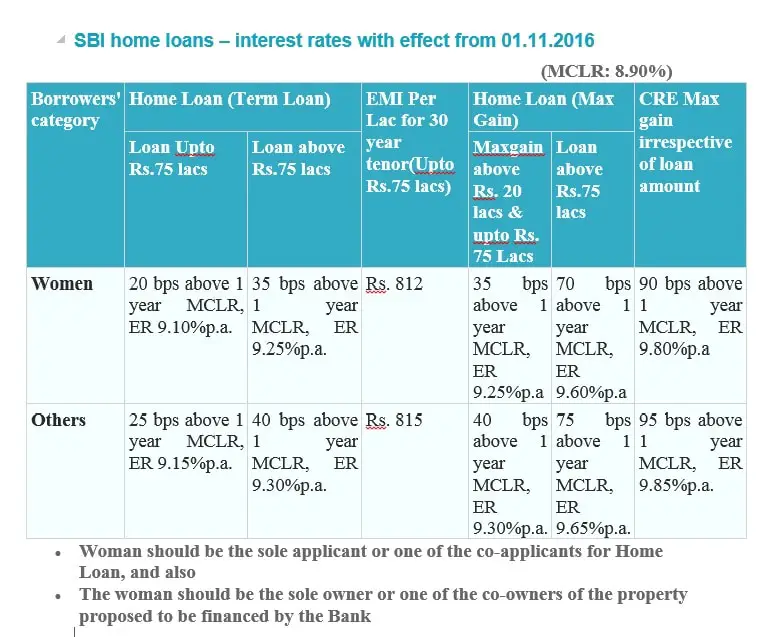

Mclr Or Benchmark Rate

The Marginal Cost of Funds-based Lending Rate or MCLR is the minimum interest rate at which a bank can lend home loans. The MCLR rate is fixed considering several factors such as the marginal cost of funds, operating cost, cash reserve ratio and tenure. The banks review the rate for the borrowers during the annual reset date of the MCLR, where the duration may be 3, 6 or 12 months. The home loan interest calculation is done and charged based on the changes in the MCLR rate.The rate at which banks borrow money from the RBI for short-term financing is called the repo rate. When the RBI hikes the repo rate, banks must pay more interest to the RBI to borrow money from it. This further increases the interest rate of home loans. It is, hence, essential to consider a hike in repo rate by the RBI before taking a home loan.

Which Is The Best Bank To Get A Housing Loan From

SBI Home Loan is number one. SBI can finance up to 90% of a property’s cost for up to 30 years at a rate of 7.05 percent per year on average. Defense personnel, government employees, non-salaried people, candidates purchasing “green” homes, and those living in hilly/tribal areas are all eligible for special home loan packages offered by the bank.

Recommended Reading: How Do I Find My Mortgage Loan Number

Canara Banks Home Loan Rates

Canara Bank offers loans for the purchase, repair, and construction of houses. It is available to salaried people, businessman, self-employed and even NRIs. It requires a mortgage of flat and can be repaid within a maximum time of 30 years or up to the age of 70 whichever comes early. The processing fee is 0.50% which is Rs 1500 minimum and maximum of Rs 10000.

| Up to 75 lakh |

| Home Loan for 3 to 10 years | 8.00% |

Why Choose Citi Home Loans

Congratulations on finding your dream home!

Choose from one of our home loan options and allow us to make your dream a reality. Our home loans, with their extensive features, host of benefits and competitive interest rates, have been specially designed to suit your home finance needs. With the Citibank Home Credit option, you can also avail the benefits of interest savings available for withdrawal, or faster repayment, towards your home loan.

Learn about how Citibank home loans can provide the financing you desire and when you’re ready, apply for a housing loan.

You can also visit our ‘Useful Links’ section below to find more information about our home loan interest rates and other details.

Check out our Home Loan Eligibility Calculator to determine your home loan eligibility

to see the list of residential properties in your city which are approved with Citibank

Check out our Home Loan EMI Calculator to calculate your home loan EMI

You May Like: When Can I Sell My House Fha Loan

Tips To Avail Low Interest Home Loans

With so many factors affecting the housing loan interest rate in India, such as income, loan amount, employment type, CIBIL score, etc., customers can rest assured that they can improve their eligibility for a lower interest rate.

