Farm Loan Interest Rates

Farming is a long-standing tradition of people, with evidence that it began approximately 12,000 years ago in the fertile crescent. The current scientific belief is that as time progressed, people became less nomadic and began to transition from hunter gatherer societies to agricultural and food production societies.

Farming has come a long way in that time period, particularly in the United States, where agriculture not only is an important part of our history, but also makes up a large portion of our economy.

Farms are considered the basic facility in food production and are areas or tracks of land that are devoted primarily to agriculture and its processes. The primary objective in farming is the production of crops and other food. There are, however, many different types farms and of farming.

Most often when people think about farms, particular types of farms such as vegetable, livestock, and dairy farms come to mind. However, farming goes far beyond that. It is also inclusive of feedlots, orchards, fish farms, flower farms, honey, and even wind farms.

The products produced or manufactured on these farms make their way to the American table, or to other farmers, or even as commodities for other industries. These are just a few of the many different farming specialties being carried out today.

How Much Of A Loan Can I Get For Land

There are no blanket rules for how much you can borrow with a land loan, and loan amounts can range depending on the type of land youre purchasing and the mortgage lender youre working with.

One lender might help you finance up to 85 percent of the cost of developed land, for example, or 70 percent of the cost of raw land. Keep in mind that how much you can borrow is directly related to your creditworthiness, how much cash you have on hand and the amount you plan to put down.

What Is A Land Loan

A land loan sometimes referred to as a lot loan is used to finance the purchase of a plot of land. You can take out a land loan if youre interested in buying a piece of land to build a home or to utilize for business purposes. The type you take out will depend on where youre buying land and how you intend to use the land.

A land loan is sometimes confused with a construction loan, which is another type of loan often used by people looking to build a house. So, whats the difference? Typically, if you want to buy land and start building on it right away, youll want a construction loan. These short-term loans are intended for prospective home builders who want to get started on their project right away and already have everything planned and ready to go.

Land or lot loans, on the other hand, are a better choice for future home builders who have a plan but may not want to jump right into building and financing a house immediately. If you have circumstances pushing your building project out a year or so a land loan is likely a better choice for you.

While Rocket Mortgage doesnt offer land or construction loans, you can still qualify for a mortgage on a new construction house. We can also help you refinance an existing construction loan into a traditional mortgage after your new home is built, given the home is finished and you obtain a Certificate of Occupancy whatever option works best for you.

Looking for the right place to build?

Recommended Reading: How To Loan Money For Profit

Farm Loan Interest Rate Breakdown

Well, farm loan interest rates can best be described as proportions of the principal that are charged as a percentage of the outstanding loan. This is a fee assessed by the lender to the borrower for the use of their assets. Most interest rates are assessed on an annual basis and are known as the annual percentage rate.

How does a bank or lender come up with their farm loan interest rates for the borrower? That depends on whether they are low-risk or high-risk party. The lower-risk a borrower is deemed to be, the lower that their interest rate will be, depending on the markets.

Farm loan interest rates are assessed by a lender as a compensation for loss of the capitals use. Basically, this means that if a lender invested the money or used it themselves, as opposed to lending it out, they could have generated an income, especially on a large amount of money.

How Can I Qualify For A Farm Credit

To qualify for a farm credit, find a lender that finances in your state and see if you meet their credit score criteria. Some lenders require a of 680 while others specialize in helping borrowers with much lower credit scores. Many loans will be collateralized by real estate, so there are many more farm loan options for you once you have an established farm. New farmers can qualify through loan programs designed to help them with less collateral and lower down payments, but typically require you to be under age 35.

Read Also: How Much House Can I Afford Loan Calculator

How Do Land Loans Work

Land and lot loans are obtained in the same way a buyer would obtain a mortgage loan for a house, but unlike receiving a dollar amount assigned to the property, it can be harder to determine what the land is worth because there is no property collateral.

This means that land loans are a riskier transaction for lenders, which results in higher down payment requirements and interest rates than a typical home loan.

