How A Home Equity Loan Works

With a home equity loan, your primary residence is used to secure the loan. If approved, you can borrow from the equity your home has accrued. That includes any of the homes value youve paid off over time as well as the equity youve gained through rising home prices.

Home equity loans work a lot like primary mortgage loans. They typically have fixed interest rates and a set repayment term . After the loan closes, you receive a one-time lump sum of cash and pay it off in equal monthly payments to your lender. If you have an existing mortgage on the home, your home equity loan will be a second, separate payment on top of your current mortgage payment.

Many mortgage lenders, banks, credit unions, and other financial institutions offer home equity loans.

Home Equity Loan Vs Heloc

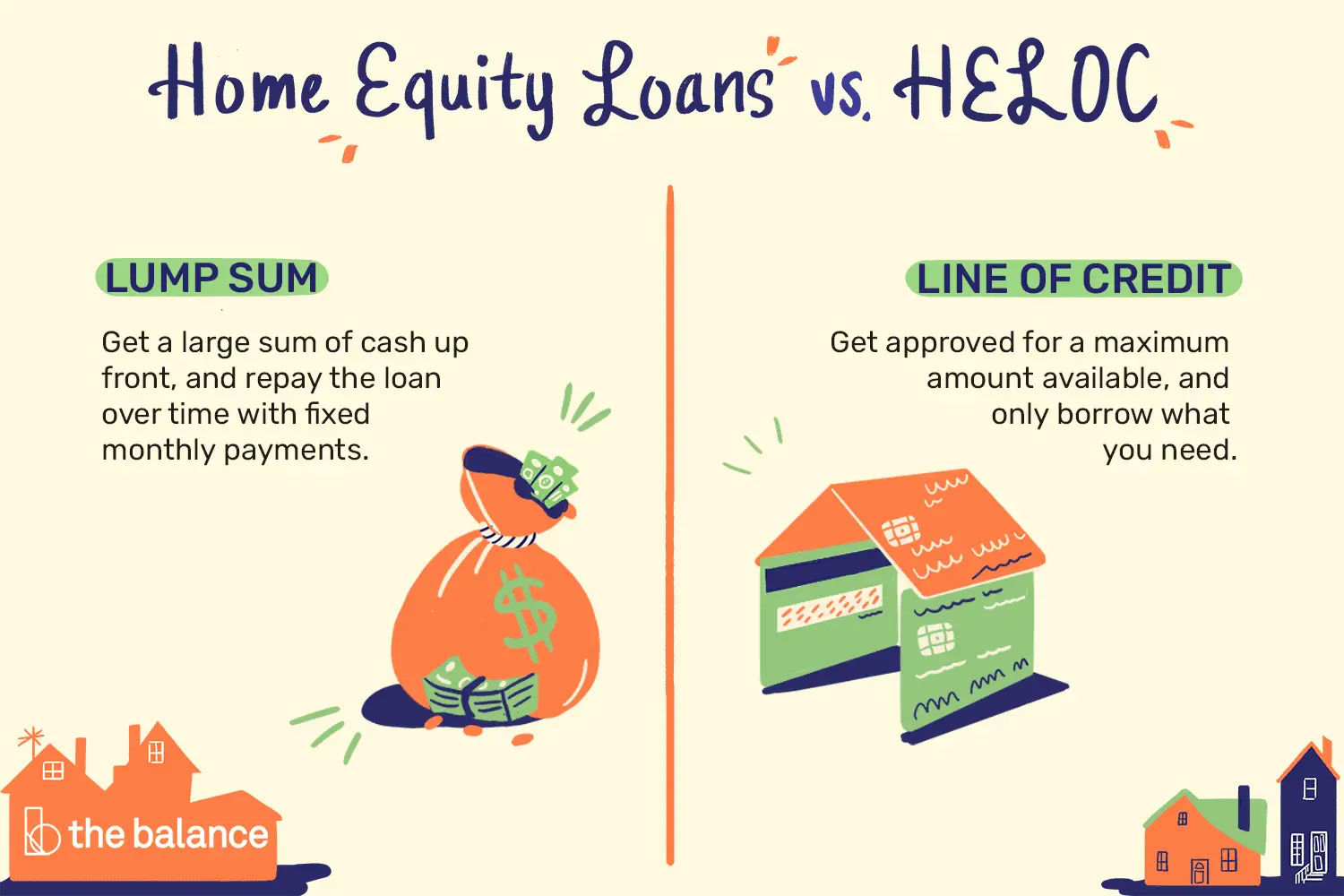

Understandably, there exists some confusion between a traditional home equity loan and whats called a HELOC, or home equity line of credit. They may sound similar but they are not the same.

