Renting Vs Buying A Home

Deciding whether it makes sense to rent or buy is about more than just comparing your monthly rent to a potential mortgage payment. How long you plan on staying in that area should also factor into the decision. Buying a home requires you to pay thousands of dollars in upfront fees. If you sell the house in the next two or three years, then you may not have enough equity built up in the home to offset the fees you wouldnt have paid if you were renting. You also need to factor in maintenance and upkeep costs with owning a home.

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

What Is The Current Prime Lending Rate

As of May 2022, the prime lending rate in South Africa is 8.25%. It was increased by 0.25% in November 2021, and by another 0.25% in January 2022.

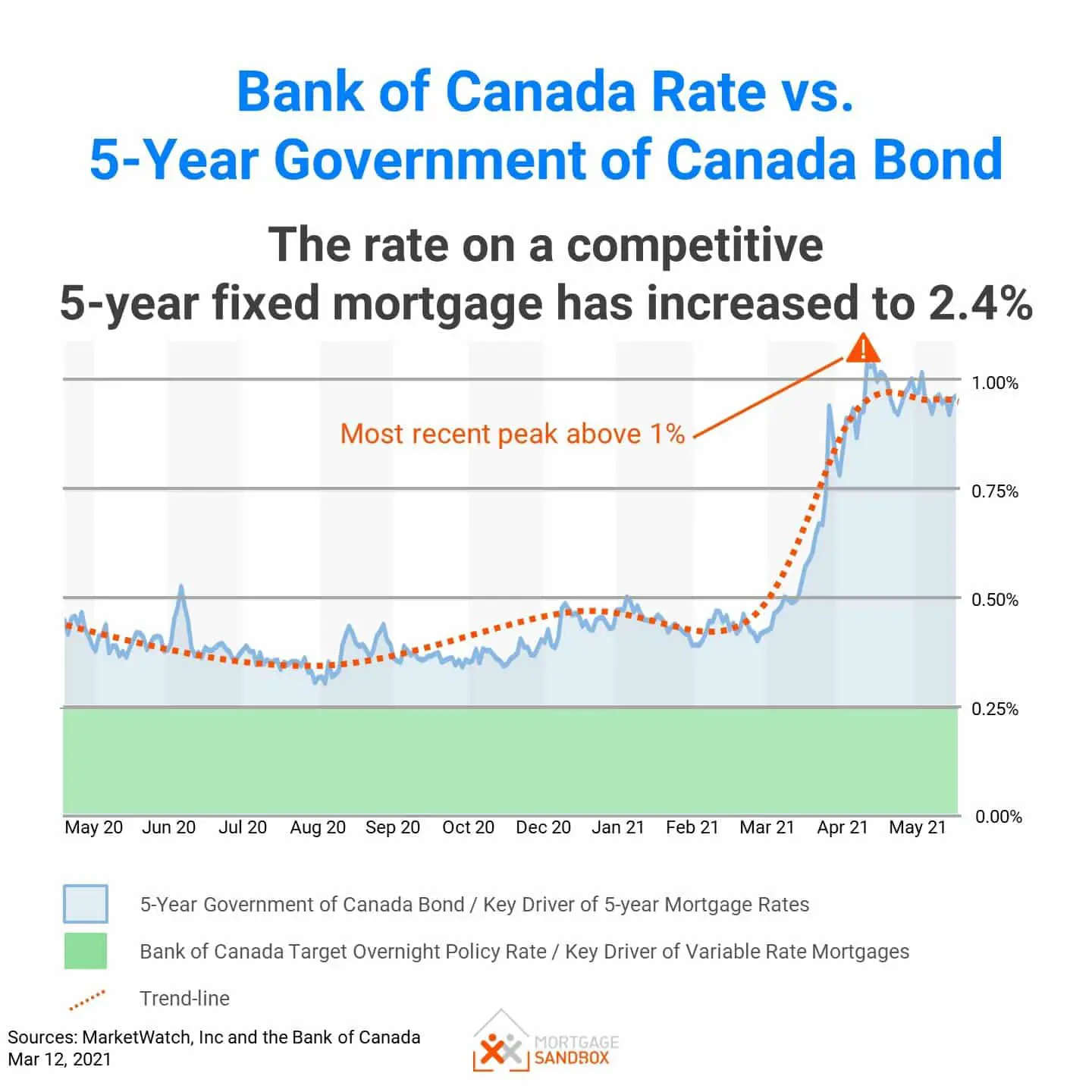

This increase follows a succession of interest rate cuts in 2020, which brought the interest rate to the lowest it had been in decades.

These cuts were intended to keep the property market going during the tough Covid lockdown period. The November and January increase signals that the South African Reserve Bank is attempting to adjust for rising inflation. More rate hikes are predicted for 2022.

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV.

Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.

