Los Angeles Homebuyers Can Take Advantage Of Historically Low Mortgage Rates Today

Own your very own piece of Los Angeles. Lock in low rates currently available in and save for years to come! In spite of the recent rise in rates current mortgage rates are still below historic averages. If you secure a fixed mortgage rate your payments won’t be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the radio button. Adjustable-rate mortgage loans are listed as an option in the check boxes. Alternate loan durations can be selected and results can be filtered using the button in the bottom left corner. You can select multiple durations at the same time to compare current rates and monthly payment amounts.

Help your customers buy a home today byinstalling this free mortgage calculator on your website

As Seen In

How Much Home Can You Afford

Buying too much house can quickly turn your home into a liability instead of an asset. Thats why its important to know what you can afford before you ever start looking at homes with your real estate agent.

We recommend keeping your mortgage payment to 25% or less of your monthly take-home pay. For example, if you bring home $5,000 a month, your monthly mortgage payment should be no more than $1,250. Using our easy mortgage calculator, youll find that means you can afford a $211,000 home on a 15-year fixed-rate loan at a 4% interest rate with a 20% down payment.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Recommended Reading: What Are Rv Loan Rates

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

Impact Of Interest Rate Hike On Your Loan Emi & Repayment Schedule

Since most home loans are floating rate loans, the actual loan rate changes over the course of the loan depending on whether RBI policy rates are being hiked or cut.

If the interest rates are hiked and the lender passes on the hike to borrowers, then your home loan rate will increase.

This will have either of the 2 impacts:

- Increasing the tenure but the loan EMI remains the same

- Increases the EMI but the loan tenure remains the same

Impact of interest rate CUT on your loan EMI & repayment schedule

This will have either of the 2 impacts:

- Loan tenure decreases but the loan EMI remains the same

In general, the lenders have 2 options in case of loan interest rate changes: Either i) change the EMI and keep the tenure the same, or ii) keep the EMI constant and change the loan tenure.

Many people are looking to maximize the tax benefits of home loans. But if you wish to manage your home loans wisely without compromising other goals, do read this detailed post on managing home loans.

And it goes without saying that you might be excited to take home loan due to rate cuts, but its always advisable to assess other factors as well and not just depend on the loan interest rates. Also, read why taking personal loan for downpayment is not advisable.

Further readings:

Also Check: How To Calculate Student Loan Interest Paid

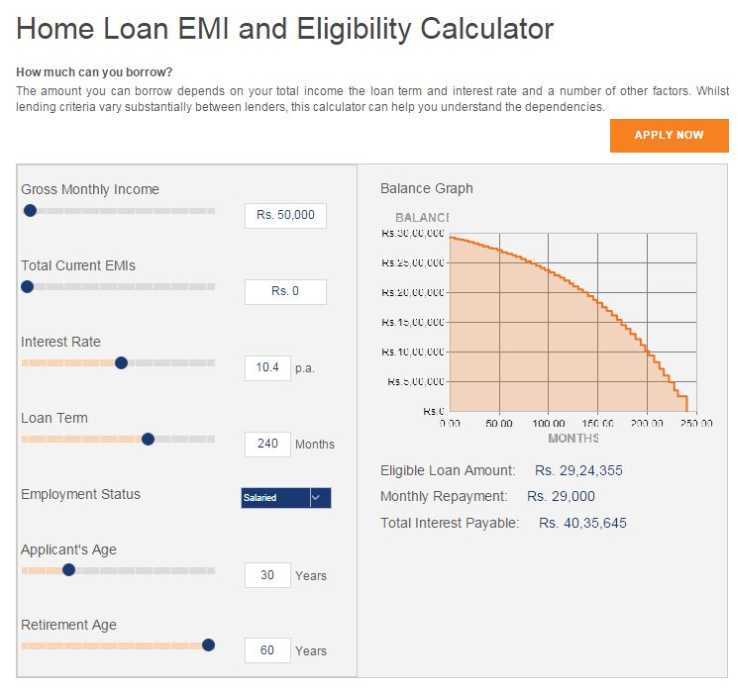

How To Calculate Home Loan Emi Using The Home Loan Emi Calculator

The Home Loan EMI calculator is a simple and easy-to-use tool that allows you to calculate the home loan EMI, which you need to pay each month. Once you have entered the details, the calculator will calculate the EMI for you. You can also modify the EMI amount as per your need. The EMI is the amount of money that you pay to the bank each month to repay the home loan.

Whats The Difference Between The Apr And The Interest Rate

The annual percentage rate is a broader measure of the cost to you of borrowing money. The APR reflects not only the interest rate but also the points, mortgage broker fees, and other charges that you have to pay to get the loan. For that reason, your APR is usually higher than your interest rate.

