Ways Va Home Loans Benefit First

As a current or former member of the military, you proudly served your country and made your share of sacrifices along the way. Now its time to consider buying your piece of the American dream and becoming a homeowner. Why not just rent, you ask? The primary reason is that buying a home builds long-term wealth through a system of forced savings. The math is simple. Each month you make a mortgage payment, which pays down your loan and automatically accumulates equity in your home. See? Your equity is money in the bank that you didnt have to make an effort to save. When you pay off the mortgage, youre left with a tidy sum that you probably never would have stashed yourself.

At Aligned Mortgage, we cant think of a better way for our military family to get into their first house than by availing themselves of the federally-backed VA loan program that comes loaded with benefits traditional loans cant touch. For instance:

No down payment required

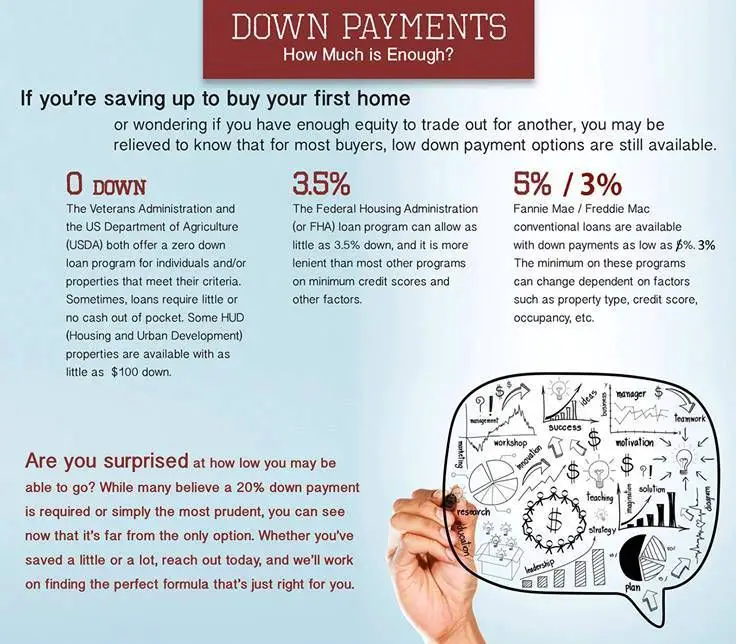

Lets face it, buying a home for the first time and putting between 3 to 20 percent down as many conventional loan programs require is a Herculean feat for most people. Thats a considerable chunk of change to gather when you consider that a 3 percent down payment for a $250,000 house is $7,5000, and 20 percent comes in at a whopping $50,000. The ideal house might pass you by in the time it takes to save up for that hefty down payment, which is why taking advantage of $0 down by using a VA loan makes a lot of sense.

Va Loans Must Be Used For Your Primary Residence

Another thing you may want to know about a VA loan is that it can only be used for your primary residence, where you plan to spend the majority of your time. All that means is that you cant use your VA eligibility to buy a temporary residence, like a vacation home.With that said, you should also be aware of the following.

Prequalify For Your Loan Amount

Pre-qualifying is important, but not required. But this step can save you time and potential surprises later. To prequalify for your loan amount, you’ll have a candid conversation with your VA loan professional about your income, credit history, employment, marital status and other factors. The prequalifying step can also reveal areas that need improvement before you can be approved, such as credit or debt-to-income ratio.

While a prequalification letter gives you a ballpark price range for house hunting, it does not guarantee you will be approved for a loan, and your lender will later have to verify the information you provide. You’ll still need final approval by underwriting once all documents have been received and reviewed .

Also Check: How To Get Teacher Loan Forgiveness

What Are The Benefits Of A Va Home Mortgage

Manageable qualification requirements

- Since these loans are financially backed by the Department of Veterans Affairs and thus lenders assume less risk, there are no credit checks for qualification and even when factoring interest rates, a borrowers credit score is less of an issue than with traditional home loans.

Down payments are not required

- For a lot of first time home buyers, saving thousands of dollars toward a down payment is daunting. This is the same for service members and veterans. With a traditional mortgage, a home buyer would need to put down a minimum of 5 percent toward the purchase price of their house and with Financial Housing Administration loans they would have to put down 3.5 percent.

- That means, if the home is $250,000, a traditional lender would require $12,500 down and an FHA lender would require $8,700. Knocking that number down to $0 allows service members and veterans an opportunity to buy a home they otherwise might not have had.

Monthly payments are lower than traditional home loans

10 Best VA Home Loans 2022

Compare 2022’s Best VA Home Loans. Federally Insured. 0% Down. Active Duty, Vet & Family. Tap to Compare Rates. No Money Down.

Comparing is quick, easy, and free!

