How Do I Know What My Apr Is

Once youve received a formal and final offer on a loan, you can find out what the APR is in one of two ways.

Balloon Payments Can Affect Car Loan Repayments

Its also possible to have your regular repayments reduced through the use of a balloon payment, which is a lump sum owed to the lender at the end of the loan term. These balloon payments can be significant, anywhere between 30-50% of the loan amount, and can be effective for people who want more manageable repayments since the loan principal is being reduced.

Lets look at an example: if you took out a $30,000 car loan for 5 years at 6% interest and had a balloon of $9,000, your monthly payments would be reduced from $579.98 down to $451. At the end of the loan term, you would then have to pay the $9,000 sum left over in full.

| Cost of a $30,000 5 Year Car Loan at 6% Interest Rate | 30% Balloon |

|---|

Balloon payments can cost more over the loan term in interest, however, and you still have to pay that lump sum back at the end, which can catch some people out.

Your Monthly Paymentand The Total

The interest rate that you get on the loan has a dramatic impact on these numbers. Consider how the numbers change if you had to pay a 6% rate instead of 4% for the same car.

- The monthly payment on a five-year loan for $40,528 at 6% interest would be $782.52. You would pay $47,011.19 in monthly payments. Throw in the 10% down payment, and the car costs $51,514.19.

- If stretched to an 8-year term, the monthly payment on that $40,528 loan at 6% interest drops to $532.60 a month. The loan payments would total $51,129.20. Add in the 10% down payment and the car costs $51,661.80.

You can run the numbers for yourself using the Investopedia Auto Loan Calculator.

You May Like: Usaa Pre Approval Car Loan

What Is The Loan Payment Formula

The payment on a loan can also be calculated by dividing the original loan amount by the present value interest factor of an annuity based on the term and interest rate of the loan. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of.

Recommended Reading: Refinance Car Loan Usaa

Where To Get A Car Loan

If youre looking to take out a loan to finance your auto purchase, you have plenty of options to choose from. When it comes to financing your vehicle, you should be sure to come prepared in order to ensure that your negotiation with a car dealership is successful and you dont wind up paying more than you bargained for.

Online rates comparison tools like can help you to learn more about what rates you qualify for. Monevo lets you compare loan offers from different lenders for free. If you see a loan that meets your needs, you can apply quickly and easily online, and have the funds available to you in as little as one business day.

Also Check: Usaa Preferred Car Dealers

Which Auto Loan Calculator Should You Use

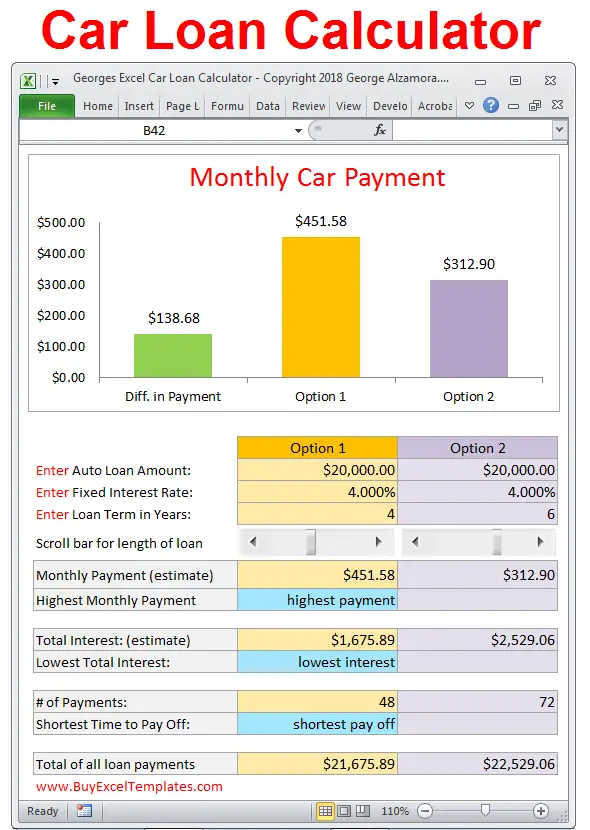

Use the auto loan payment calculator if you know what you expect to spend.