Also Check: Can You Deduct Equity Loan Interest

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed-upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

What Are The Mortgage Rate Trends In 2022

The housing market is hot, and theres no getting around how rising interest rates can make navigating it difficult for many buyers, said Channel. That does not mean that buyers cannot receive a competitive rate on their mortgage keep in mind that while rates are rising, rates still arent particularly high from a historical perspective nor does it mean that homeownership is an impossible goal for many people, Channel added.

Recommended Reading: Is Bayview Loan Servicing Legitimate

Mortgage Interest Rates Forecast 2022

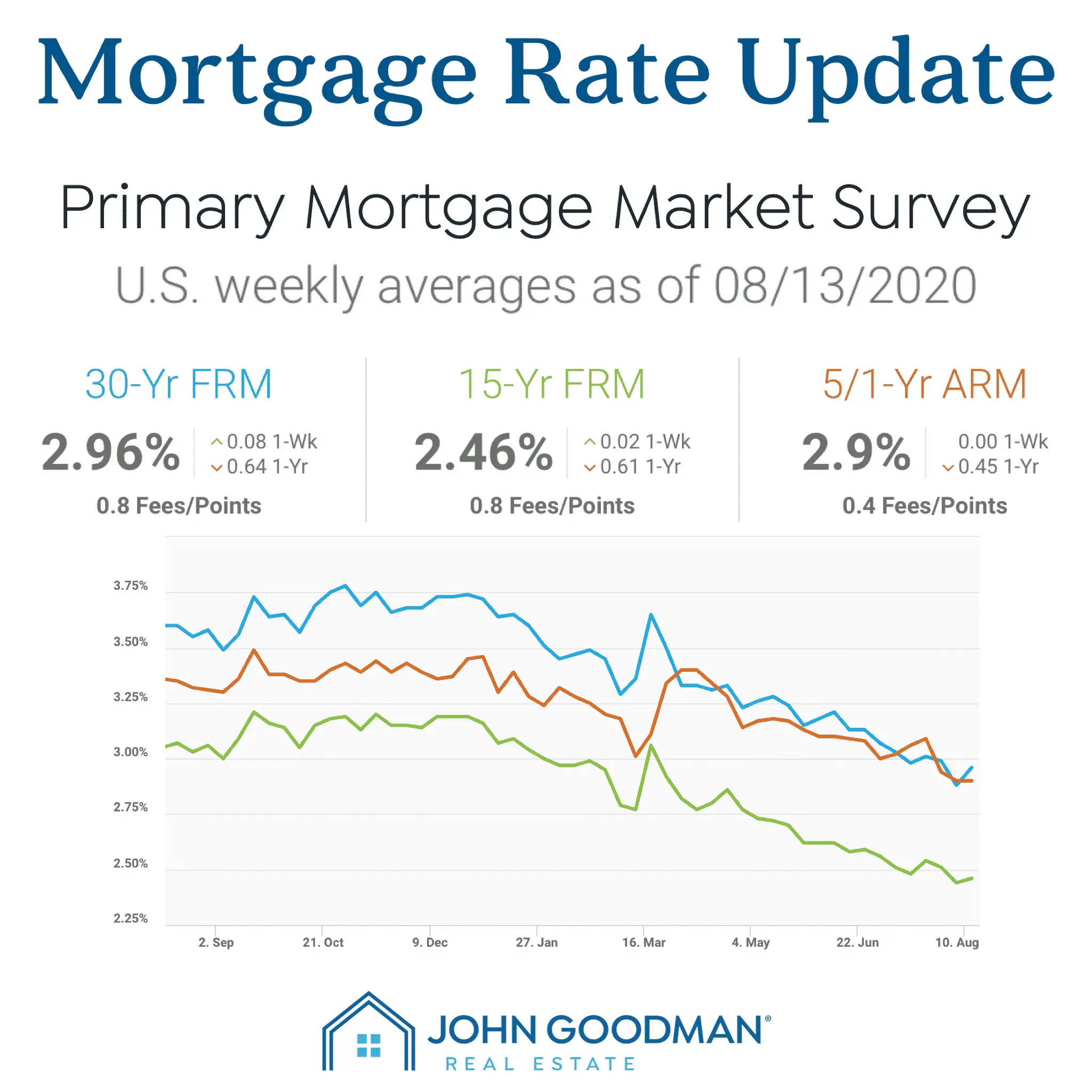

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserves monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

The pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year, says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . Additionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : Mortgage rates are expected to end 2022 at 4.8%and to decline gradually to 4.6%by 2024 as spreads narrow.

- NARs Yun: All in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.

- Matthew Speakman, senior economist at Zillow: Competing dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.

How To Calculate Interest On Home Loan

In general, home loans are long-term loans and it is important to figure out your overall interest liability towards the loan at the first place. You can calculate the same using one of the two methods listed below:

Don’t Miss: How Long Does Fha Loan Take

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

What Are The Best Ways To Use Home Equity

It can be a good idea to use your home equity for major life expenses that enhance your overall financial well-being. Some popular uses for home equity loans include:

A home equity loan makes more sense for a large, upfront expense because its paid out in a lump sum. If you have smaller expenses that will be spread out over several years, such as ongoing home renovation projects or college tuition payments, a HELOC might be a better option.

