Do Familiarize Yourself With The Three Ways To Get It

There are three ways to get your COE.

- VA eBenefits Portal via the Internet

- Atlanta Regional Loan Center by U.S. mail

- VA Online Portal through your VA-approved lender

No matter how you get it, your COE is a vital part of the VA loan process. With some methods above it can take just a few minutes to obtain! And the good news is that unless you originally applied for your COE while on active duty, it never expires. If your COE was obtained while on active duty, youll need to get another one after discharge. Surviving spouses may only use option #2.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Entitlement Code 10 On Va Coe

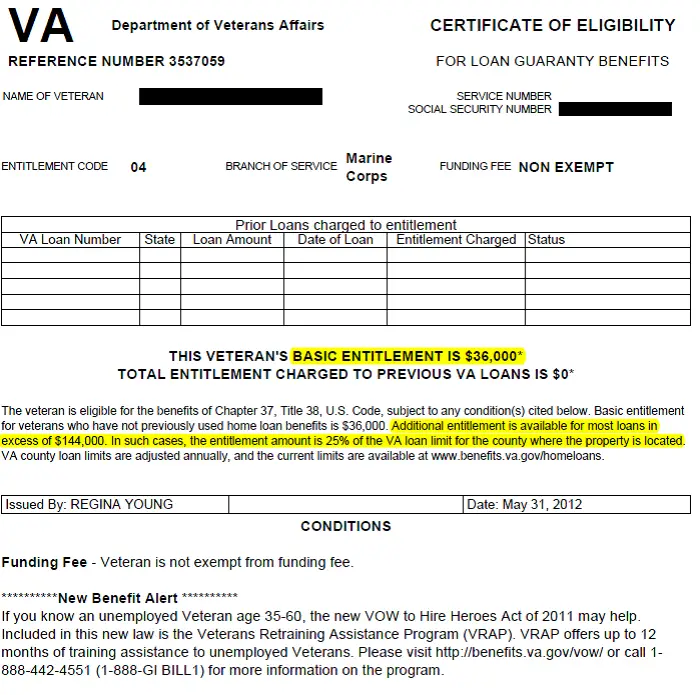

Most veterans who served on active duty in the last 20-30 years will receive an entitlement code of 10. This represents an enlisted date during or after the Gulf War, which the VA has defined as enlistment between 8/2/1990 present. Maybe it’s time to update that since we’ve started and ended several wars since then?

Here is a list of all the VA entitlement codes you can find on the COE.

Recommended Reading: Usaa Credit Score Range

Why You Need A Va Certificate Of Eligibility

Over 60 years ago, the VA Loan Guaranty Program began offering affordable loans to veterans as a way of thanking them for their service and giving them an opportunity to purchase homes that some might find difficult to fund otherwise.

VA Loans are unbeatable, offering veterans a guarantee that the government will pay close to a quarter of their mortgage in case of default.

While theyre distributed by private lenders, these loans are backed by the VA, adding a layer of certainty to their commitment.

Even more beneficial, VA loans come with no required downpayment, letting vets and active duty miltary personnel purchase, build, or refinance a home no matter the state of their savings account.

These loans also come without the requirement of monthly PMIs, saving you money on premiums.

In order to qualify for a low-interest VA loan with no down payment, you must have a VA Certificate of Eligibility, which is available to those people who serve or have served in one of the branches of the armed forces.

In order to obtain a certificate, you must meet certain eligibility requirements as listed on the Department of Veterans Affairs website.

Without the certificate, there is no way to obtain a loan through the VA Home Loan Program.

How Do I Apply For My Coe

Ready to apply for your VA COE? Here are the steps youll need to take:

For the VA COE application process to go smoothly, youll want to confirm your eligibility ahead of time. Lets explore the application requirements below.

Recommended Reading: What Credit Score Does Usaa Use For Auto Loans

Your Lender Can Help You Get The Coe

The easy way to get your COE is to have your lender get it for you. If you have already identified an approved VA lender, your loan officer can request the COE electronically.

