Lisa Simpson Cpa Cgma

Lisa is Vice President Firm Services for the AICPA. She leads the Private Companies Practice Section team in the development of practice management tools that address topics most important to firm owners. Lisa and her team develop and foster relationships with firms of all sizes, including through the AICPAs Major Firms Group and Group of 400 initiatives as well as networking groups for small firms.Lisa began her career with EY gaining audit and tax experience in her six years with the firm. She then worked for a small firm in Lexington, Kentucky for five years. Lisa has 20+ years of industry experience as well, having served as the CFO for non-profit and for-profit organizations before joining the AICPA in 2012. Lisa graduated from Eastern Kentucky University and is licensed as a CPA in NC and KY.

Economic Injury Disaster Loans

In response to the Coronavirus pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available following a successful application. This loan advance will not have to be repaid. If a business received an Economic Injury Disaster Loan advance in addition to a Paycheck Protection Program loan, the amount of the Economic Injury Disaster Loan advance will be deducted from the PPP loan forgiveness amount by SBA.

The SBAs Economic Injury Disaster Loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the COVID-19 pandemic.

This program is for any small business with fewer than 500 employees , private non-profit organization or 501 veterans organizations affected by COVID-19.

Businesses in certain industries may have more than 500 employees if they meet the SBAs size standards for those industries.

The Economic Injury Disaster Loan advance funds will be made available within days of a successful application, and this loan advance will not have to be repaid.

Federal Court: Ppp Loan Applicants Cant Sue The Bank Over Ppp Rules

With the promise of low-interest or no-interest loans, and even the possibility of loan forgiveness, small businesses rocked by COVID-19 have recently turned to banks to apply for federally guaranteed funds. These funds are vital to many small businesses in order to help them stabilize their financial health during the widespread economic fallout from the pandemic. They are seeking these funds under the recently enacted CARES Act.

On March 27, the president signed into law the CARES Act, H.R. 748, P.L. 116-136, to provide emergency assistance and health care response for individuals, families, and businesses affected by the coronavirus pandemic. The purpose of the CARES Act is to provide immediate assistance to individuals, families, and businesses affected by the COVID-19 emergency.

Section 1102 of the CARES Act, entitled Paycheck Protection Program, also known as the PPP, authorizes participating lenders to make general business loans available to eligible recipients in order to cover payroll and other expenses. CARES Act § 1102, . The PPP loans are federally guaranteed up to a maximum amount of $10 million and might be forgiven if the businesses meet certain conditions centered around encouraging businesses to maintain jobs and salaries for employees.

The opinion reads:

You May Like: How To Get Out Of Car Loan Early

General Disclaimer For Bank Of America Merrill Lynch

Bank of America and BofA Securities are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. Lending, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation , including, in the United States, BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp., both of which are registered broker-dealers and Members of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA.

Investment products offered by Investment Banking Affiliates:

| Are Not FDIC Insured |

Bofa Securities Inc Further Information

“Bank of America Merrill Lynch” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation , including, in the United States, Merrill Lynch, Pierce, Fenner & Smith Incorporated, BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp., all of which are registered as broker-dealers and members of FINRA and SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp are registered as futures commission merchants with the CFTC and are members of the NFA. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured May Lose Value Are Not Bank Guaranteed.

Read Also: How To Assume Someone’s Car Loan

Other Related Questions And Topics

Does workmans comp or other payouts count towards my payroll cost?According to the latest guidance released by the SBA, payroll costs consist of compensation to employees in the form of salaries, wages, commissions, or similar compensation cash tips, or the equivalent payment for vacation, parental, family, medical, or sick leave allowance for separation or dismissal payment for the provision of certain employee benefits payment of state and local taxes assessed on employee compensation, and for an independent contractor or sole proprietor wages, commissions, income, or net earnings from self-employment, or similar compensation. Please visit the SBA Website for more in-depth information about what payroll costs are covered.

I dont have enough PPP funds to cover my payroll expenses. Can I deposit into my PPP account to cover an upcoming payroll?Yes, you can make a deposit into your deposit account that was used for funding your PPP loan.

What happens if I only spend 70% on payroll and 90% in total of the loan amount? Would I owe 10% back?If only a portion of the loan is forgiven, any remaining balance due on the loan must be repaid by the borrower on or before the maturity of the loan, in accordance with the terms of your loan note. Please see the SBA Website for additional guidance.