First of all, both loans are secured by a borrowers home equity and require an approval process in which credit scores are prominently featured. As stated above, a home equity loan provides the homeowners with a lump sum, which they in turn must repay at a fixed rate over an agreed amount of time.

A HELOC on the other hand is a revolving credit line extended to borrowers up to a certain preset credit limit. Payments are not typically fixed and borrowers will be subject to variable interest ratesmuch like credit cards.

Additionally, a HELOC only enables you to take out loans on a periodic basis you dont receive the entirety of the loanthe line of creditall at once. Borrowers tap into their line of credit as needed, begin repayment, and then return to the line of credit if/when they need access to additional funds. There is a draw period when you can borrow money and are typically obliged to pay some interest-only payments on the loan, and a repayment period where you must pay back the principal plus interest. Borrowers need to be careful to budget for any increases in interest rates that can affect repayment amounts.

Under The Rule How Long Do I Have To Cancel

You have until midnight of the third business day to cancel your loan. Day one begins after all these things have happened

- you sign the loan at closing, and

- you get a Truth in Lending disclosure form with key information about the credit contract, including the APR, finance charge, amount financed, and payment schedule, and

- you get two copies of a Truth in Lending notice explaining your right to cancel

If you didnt get the disclosure form or the two copies of the notice or if the disclosure or notice was incorrect you may have up to three years to cancel.

Don’t Miss: How Do Loan Officers Get Leads

How To Use Home Equity Loans

You can use a home equity loan for just about anything it doesnt have to be home-related. However, home equity loans are most commonly used for large expenses like home improvements because they offer lower interest rates than and personal loans, large loan amounts, and long loan terms. Home improvements can often add value to the house, so many people consider it an investment thats worth taking on debt for.

In addition, the interest paid on the loan can be tax-deductible if you use the funds to substantially improve a qualifying home, and the total debt related to the house does not exceed $750,000.

Besides home improvement, other common uses for a home equity loan include:

Experts dont recommend taking out a home equity loan, or any other kind of loan, for non-essential expenses like a vacation or wedding. Instead, try to save up for those expenses over time so you can pay for them in cash instead of going into debt.

Who Should Consider A Home Equity Loan

Taking out a loan against the value of your home is something you might consider if you have to pay for something but dont have the cash to do so, says Michael Caligiuri, CFP, founder and CEO of Caligiuri Financial.

One of the most common reasons to get a home equity loan is for home remodeling and improvements. Utilizing a relatively low-interest loan, especially if it is to cover the cost of a major home improvement or renovation, could be a smart financial move, says Pepper. This is because the improvements or renovations can increase the value of your home in the long run and improve your quality of life.

Another good reason to get a home equity loan is to consolidate debt, which can save you a lot of money in the long run if you have a large amount of high-interest debt you anticipate needing a long time to pay off. How much you can save will depend on how much debt you have, the interest rate on your current debt, and the interest rate you can get on a home equity loan.

But, since home equity loans come with fees and closing costs, make sure you do the math to determine whether youll actually save enough in interest over time to offset the upfront costs. And, think carefully before you consolidate unsecured debt into a secured home equity loan, as that increases the risk to you in the event that you default.

You May Like: Do I Qualify For Student Loan Forgiveness

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Using Home Equity Lines Of Credit To Invest

Some people borrow money from a home equity line of credit to put into investments. Before investing this way, determine if you can tolerate the amount of risk.

The risks could include a rise in interest rates on your home equity line of credit and a decline in your investments. This could put pressure on your ability to repay the money you borrowed.

Also Check: How Do I Apply For Sba Loan

Home Equity Loan Closing Costs

According to Time magazine, closing costs on a home equity loan tend to range between 2% and 5% of the loans value. Thats the same proportion of the loans value that most mortgage closing costs represent.