To get your COE using the VAs Web-based application, known as Web LGY or the Automated Certificate of Eligibility portal, your loan officer only needs your evidence of service. ACE does not have access to all COEs. If the VAs database doesnt have enough information about you, youll have to get your COE through other options.

Most VA mortgage lenders can produce an eligibility certificate on the spot if the systems database contains adequate information.

Before buying a home, understand the different VA loan options available to you.

Can I Restore My Full Entitlement

Absolutely. Your VA loan entitlement is a lifelong benefit that you can use time and time again. The key is knowing how to restore your entitlement eligibility after buying a property. Lets take a look at your options.

How do I get my VA loan entitlement restored?

There are three ways to restore your full VA loan entitlement.

Also Check: Typical Motorcycle Loan

Why Are Certificates Of Eligibility Mandatory For Va Residence Loans

And not using a COE, your lender can not confirm that you just qualify for a VA mortgage. And in keeping with your certificates of eligibility, you may have a certain quantity of entitlement, however what precisely does that imply?

Your VA entitlement is the quantity the VA is prepared to ensure for those who default on the mortgage. It additionally helps decide whether or not or not youll should pay the VA funding charge. The VA funding charge is a one-time charge youll pay to the VA.

How To Apply For A Va Certificate Of Eligibility

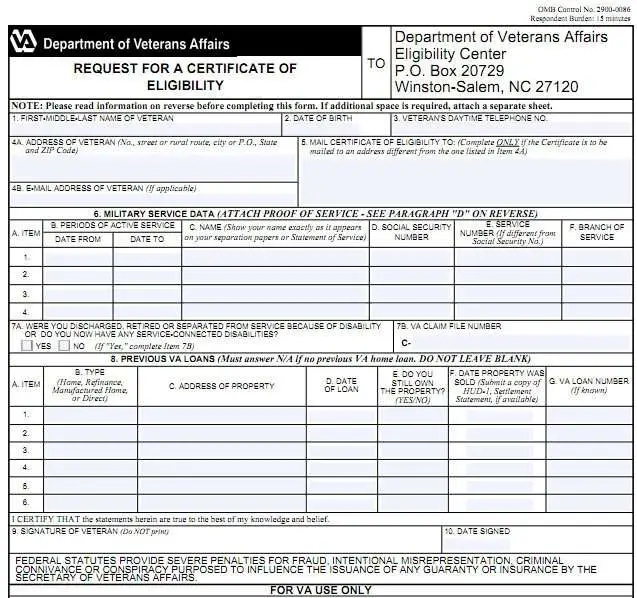

The procedure for applying for a VA COE varies depending on the status of the applicant as an active duty service member, a member of the National Guard or Reserve, etc. Here is the breakdown of application procedures for each category of applicant.

What follows are the requirements for applying for the VA COEthis is NOT the application procedure for a VA loan itselfonly the COE which establishes your ability to apply for a VA loan.

Recommended Reading: Fha Loan Limits Texas

My Lender’s Automated System Can’t Determine My Eligibility What Should I Do Now

If your lender can’t automatically obtain your Certificate of Eligibility, it could be from a few reasons that may include:

- Service members who had a prior VA loan go into foreclosure.

- Service members who were discharged under conditions other than honorable.

- Some Reservists and National Guard members.

- Unmarried surviving spouses.

Don’t panic if you fall into this group. It occasionally happens, and VA-savvy lenders typically know how to handle it. In these cases, your lender will typically ask for your DD-214 or points statement and send it directly to the VA for evaluation.

Do Learn The Basics Of Va Loan Eligibility

Heres the bottom line: your COE shows VA eligibility for home loan benefits. To be clear, just because youre eligible doesnt mean you qualify. Once you prove VA eligibility to a lender, then they will still need to determine if you qualify for a VA home loan.

Your eligibility is based on the Department of Veterans Affairs service guidelines. You may be eligible if youve served:

- 2 years on Active Duty

- 6 years in the Reserve/National Guard

- 90 days of Wartime Duty

- 181 Days of Peacetime Duty

Eligibility is also extended to certain veterans discharged honorably from active duty for service-connected injuries or other reasons outlined by the VA. Additionally, many surviving spouses may also be eligible. Eligibility requirements have recently been extended to include more surviving spouses. If you werent eligible in the past, your status may have changed due to new extended rules.