Here are some useful tips on how you can get your hands on the best possible home loan rates in India:

- Increase your down payment and tenure: Generally, home loan amount of up to Rs. 35 lakh is available at a lower interest rate compared to higher loan amounts. Hence, try to pay as much as possible in a down payment in order to bring down your loan amount. Additionally, opt for a longer tenure, usually more than 15-20 to reduce your EMI burden.

- Choose the right type of interest rate: While a fixed interest rate gives you a fixed EMI outlay for a fixed period, a floating interest rate will increase or decrease your tenure as per any volatility in the market rates of interest. Generally, the latter is slightly higher than the former. But fixed interest home loans are rarely available in the market. Check with your lender to understand their interest rates.

- Factor in income and employment status: Make sure that the home loan applicant has a steady, sufficient income and is employed in a PSU or a reputed company to avail competitive interest rates.

What Is Home Loan Amortization Schedule

Loan amortization is the process of reducing the debt with regular payments over the loan period. A home loan amortization schedule is a table giving the details of the repayment amount, principal and interest component.

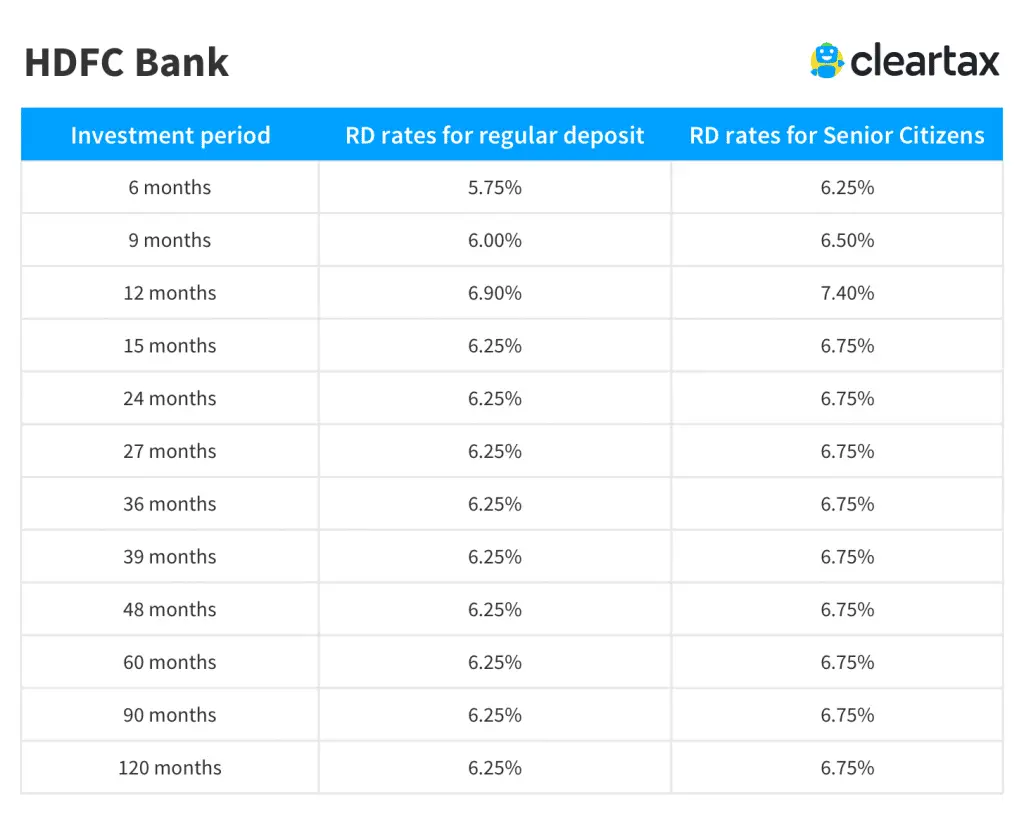

HDFCs EMI calculators give a fair understanding about the ratio of the principal amount to the interest due, based on the loan tenure and interest rates. EMI calculator also provides an amortization table elucidating the repayment schedule. HDFCs home loan calculator provides a complete break-up of the interest and principal amount.

