Is There A Difference Between Pre

Yes. Pre-approval tells you how much you can borrow and at what interest rates, but it doesnt give you access to funding. Instead, it lets you shop around for vehicles with a set price in mind. Once you find a car, you can then go through an expedited process to get financing from your lender by submitting an application for full approval.

Getting Preapproved For An Auto Loan Before You Walk Into A Dealership Helps Put You In The Drivers Seat During The Car

A preapproval is conditional approval given to you from a lender with estimated terms such as the amount of money you can borrow, the interest rate and loan term to finance the purchase of a car. This loan quote makes it easier to estimate the total cost of the loan and to create a budget before you start shopping.

A preapproval is a great way to let dealers know youre a buyer whos done your homework. Also, if you get preapproved, you wont necessarily have to rely on dealer financing. This could give you greater negotiating power at the dealership, which can make the car-buying process less stressful.

Getting preapproved for an auto loan can be an easy process if youre prepared with the application documents you need and have healthy credit. Lets explore what you need to do to help get preapproved, how it can benefit you and what you might want to consider if you dont get preapproved.

Its An Easy Out When Dealer Finance Is Brought Up

Some people can find it a little uncomfortable when, while talking to a salesperson in the showroom, dealer finance is brought up. And they will most certainly try their absolute best to get you on board with it, not only because it helps them fudge numbers during the negotiation but also due to the fact that a substantial amount of their commission comes from the money made selling their financing.

But when you have pre-approval, not if but when dealer finance is brought up, you can simply let them know youve been pre-approved and arent interested.

Also Check: How To Get Approved For Capital One Auto Loan

Other Factors To Consider When Getting A Car Loan

- Your annual percentage rate includes both interest and fees. Its the easiest way to compare the cost of car loans with similar terms.

- Down payment. Your lender may require you to have between 15% and 20% saved up before they approve you for financing.

- Loan term. You may want to choose a short-term loan to save money on interest, or go with a longer term loan if you want to lower your monthly payments.

- Availability. Many lenders have restrictions on which cars they will finance . Make sure your lender is willing to give you financing for the vehicle you want.

How Long Will It Take My Lender To Finalize My Loan

| Type of lender |

|---|

This could take a few days to process, and it may take one to three business days for your funds to show up in your account. From start to finish, it can take up to a week to receive a car loan from an online lender.

Others require you to visit a branch, fill out an application and wait days for the more traditional approval process. Because the time varies so widely, talk to your bank or credit union to see how long it might take.

spot deliverybefore

If you dont have good to excellent credit and a strong income, you might have to renegotiate your loan usually for a less optimal rate or return your car. This is commonly referred to as yo-yo financing because the lender promises you one monthly payment or interest rate, then readjusts it if it cant find a lender to approve you.

Make sure your purchase agreement doesnt have language that states your loan is subject to approval. If so, your quick loan approval time might not mean much.

Also Check: How Long Does It Take Prosper To Approve A Loan

Shop Around For Loan Options

Just as you will shop around for your vehicle, you should compare lenders. Your interest rates are determined by your credit history and a combination of other factors all of which vary to some degree by lender. Check out Bankrates winners for the best auto loans to start your search.

To get the most favorable rates, fill out applications with multiple lenders. Keep in mind that preapproval applications will temporarily reduce your credit score if they require hard credit inquiry. Its best to submit all applications within a two-week period so that they only count as a single inquiry.

Save For A Higher Down Payment

Increasing your down payment toward the purchase price of an automobile may help in two ways. First, it lowers the amount of money you are requesting to borrow from the lender. While that alone could make the difference between approval and denial, youre also decreasing the loan-to-value ratio on the car you want to buy, making it a safer loan for the lender.

