When To Consider Refinancing For A Lower Interest Rate

If you are paying a high interest rate on your student loans anything at or above 10% according to refinancing lender CommonBond consider refinancing. If you’re on the fence, calculate the amount of interest you pay each month. A lower interest rate will likely save you a considerable amount of money over time.

But federal borrowers should be aware of certain caveats to refinancing: With the current federal loan payment and interest pause extended through at least Sept. 30, 2021 as part of the Covid relief, it wouldn’t make sense for federal student loan borrowers to refinance with a private lender right now. You can’t get a lower interest rate than the current interest freeze.

In accordance with the Fed lowering interest rates across the board, private lenders have also lowered the rates they offer. But note that refinancing from federal to private lenders is irreversible, so once you switch you can’t go back. Putting your student loan payment instead into a high-yield savings account like the Varo Savings Account from now through September could bulk up your emergency fund while you decide the best course of action.

How To Decide Which Private Student Loan Is The Best For You

While our evaluation of our private student loan partners was created as a starting point for students and their families to find the best private student loan, we recommend you do your own research as well.

When looking for a private student loan, comparing your options is the most important thing you can do. By doing this, youll be able to find an affordable loan that comes with borrower-friendly repayment terms. Here are the steps we recommend taking to find the best private student loan:

How To Look For Private Loans For College

There are differences between private loans for college. Its important to find a reputable student loan lender here are some ways to find the right one:

- Start with your school to see if they offer a lender list.

- Confirm that the lender works with your school of choice.

- Ask others for recommendations on lenders they’ve used for their student loans.

- Make sure youre looking at the right private student loan for your education. There may be different loans for undergraduate, graduate, continuing education, or certificate courses.

Don’t Miss: Best Banks For Land Loans

Get Better Rates With A Cosigner

A creditworthy cosigner can make all the difference when it comes to a private student loan application’s chances for approval. Cosigners play a critical role in helping borrowers to secure the best private student loans and qualify for a lower loan rate. If youre a creditworthy cosigner, you can help a student responsibly borrow funds for their education. And often for a rate well below one they could get on their own.

Being a cosigner helps make a college education possible for the borrower, but the responsibility does come with financial risks. If the student defaults on the student loan, the cosigner will be held liable for the remaining loan payments, and his or her credit history may be affected . There are also certain requirements the cosigner must meet. The cosigner must have a good credit history and demonstrate certain income requirements.

What Are The Requirements For A Private Student Loan

In this article, learn what you need to qualify for a private student loan.

Zina Kumok

Federal student loans are the gold standard for education loans. But sometimes, a federal loan just isn’t enough.

That’s where private student loans can be helpful. In this article, we’ll go over the borrower requirements to qualify for a private student loan.

You May Like: What Home Loan Interest Rate Can I Expect

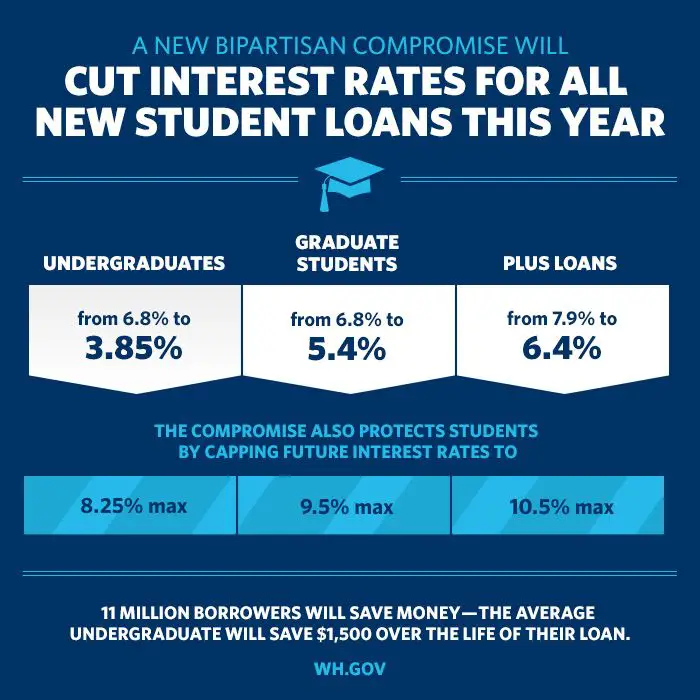

Federal Student Loan Vs Private Student Loan Interest Rate

Federal student loan rates are the same fixed rate for all borrowers regardless of credit score. These rates for federal student loans are updated yearly on July 1st.