You May Like: How Much To Spend On Car Based On Income

Va Mortgage Loan Options

Purchase loan:

If you are a conventional home buyer, you will most likely be looking to secure VA-backed purchase loans. This loan will help you buy, build, or improve a home with a competitive interest rate and the option to put no money down without restriction.

Interest Rate Reduction Refinance Loan :

If you already have a VA home loan and would like to reduce your monthly mortgage payment or interest, an Interest Rate Reduction Refinance Loan could be the right choice for you.

Cash-out refinance loan:

A VA-backed cash-out refinance loan can help you take cash out of your home equity. This loan will replace your current loan with a new VA loan under different terms. You can also use a VA cash-out refinance to refinance a non-VA loan into a VA-backed loan.

We would also like to mention that the VA offers a Native American Direct Loan . If you are veteran, and either you or your spouse is Native American, you may qualify for this loan. Because the VA directly backs this loan, you do not need to contact a private lender the U.S. Department of Veterans Affairs will serve as your lender.

Minimum Va Mortgage Guidelines And Requirements

Here are the minimum VA Agency Guidelines:

- 100% financing with no down payment required

- No closing costs if the borrower can get a sellers concession and/or lender credit

- No minimum credit score requirement

- No maximum debt to income ratio requirements as long as the borrower can get an AUS Approval

- 2 years out of bankruptcy, foreclosure, deed in lieu of foreclosure, short sale

- Borrowers can qualify for VA Loans during Chapter 13 Bankruptcy Repayment Plan via manual underwrite with Trustee Approval

- There is no waiting period after the Chapter 13 Bankruptcy discharged date with manual underwriting

- Any discharge seasoned less than 24 months after Chapter 13 Bankruptcy discharge are manual underwrites

Outstanding Collections and Charge Off Accounts do not have to be paid off to qualify for VA Home Loans.

Don’t Miss: How To Get A Car Loan When Self Employed

How Do I Prepare Before Starting My Application

-

Veteran:- If you are a Veteran, youll need to show a copy of your discharge or separation papers .

-

Service member:- If youre an active-duty service member, youll need a statement of service showing the information mentioned below:

-

Full name of Servicemember

-

Social Security number of member

-

The actual date of birth

-

The date you Joined the duty

-

The duration of any lost time

-

The name of the command that confirms the information

-

National Guard or Reserve member:- If youre a current or former member of an activated National Guard or Reserve force, you will need to submit a copy of your discharge, or separation papers .

What Do I Do Once Ive Got My Certificate Of Eligibility

Once youve received your COE whether through the Department of Veterans Affairs or through your lender you can begin the process of finding a home to purchase and getting approved for a VA loan.

Once youve found your home, your lender will work with you to get your loan approval and complete the steps needed to close on a loan if youre approved.

Don’t Miss: How To Find Out Where My Student Loans Are

Include Your Proof Of Service

In order to apply for your COE, youll need to provide proof of service. The VA gives clear directions on what documentation is required for eligible proof of service depending on whether you are a veteran, an active service member, or a member of the National Guard or Reserves. This could include discharge forms or a statement of service.

What Is A Va Certificate Of Eligibility

To receive a VA mortgage, youll have to obtain a VA certificates of eligibility which verifies your standing as a qualifying service member or surviving partner. You may obtain this way from the Veterans Administration. A COE proves to your lender that you just meet the necessities to take out a VA mortgage.

Read Also: Usaa Prequalify

Va Loan Step By Step #: Obtain Your Coe

Following 6 easy steps to a VA mortgage can prevent slipups and delays. Learn the DOS and DONTS of the second step: obtaining your COE.