Best Overall: Farm Credit Mid

Farm Credit Mid-America

With Farm Credit Mid-America, farmers can purchase farmland, construct or repair buildings and other fixtures, and finance equipment, making it our best overall lender for farm loans.

-

Up to 25-year repayment terms

-

Loans of $150,000+

-

Complementary programs to help farmers changing needs

-

To qualify, you must show that you are backed by an FSA Guarantee

-

Only lends in Indiana, Ohio, Kentucky, and Tennessee

Farm Credit Mid-America can fund any stage of a farming business. Its the best overall farm loan lender because of its breadth of services and additional features, like equipment financing, cash management, crop insurance, and food and fiber debt syndications.

Closing costs, including title and appraisal, accompany a very low 5% down payment minimum at the beginning of the loan.

In addition to real estate loans, they also offer crop insurance, investments, equipment leasing, and specialized financing for beef, dairy, poultry, swine, and timber farmers. Some of Farm Credit Mid-Americas programs can even fund in less than a month.

As part of the Farm Credit System, this lender has been a financial services cooperative since 1908. As a cooperative, it is owned by its customer stockholders who purchase voting stock. In the Spring of 2022, its Patronage program will return a record $210 million to its eligible customers. Customer reviews appreciate these annual distributions and reinforce consumer loyalty.

Don’t Miss: How To Roll Over Car Loan

What Are Farmland Loan Interest Rates In 2020

Sep 9, 2020 | Agriculture, Finance

The FSA offers a variety of loan programs, both to experienced farmers and to those who arejust getting started. Throughout the year, the FSA continually updates the interest rates for its loans to adjust with current economic conditions.

If youre interested in securing a farmland loan, your first step should be to research and understand current interest rates. These determine how much you must repay to your lender each month.

This article will walk you through current interest rates and how you can secure afarmland loan.

Trends In Farmland Price To Rent Ratios In Indiana

A standard measure of financial performance most commonly used for stocks is the price to earnings ratio . A high P/E ratio sometimes indicates that investors think an investment has good growth opportunities, relatively safe earnings, a low capitalization rate, or a combination of these factors. However, a high P/E ratio may also indicate that an investment is less attractive because the price has already been bid up to reflect these positive attributes. This paper computes a ratio equivalent to P/E ratio for farmland, the farmland price to cash rent ratio , and discusses trends in the P/rent ratio.

You May Like: How To Pay Huntington Car Loan Online

Land Loans: Everything You Need To Know

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

Sometimes when potential home buyers are looking to purchase a home, they may also consider building one. The thought can seem perfect until future homeowners realize what it might cost to build a house. Though building a house can be expensive, there are many ways to make it more feasible for first-time homeowners. Land loans are one of these resources.

If you choose to build a house, chances are you might have to apply for a land loan. While Rocket Mortgage® does not offer land loans or lot loans, we understand the importance of educating our clients, and we can help point you in the right direction to find the right lot for your new home.

Get approved for a mortgage.

Find out how much you can qualify for.