You May Like: Sallie Mae Student Loan Forgiveness

How To Check Home Loan Eligibility

The Pradhan Mantri Awas Yojana plan was created by the Central Government through the Ministry of Housing and Urban Poverty Alleviation, and it allows recipients to get subsidies on their house loans. According to the PMAY scheme’s rules and regulations, candidates would be divided into four groups: EWS, LIG, MIG 1, and MIG 2. The yearly family income determines the PMAY eligibility requirements for these categories.

Home Loan Emi Calculator

Use Paisabazaars home loan EMI calculator to calculate the loan EMI instantly. The online loan calculator gives results on the basis of principal amount, interest rate and tenure. The loan calculator also displays total interest payable, total principal payable and amortization schedule to help you understand your home loan repayment better.

Home loan eligibility differs across lending institutions and loan schemes. However, a common set of housing loan eligibility criteria is given below:

- Nationality: Indian Residents, Non-Resident Indians , and Persons of Indian Origin

- Preferably 750 and above

- Age Limit: 18 – 70 years

- Work Experience: At least 2 years

- Business Continuity: At least 3 years

- Minimum Salary: At least Rs. 25,000 per month

- Loan Amount: Up to 90% of property value

Note: Apart from the above parameters, your home loan eligibility also depends on the property you are buying and the location of the property.

Check the home loan eligibility criteria of top banks and HFCs.

Also Check: How Long Does Stilt Loan Take

Final Interest Rate Varies

While everyone who applies for a house loan would prefer to receive the lowest interest rate possible, this is not always possible due to a variety of reasons. Regarding the kind of properties and borrower segments it will lend to, each lender has its own set of guidelines. As an illustration, several lenders offer their greatest interest rates to salaried clients, while others only offer their best rates to borrowers with excellent credit. Many lenders also charge female borrowers additional interest rates.

How Can I Reduce My Housing Loan Rate Of Interest

You can reduce your home loan interest rate through the following approaches:

- You can shift your pricing regime.

- You may switch from fixed interest rates to floating interest rates. When the floating rate comes down, so does your home loan interest rate.

- You can switch to lenders who are providing a lesser interest rate than your current lender.

- You can also negotiate for a better rate with your existing lender.

Don’t Miss: How To Get Personal Loan From Chase Bank

Several Banks Including Sbi Icici Bank Bank Of Baroda Canara Bank And Pnb Have Raised Their Loan Interest Rates

Reserve Bank of IndiaSBIICICI BankBank of BarodaCanara BankPNBWhat is the external benchmark-based lending rate?State Bank of IndiaEBLRICICI BankBank of BarodaCanara BankPunjab National Bank

-

The Securities and Exchange Board of India is considering a proposal to allow private equity funds to own local asset management companies , a move that will boost competition and mergers and acquisition activity in the space.

Read More News on

Is The Conversion Allowed Within A Floating Rate Home Loan

While switching from a fixed rate to a floating rate means considerable benefits for borrowers in terms of interest savings. You can further enhance your savings by switching to the most cost-efficient floating interest rate benchmark. Presently, there are base rate, the marginal cost of lending rate and repo-linked lending rate benchmarks. Of these, the RLLR is an external benchmark and is more transparent to the rate changes made by the Reserve Bank of India than the other benchmarks. If you compare well. Youll find that RLLR-based home loans come with an interest rate lower than the MCLR-based one by at least 0.30%-0.40% on average. So, if youre in the base rate or MCLR and want to get into an RLLR-based home loan. The conversion fee will apply. Want to see the fee? Check out the table below.

| Lenders | |

|---|---|

| YES BANK | NIL |

Recommended Reading: What Is Home Loan Insurance

What Are The Factors That Affect Home Loan Interest Rate

Home loan interest rate is decided by the lender in accordance with the required terms and conditions to determine the home loan rate. However, there are certain factors taken into consideration to offer a home loan interest rate. These are listed as follows:

- Interest rate type: The type of interest rate is distinguished into two-fixed and floating. In general, fixed home loan interest rate is higher than floating home loan interest rate.