Important disclosure information

Contract Workers Render Promises Of Loan Forgiveness Null And Void For Small Businesses

Bank of Americas alleged misleading marketing of the PPP Loan program is claimed to be fatally flawed. The SBA only forgives loans to business owners with employees who report income on IRS Form W-2, not to independent contractors. Despite this limitation, BANA marketed PPP Loans not only to businesses with employees who report income on Form W-2, but also those that had contract workers who report on Form 1099even though payments to those contract workers were not eligible for forgiveness. Defendants marketing and application materials consistently and repeatedly misrepresented PPP Loan forgiveness eligibility for these business owners with contractor-workers reporting Form 1099 income.

If you been victim of these alleged misleading statements by Bank of America, contact us today by filling out the form above to schedule a consultation.

Don’t Miss: How Much Mortgage Loan Calculator

Pricing And Market Information

Actual prices can be obtained only on a real-time, expressly agreed-upon basis. Any indicative valuations on the Sites are provided for information only. They are not an offer to enter into, transfer and assign or terminate any transaction, or a commitment by Bank of America or its Affiliates to make such an offer. An indicative valuation may differ substantially from an actual value. Such estimates do not necessarily reflect Bank of Americas or its Affiliates internal bookkeeping or theoretical model-based valuations. Certain factors, which may not have been assessed for purposes of these valuations, including, for example, notional amounts, credit spreads, underlying volatility, costs of carry or use of capital and profit, may substantially affect a stated valuation. Indicative valuations may vary significantly from indicative valuations available from other sources. While Bank of America and its Affiliates have obtained the information on which these evaluations are based from sources they believe are reliable, Bank of America and its Affiliates make no representations or warranties with respect to any indicative valuations. Prior to the execution of a Transaction based upon the Content of these Sites, Client is advised to consult with its broker or other financial representative to verify pricing information.

Small Business Paycheck Protection Program

The Paycheck Protection Program established by the CARES Act, is implemented by the Small Business Administration with support from the Department of the Treasury. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. Funds can also be used to pay interest on mortgages, rent, and utilities.

The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $659 billion toward job retention and certain other expenses.

Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards.

Previous Versions of Applications

You May Like: How Much Home Loan Can I Get On 70000 Salary

Compliance With Laws And Indemnity

The Sites may be used only for lawful purposes. Clients conduct may be subject to local, state, national and international laws. Client agrees that it and any of its Authorized Persons shall comply with this Agreement, applicable laws, rules, regulations, ordinances and other similar national and international requirements of the country, state and province in which you are accessing and using the Sites.

Client agrees to abide by applicable export control laws and not to transfer, by electronic transmission or otherwise, any content on the Sites subject to restrictions under such laws to a national destination prohibited under such laws, without first obtaining, and then complying with, any requisites government authorization. Client further agrees not to upload to the Sites any data or software that cannot be exported without prior written government authorization, including, but not limited to, certain encryption software. This assurance and commitment shall survive termination of these Terms and Conditions. Offices, residents and operations of your organization in Cuba, Iran, Iraq, Libya, North Korea, Sudan, Syria and any other countries that are the subject of sanctions by the United States Office of Foreign Asset Control or other general U.S. embargo restrictions are not permitted to access and use the Sites, and any such access and use is a violation of these Terms and Conditions.

House Members Urge Sba To Change Ppp Loan Forgiveness Policy

A group of House members led by Rep. Chrissy Houlahan sent an ICBA-supported letter to the Small Business Administration calling for common-sense reform to Paycheck Protection Program loan forgiveness.

Joint Letter: The letter calls on the SBA to forgive PPP loans in which the loan amounts were miscalculated due to good-faith errors. There are more than 300,000 PPP borrowers facing financial hardship due to good-faith loan amount miscalculations, it says.

ICBA Position: ICBA expressed support for the joint letter. The SBA should forgive excess loan amounts in cases in which errors were made in good faith and the loans were used for forgivable uses, to avoid imposing unexpected debt on small businesses that did their part to pay employees and serve customers during the worst of the pandemic, ICBA President and CEO Rebeca Romero Rainey said.

Background: According to SBA policy, excess loan amount errors that exceed the borrowers correct maximum loan amount are not eligible for loan forgiveness and must be repaid, even if they were spent on forgivable uses during the covered period.