Indexes Of Seventh District Farmland Values

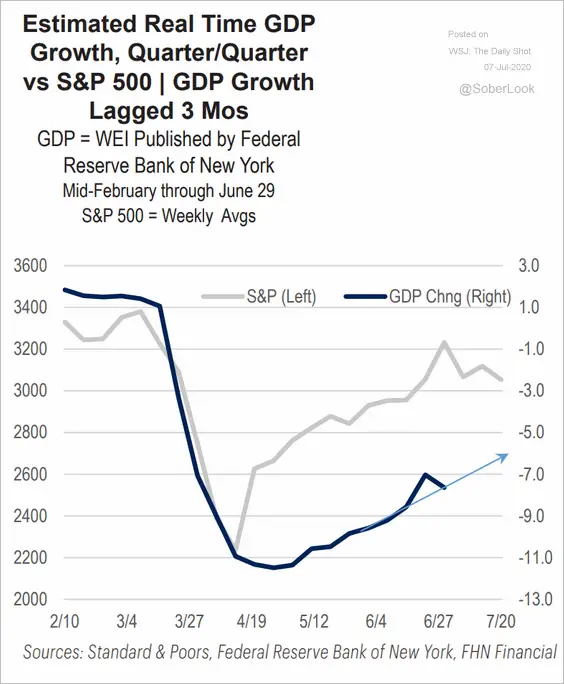

In addition to the impetus from lower interest rates, farmland values were boosted by 2020s rebound in total revenues from corn and soybean production in the five District states. All but one of the states had higher levels of both corn and soybean output in 2020 than in 2019. While most of the District states were spared from extreme weather events in 2020, Iowa was not, so its levels of corn and soybean production were down from a year ago. Based on calculations using U.S. Department of Agriculture data, the District states corn yield actually dipped to 182 bushels per acre in 2020 this yield was down 0.5 percent from 2019, chiefly because of Iowas lower corn output. In contrast, the District states soybean yield climbed to 55.5 bushels per acre in 2020up 5.7 percent from 2019. Given that harvested acres for both crops were 6 percent higher than in 2019, corn and soybean production for the District states increased 5.2 percent and 12 percent, respectively, in 2020. Even so, U.S. crop stocks were drawn down to fulfill demand in 2020 as exports picked up. The USDA projected prices for the 202021 crop year of $4.20 per bushel for corn and $11.15 per bushel for soybeans . When calculated with these prices, the estimated revenues from the 2020 harvest for District states would be up 24 percent for corn and 46 percent for soybeans relative to 2019.

Recommended Reading: Can You Get An Fha Loan If You Owe Taxes

About The Usda Rural Housing Mortgage

The Rural Development loans full name is the USDA Single Family Housing Guaranteed Loan Program. However, the program is more commonly known as a USDA loan.

The Rural Development loan is sometimes called a Section 502 loan, which refers to section 502 of the Housing Act of 1949, which makes the program possible.

This program is designed to help single-family home buyers and stimulate growth in less-populated, rural, and low-income areas.

That might sound restrictive. But in fact, 97% of the U.S. map is eligible for USDA loans, including many suburban areas near major cities. Any area with a population of 20,000 or less can be an eligible rural area.

Yet most U.S. home buyers, even those who have USDA loan eligibility, havent heard of this program or know little about it.

This is because the USDA loan program wasnt launched until the 1990s. Only recently has it been updated and adjusted to appeal to rural and suburban buyers nationwide.

Many USDA-approved lenders dont even list the USDA loan on their loan application menu. But many offer it.

So if you think youre eligible for a zero-down USDA loan, its worth asking your shortlist of lenders whether they offer this program.

Best For Low Down Payment: Farm Credit Services Of America

Farm Credit Services of America

Our best low down payment lender, Farm Credit Services of America, can act as the commercial lender partner for the low fee, rate, and down payment loans offered by the FSA, and further stands out with its down payment financing for contract facilities.

-

Can be used for virtually anything having to do with farm operations

-

General and Specialized loans

-

Must be 35 years old or less to qualify for the low down payment terms

-

Must have less than 10 years of primary operation management

-

Projected annual gross farm income must be less than $250,000

-

Lends in Iowa, Nebraska, South Dakota, and Wyoming only

Farm Credit Services of America goes the extra step by helping you finance your down payment, making them our best low down payment farm lender.

To qualify for a 5% down payment loan, you need to pursue one of the USDA FSA loan programs. Farm Credit Services of America can help you finance even your down payment money, which is usually something lenders wont do.

Naturally, with just a 5% down payment, the borrowers upfront costs become much lower. All that will remain will be the appraisal, title, and other document fees for the loan to close. During the loan, the annual percentage rates are dictated by the USDA.

Funds from Farm Credit Services of America can be used for cash liquidity during startup operations, restoring liquidity for farms facing operational challenges, and the purchase and breeding of livestock.