- Borrowers credit score: A good credit score can help one grab a good home loan deal, while a lower credit score can force the home loan lender to charge a higher interest rate.

- Occupation: Salaried individuals are likely to get a lower interest rate when compared to other employee types because salaried employees have fixed source of income.

- Loan type: Home loan is an exclusive term that covers under its arm various home loan products such as home improvement loan, home renovation loan, and home purchase loan, among others.

- Loan amount: A higher home loan amount will attract a lower home loan rate, while a small home loan amount will attract a higher interest rate.

- Loan offers: In case one applies for a home loan with the applicable offers when the lender is offering various customer-centric promo offers, a negotiable home loan interest rate can be availed.

Home Loan Interest Rate Faqs

1. What is the home loan interest rate?

Home loan interest rate is the percentage of the principal amount charged by the lender to the borrower for using the principal amount. The interest rate charged by banks and non-financial institutions determine the cost of your home loan. So, when you are paying your home loan EMI , the interest rate charged determines how much you have to pay your lender against your loan every month. Interest rates are usually linked to repo rate and can vary from lender to lender.

2. Which bank has lowest home loan interest rate?

Though interest rates offered by banks can increase or decrease as per the banks discretion, right now the State Bank of India is offering the lowest home loan interest of 6.65% p.a. to its customers. However, note that this rate is applicable only on home loan for women applicants.

3. How to Get Lowest Home Loan Rates in India?

Home loan interest rates are at a 15-year low, so almost all the banks are offering lower interest rates on home loans compared to what they were offering in the previous financial year. However, to get the lowest home loan interest rates, compare rates offered by lenders. Always use a home loan EMI calculator while comparing rates it will help you estimate how much you have to pay every month against your loan.

4. How to reduce home loan interest?5. How Home Loan Risk weightage is linked to LTV Ratio?6. Which bank has the lowest rate of interest for the self-employed?

Don’t Miss: How To Transfer Home Loan From One Bank To Another

How Can I Check The Total Interest Payout For My Home Loan

Home Loan EMI calculator assists borrowers in determining the monthly amount they have to pay to settle their Home Loan. You input required loan amount, the rate of interest, and the loan tenure in the home loan EMI calculator. The calculator will then show you the total interest payout and the EMI estimate.

Benefits Of Taking Fixed Rate Home Loans:

- There is no change in the rate of interest, irrespective of market fluctuations

- A fixed-rate home loan assists in long-term planning and budgeting by enabling a fixed monthly repayment schedule, which is easy to budget and doesn’t fluctuate

- It ensures financial security since customers need not expect any future risks.

Recommended Reading: How Much Is Federal Student Loan Interest

How To Reduce Home Loan Interest Burden

To repay affordably over the tenor of your home loan, you can put certain strategies into action. These will help you lower your interest rate or help you reduce your overall interest payment.

- Select a short tenor for repayment

A shorter tenor keeps your interest accumulation in check as the interest rate is levied for a fewer number of years. In addition, a shorter repayment timeline helps you get a more affordable interest rate from the lender.

- Opt for a balance transfer facility

A home loan balance transfer facility allows you to switch your loan to a financial institution offering a reduced home loan interest. This is the easiest way to get a lower rate, but ensure you do a cost-benefit analysis before going ahead and this does include some fees and charges.

The home loan refinancing facility from Bajaj Finserv also comes with high-value top-up loan that you can use without restrictions.

- Request annual EMI revisions

You can also opt for annual EMI revisions with each increase in income or a salary hike as higher EMIs mean quick reduction of the outstanding loan liability. Early repayment of the principal also cuts down the loan tenor and helps reduce the total interest accumulation. You can ideally increase your EMIs by 5% with every 10% increment in income.

- Prepay with surplus funds available

*Conditions apply