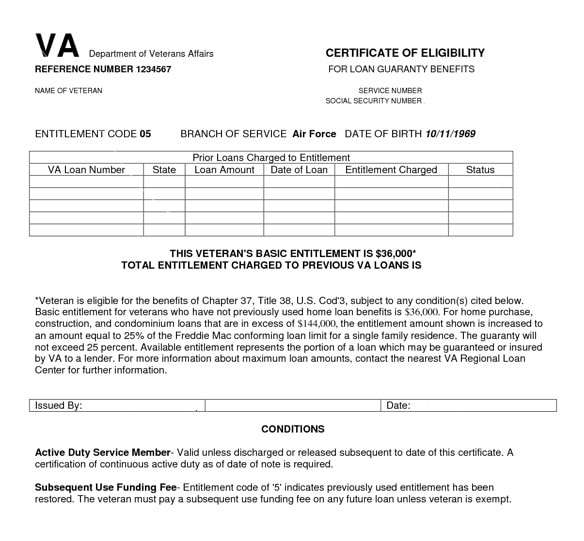

COE stands for Certificate of Eligibility. Its a document generated by the Department of Veterans Affairs that tells your VA-approved lender if you meet certain requirements for home loan benefits based on your military service. It also contains important information that can help your loan officer calculate your entitlement and fees .

If youve served in one of the seven uniformed services, or are a surviving spouse, you may have earned home loan benefits. Obtaining your COE will help you know for sure.

To help you obtain this important document, here are some dos and donts to consider at this second step in the VA loan process.

Obtaining Certificate Of Eligibility To Become Eligible For A Va Loan

Lets dig into this in a bit more detail. Individuals who have served in the Army Reserves or the National Guard may still obtain a VA home loan. These loans are put in place to help service members and Veterans purchase a primary residence. Below are the requirements to meet in order to qualify for a VA guaranteed home loan. You must meet at least one of the below:

- Serve at least six full years in the service or in the Selected Reserves AND

- Were discharged honorably OR

- Placed on the retired list OR

- Moved to the Standby Reserves or an element of Ready Reserves other than the Selected Reserve after service characterized as honorable OR

- Continue to serve in the selected Reserve longer than six years OR

- Served 90 days or longer during active duty during a wartime period OR

- Were discharged from active duty for a service-related disability

If you meet the requirements above, you will be issued a Certificate of Eligibility from the office of the VA. You must provide this to your lender in order to obtain a VA mortgage. There are times where we will need to help you go about obtaining Certificate of Eligibility. Please see our COE BLOG for more details. At Gustan Cho Associates, we have closed and funded many VA-eligible clients. Most of the time, a VA loan is the best loan available. Mainly due to no down payment requirement and no monthly mortgage insurance.

Read Also: Usaa Mortgage Credit Score Requirements

National Guard Va Loan Eligibility

A VA home loan will only be available for members of the National Guard or Reserves who have completed a minimum of six years of honorable service, mobilized for active duty for a minimum of 90 days, or were discharged from active duty due to a service-related disability.

Veterans who are not eligible for VA housing loan benefits may be able to take advantage of attractive terms offered by the Federal Housing Administration , a division of the Department of Housing and Urban Development .

Your Path To Buying A Home With A Va Loan:

Navy Federal makes the process easy for you. Were here to explore whether you meet VA home loan requirements and answer any questions along the way.

You May Like: How To Refinance An Avant Loan

Also Check: How To Pay Upstart Loan

How To Prepare For The Va Coe Application

The VA has a comprehensive COE application page that will list out exactly which documents you will need to have present depending on your status within the military. If you are a veteran or surviving spouse, youll need a copy of you or your veteran spouses discharge or separation papers . If you are currently serving on active duty, you will need a statement of service signed by your commander or a personnel officer.

Minimum Va Eligibility Requirements

All borrowers need to meet the minimum VA Eligibility Requirements mandated by the United States Department of Veterans Affairs to qualify for VA Loans. However, lenders may have additional lending requirements that are above and beyond VA Agency Guidelines. These additional lending requirements are called lender overlays. Gustan Cho Associates has no lender overlays on VA Loans.

Recommended Reading: Can You Use The Va Loan To Buy Land