Don’t Miss: Who Can Loan Me Money

Second Quarter National Survey Of Terms Of Lending To Farmers

Interest rates on some agricultural loans have increased slightly in recent quarters, according to the National Survey of Terms of Lending to Farmers. The average rate on non-real estate farm loans increased about 30 basis points from the all-time low at the end of 2020 while the average for real estate loans declined further . However, alongside steady benchmark rates, the average cost of financing on all farm loans remained more than 80 basis points less than the recent average and substantially lower than any previous period on record.

The slight uptick in interest rates for non-real estate loans was consistent across nearly all types of non-real estate lending, but rates also remained well below historic averages. Rates on operating loans increased 60 basis points from the record low reached at the end of 2020 . Rates for farm machinery, feeder livestock and other livestock loans also were higher than recent quarters. In contrast, the average rate on farm real estate loans declined slightly and remained at a historic low.

The distribution of rates on operating and real estate loans was similar to five years ago, but starkly different than 10 years ago. About 15% of operating loans had rates less than 3% in the second quarter, compared with 12% of loans the same time in 2015 and 2% of loans in 2010 . Almost a third of farm real estate loans had an interest rate less than 3% in the second quarter of 2021, compared with a similar share in 2015 and none in 2010.

Tips For Managing Higher Interest Rates In 2022

Sky-high fertilizer prices, costly herbicides and equipment parts scarcity make for a bleak combination for growers this planting season. As inflation and high grain prices drive input costs higher, rising interest rates are once again making headlines for the first time since 2018.