But, of course, most people borrow less with a home equity loan than a whole new first mortgage. So, in dollar terms, the amount of those costs will usually be significantly lower. Thats why so many borrowers prefer this sort of loan to a cash-out refinance: They save a bundle on closing costs.

And they may save an even bigger bundle by comparison shopping for their home equity loan. At least one lender pays all closing costs incurred during the loan process so that you dont have to bring any cash to your loan closing.

Bear this in mind when youre comparing quotes from lenders. If you currently have plenty of cash, you may be better off paying high closing costs if the lender offers an uber-low interest rate in return.

But, if your priority is getting your hands on every cent you can, you may be willing to pay a higher rate in exchange for low or zero closing costs. Sometimes, you have to sacrifice your long-term interests for necessary short-term advantages.

Do I Have Home Equity

If youve been paying off your mortgage for several years, then you likely have at least some home equity. As we explained above, you build equity as you pay down your mortgage. If you decide to use your home equity to take out a second mortgage, youll need to have your house appraised to determine how much it is worth. But, if youre simply curious about how much equity you have or want a general idea of how much equity you have before you head to your lender, heres how to do a quick estimate.

Home value= $376,000

80% of value = $300,800

How much you still owe on mortgage= $232,000

80% of your homes value amount you owe on mortgage= $68,800

In this case, you can expect to get a second for $68,800 or less.

Keep in mind that the number youll get from the above equation is just an estimate as youll only truly know the current value of your house when you get it appraised.

Read Also: How Much Is An Rv Loan

Find Out Your Credit Score

Before you go to the trouble of filling out a loan application, you need to get a handle on whether your credit scores are high enough to make you a viable candidate. Wells Fargo offers up this advice for homeowners seeking a home equity loan or line of credit.

You’ll need an “excellent” credit sore of 760 and up to get the best rates, according to Wells Fargo. A score of 700 to 759 lands you in the “good” pile – you’ll like get a loan but maybe not the best rates. It goes downhill from there, with 621 to 699 considered “fair,” meaning “you may have difficulty obtaining credit, and likely pay higher rates for it,” with 620 and below classified as “poor.”

What Is Home Equity And How Much Home Equity Do I Have

Your home is one of your greatest assets. As you pay down your mortgage and property values in your neighborhood rise, the cash value of your home increases. That cash value is your home equity. It is the value of your homeownership.

To calculate your home equity, you must know the total amount of all debts secured by your home , and you must know the current fair market value of your home.

Simply put, your home equity can be calculated by subtracting all debts secured by your home from your homes fair market value.

For example, if your home is worth $400,000 and your current mortgage is $220,000, then you have $180,000 of equity in your home. Your borrowing ability depends on your closed loan-to-value . CLTV is your loan amount plus your mortgage balance, divided by your home discover $200,000.

Using our previous example, you can borrow up to $140,000 of your home equity. This is because $140,000 plus $220,000 , divided by $400,000 , is equal to 90% CLTV. Your borrowing ability is also dependent on your FICO score.

Also Check: How Long To Get Approved For Parent Plus Loan

Advantages And Disadvantages Of A Home Equity Line Of Credit

Advantages of home equity lines of credit include:

- easy access to available credit

- often lower interest rates than other types of credit

- you only pay interest on the amount you borrow

- you can pay back the money you borrow at any time without a prepayment penalty

- you can borrow as much as you want up to your available credit limit

- its flexible and can be set up to fit your borrowing needs

- you can consolidate your debts, often at a lower interest rate

Disadvantages of home equity lines of credit include:

- it requires discipline to pay it off because youre usually only required to pay monthly interest

- large amounts of available credit can make it easier to spend higher amounts and carry debt for a long time

- to switch your mortgage to another lender you may have to pay off your full home equity line of credit and any credit products you have with it

- your lender can take possession of your home if you miss payments even after working with your lender on a repayment plan

These are some disadvantages of a home equity line of credit that are common to other loans:

- variable interest rates can change which could increase your monthly interest payments

- your lender can reduce your credit limit at any time

- your lender has the right to demand that you pay the full amount at any time

- your credit score will decrease if you dont make the minimum payments as required by your lender

What Can You Use Home Equity Loan Funds For

You can use the funds you borrow from your home equity for any purpose, but its prudent to have an important goal for the money, as it can be tempting to use it to cover everyday expenses and make unnecessary purchases that youll have to pay back, with interest.

