Ways To Finance A Manufactured Home

Once youve decided what type of manufactured home you want, youll need to figure out how to finance it.

Before we get into specific funding options, keep these factors in mind when seeking financing:

- Where will you put the home? The loan will likely be for the home only, so youll need to either buy the land for it through another loan, or rent some land through a mobile home community. Renting land could make you eligible for fewer loans.

- Bigger homes may not be eligible for some loans Buying a double-wide home that costs $100,000 or more isnt allowed in an FHA loan. Maximum loan amounts vary by the type of home bought.

- Compare lenders Not only should you compare the type of loan, but see how fees and interest rates vary among lenders.

Here are four broad financing options:

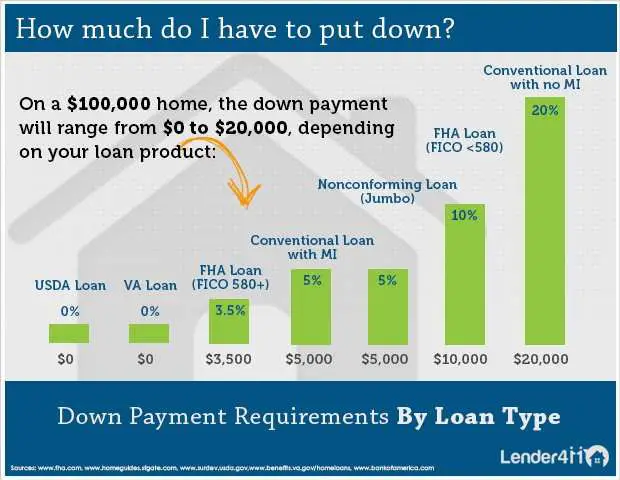

Home Buyers Dont Need To Put 20% Down

Its a common misconception that 20 percent down is required to buy a home. And, while that may have true at some point in history, it hasnt been so since the advent of the FHA loan in 1934.

In todays real estate market, home buyers dont need to make a 20% down payment. Many believe that they do, however despite the obvious risks.

The likely reason buyers believe 20% down is required is because, without 20 percent, youll have to pay for mortgage insurance. But thats not necessarily a bad thing.

No Down Payment: Usda Loans

The U.S. Department of Agriculture offers a 100% financing mortgage. The program is known as the Rural Housing Loan or simply USDA loan.

The good news about the USDA Rural Housing Loan is that its not just a rural loan its available to buyers in suburban neighborhoods, too. The USDAs goal is to help lowtomoderate income homebuyers, wherever they may be.

Many borrowers using the USDA loan program make a good living and reside in neighborhoods that dont meet the traditional definition of a rural area.

Some key benefits of the USDA loan are:

- No down payment requirement

- The upfront guarantee fee can be added to the loan balance at closing

- Monthly mortgage insurance fees are cheaper than for FHA

Just be aware that USDA enforces income limits your household income must be near or below the median for your area.

Another key benefit is that USDA mortgage rates are often lower than rates for comparable low or nodownpayment mortgages. Financing a home via USDA can be the lowestcost path to homeownership.

Recommended Reading: Capitol One Autoloans

What Are The Requirements For An Fha Loan

To qualify for an FHA mortgage loan, the FHA guidelines state that applicants must meet the following requirements.

Fha Credit History Standards

Your credit score is just a three-digit number. Your credit history details your payments for each of your debt accounts.

Lenders look for red flags in your credit history that might indicate you will not repay the loan. Occasional, infrequent late payments on a credit card, for example, will not raise a concern if you can explain why they occurred.

Collections and late payments are evaluated on a case-by-case basis. Lenders may overlook occasional late payments on your cable bill or clothing store credit card. A serious delinquency in these types of accounts would reflect negatively on your credit score. However, lenders are more concerned about late payments on your rent or mortgage. Lenders see a history of late rent and mortgage payments as a sign you may default on future home loans.

If you defaulted on a federal student loan or have another unpaid federal debt, you will be required to come up to date and have the debt either paid off in full or be current for several months. Similarly, judgments against you must be paid. Sometimes credit issues are beyond your control. The FHA realizes this and creates programs that take into account how one’s credit history may not reflect that person’s true willingness to pay on a mortgage.

If you experienced a bankruptcy, short sale, foreclosure or a deed in lieu of foreclosure in the last two years, check out this foreclosure page to learn about your mortgage options.

Read Also: Va Loan For Land And Modular Home

How Can I Lower My Fha Mortgage Payment

If the numbers in your FHA loan payment calculation seem a bit high, there are ways to lower them:

-

Extend the loan’s term. If you don’t plan to move, you can extend the number of years youll pay, say from 15 to 30 years. Yes, youll pay more interest over that longer timeframe, but your monthly payment will be significantly lower.