For example, perhaps you think you can afford a $20,000 loan on a new car. A 48-month loan for the most creditworthy borrowers would be 3% or less. At that rate, you’d pay about $440 a month and $1,250 in interest over the life of the loan. A subprime rate might be 11%, making the payments about $515 and you’d pay more than $4,500 in interest.

Many people reduce payments by lengthening the term of the loan. If you change the term to 60 months, payments on that $20,000 loan at 11% fall from $515 to $435. However, you would pay nearly $6,100 in interest, or an additional $1,600, for doing so.

Use the reverse auto loan calculator if you have a specific monthly payment in mind. Say you have decided that you can afford to spend $350 a month on car. Depending on the interest rate and length of loan you choose, a $350 car payment could repay a $15,600 car loan at 3.66% in 48 months or a $19,100 loan at 60 months.

How Are Interest Rates Calculated On Car Loans

Iâm shopping around for car loan rates, but Iâm not quite sure how lenders decide on interest rates. How are interest rates figured on car loans?

Answer

simple interestuse an online car loan calculator or an amortization scheduleseveral factors to determine your interest rate

- Amount of the loan

- Loan-to-value ratio

fluctuate based on your current principalmorelessamortization scheduletable of monthly paymentsin minutes

Did this answer help you?

Recommended Reading: Maximum Fha Loan Amount In Texas

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

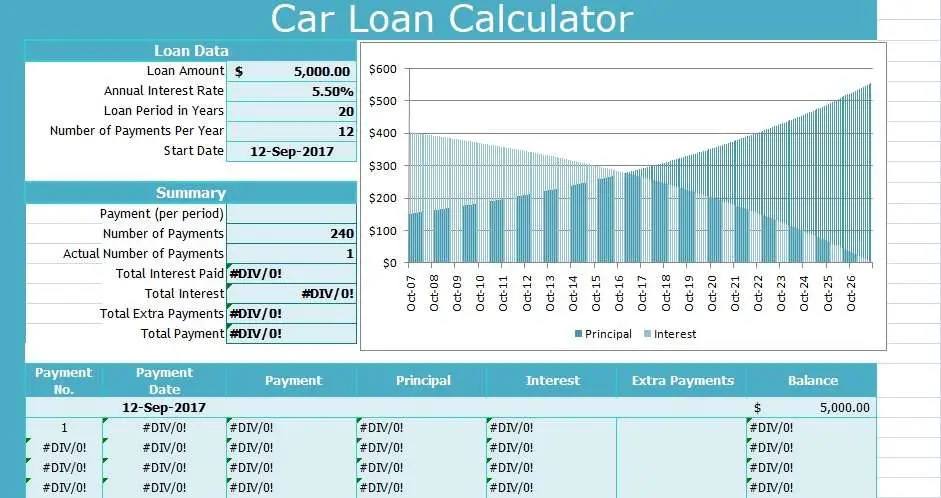

About Our Car Loan Calculator

Use our auto loan calculator to estimate your monthly car payment based upon the price of the car, your down payment and trade-in allowance, taxes and fees, and the interest rate and term of your auto loan. See how changing one factor will affect your down payment.

The auto loan calculator will also show you the total interest paid if you hold your car loan for the full term. Dont overlook this number! Even though you pay the interest over many years, this is real money that gets added to the total purchase price of the car. If you want to save money, look at ways you can reduce the interest you pay: Buy a less expensive car, put more money down, and/or get a shorter loan with larger monthly payments .

Don’t Miss: How Long Does An Sba Loan Take

How To Calculate Interest On A Car Loan

To take a car loan means commonly that to buy a car. Car loan also is known as a hire purchase loan. Here in this article, you will see how it works and how to calculate our monthly installment for a car loan.

Calculation

Effective Interest Rate On A Discounted Loan

Some banks offer discounted loans. Discounted loans are loans that have the interest payment subtracted from the principal before the loan is disbursed.