- Thanks to competitive interest rates available through the VA Loan program as well as the absence of a private mortgage insurance requirement, VA Loan borrowers are able to save thousands of dollars throughout the life of their home loan.

What Is A First

With the help of a first-time homebuyer loan, the dream of owning a home can become a reality. These loans make homebuying accessible for borrowers who may struggle with the process due to low credit scores, limited income, or little savings for a down payment. Some loans aren’t specifically geared toward first-time homebuyers but still can offer an entry to homeownership all the same.

While first-time homebuyer grants exist and are worth exploring, here we’ll go in-depth on loans.

Read Also: How To Negotiate Student Loan Debt

What Are The Va Loan Terms For 2022

As of 2020, VA loan no longer have value limits for qualified borrowers. That means first-time VA loan borrowers will have no cap on the size of $0 down VA loans. The VA funding fees, which most borrowers have to pay when they close on their mortgage, remain the same as they were in 2020.

The funding fees range from 0.5 percent on some refinances to 3.6 percent for some home purchases. The exact fee varies depending on the value and type of your loan, how much you put down, and whether its your first VA financing.

These one-time fees help keep the loan program running. However, some borrowers may have to pay slightly more than the published rates in 2021. Veterans and service members will be charged the higher rates though National Guard and Reserve members will have their funding fee lowered to the same level as other military borrowers.

Veterans with service-related disabilities and some surviving spouses dont have to pay a funding fee. Purple Heart recipients on active duty are also exempt from the fee.