-

Buy less house. A smaller loan means smaller payments. Maybe you can do with a “good enough” home to start and make improvements over the coming years.

-

Avoid paying mortgage insurance premiums for any longer than necessary.FHA loan requirements mandate mortgage insurance premiums, but to avoid paying them for the life of the loan, consider making a down payment of at least 10%. With a down payment of 10% or more, your mortgage insurance premiums will end after 11 years

-

Get a better interest rate. Shop at least three FHA lenders to get the best shot at a lower interest rate. And mix up the competition: consider lenders that are local, national and online-only.

Can You Get A No Down Payment Fha Loan

You might see information about “no down payment” FHA loans on websites. What these websites generally mean is that it is possible to get help finding the money for your down payment. For example, the Federal Housing Administration allows you to use a gift from a family member to make your FHA loan down payment.

Many states also have FHA loan down payment assistance programs. Visit theU.S. Department of Housing and Urban Development website to see what assistance may be available in your state. Youll find links to various programs such as housing counselor agencies who can provide advice on topics such as buying, foreclosures, credit issues and more.

In addition, there are state-specific homeownership assistance programs such as Habitat for Humanity, educational programs to learn about buying and maintaining your home, community resources, and homeownership voucher programs that provides down payment assistance if you qualify.

Also Check: Usaa Used Auto Loan Rates

Example: How To Calculate Your Minimum Down Payment

The calculation of the minimum down payment depends on the purchase price of the home.

If the purchase price of your home is $500,000 or less

Suppose the purchase price of your home is $400,000. You need a minimum down payment of 5% of the purchase price. The purchase price multiplied by 5% is equal to $20,000.

If the purchase price of your home is more than $500,000

Suppose the purchase price of your home is $600,000. You can calculate your minimum down payment by adding 2 amounts. The first amount is 5% of the first $500,000, which is equal to $25,000. The second amount is 10% of the remaining balance of $100,000, which is equal to $10,000. Add both amounts together which gives you total of $35,000.

Whats The Minimum Amount You Can Put Down

The mortgage you can get largely depends on your personal circumstances.

Weve already mentioned some of the restrictions on certain loans. But lets take a deeper dive into the requirements for low and zerodown mortgages.

VA loans

To get a zerodown VA loan , you need a Certificate of Eligibility. And the VA has strict rules about those.

Veterans, activeduty service members, members of the National Guard, and reservists typically qualify along with some surviving spouses.

Youll need an acceptable credit history as well. Some mortgage lenders are happy with a credit score of 580, but many want 620660 or higher. Shop around if your scores low.

USDA loans

USDA mortgages are backed by the U.S. Department of Agriculture as part of its rural development program. Like the VA loan program, USDA allows a 0% down payment .

Youll have to buy in an eligible rural area to qualify. However, your occupation doesnt have to be connected to agriculture in any way.

You must also have an income thats low or moderate for the area where youre buying. Not sure whether yours is? Use this lookup tool to check whether your qualify.

According to Experian: While the USDA doesnt have a set credit score requirement, most lenders offering USDAguaranteed mortgages require a score of at least 640. This is the minimum credit score youll need to be eligible for automatic approval through the USDAs automated underwriting system.

Conforming loans

FHA loans

Don’t Miss: Current Usaa Car Loan Rates

Down Payment Options Fewer In Some Parts Of The Country

Some areas of the country feature a smaller number of condos approved by either Fannie Mae and Freddie Mac or the Department of Veterans Affairs or Federal Housing Administration. So depending on where you are looking to buy your condo, your down payment options might be even more limited.

You can search for FHA-approved condos by state and county on the link shown. You may find limited options in some states. In Florida, for example, only 130 condo buildings were approved for FHA insurance as of June 16 of this year. In Nevada, only 29 condo developments were approved for FHA financing. In Arizona, only 145 condo buildings had earned this approval, and in New Jersey just 298. Looking for an FHA-approved condo in New York? Your options were limited to just 84 as of June 16.

But in California, 2,056 condo developments have been approved for FHA financing as of June 16. In Illinois, buyers can find 632 FHA-approved condo developments.

Michael Kelczewski, a real estate agent with Brandywine Fine Properties in Centreville, Delaware, said that buyers might struggle to find condos in their states that are approved for FHA or VA loans, so they’ll typically have to go with conventional mortgages, those not insured by a government agency. Often, lenders will request higher down payments for these loans.

Frequently Asked Mortgage Question From First

Gustan Cho Associates work with many different families in all different areas of the country. But our clients commonly ask similar questions. In this blog, we will detail some of the most common questions we receive. We will also discuss how to apply for a mortgage with our highly skilled team. If you are a regular reader of our website, you will know that we help many families with less than ideal credit scores. The mortgage process can be confusing and that is why it is important to choose a mortgage team that can get you to the finish line. Buying a home is a large investment and we make sure all of our clients understand every step of the process. In the paragraphs below, we will be going over frequently asked mortgage questions by first-time homebuyers on purchase transactions and homeowners on refinances.