Effective rate on a discounted loan = /

Effective rate on a discounted loan = / = 6.38%

As you can see, the effective rate of interest is higher on a discounted loan than on a simple interest loan.

Also Check: Fha Max Loan Amount Texas

How Is A Car Loan Apr Calculated

It would be great to borrow $20,000 for a car and simply repay the $20,000 and be done with it, but unless you borrow from a generous relative or close friend, it doesnt work that way. An auto loan includes interest on the principal balance, and often some additional fees as well.

The annual percentage rate is what youll actually pay to finance the purchase of a vehicle. Its the yearly cost of your interest rate. You can find out what yours is the easy way: Simply ask your lender. The Truth in Lending Act, a federal law, requires that all lenders provide this information before someone commits to a loan agreement. Alternatively, you can grab a calculator and figure it out the good old-fashioned way if youre good at math and would rather not take someone elses word for it.

Video of the Day

Tip

The APR on your loan tells you how much its going to cost you to borrow money to buy a car.

Also Check: Where Do I Find My Student Loan Account Number

How Does Interest Work On A Car Loan

Why you can trust Jerry

If you borrow money from a lender to finance a vehicle, you will be charged interest on the monthly payments you make toward the loan. Interest is how much you pay per year to borrow moneyâand it is paid as a percentage, also called an interest rate.

Recommended Reading: Golden1 Car Loan

Learn How Car Loan Interest Affects How Much Your Car Costs

When you take on a car loan to buy a car, your lender purchases the car for you and allows you to pay it back over a period of years. Essentially, the lender gives you the service of using its money, and in exchange, you compensate the lender for its services by paying interest.

Most car loans use simple interest, a type of interest of which the interest charge is calculated only on the principal . Simple interest does not compound on interest, which generally saves a borrower money.

However, simple interest does not mean that every time you make a payment on your loan that you pay equal amounts of interest and principal. Instead, car loans are paid down via amortization, meaning you pay more interest at the beginning of your car loan than at the end.

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether itll be affordable for you based on your income and other monthly expenses.

Also Check: Usaa Refinance Auto Loan

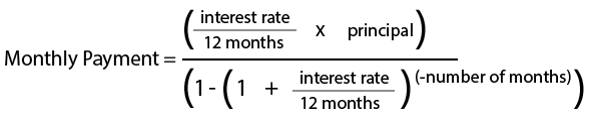

Amortized Loan Payment Formula

Calculate your monthly payment using your principal balance or total loan amount , periodic interest rate , which is your annual rate divided by the number of payment periods, and your total number of payment periods :

Assume you borrow $100,000 at 6% for 30 years to be repaid monthly. To calculate the monthly payment, convert percentages to decimal format, then follow the formula:

- a: 100,000, the amount of the loan

- r: 0.005

- Calculation: 100,000//=599.55, or 100,000/166.7916=599.55

The monthly payment is $599.55. Check your math with an online loan calculator.

How To Figure Interest On A Car Loan For The Future

After you begin to pay down your initial principal, you will then be required to determine your new balance to see what you will be paying going forward. Here is how you can calculate these payments:

Errors in the calculation and the fact that the numbers are rounded will cause you to not have an exact calculation each time, but it does give you a good idea on how to calculate the interest rate on a car loan.

You May Like: What Credit Score Does Usaa Use For Mortgage

How Can I Reduce My Interest Charges On My Auto Loan

Since your interest charge every month is based on how much you still owe on your loan, you can reduce your interest charges by making unscheduled payments that bring down your loan balance. When you make unscheduled payments, you are engaging in an accelerated car loan payoff which will reduce the total amount of interest charges you pay over the course of your loan and may help you pay back your loan faster than originally planned.

Paying a debt like a car loan early is generally a good thing, because you end up paying less interest charges. However, you should always consider your entire financial situation before choosing to make unscheduled payments. Obviously, you need to have the extra cash to make such a payment, but even if you do, you have to ask yourself if you have better uses for that extra money. For example, if you owe money on a credit card, then you are probably better off paying down that credit cards balance before making an unscheduled car loan payment. Ultimately, you should consider carefully if an accelerated payoff makes sense for you.

