What Are Mobile Homes Manufactured Homes And Modular Homes

There are three different types of homes.

Manufactured homes: Manufactured homes are usually built in a factory. Traditional homes are built onsite. Once completed, manufactured homes are moved to their final destinations on a truck and placed onto foundations, making them permanent. You will need to own the land on which the manufactured home foundation is built.

Modular home: Modular homes are primarily constructed in a factory, but the house is transported in pieces to the home site, where construction is finished. Once built, the modular home cant be moved.

Mobile home: A mobile home is built in a factory but on a permanently attached chassis. It is then transported to the site by being towed or on a trailer. They are often left permanently or semi-permanently in one place but can be moved. You can rent mobile home space or own it.

Saving Your Small Business From Collapsing

When the economy experiences a recession, small businesses suffer badly because they lack sufficient capital reserves to weather the national economic storm. An economic recession is bad for business because customers have much lower purchasing abilities than they had during stable economic periods.

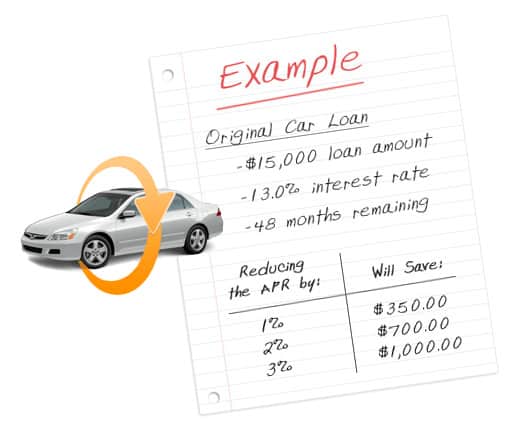

In addition to reducing cash flows, small businesses cannot borrow emergency business loans because interest rates shoot up when the economy performs badly. If you dont want to sell your car or house in order to have sufficient working capital, its better to apply for car loan refinancing.

Its easier to save up lump sums of cash when you pay lower installments. These lump sum savings will help you to run your business smoothly because you dont rely on credit to purchase stock and pay monthly bills.

Know The Difference Between Interest Rates And Apr

You may see online lenders and others use the terms interest rate and APR in similar ways. But its important to understand the difference.

Interest rate refers to only the rate of interest that a lender charges on a loan. APR, on the other hand, includes taxes, fees, and other costs that are rolled into your loan in addition to the interest rate. Make sure you are comparing the same figures when you compare loan offers from multiple lenders.

Don’t Miss: What Is The Highest Fha Loan Amount

Heres How Refinancing A Car Loan Works If You Have Bad Credit

Are you stuck with a high interest rate on a car loan? If so, you might feel like the kid who wasnt invited to the secret club that hung out after school. All your friends might brag about their 2.9% rate while youre stuck with a number in the teens , making you feel like dont belong.

Poor credit puts you in a hamsters wheel. You know how it goes a low score means high interest, high interest brings more debt, and more debt tends to reduce your score even more. Ultimately, it brings you further away from the chance of refinancing a car loan.

In a world that takes advantage of or ignores those with bad credit, you might assume that no one cares about your situation. But there is hope. You can get in the not-so-exclusive club of low interest-paying members if youre willing to turn your obstacles into an advantage.

In fact, with this post, were going to teach you how to do just that.

Pay Off Existing Debt

If you are in debt, then paying off your debt could lead to a better credit score. When you eliminate an existing debt from your, you may see an increase in your credit score.

Making the decision to get serious about debt repayment is a great first step. But it is important to take consistent action while paying down debt.

Consider the snowball method or the avalanche method as potential strategies to free you from the cycle of debt. Once you get out from under your current debt obligations, your improved credit score will allow for better refinancing opportunities.

If you are working towards building a better credit score, I highly encourage you to take advantage of our free credit resources.

You May Like: How To Get Your First Loan With No Credit

Our Top Picks For Best Auto Refinance Companies

- RateGenius Runner-up for Best Marketplace

- OpenRoad Best for Low Credit Score

- AutoPay Runner-up for Best for Low Credit Score

- Caribou Best for Fair Credit

- myAutoloan Runner-up for Best for Fair Credit

- Lightstream Best for Any Kind of Vehicle

- Digital Federal Credit Union Best for Newcomers to Credit Building

Why we chose it: We chose LendingTree as best auto refinance marketplace because, among its approximately 40 lenders, some will consider borrowers with credit scores in the low 500s.

- Quote request form takes less than five minutes

- Serves a wide range of credit scores

- Minimum loan balance for refinancing is $8,000

- No 24-month loans terms start at 36 months

- No set loan amount range this varies by lender

- Loan Terms

- 36 to 72 months

LendingTree is a marketplace of about 40 lenders where you can compare rates for a wide variety of financial products, including auto refinance loans.