Also Check: Refinance Usaa Car Loan

What Is The Step By Step Application Process At Loanscomau

Apply online

Speak to a lending manager and obtain pre-approval

Provide supporting car loan application documents

Sign a purchase contract for a vehicle with a dealer

We will contact the dealership and obtain an invoice

Final car loan approval will be granted

We issue loan documents and you sign them and return

We will pay the funds to the dealership

You drive away

What Are The Benefits Of Car Loan Pre

A pre-approved car loan can be beneficial in that it grants you the power of knowing what you can afford before you go out to buy a car. For example, if youve been pre-approved for a $20,000 loan, youll limit yourself to cars within that price range. Dealers wont try to tempt you with a more expensive car, as theyll also know you have a set budget.

Having this knowledge and confidence in yourself and your ability to secure the affordable car you want can also give you an edge in negotiating the sale price of the vehicle. Without pre-approval, you may be at the mercy of persuasive car dealers whose job it is to squeeze as much money out of you as possible. Even if youre strong-willed, that intoxicating new car smell can sometimes override your better judgement!

Also, car dealers often push their own dealer finance options, so if you have a pre-approved car loan the dealer may offer you finance at an even lower rate. Just make sure you take into account all other costs too before you agree to either dealer finance or a loan.

Don’t Miss: Usaa Car Loan Refinance

What Is Auto Loan Preapproval

Car loan preapproval is the ability to get approved for a loan of a specific amount before purchasing a car. It means that the potential lender has looked at your credit history, application and required documentation and is willing to give you a formal offer. Simply put, it is being approved for an auto loan before having the vehicle to go along with it.

Prequalification differs from preapproval, though the terms are used interchangeably at times. When you prequalify for a loan, the lender only does a soft credit check, and approval isnt guaranteed until you submit the full application. Getting preapproved for an auto loan provides you with the added security of having a formal loan offer without the pressure of choosing a vehicle right away.

Be Protected From Sales Tactics

When you buy your used car from Shift, pre-approved or not, youll enjoy our no-pressure environment where you never need to worry about negotiating or aggressive sales tactics. Shift offers you a fair, up-front price based on powerful machine learning algorithms and tons of data.

Getting pre-approved transforms you into a cash buyer, as you have your approved check in hand before signing the papers.

Having your check with you offers several benefits as you move forward with your transaction.

First, it shows you’re serious about buying and that you’re not just looking to take a test drive or kick the tires. As you browse different vehicles, selecting the ones you like, its obvious that you’re planning to purchase.

Pre-approval also guards you against salespeople steering you toward models and options outside your price range.

But with your pre-approved check showing a set total you’re able to spend, you’ll know your financial limit and just what you can afford.Whether you’re shopping used for a truck or an electric car, you can trust Shift for a vehicle that lasts. At Shift, certified mechanics perform 150-point inspections on every vehicle sold, and you get a free Carfax report for the ultimate in transparency. And with Shift’s best-in-industry service contracts, you can be sure that it will be running smoothly, mile after mile.

Don’t Miss: Should I Do Fixed Or Variable Student Loan

Better Grasp On Expected Cost

The true cost of vehicle ownership tends to be higher than expected for first-time buyers. Having a solid number for what you can borrow will make it that much easier to budget and keep your expectations grounded when shopping. It is recommended you calculate various potential auto loans in advance so you know the amount you can comfortably borrow.

What Are The Steps To Get Pre

Depending on where you are in your car buying journey, you can do any or all of the following:

-

Calculate your repayments – Find out how much you can afford to pay for a car using our car loan calculator. It only takes a minute to get an estimate.

-

Get car loan pre-approval – complete an online car loan application and then arrange a call with one of our experienced lending managers. They will quickly run through some extra questions and do a credit check. Once an assessment has been made, we will provide a pre-approval. Later, this makes it easier to get approved for a car loan online.