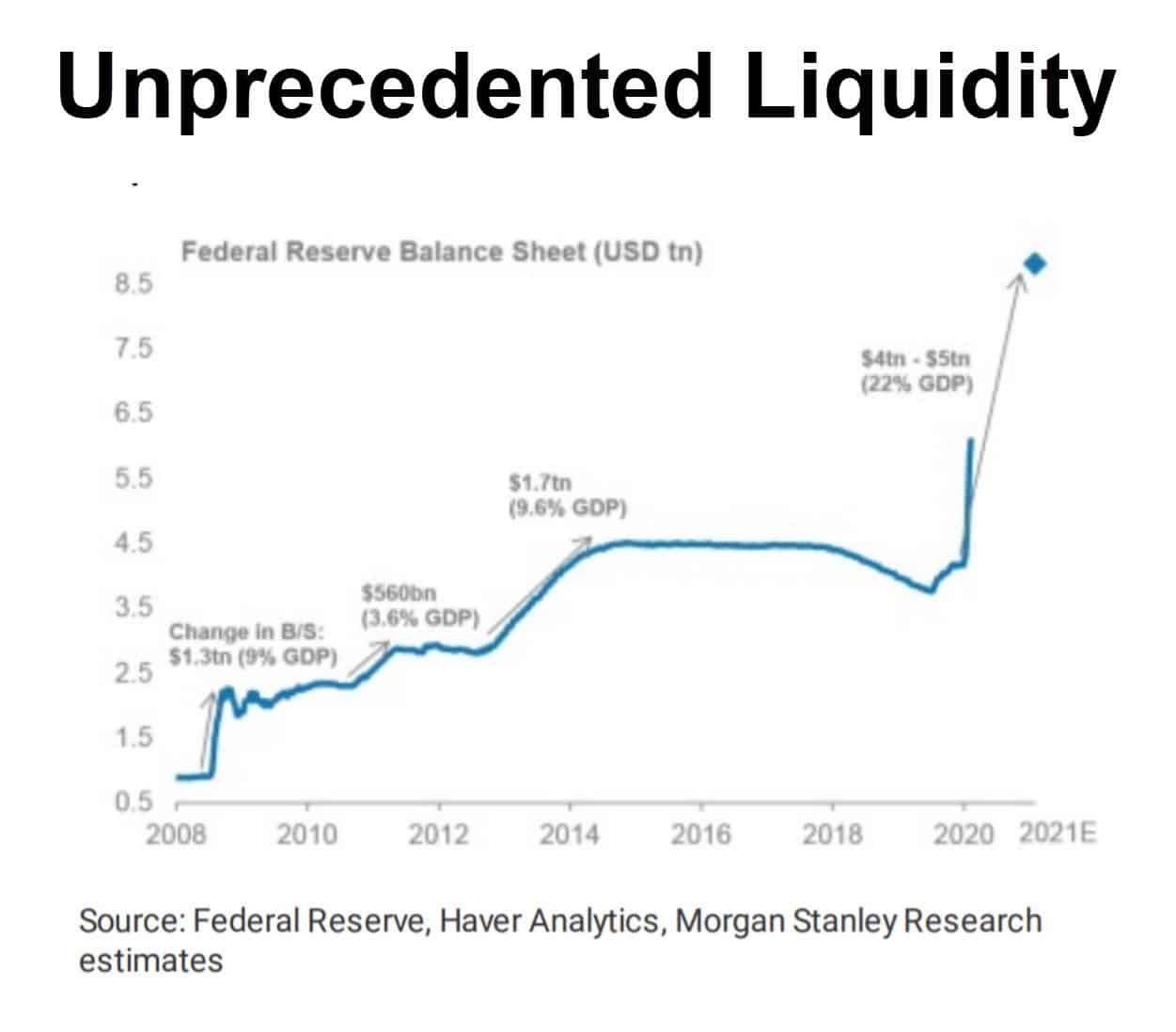

To slow down inflation, the Federal Reserve System can raise interest rates and they already have. After seeing significant inflation in 2021 without any correction from the Fed, retroactive correction is now taking place. On March 17, the Fed raised rates 25 basis points and has indicated it will again raise target interest rates another 50 basis points in early May. Historically, adjustments have been limited to 25 points.

What does this mean for farmers and ranchers?

Producers should expect to see increasing costs to borrow money throughout the year, says T.J. Roemmich, Conterra Ag Capital senior vice president, credit officer. The inflation weve experienced isnt typical and without policy action, its here to stay. This will increase the cost to farm and widen credit spreads.

Some producers may favor long-term loans that can offer assurances with a long-term fixed rate. Other producers gravitate toward shorter, more variable rate loans believing the lower cost is worth the risk if next years rates stabilize or fall back.

To combat this volatility, Roemmich offers two options that producers could consider to limit risk in this environment:

Also Check: How To Calculate Income Based Student Loan Repayment

How We Chose The Best Farm Loans

After reviewing 15 lenders we found a strong seven that can help you either in specific circumstances or as a full-service financial offering for decades of farming growth. We summarized the perks and imperfections of each lender and program, laid out the costs you can expect for each loan, and explored the extra services the lender provides to supplement your experience with them.

We valued companies with demonstrated experience, high customer satisfaction ratings, and wherever possible, a nationwide offering. Companies with an efficient online application process earned points with us too. Funding speed also matters, but lenders who offered the highly beneficial FSA programs made it to our top rankings because the USDA largely controls the processing speed for those programs. They are often worth their wait.

USDA Farm Service Agency. “Program Data.”

U.S. Department of Agriculture. Farm Loan Programs. Accessed March 7, 2022.

How Are Farm Loan Interest Rates Determined

They typically are assessed using three separate pieces of information. The first, which impacts not only the U.S., but can affect other countries is the Federal Reserve. This is the central bank of the United States and they set the feds funds rate. This is what affects short-term and variable interest rates.

The second is the investor demand for U.S. Treasury notes and bonds. The reason this is important it because they affect long-term and fixed interest rates.

Lastly, farm loan interest rates are determined by the banking industry itself. It is because they offer loans and mortgages and can charge interest rates depending on their business needs.

Recommended Reading: Can I Get An Investment Property Loan With 10 Down