The companys marketplace covers the full spectrum of credit scores. This means that subprime borrowers people with scores between 580 and 619, also referred to as poor credit have a chance at refinancing their auto loan through LendingTrees network.

We particularly liked LendingTrees Auto Refinance Rates comparison tool, which allows you to input your zip code, loan amount and estimated credit score, and then get examples of potential auto refinance options with terms from 36 to 72 months .

- No limit on existing loan balance

- Prequalify with a soft credit inquiry

Requirements For Auto Refinancing

There is no minimum waiting period for when you can refinance a car loan, but there are some other requirements you must meet:

- You cannot be upside down in your current loan

- You need to be current on your current loan payments

- Your car needs to meet the age and mileage requirements of the new lender

- Your loan amount must fall within the new lender’s acceptable limits

- Your credit score must be good, or it needs to have improved

Generally, lenders are looking for a credit score that can be considered “good” or at least above average. However, it is also possible to be approved for a refinance if you are far enough along in the credit rebuilding process.

For example, those that took out a bad credit auto loan can significantly improve their credit score over the course of a year or two with steady, on-time payments. And while their credit still may be less than perfect after that time, they can still be approved for a refinance with better terms.

Don’t Miss: How To Compare Mortgage Loan Estimates

What Does It Mean To Refinance An Auto Loan

When you refinance an auto loan, you take out a new loan to pay off an existing loan. In that sense, a refinance auto loan is simply a used car loan on a car you already own.

There are several reasons why you might want to refinance:

- Take advantage of lower interest rates: If your original loan came with a high interest rate and you now have access to a lower one, refinancing can help reduce how much you spend on interest over the life of the loan.

- Shorten your loan term: You can choose to refinance to shorter terms. While this will increase your monthly payment, it will reduce the amount of time you need to pay on your vehicle loan.

- Lower your monthly payment: When you refinance your current auto loan, you can also choose to extend your loan to a longer term in exchange for a lower monthly car payment.

- Get a new lender: Whether itâs due to lots of fees, a bad customer experience or any other reason, sometimes you just want to part ways with your current lender.

If Youre Struggling To Make Your Auto Loan Payments Or Want To Take Advantage Of Lower Interest Rates You Might Want To Consider Refinancing A Car Loan Even If You Have Bad Credit

Although there are no guarantees, you may be able to refinance your car loan with bad credit. Whether you want to refinance to lower your interest rate, reduce your loan payments or get a loan with better terms, some lenders focus on auto loan refinancing for people who have bad credit.

Here are some steps to consider if you want to refinance.

Also Check: Where To Get Heloc Loan

Refinancing Car Loans With Bad Credit

Have you ever wondered How Does Car Refinancing Work? And, Does it affect your credit rating?

Car refinancing helps drivers to retain their vehicles when facing temporary financial challenges. It also lowers your monthly car loan installments and this helps you to save up for a better car or buy important accessories. Plus, its one of the benefits of having an excellent credit score. If youre looking for bad credit car dealerships apply with us today and well get you approved fast!

Do You Need An Auto Refinance Calculator

An auto refinance calculator will come in handy to help you:

- Determine the amount of money you can save through refinancing your existing loan

- Determine how the length of your loan impacts your monthly payment

- Understand your new monthly payment

- Compare loan offers to establish the best that meets your needs

Read Also: How To Pay My Student Loans

Auto Refinance With Bad Credit

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Are you hoping to replace your existing car loan with another maybe at a better rate? It makes sense if it reduces your car payment and doesnt require paying a hefty penalty or fee, but trying for an auto refinance with bad credit can be challenging. However, depending on the situation, there may be ways to make it work for you.

Here are some tips for borrowers trying to refinance an auto loan when they have poor credit.

Subaru Of Moncton Is Here To Help

Let the qualified staff at Subaru of Moncton help you develop a plan that will set up a sustainable payment plan along with a vehicle suitable for you and your family. We will even work with you to secure a no credit car loan if your situation demands it. We welcome all new and existing customers to visit our Finance Department for only the very best in auto loans and refinancing options. Already have a loan with us? Come in today and we can help you reduce your interest rate on your existing loan, refinance your car loan, or adjust the term of the contract. Most people do not realize that taking a car loan with us can help improve your credit rating in as little as one year. Drive one of our new or pre-owned vehicles today, establish a good payment history, and watch your credit improve. It’s that simple. Contact us today and let’s work together to rebuild your credit with the Subaru of your choice.