Private student loan interest rates are competitive and based on current market trends. When borrowing a private student loan, you will be offered a fixed or variable interest rate. If you choose a loan with a variable interest rate, that variable interest rate/variable APR is subject to change throughout the life of the loan.

The loan interest rate you receive for a private student loan with depends on your or that of your . While there is no minimum credit score needed to qualify for federal student loans, private student loan applicants can be denied if their credit score does not meet the minimum standards, indicating possible bad credit and a risk for the lender.

Quickly compare federal student loan interest rates and private student loan interest rates with the tables below.

Comparing Federal And Private Student Loans

Federal student loans, such as the Federal Direct Loan and the Parent PLUS Loan, generally have more favorable terms and conditions than private loans. We recommend using all federal loan eligibility before turning to private loans.

We will hold the processing of a private alternative loan until you:

Also Check: How To Apply For Wells Fargo Loan

Sallie Mae Study: Less Than Half Of Families With College

Among families with college-bound students, 47% think theyll need to borrow to finance a college education, according to Sallie Maes 2022 College Confidence study. Yet just under half of those families identified federal direct subsidized and unsubsidized loans as aid that needs to be repaid, underlining the importance of learning the obligations of the debt youve been offered before accepting it.

Additionally, those families with college-bound students arent clear on the purpose of the FAFSA 34% dont know why someone would submit the FAFSA, and 44% dont know that its for everyone, regardless of income level. If you or your child are considering going to college, familiarize yourself with all of the options available to you to fund that education and submit the FAFSA to be considered for the most aid possible.

Q What Do I Need To Apply For A Private Student Loan

For most student loans, you can apply online within a matter of minutes if you have the right documentation on hand. The information you might want to have at the ready includes:

- Anticipated graduation date

- A personal reference

Note: If youre applying with a cosigner, youll need the above info as it pertains to him or her as well.

You May Like: How Do I Find My Student Loan Lender

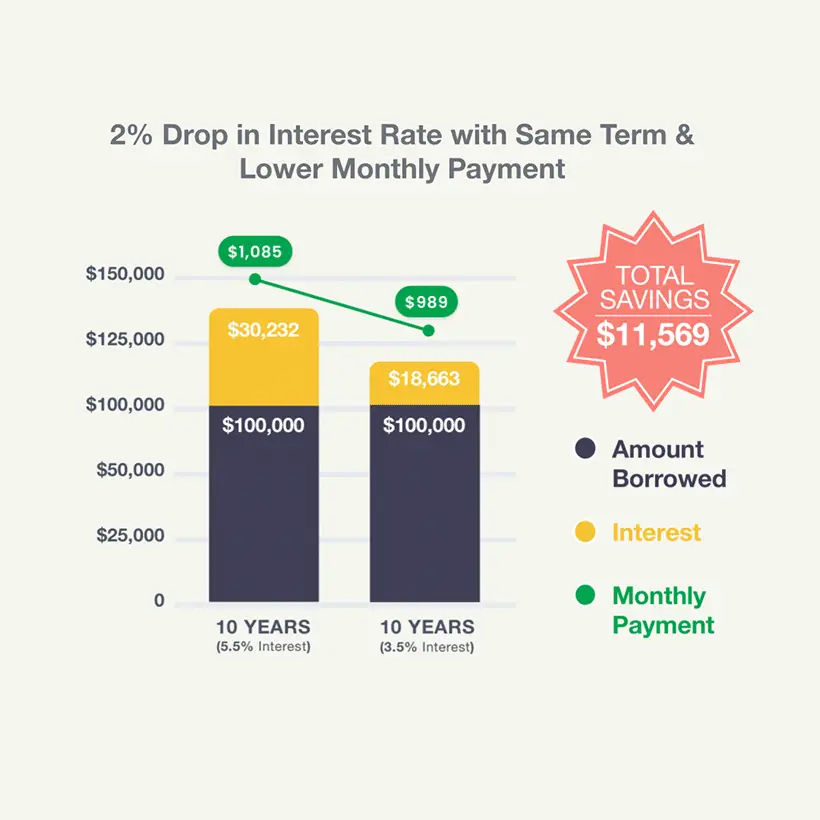

How Interest Rates And Repayment Terms Affect Loan Costs

The following tables are based on a hypothetical $50,000 private refinance student loan with no origination or application fees. Interest rates and repayment terms can have a bigger influence on the cost of your refinance loan than you might think, so compare carefully before signing on the dotted line!