Your interest rate is the cost you will pay each year to borrow the money, expressed as a percentage rate. It does not reflect fees or any other charges you may have to pay for the loan.

Also Check: Can I Refinance My Fha Loan

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Average Closing Costs By County

| County | |

|---|---|

| $113,200 | 3.87% |

Our Closing Costs Study assumed a 30-year fixed-rate mortgage with a 20% down payment on each countys median home value. We considered all applicable closing costs, including the mortgage tax, transfer tax and both fixed and variable fees. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find the closing costs as a percentage of home value figure. Sources include the U.S. Census Bureau, Bankrate and government websites.

Rule of thumb is to plan for 2% to 5% of home price as your estimated closing costs. Within that blanket number, youll portion out money to various entities. The first is your mortgage lender. The various fees the bank charges are called origination fees and include services such as underwriting, document preparation, processing, broker services fee, origination points and commitment fees. These charges depend on the mortgage lender and will vary. In addition to origination fees, youre responsible for paying for a credit report, appraisal , attorney, flood certification and possible survey.

Recommended Reading: How To Remove Name From Home Loan

Mortgage Legal Issues In Florida

Florida used to be known as a caveat emptor state, meaning buyer beware. However, over the last 20 years, more and more lawsuits have sided in favor of the homebuyer rather than the seller. That makes this state quite homebuyer-friendly.

Sellers are required to disclose facts materially affecting the value of the property which are not readily observable and are not known to the buyer, according to Johnson vs. Davis, a Florida Supreme Court case quoted by the Florida Realtors association. In addition to court precedents, Florida law requires coastal erosion disclosures, radon gas, mandatory membership in a homeowners association and condo disclosures. While there isnt a specific disclosure form set by law, many Florida realtors will use this five-page Florida Realtors sellers disclosure. As always, its essential to arrange a home inspection yourself to get the best picture you can for a property. While Florida does have laws in place, youll have to go through a lawsuit to collect any damages if you do, in fact, find issues with a property after purchase.

Worried about foreclosures in Florida? The state had the second-highest foreclosure rate as of November 2021, but in past years it ranked closer to the top of these lists. Florida also has a large number of zombie homes, which are abandoned, unsold foreclosed homes. This generally drives down the overall property value in neighborhoods with high concentrations of these empty homes.

How Does Emi Calculation Help In Planning The Home Purchase

HDFCs Home Loan EMI calculator gives a clear understanding of the amount that needs to be paid towards the EMIs and helps make an informed decision about the outflow towards the housing loan every month. This helps estimate the loan amount that can be availed and helps in assessing the own contribution requirements and cost of the property. Therefore knowing the EMI is crucial for calculation of home loan eligibility and planning your home buying journey better.

Recommended Reading: How To Determine Home Loan Amount Based On Income

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

This Mortgage Calculator Includes Hoa Fees

Homeowners association fees are typically charged directly by a homeowners association, but as HOA fees come part and parcel with condos, townhomes, and planned housing developments, theyre an essential factor to consider when calculating your mortgage costs.

Homes that share structural elements, like roofs and walls or community elements such as landscaping, pools, or BBQs, typically require homeowners to pay HOA fees to maintain the upkeep of these amenities. While youre still in your budget planning stage, its good to remember that HOA fees typically increase annually. HOAs may also charge additional fees known as special assessments to cover unexpected expenses from time to time.