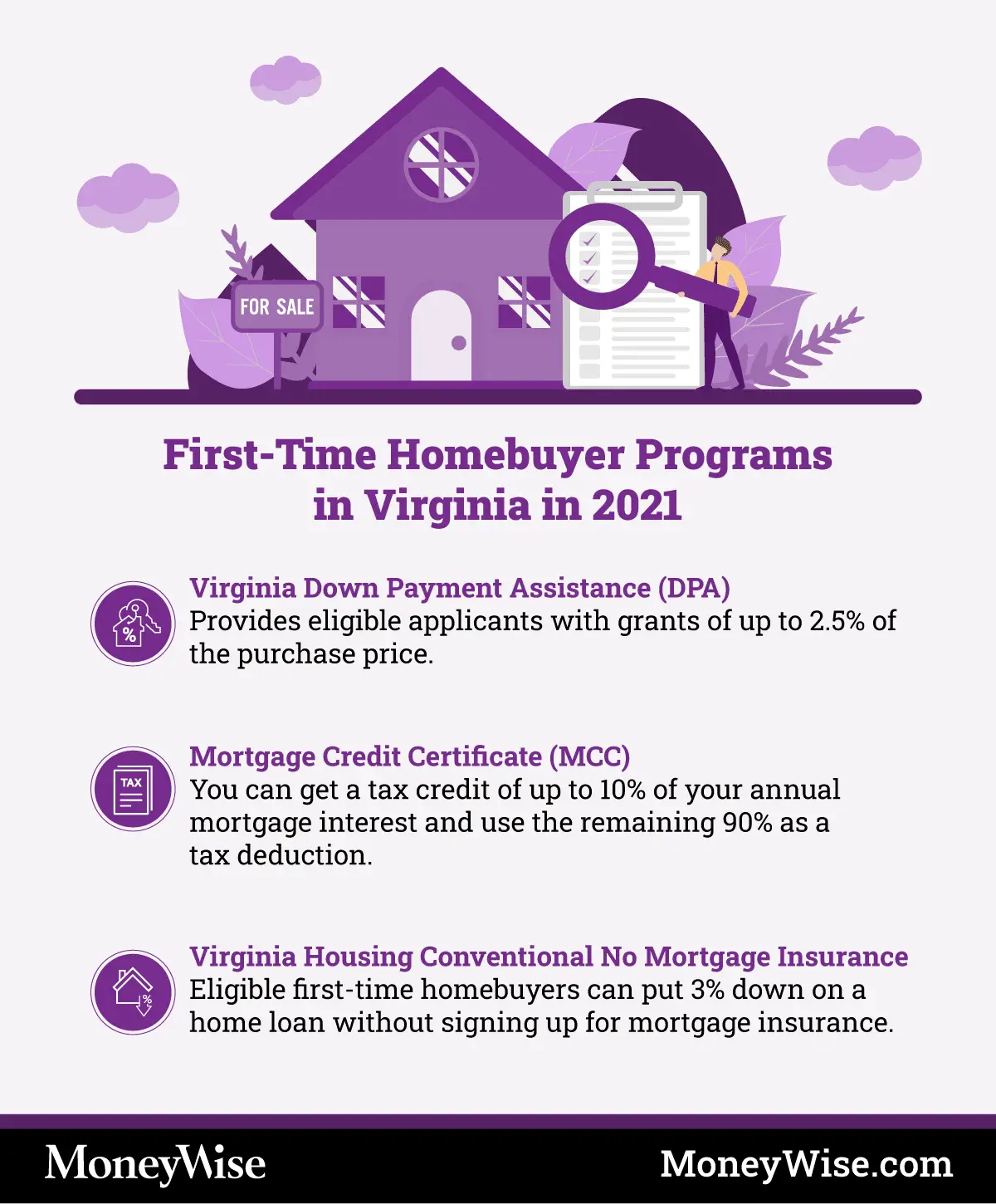

State Resources For First

There is an extensive range of programs available for first-time homebuyers across the country, but these programs vary by location. Residents in California can find great resources offered through the California Housing Finance Agency. In Colorado, the Colorado Housing and Finance Authority offers both down payment assistance grants and second mortgage loans. In New York, the HomeFirst Down Payment Assistance Program may offer you up to $100,000 in funds toward the purchase of your first house. Texas residents may qualify for down payments and special purchase programs through the Texas State Affordable Housing Program.

Read Also: When Do You Start Paying Back Student Loan

Who Can Buy A House With No Down Payment

Its easiest to buy a house with no down payment if you qualify for a zero-down VA loan or USDA loan. Veterans and active-duty service members are usually eligible for the VA program, while the USDA home loan is intended for buyers with moderate income in rural areas and small towns.

Other buyers may be able to purchase a home with no down payment if they qualify for down payment assistance. Many first-time home buyers who make below-average income for their area could be eligible for DPA funds. But you dont always have to be a first-time buyer to qualify rules vary by program and your local DPA might allow repeat buyers, too.

The Bottom Line: Is A Va Loan Right For You

A VA loan is an important benefit earned by our military. If you qualify, you can get a great interest rate with no money down, which means homeownership can be more affordable with a VA home loan.

If you feel like youre ready, apply for a VA loan with Rocket Mortgage today! You can also give us a call at 326-6018.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

You May Like: Can I Rent Out My Va Loan House

Documents Required For Coe:

You can apply for a Certificate of Eligibility through your private lender, by mail or online using the eBenefits portal. Documents needed to apply include a copy of discharge or separation papers if youre a veteran or a former National Guardsmen or Reservist. Current active duty service members, National Guard members and Reservists must provide a Statement of Service signed by their commander.

How To Apply For A Va Home Loan

After confirming eligibility for a VA loan, take the following steps to apply:

- Gather the information you need to apply for your Certificate of Eligibility . You can apply online through your lender using a WebLGY system or by mail downloading a VA Form 26-1880

- Submit your loan application. The lender will request a VA appraisal of the house. The lender reviews the appraisal and your credit income and decides if it accepts your loan application

- Apply for your COE and contact your states regional VA loan center to start the process directly with the government, in the case of Native American Direct Loans.

Once your lender accepts your application, they’ll work with you to select a title company to close on the house.

If you have any questions that your lender cant answer, please call your VA regional loan center at 877-827-3702. You can also watch a video on the official U.S. Dept. of Veteran Affairs YouTube page to learn more about VA home loans and how to apply.

When shopping for a VA loan lender, we recommend the following steps.

Key takeaways:

Don’t Miss: What Is Equity Reserves Fha Loan

A Va Loan Is Reusable

Once you completely pay off a VA loan, you regain your full VA eligibility and can reuse it for another VA loan.

You can reuse a VA loan as many times as you want, as long as the previous loan is paid off.

And like I mentioned before, you can also have two VA loans at a time, if you have enough entitlement available.

How Does A Va Home Loan Work

The VA does not issue VA loans, but they do determine who qualifies for one and which lenders issue them. There are several types of VA loans, and they pose less of a risk to lenders because theyre backed by a government agency.

VA mortgages are considered non-conforming loans because they dont meet the guidelines of conventional lenders Fannie Mae and Freddie Mac. However, this allows more flexibility for clients to qualify because of their easier credit score requirements. They offer many advantages over conventional loans, including lower interest rates, more lenient borrowing requirements and no down payment due at closing. VA loans also never have monthly mortgage insurance.

Recommended Reading: How To Calculate Car Loan

Understanding Va Closing Costs & Funding Fee

A common misconception about VA loans is that their closing costs are higher. This is simply not true, but its important to note that there is a mandatory funding fee on all VA mortgages . The funding fee is due at the time of closing, but clients have the option to finance the VA funding fee into their home loan. The funding fee for a VA loan depends on down-payment and whether youre a first-time homebuyer or if this is your second or subsequent loan.

Funding Fee Table

|

0.5% |

0.5% |

One of our VA loan officers would be happy to provide you with a custom loan quote.