| Variable |

|---|

What Affects Federal Student Loan Rates

Here are some factors that contribute to your interest rate:

- What type of student loans youre getting. Direct subsidized and unsubsidized loans carry the lowest federal student loan rates, while PLUS loans cost more.

- What type of borrower you are. On direct unsubsidized loans, undergraduate students pay rates that are 1.55 percentage points lower than those for graduate or professional school borrowers.

- When you take out a loan. Federal student loan interest rates are decided annually on June 1 and take effect from July 1 to June 30 of the following year. Your loan will be assigned the federal student loan rate based on the date of the first disbursement.

- Recent 10-Year U.S. Treasury yields. The formula for federal student loan rates is based on the 10-year Treasury yield, plus a fixed add-on amount. When U.S. Treasury yields rise or fall, student loan rates track along with them, up to a rate cap set by law.

Recommended Reading: What Type Of Car Loan Is Best

How Do Student Loan Interest Rates Work

Most private student loans offer two types of interest rates: variable and fixed. With a fixed interest rate, the rate doesnt change throughout the life of the loan. Borrowers who prefer predictable payments may prefer fixed rates, although the rates usually start a little higher.

Variable rates, on the other hand, are tied to changes to an index, such as the Libor or SOFR. These rates may go up or down during repayment, although lenders usually limit how high the rate can go.

Every month, your bill include part of the principal the base loan amount you borrowed and interest charges. While your monthly payment will be the same if you have a fixed interest rate, more and more of each payment will go toward the principal and less toward interest with each successive month.

You can use a student loan calculator to determine how different interest rates will affect your monthly payment over time.

How To Get A Federal Loan

You can get the lowest interest student loans by applying for a federal loan. You must file a Free Application for Federal Student Aid , which is used by the federal government and most college and universities to determine the eligibility of a student applying for non-merit based financial aid.

Filing a FAFSA form is the first step in applying for more than 90% of aid money. Merit-based aid, which accounts for the other 10%, is awarded based on talent.

All applicants must:

- Have a valid Social Security number

- Have a high school diploma or GED

- Be registered with the U.S. Selective Service

- Be enrolled or accepted for enrollment at an eligible degree or certification program

- Not owe refunds on federal student grant

- Not be in default on student loans

- Not be guilty of the sale of illegal drugs while federal aid was being received

The FAFSA consists of approximately 130 questions related to the students and parents assets, investments, income, taxes paid, household size and number of dependent students in the family attending college or graduate school.

A student is considered a dependent and must include parental information on the FAFSA until he or she:

- Turns 24 years old

- Becomes an orphan or ward of the court

- Becomes a veteran of active military service

- Has one or more dependent children

Read Also: Where Can I Get An Emergency Loan

How To Qualify For A Private Student Loan

Getting a private student loan is not the same as applying for a federal student loan. Federal loans are given to all students who meet basic citizenship and school requirements, but private student loan lenders have stricter standards.

If you are denied a private student loan, contact the lender and ask them for an explanation. It could be as simple as a typo on your application or something more complicated, like not having a good credit score. Read below to understand how to qualify for a private loan.

Private Student Loan Historical Rate Trends

The chart above shows average prequalified rates for borrowers with credit scores of 720 or higher who used the Credible marketplace to select a lender. The chart lists weekly rates for the last year.

For students who have hit their federal borrowing limits, private student loans can provide another source of funding for college. Rates on private student loans depend on factors including the borrower or cosigners credit score, so its important to compare lenders.

Compare student loan rates from top lenders

- Multiple lenders compete to get you the best rate

- Get actual rates, not estimated ones

- Finance almost any degree

If you qualify for a private student loan, the interest rate offered to you can depend on factors such as:

The chart above shows that a good credit score can help you get a lower rate and that rates are often lower on cosigned loans. Rates tend to be higher on loans with fixed interest rates and longer repayment terms.