Also Check: Do I Qualify For Rural Development Loan

Content And Service Availability

Bank of America or its Affiliates may make changes to the Sites and reserves the right to do so without prior notice to you. Client acknowledges that not all products and services listed or discussed in the Sites are available in all geographic areas. Your eligibility for particular products and services is subject to final determination and acceptance by Bank of America or its Affiliates.

What Can You Expect From The Sba Direct Forgiveness Portal Process

Recommended Reading: What Do I Need To Get Home Equity Loan

Paycheck Protection Program Loan Forgiveness

Eligible clients can apply now for PPP loan forgivenessOur PPP loan forgiveness portal is now open and includes a simplified forgiveness application for PPP loans of $150,000 or less. We will email clients with a link to access our loan forgiveness application over the coming weeks, when the application becomes available to them.

When can I apply for PPP loan forgiveness?

The simplified SBA Form 3508S is now available, in addition to the revised SBA Form 3508EZ and SBA Form 3508 applications. Eligible clients will receive an email with a link to access our loan forgiveness application when it becomes available to them.

As a reminder, based on the latest updates from the SBA, you now have more time to gather your documents and prepare your application. The timeframe for applying for loan forgiveness in the promissory note no longer applies.

For additional assistance with PPP loan forgiveness documentation, view our documentation guide.

Is Bank of America participating in the SBA Direct Forgiveness program for applications equal to or less than $150,000?

The Small Business Administration announced on July 28, 2021 a new initiative that will allow borrowers of participating lenders with loans less than or equal to $150,000 to apply for forgiveness through the SBAs direct forgiveness online portal.

Do I need an Online Banking ID to access my PPP loan forgiveness application online?

Yes, you need a profile set up for Business Advantage 360, our small business online banking.

Reasons Borrowers Shouldnt Rush Their Ppp Forgiveness Applications

Lisa Simpson CPA, CGMA

This blog post explains why borrowers shouldnt rush their PPP loan forgiveness applications. Please share with clients who participated in the program.

Borrowers who received Paycheck Protection Program loans under the Coronavirus Aid, Relief, and Economic Security Act are asking their CPAs if and how they will qualify for PPP loan forgiveness. There is uncertainty over some of the program details. Organizations especially small businesses worry about meeting the maximizing loan forgiveness requirements.

While you may be anxious to apply for forgiveness, here are five factors affecting the forgiveness application process.

Most lenders are not ready to process forgiveness applications. Many are developing technology tools such as forgiveness portals or will leverage other automation options for a more efficient process. Until the U.S. Small Business Administration and the U.S. Treasury Department issue final guidance, those technology tools cant be finalized. The timing on when that guidance will be available is uncertain. Bank of America, as one example, is PPP loan holders it expects to begin opening its online loan forgiveness application process in early August and will email instructions to borrowers when its ready.