If you cannot afford to pay extra each month for your car loan, but would still like to pay less for your car in the long run and/or reduce your monthly payments, you may want to consider refinancing your car. If you refinance to a lower interest rate, you may pay significantly less for your car loan in the long-run and reduce your monthly payments.

Between Choosing A Make Model And Options Shopping For A Car Can Feel Overwhelming And Youre Not Done There Car Loan Shopping Is Just As Important And Knowing How To Calculate The Apr On An Auto Loan Can Help You Determine Whether A Loan Might Be Right For You

The more you know about how to calculate the APR on a car loan, the more informed youll be when its time to either sign on the dotted line or walk away if the loan doesnt fit your financial needs.

A car loans APR is the cost youll pay to borrow money each year, expressed as a percentage. It includes not only the interest rate on the loan but also certain fees. The interest rate, on the other hand, reflects only the annual cost of borrowing the money no fees included. When comparing loans, the Consumer Financial Protection Bureau suggests looking at APRs versus interest rates, because APR more accurately reflects how much youll pay to finance a car.

Lets take a look at how to calculate APR on a car loan using a computer spreadsheet program and some of the factors that could affect the APR youre offered.

You May Like: How Long Does It Take Sba To Approve Ppp

Why Car Loan Interest Charges Are Actually Pricier Than What It Seems

Many Malaysians love cars, but do not fully understand how interest rate charges work when it comes to getting a hire purchase loan to buy a car. If you have tried to calculate what you are actually paying and found that it is different from the interest rates by the banks, you need to read this.

When it comes to loans, there are different ways to calculate the interest rate you will be paying than the ones displayed upfront by the banks. This is obvious when it comes to car loans if you tally the amount spent at the end of the loan, it is seldom equivalent to the advertised rate.

Is this a scam? No, its just the way car loans work.

Contents

How To Calculate Interest Rate On A Car Loan

If youre adamant about doing the calculations yourself , then calculating the regular interest payments on a car loan is done the same way it is with any loan using the standard amortisation formula:

Interest payment = outstanding balance x

So lets say youve just borrowed $20,000 for a car loan , with a competitive interest rate of 6% p.a. making monthly payments. In this case:

- the outstanding balance is 20,000

- the interest is 0.06

- number of payments is 12

So your interest formula looks like: 20,000 x

Therefore, the interest payment in the first month = $100

BUT as you continue to pay off the loan, your interest payments will shrink, with more of your regular repayment going towards paying off the principal. Allow us to demonstrate.

Over five-years, the $20,000 car loan with a 6% p.a. interest rate could require 60 monthly repayments of around $387.

To work out how much interest youll pay in the second month, you need to calculate how much of the loan is left to repay , which you can do using the formula:

Outstanding balance = principal

= 20,000

= 19,713

In this case, after the first month, your remaining loan amount would be $19,713. Using that number we can now calculate what your interest payment will be in the second month.

Interest payment = 19,713 x

= $98.57

See how this number continues to shrink over the first ten repayments:

| Month | |

|---|---|

| $ 86.82 | $17,064.56 |

Also Check: Student Loans Average

Calculate The Total Interest Payment

In order to calculate your interest payments over time, it is necessary to know the total amount of interest due on your loan. Begin by multiplying your loan’s interest rate by the number of years you will be paying the loan off. For example, if you have a 6 percent interest rate on a five-year term, you would multiply 0.06 by 5 to get 0.30. Multiply it by the total amount of money you are borrowing on the loan to get the total amount of interest you will pay over the course of paying off the loan.

If you get a $20,000 loan at 6.0%, you will pay $6,764.51 in interest for the five-year duration, making that a total of $26,764.51. That’s considerably more than you will take out.

Using a monthly payment calculator brings is similar in that it simplifies loan calculations. Enter in the amount borrowed, the interest rate and the time period. Using the same example, your monthly payment would be $386.65.

Both types of calculators give an approximate total, whether its interest or a monthly payment. Fees may alter the numbers given but offer a good estimate.