Can you use a home equity loan for a down payment?

You can use a home equity loan to access the equity in your current home to apply toward a down payment on your next home. This is a popular way to allow you to make a sizable down payment on a new home without needing to sell your current home concurrently.

Keep in mind that your overall debt will be factored into your debt-to-income ratio , which can affect your interest rate and eligibility for your new mortgage.

When your old home sells, the proceeds will first pay off your remaining mortgage balance, then your home equity loan. Any money left over will be distributed to you in cash.

Can you use a home equity loan to pay off your mortgage?

A home equity loan can be used to pay off your current mortgage, but this only makes sense if you can get a lower interest rate than your current mortgage. If you can, this will allow you to save on interest and thereby reduce your monthly payment.

Also Check: How To Roll Over Car Loan

How Will You Use Your Home Equity In 2022

In the end, the way you decide to access and use your home equity is up to you. Whatever path you choose should be based on your financial situation, so dont make that choice until youve got all the advice you can and weigh all your options equally. If youre having trouble figuring out which solution will suit your needs best, Loans Canada can help match you with the right home equity loan product and licensed specialist.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 23 votes.

How We Chose The Best Home Equity Loans

To narrow down our list of best home equity loans, we vetted each mortgage lender by evaluating them on the following criteria:

- Loan features: We evaluated the types of loans offered, minimum and maximum loan amount, interest rates, loan terms and credit score requirements for each lender.

- Price transparency: We preferred lenders that openly disclose loan costs, discounts, fees and other charges on their website.

- Application process: We checked eligibility requirements and approval times. In addition, we compared application and evaluation fees, and whether application services were available online, by phone and/or in person.

- Reputation and customer satisfaction: We looked into two main data sources: J.D. Power’s 2021 U.S. Primary Mortgage Servicer Satisfaction Study and complaint data as reported by the Consumer Financial Protection Bureau .

Recommended Reading: Are Home Equity Loan Rates Lower Than Mortgage Rates

Home Equity At Record Highs

We deliberately chose a borderline example. However, many homeowners have much more equity than that. Indeed, the amount available hit record highs at the end of 2021.

And, according to CoreLogic, on average, American homeowners each saw their home equity rise by $55,000 just over the 12 months ending in December 2021.

So theres a good chance you have way more home equity than you realize.

When A Heloc Makes Sense

The other factor to consider is what alternatives you have available.

If you have a true emergency and no emergency fund, an already established HELOC can be a better option than a credit card, which typically comes at a higher interest rate, says Barrow.

It might also be a better option than liquidating your investments or drawing from your retirement savings.

A HELOC could be a viable strategy for covering an emergency, as long as you understand the caveats and have looked into all your other options. But if you want to be financially prepared for the future, the very best option will always be to build an emergency fund before you ever need it.

Read Also: What Is The Commitment Fee On Mortgage Loan

Which Is Best For Me

Its about your preference, says Karen Gajeski, senior vice president of Mortgage Banking for Thrivent Credit Union. The differences come down to when you need your money, how much debt youd like to take on, and what payments youd like to make. The interest rates can be very similar between the two, Gajeski says, but rates with HELOCs can adjust over the term of the loan based on market conditions, whereas term loans typically have a fixed rate.

If youre using to make home improvements, then pay it down, and use it again for another reason, HELOCs are great, she says. If theres something you need to purchase, and pay off over a longer time frame, then term is your solution.

Learn more about home equity loans and other services at

How Hard Is It To Get A Home Equity Loan

Qualifying for a home equity loan is similar to qualifying for a mortgage. Youll have to prove creditworthiness, or that you can repay the loan. Lenders will check your credit score, income, debt-to-income ratio and maximum loan-to-value ratio. Lenders typically prefer your DTI to be less than 43% and an LTV of no more than 80%.

Lender requirements vary but, in general, youll need to have at least 20% equity in your home to qualify for a loan.

Don’t Miss: Can You Roll Closing Costs Into Fha Loan