Keep in mind that just because you can use your equity doesnt mean you should. Leveraging your home to pay for a wedding, for example, might put your finances and home at risk down the line.

Recommended Reading: Guaranteed Loan Approval Bad Credit

What Is A Good 30

A 30-year fixed-rate mortgage is a home loan that maintains the same interest rate and monthly principal-and-interest payment over the 30-year loan period. With a rate that lasts the length of the loan, youll want the best rate you can get. Since your rate is most directly impacted by your credit score and down payment, youll want to make sure your credit file is accurate and make a down payment thats as much as you can easily afford.

Getting a good deal on a mortgage is like getting a good deal on a car. You do online research, you talk with friends and family, and then you comparison-shop. That last step, which involves applying with multiple lenders, is the most important step.

When you compare loan offers using the Loan Estimates, youll feel confident when you identify the offer that has the best combination of rate and fees.

A Freddie Mac report concluded that a typical borrower can expect to save $400 in interest in just the first year by comparison-shopping five lenders instead of applying with just one lender. Over several years, comparison-shopping for a mortgage can save thousands of dollars. Thatll give you something you can brag about.

The 30-year fixed isnt your only option. The 15-year fixed loan is common among refinancers. Adjustable-rate mortgages have low monthly payments during the first few years of the loan, making them popular for high-dollar loans.

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Don’t Miss: How To Get Commercial Loan Financing

Is It Worth Refinancing To A 15

You can save money and build home equity faster with a 15-year mortgage than with a 30-year mortgage. But the monthly mortgage payment will be higher on a 15-year mortgage because there is less time to pay off the loan.

Its worth comparing 15-year mortgage rates if youll be able to afford the monthly payments and still have enough money for other needs, such as saving for retirement.

Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

When you compare 15-year refinancing offers using the Loan Estimates you receive from lenders, youll feel confident when you identify the offer that has the best combination of rate and fees.

What Are Interest Rates Based On

Fixed mortgage interest rates operate in their own market. Theyre not directly tied to the Federal Reserves fed funds rate, although this benchmark rate can help influence the direction mortgage rates are headed. Other factors that influence mortgage rates include the health of the economy, the inflation rate, and how much demand lenders are seeing for home buying and refinancing. Only adjustable-rate mortgages are directly tied to market indices and therefore to the Feds benchmark rate.

You May Like: How Much Interest Rate For Auto Loan

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

How Does Your Credit Score Affect Your Rate

Your credit score measures your likelihood of making continuous, on-time mortgage payments. Homebuyers with higher credit scores seem less risky to lenders. So, in general, the higher your credit score, the lower your mortgage rate. But other factors such as your personal debt, down payment size, and loan program also influence your rate.

Recommended Reading: What Will My Monthly Loan Payment Be

What Is A Good Mortgage Rate

Rates have been on the rise since the beginning of 2022, but are still in the favorable range. If youre considering a refinance, a good mortgage rate is considered 0.75% to 1% lower than your current rate. New homebuyers can also benefit from the latest mortgage rates as they are comparable to rates prepandemic rates.

Even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Its important to understand that buying points does not help you build equity in a propertyyou simply save money on interest.

Read Also: Can Loan Companies See Other Loans

Mortgage Rate Strategies For September 2022

Mortgage rates grew fast and furiously to open 2022. The pace slowed in the second quarter, then interest rates shot up after the Feds 0.75% federal funds rate hike in mid-June. The central bank said it anticipates multiple similar hikes in 2022. Mortgage rates could climb throughout the rest of the year as a means to offset inflation. However, opportunities to lock in a low interest rate do still exist for home buyers and refinancing homeowners.

Here are just a few strategies to keep in mind if youre mortgage shopping in the coming months.

What Are Current Home Equity Interest Rates

Home equity interest rates vary widely by lender and the type of product. Generally speaking, home equity lines of credit have lower starting interest rates than home equity loans, although the rates are variable. Home equity loans have fixed interest rates, which means the rate you receive will be the rate you pay for the entirety of the loan term.

As of Sep. 7, 2022, the current average home equity loan interest rate is 6.98 percent. The current average HELOC interest rate is 6.51 percent.

| LOAN TYPE | |

|---|---|

| 6.51% | 5.27%-9.14%% |

Read Also: How To Find Out Who Owns My Student Loan

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their forever home have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thats why its so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

The Ontario Housing Market: Things To Know

- Homes in Ontario typically cost above $675 000, which is higher than the national average.

- Residential property prices are expected to see steady gains, in part due to a growing demand for homes in Toronto and the greater Toronto region.

- The federal government has taken steps to make homeownership more affordable for certain first-time buyers whether in Ontario or nationally by introducing the First-Time Home Buyer Incentive.

- Before you start searching for your home, its important to consider how much debt you can take on. Enter your details to find out how much you might be able to borrow.

Recommended Reading: What Is The Lowest Interest Rate For Used Car Loan