National Guard & Reserve Member

Six years of service in the Selected or National Guard, AND

- Were discharged honorably, OR

- Were placed on the retired list, OR

- Were transferred to the Standby Reserve or an element of the Ready Reserve other than the Selected Reserve after service characterized as honorable, OR

- Continue to serve in the Selected Reserve

You May Also Be Eligible for a VA Loan If:

- You are an un-remarried spouse of a Veteran who died while in service or from a service-connected disability

- You are a spouse of a Service Member missing in action or a prisoner of war

- You are a surviving spouse in receipt of Dependency and Indemnity Compensation benefits in cases where the Veterans death was not service-connected

If you think youve met your service level requirement for a VA loan, your Mutual of Omaha Mortgage loan officer will be able to help you pull your Certificate of Eligibility.

Don’t Miss: Va Home Loans With Bad Credit

No Down Payment Option

Many first-time homebuyers don’t have enough savings for a down payment on a home purchase. And first-time homebuyers do not have proceeds from the sale of a prior home to put toward their real estate purchase.

VA home loans allow eligible borrowers to buy a home with as little as zero money down. When compared to most other mortgage programs, which may require 3.5% to 20% cash down, a VA-guaranteed mortgage can help first-time borrowers retain any savings they do have for future use.

Undergo Va Appraisal And Underwriting

Underwriters from your lender assess your finances and make sure you qualify for a VA loan. The VA will also require an appraisal before they approve the loan. VA appraisals are stricter than conventional loans. During a VA appraisal, the appraiser will check that the home meets the VAs MPRs and is sanitary, structurally sound and move-in ready with minimal repairs.

Don’t Miss: What Is Being Done About Student Loan Debt

Additional Va Loan Requirements:

In addition to service level requirements, to be eligible for a VA loan, you must also meet the credit and income guidelines for your mortgage. Well dive into those requirements next:

A Reliable Income Source – Youll need to be able to show your lender that you have a consistent and stable income source that will allow you to meet your monthly mortgage payments.

– Due to the coronavirus pandemic, credit score requirements have tightened across the entire mortgage industry. Generally, to be eligible for an VA loan you will need to have a credit score of at least 620.

VA Loan Limit – In most parts of the U.S., veterans who qualify for the VA Loan can purchase a home worth up to $510,400 without putting any money down: borrowers in high-cost counties may be able to purchase homes far exceeding that amount without a down payment. With a required minimum down payment, Mutual of Omaha Mortgage will authorize VA loans above county limits in excess of $1.5 million.

VA Property Requirements – The property that you wish to purchase must be your primary residence – it cannot be a second home or investment property. However, it can be used to buy a one-to-four unit home, as long as you use one unit as your primary residence.

A Mutual of Omaha Mortgage VA home loan specialist can help you assess your VA loan eligibility and review your home loan financing options.

Can A Spouse Apply For A Va Loan

Yes, surviving spouses may be eligible for a VA loan. Here are some eligibility cases for spouses, according to the VA website:

- A spouse, who has not remarried, of a veteran who died in service or from a service-related disability

- A spouse of a prisoner of war or service member missing in action

- A surviving spouse of a veteran, who is receiving compensation for a non-service-related death.

- A surviving spouse who remarried at age 57 or later, on or after December 16, 2003.

- In some cases, a surviving spouse of a totally disabled veteran whose death was not related to the disability.

You May Like: Does Collateral Have To Equal Loan Amount

A Va Loan Is Assumable

Your VA loan can also be assumed by someone else. That means that another buyer could take over your existing mortgage , basically a transfer of loan terms from current owner to a new buyer. The only contingency is that the new buyer must also be VA loan eligible.If the new buyer doesnt have VA entitlement, your entitlement will remain attached to the loan even after assumption. However, this means that the current owner is basically putting their entitlement on the line, so beware and make sure your entitlement will be fully restored after assumption.Overall, a VA loan is an amazing option for service men and women to achieve homeownership. If youd like to know if youre eligible for this program, an Atlantic Bay Mortgage Group mortgage banker can help guide you through the process.

Can I Apply For A Va Loan If I Have Defaulted On A Previous Va Loan

It is possible for borrowers to apply for another VA loan even if they have defaulted on a previous loan, although their VA entitlement may be reduced. There may also be a required waiting period for a VA loan following a foreclosure, but the waiting period is significantly lower for VA loans than Conventional loans .

Recommended Reading: How Can You Get Rid Of Student Loan Debt

Usda Loans: For Buyers With Lower To Moderate Incomes In Eligible Rural Areas

United States Department of Agriculture loans are mortgages guaranteed by the U. S. Department of Agriculture. A USDA loan can be a good option for home buyers on a budget that are flexible about where they live. They offer zero down payment loans with low interest rates and typically have more flexible credit requirements than conventional mortgages.

To be eligible for a USDA loan, the home must meet certain requirements. It must be your primary residence in a rural community with a population of less than 35,000. Rental properties and vacation homes do not qualify.