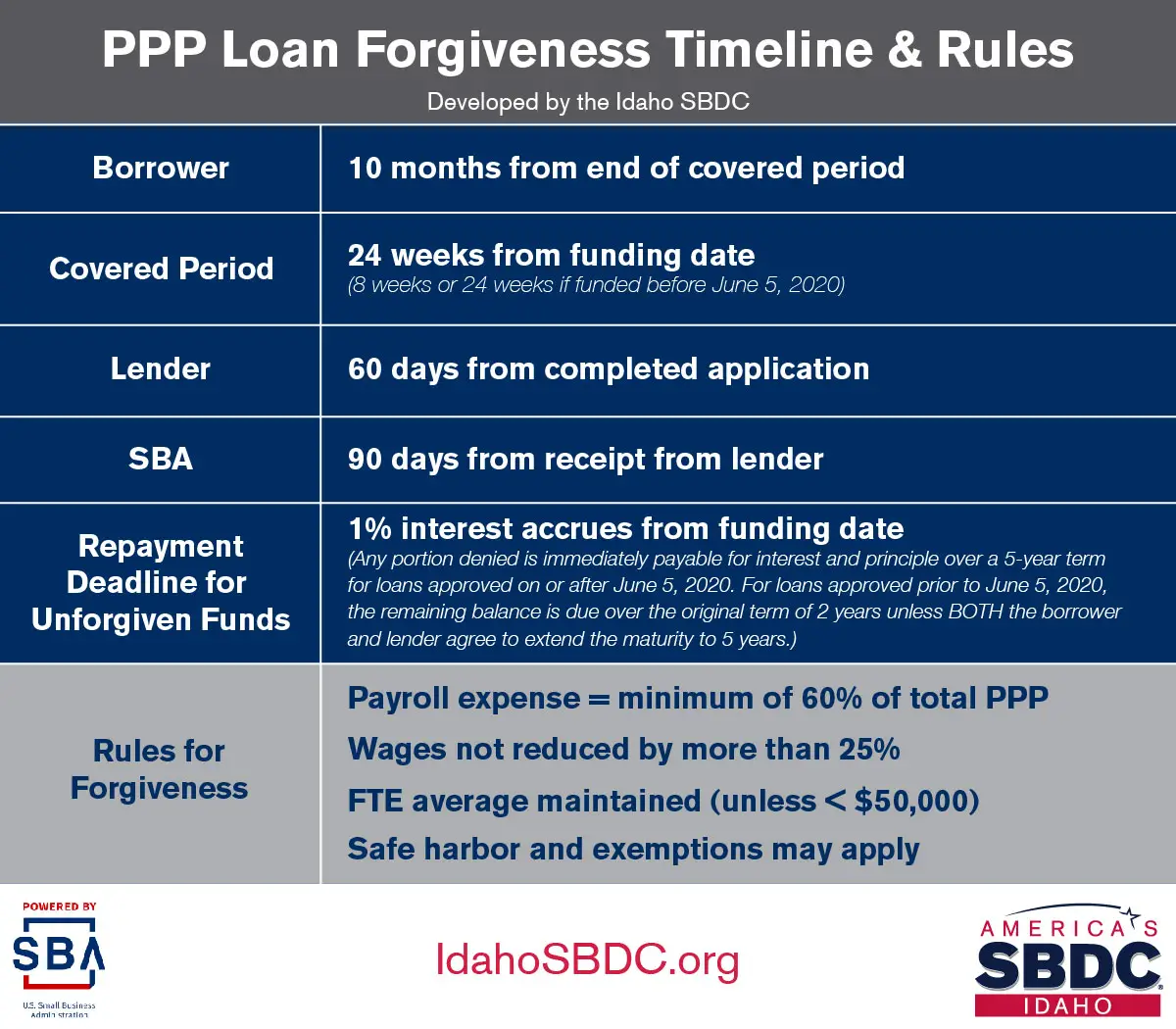

Borrowers arent required to make any loan payments before they apply for forgiveness or until 10 months after their covered loan period ends. Since payments arent due yet, there is less urgency to apply for forgiveness.

Also Check: Emi Calculator Home Loan Usa

Sba Paycheck Protection Program Data Lookup

Under open government transparency guidelines, information on recipients of the $793B in forgivable government loans issued through the 2020 Paycheck Protection Program by the US Small Business Administration are a matter of public record. FederalPay.org has created a powerful search tool that allows public access to the PPP loan database.

Common Ppp Forgiveness Questions

Where Can I Find the Forgiveness Application forms?

- Congressionals PPP Forgiveness Portal will fill out the required form for you so you should not fill out the form prior to starting the forgiveness process, but if you would like to see the forms for what questions you will be asked, see below

- The SBA has 3 different types of forgiveness applications:

- Form 3508S, which is to be used for all PPP loans $50,000 and below.

- Form 3508EZ, which can be used by borrowers who have not reduced salaries / hourly wages by more than 25% for any employee, and either did not reduce headcount during the forgiveness period OR certify they are unable to operate during the forgiveness period at the same level of business activity as before February 15, 2020 due to safety / health restrictions or guidance related to COVID-19.

- Form 3508, which is to be used for all PPP borrowers who do not meet the criteria for Form 3508S or Form 3508EZ.

What Supporting Documentation Will Congressional Bank Require for My PPP Forgiveness Application?

For PPP loan amounts less than $150,000, no supporting documentation is required to be submitted to us. You should retain records of how PPP proceeds were spent in the event the SBA requests to review.

For payroll expenses, borrowers should provide EACH of the following:

For mortgage interest, borrowers should provide EACH of the following:

For business rent or lease expenses, borrowers should provide EACH of the following:

What Costs Are Eligible for Forgiveness?

You May Like: How To Apply For More Student Loan Money