In this article

Don’t Miss: Pen Fed Car Buying Service

What Is A Federal Housing Administration Loan Loan

A Federal Housing Administration loan is a mortgage that is insured by the FHA and issued by an FHA-approved lender. FHA loans are designed for low- to moderate-income borrowers. They require a lower minimum down payment and lower than many conventional loans do.

Because of their many benefits, FHA loans are popular with first-time homebuyers.

Fha Loans Vs Conventional Mortgages

FHA loans are available to individuals with credit scores as low as 500. If your credit score is between 500 and 579, you may be able to secure an FHA loan assuming you can afford a down payment of 10%. If your credit score is 580 or higher, you can get an FHA loan with a down payment for as little as 3.5% down. By comparison, you’ll typically need a credit score of at least 620, and a down payment between 3% and 20%, to qualify for a conventional mortgage.

When it comes to income limitations and requirements for FHA home loans, there is no minimum or maximum.

For an FHA loanor any type of mortgageat least two years must have passed since the borrower experienced a bankruptcy event . You must be at least three years removed from any mortgage foreclosure events, and you must demonstrate that you are working toward re-establishing good credit. If you’re delinquent on your federal student loans or income taxes, you won’t qualify.

| FHA Loans vs. Conventional Loans |

|---|

Read Also: Fha Maximum Loan Amount Texas

What Does Protection Do Homeowners Insurance Cover

Homeowners insurance will protect you if something goes wrong with your properties such as a fire or physical damage. Once again, mortgage insurance is only there to protect the lender. Paying mortgage insurance allows most first-time homebuyers to enter the housing market because they do not require a 20% down payment. Lets go over mortgage insurance for FHA mortgage lending.

Debt In An Fha Dti Ratio Calculation

You must disclose all debts and open lines of credit on your loan application. You might wonder why you need to describe your open line of credit. These can become debt if the homebuyer goes on a shopping spree before closing, so the FHA directs lenders to keep an eye on open lines of credit.

Let’s start by calculating a back-end DTI ratio with example numbers.

The FHA calls the back-end ratio the total fixed payment expense DTI Ratio. Disclose your college loans, balances on your credit cards, auto loans, and how much you’ll pay in both auto insurance and homeowners insurance. Include any personal loans from family, and other debts.

Spousal and child support obligations are considered debt to the person required to make the payments.

Now let’s use the same numbers to calculate a front-end DTI ratio:

The FHA calls the front-end DTI ratio the total mortgage expense DTI Ratio.

Don’t Miss: How To Get A Mortgage License In California

How To Calculate Your Dti Ratio

There are two ways to calculate a DTI ratio. Most loan officers call one the front-end ratio and the other the back-end ratio. The FHA uses different terminology to express the same ideas. Your loan officer might use either set of terms to describe your DTI.

How does your DTI measure up? Use our quick and easy calculator to find out.

Conventional or conforming lenders call the typical maximum ratio the “28/36 rule.” For FHA loans, it’s the “31/43 rule.”

Frequently Asked Mortgage Questions On Tax Benefits Of Homeownership

What are the tax benefits of homeownership? This is a question that is very important. The tax benefits of owning a home are one reason why owning a home is better than renting. There are deductions you are able to take for mortgage interest and real estate taxes paid. If you end up paying discount points to purchase a home, that amount is also a tax deduction. As a first-time homebuyer, you do not need to worry about capital gains assuming you live in the house for two or more years. As your income starts to increase, tax deductions are more and more important.

Read Also: Myeddebt Ed Gov Legit

Down Payment Requirements For A $300k House

The down payment amount youll need depends on what type of mortgage loan you choose.

Here are the minimum down payments for different home loans on a $300,000 house:

- VA loan: $0 Only available to service members and veterans who have reached minimum service thresholds. Surviving spouses may also apply

- USDA loan: $0 You need to be buying in a designated rural area and have a lowtomoderate income for the area where youre buying

- Conforming loan: $9,000 A loan that conforms to Fannie Mae and Freddie Macs requirements, including a minimum credit score of 620

- FHA loan: $10,500 Backed by the Federal Housing Administration. Your credit score may be as low as 580 if you have a 3.5% down payment

- No-PMI conventional loan: $30,000-$60,000 If you want to avoid private mortgage insurance you need 20% down. But you may find lenders that allow you to borrow a second mortgage to bridge the gap between your savings and that 20%. More on that below

Of course, all these are minimums. And as a general rule, the more cash you put down, the lower your interest rate is likely to be.

But even if you come up short of 3% or 3.5% down, you may have options.

Down payment assistance programs exist across the country. And these can help with grants or loans to cover some or all your down payment needs. Some even contribute to closing costs.