Don’t Miss: Which Bank Gives Lowest Interest Rate For Car Loan

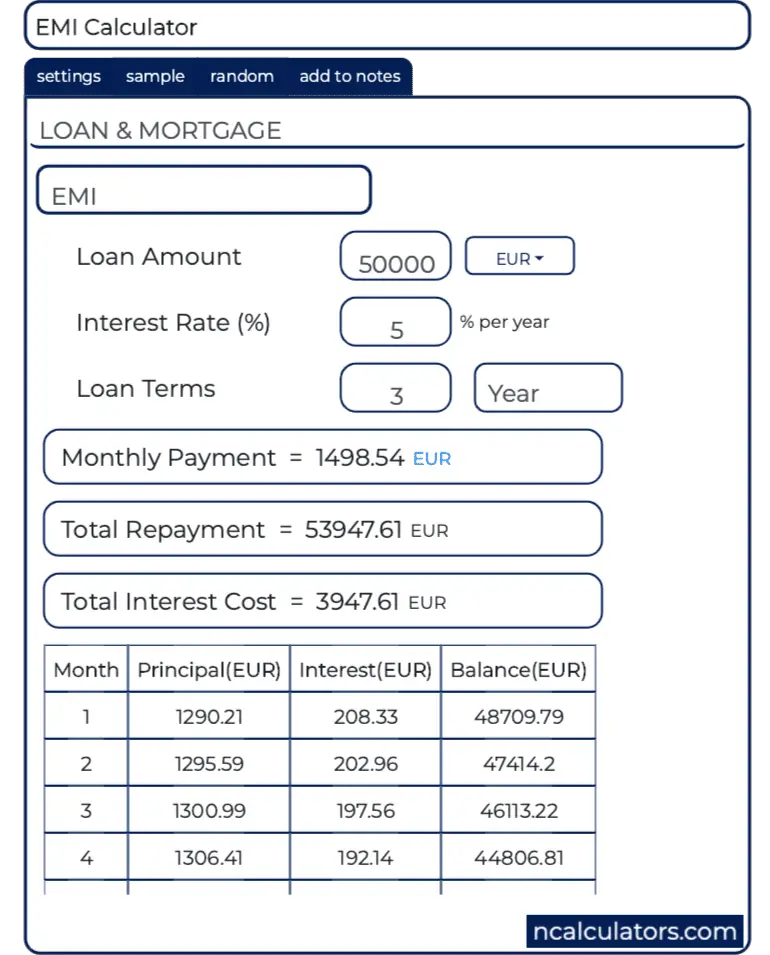

What Is Home Loan Amortization Schedule

Loan amortization is the process of reducing the debt with regular payments over the loan period. A home loan amortization schedule is a table giving the details of the repayment amount, principal and interest component.

HDFCs EMI calculators give a fair understanding about the ratio of the principal amount to the interest due, based on the loan tenure and interest rates. EMI calculator also provides an amortization table elucidating the repayment schedule. HDFCs home loan calculator provides a complete break-up of the interest and principal amount.

What Is The Minimum Down Payment For Conventional Fha And Va Loans

Wells Fargo offers several low down payment options, including conventional loans .

- Conventional fixed-rate loans are available with a down payment as low as 3%.

- Keep in mind that with a low down payment mortgage insurance will be required, which increases the cost of the loan and will increase your monthly payment. We’ll explain the options available, so you can choose what works for you.

- Talk with a home mortgage consultant about loan amount, loan type, property type, income, first-time homebuyer, and homebuyer education requirements to ensure eligibility.

Recommended Reading: What Is An All In One Loan

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Use Our Calculator To Estimate Your Monthly Payment

Most people need a mortgage to finance a home purchase. Use our mortgage calculator to estimate your monthly house payment, including principal and interest, property taxes, and insurance. Try out different inputs for the home price, down payment, loan terms, and interest rate to see how your monthly payment would change.

Recommended Reading: Can I Use Va Loan Overseas

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, it’s important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

How To Lower Your Monthly Mortgage Payment

If the monthly payment you’re seeing in our calculator looks a bit out of reach, you can try some tactics to reduce the hit. Play with a few of these variables:

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Also Check: Minimum Credit Score For Rv Loan

How Emi Is Calculated

EMI calculation depends on three things, Loan Amount that you have availed from the bank, Interest Rate that the bank is charging, and the Tenure for which you have taken the loan. Below is the formula to calculate the Loan EMI:

EMI = * ^ N /

P = Principal Amount of your Loan I = Rate of Interest charged by bank for your Loan N = Repayment Period of your Loan

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Also Check: Do You Get Student Loan All At Once

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Recommended Reading: How Much Personal Loan Can I Get On 50000 Salary

Details Of Florida Housing Market

Florida is known to many as a vacation destination thanks to Disney World, miles of beaches and a plethora of resort towns catering to tourists. However, a large number of residents live year-round in the Sunshine State. Its total population, according to the Census Bureau, is an estimated 21.78 million, which places it as the third-largest state in the U.S.

The state has over 8,400 miles of shoreline, and almost all of its residents live in coastal counties. Florida cities have seen some of the fastest growth in the U.S. The Cape Coral-Fort Myers area, Orlando-Kissimmee, Jacksonville and Deltona-Daytona Beach areas in Florida regularly hit the top of lists for fastest growing U.S. cities.

If you take the Florida housing market as a whole, youll see that the state is recovering from the recession, which led to many foreclosed homes. The state also ranks in the bottom half of SmartAssets Healthiest Housing Markets study, which looks at stability, affordability, fluidity and risk of loss factors.

Floridas largest urban areas by population are Jacksonville, Miami, Tampa, Orlando and St. Petersburg, according to U.S. Census Bureau estimates. Each of this large states cities is diverse and distinct in its own way and has its own housing market dynamics. Take for example, Miami-Dade County, where the median home value is $289,600, according to Census data. Compare that with Duval County, home of the largest city, Jacksonville, at only $180,700.