Read Also: What Type Of Loan Is Best For Investment Property

Bad Credit Loans Most Reputed Bad Credit Loan Approvals

The companys name tells a story Bad Credit Loans specializes in getting loans for bad credit customers. Your credit score does not disqualify you from a loan, although the company will perform a small check on your credit history. The reason is that it understands the pressing needs of most people when it comes to financial emergencies. Car loans are no different since such a car can be a means of survival.

It is a known fact that bad credit loans of any type attract high-interest rates. The lack of a credible credit rating usually makes many lenders attach a high rate to the money they loan out. Moreover, the loan amount does not reduce the rates, so you may be paying almost double or more of what you borrowed. The case is not the same with Bad Credit Loans, as it strives to provide for all its customers.

The company has a large base of satisfied and happy customers, and this should boost your confidence. It also shows the company provides essential services to people who trust the platform, getting many referrals and returning customers. The best part is that the steps to apply for and secure a loan are short and straightforward.

Highlights

No Extra Charge: Bad Credit Loans does not charge anything extra for its service. If anything, it delivers its service free of charge so that it does not increase how much you have to pay. Lenders deduct most fees from the loan sum, which may affect how much you have left for the car.

Pros

How Do I Refinance A Car Loan With Bad Credit

There are several steps involved with refinancing a car loan, and the process should start before you reach out to potential new lenders. Heres an overview of the steps you can take to get the best deal:

Check your credit

Review your credit to see if it has improved. You should also be sure to dispute errors that hurt your scores, such as inaccurate records showing missed payments or accounts that dont belong to you. You can pull your credit reports from all three credit bureaus for free, with no negative impact to your scores, from AnnualCreditReport.com.

Contact your current lender

You can streamline the refinancing process by working with a lender who already has your information on file. Plus, you may even get a better deal for having a preexisting account with your lender. Just make sure your lender offers refinancing for its own loans.

Shop for the best rate

Even if your current lender offers a good rate, you should still shop around. To get the best deal, see whats available from other car refinance companies in terms of rates, fees and other loan terms that youre looking for, like the length of repayment.

Select a lender and apply

Don’t Miss: How To Get Hardship Loan

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

What Is The Minimum Credit Score For A Refinance

Each lender sets its own credit score requirements for its auto refinancing loans. For example, you must have a score of at least 540 to get refinancing from Capital One Auto Refinance. Some lenders may offer no-credit-check loans in which they consider other factors instead, including income and expenses.

The lenders reviewed in this article all share a commitment to working with bad credit consumers to arrange automobile refinancing. Typically, the lower your credit score, the more monthly income you must have to compensate.

Recommended Reading: Fha Loan For Multifamily Property

Can I Refinance My Car With The Same Lender

It depends on whether they offer car refinancing. Car retailers make more profit when you purchase a car using an auto loan. Since car refinancing enables a buyer to pay lower monthly installments, the lender makes less profit.

Nowadays, theres a lot of competition in the auto industry because its much easier to buy a car than it was two decades ago. Theres an abundance of well-paying jobs that can enable you to save up for your cars deposit within 6 months. Plus, youll come across hundreds of registered credit unions and lending institutions offering various loans at really affordable interest rates.

How To Refinance A Car Loan With Bad Credit

Whether you want to lower your monthly payment or lower your interest rate, auto refinancing is a popular solution to explore. But is refinancing possible if you have bad credit? Read on to learn if refinancing is the right path to take in your current situation, how you can make it work for you in the future, and what other options are available to you.

Read Also: Companies That Pay Student Loans

Best For Fast Approvals: Alliant Credit Union

Alliant logo

-

No online chat option

Alliant Credit Union is an online credit union based in the Chicago, Illinois area. Its the largest credit union in Illinois and one of the biggest in the nation. However, it doesnt have physical branch locations and instead offers online and over-the-phone banking and loan services. It prides itself on putting its members first, offering personal customer service, competitive rates, and fast loan-approval times.

To join Alliant Credit Union, you can meet certain residency, employment, or relationship requirements, or you can just donate $5 to its partner charity, Foster Care to Success.

In addition to car loans, Alliant Credit Union offers online banking services, IRAs, trust accounts, credit cards, home loans, commercial real estate loans, and more. It has a unique car buying service that offers 0.50% off your rate for using it to purchase your next car. It also helps you with car research and lists cars from its trusted network and offers a vehicle service program and loans for recreational vehicles.

Alliant Credit Union offers financing for both new and used vehicles. Its rates start at 4.35% for new cars for 60 months and 4.70% for used cars. These rates will be 0.4% higher without autopay. Car loans can be up to 84 months with presumably higher rates. You can apply online or over the phone, and approval is usually done the same day. The approval process is easy with detailed instructions on the website.