Every lender has its own methods of evaluating borrowers, so its a good idea to request private student loan rates from multiple lenders and compare your options.

Through Credible, you can compare rates from the lenders below without affecting your credit score.

| Lender |

|---|

Also Check: Fha Loan Limits Maricopa County

Do Private Student Loans Have Fees

Private student loans can come with fees however, none of the lenders listed above charge an origination, application, or prepayment fee. We take this stance because we don’t believe borrowers should be charged for taking out a loan or paying one off early.

That being said, lets look at the different types of fees typically discussed with student loans.

- Origination fee: This fee is charged when you take out a loan. It’s usually calculated as a percentage of the total loan amount. For example, if you have a $10,000 loan with a 5% origination fee, the fee would come to $500. While federal student loans do come with an origination fee, none of the lenders in our list above charge one.

- Application fee: This fee is charged to you when you fill out and submit an application for a loan. Like the origination fee, none of the lenders selected above charge this fee.

- Late payment fee: This fee is charged to you if you don’t make a payment on time. A lender may set this as a flat amount or a percentage of the missed payment . Some of the lenders in our list do charge this fee, so we recommend putting together a repayment plan that can help you ensure you stay on schedule with payments.

- Prepayment fee: This fee is charged if you pay off your loan early. None of the lenders listed above charge this fee.

How Has The Coronavirus Affected Student Loan Interest Rates

When the coronavirus hit in March 2020 and the Federal Reserve Board cut interest rates, student loan rates plummeted. Federal student loan rates were at their lowest point in years, and borrowers could take out private student loans or refinance existing loans with rock-bottom rates as well. Also, federal student loan interest is waived until the ongoing litigation concerning student loan forgiveness is resolved or through June 30, 2023.

However, as the economy recovers from the pandemic, the Fed has been regularly raising rates five times so far in 2022. These rate increases drive higher interest rates across sectors. Federal student loan interest rates are up more than a percentage point for the 2022-23 school year, and private student loan rates are also starting to rise again. Rates will likely continue to rise as 2022 progresses.

Recommended Reading: Interest Rates For Boat Loan

Taking Out Federal Loans

The most common federal loan is the Stafford loan. Stafford loans offer fixed interest rates, meaning the interest rate stays the same from the time that you take out the loan until you pay it in full. There are two types of Stafford loans.

SUBSIDIZED

UNSUBSIDIZED

Subsidized Stafford

Interest accrues on your loan while you’re in school or in a deferment, but the government pays it for you. There is a time limit to the subsidy benefit. If you take out subsidized loans for over 150% of your published program length, you may lose your subsidy and become responsible for the interest that accrues on your loan at all times.

Unsubsidized Stafford

You’re responsible for interest that accrues on unsubsidized loans, even when you’re in school. You can choose to pay it while you’re in school, or you can let it accrue and be capitalized, added to the principal balance of your loan.

Regardless of which type of Stafford loan you take out, you will need to sign a Master Promissory Note . When you sign the MPN, you’re accepting the terms of the loan and agreeing to repay your loans according to these terms.

The MPN also goes over your rights and responsibilities as a borrower.

What To Know About The Fafsa

The FAFSA is the only way to get federal student loans, which is why all eligible students should fill out the form if they anticipate needing to borrow money for college.

- When does the FAFSA open? The FAFSA opens on Oct. 1 every year. For the 2023-24 school year, the FAFSA opened on Oct. 1, 2022.

- When is the FAFSA due? The federal deadline for the FAFSA is June 30 for the award year you need funding. For the 2023-24 school year, the FAFSA is due on June 30, 2024. However, some states and colleges have earlier deadlines.

- Who is eligible to apply for the FAFSA? U.S. citizens, eligible noncitizens and DACA recipients can fill out the FAFSA. However, only U.S. citizens and eligible noncitizens can receive federal financial aid.

What happens if you make a mistake on your FAFSA? If you’ve experienced a serious financial event since submitting the FAFSA or your personal details have changed, you are able to update your FAFSA after the fact.

Don’t Miss: Debt Consolidation Loans For Fair Credit