Recommended Reading: Usaa Car Loan Refinance Rates

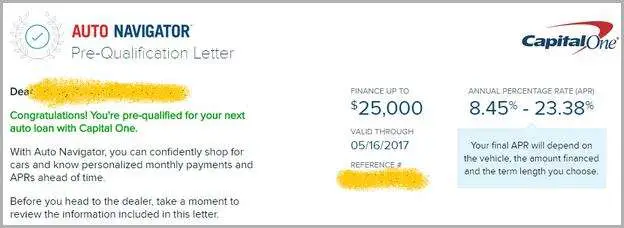

Capital One Auto Finance

If it ran commercials, Capital One Auto Finance might ask, Whats in your garage? To receive pre-approval, youll have to show a monthly income of at least $1,500 to $1,800, depending on your credit history.

Pre-approval remains active for one month, which should be plenty of time to close on a car deal.

How Long Does It Take To Get Approved For A Car Loan

It can take a s little as a few seconds and as long as a few days to get approved for a car loan. How long it takes depends on several factors. These including what type of lender, your personal finances and the type of car youre interested in buying.

How long top providers take to approve a car loan

While many lenders offer preapproval when applying for a car loan, not all do. Heres what you can expect from top car loan providers:

| Lender |

|---|

| Read review |

Read Also: How Long Does It Take Sba To Approve Loan

Pay Close Attention To The Loan Terms

- Loan amount: How much you can borrow from the lender

- Loan term: How long youll have to repay the loan

- Interest rate and APR: How much youll pay the lender to finance the loan each month, and what fees and other costs might be involved

- Monthly payments: Your minimum monthly payment over the loans lifespan.

Protection Against Unnecessary Add

Many times, dealers will push for their own financing or focus on the monthly payments which can set buyers up with long loan terms and bad interest rates. By coming in with a preapproval you already know that you have a competitive interest rate and a firm number for what you can afford. This can make it much easier to say no to additional add-ons or warranties offered when it comes time to sign paperwork.

Don’t Miss: Conventional 97 Loan Vs Fha

Use Your Rate As A Point Of Negotiation

Financing is one of the many ways dealerships can make money off of customers. If you arent preapproved for financing, dealerships may pressure you to accept loan terms with higher rates than you might qualify for. Having preapproval before you go car shopping gives you a powerful advantage in this situation, putting the pressure on the dealership to beat that rate.

What You Can Do If You Get Denied For Preapproval

There are many reasons why you may not get preapproved for a car loan. Here are just a few:

- Low credit score: Most lenders have a minimum credit score, whether or not they publish it publicly. If your score comes up lower than that number during a credit check, you wont be approved.

- High debt-to-income ratio :Your DTI is the sum of monthly debt payments you have, like credit cards, mortgages and other loans, divided by your gross monthly income. If your DTI is too high, meaning your debt payments take up too much of your income, it indicates that you might not be able to afford your car payment.

- Spotty employment history: Lenders want to know that youll be able to reliably pay your loan back, so a history of frequent job changes or long periods without work could result in you getting denied for preapproval.

- Application mistakes: A rejection isnt always due to your circumstances sometimes you just make a mistake filling out the preapproval application and it doesnt go through as a result.

A denial can be disappointing and stressful, but it doesnt mean you wont ever be able to get approved for a car loan. If you get denied for preapproval, here are a few things you can do:

Don’t Miss: Which Of These Loan Options Is Strongly Recommended For First-time Buyers

Why Do You Need A Pre

Take note of how long is a preapproval letter good for when buying a home, car, or other properties using a loan. Although a having a pre-approval letter isnt a guarantee that youll be granted a loan, this will greatly help expedite your property buying process.

With a pre-approval letter, youll enjoy the following benefits:

- Negotiate the price of property more effectively

- Get a priority ticket at auctions, knowing that you already have a financing option

- Validate your financial capacity to buy

- Builds your credibility of being a serious buyer

What Are The Drawbacks Of Car Loan Pre

Pre-approval isnt available to everyone. After looking at your history and credit score, some lenders might not deem you an acceptable customer for pre-approval, which can be demoralising.

Lets say you do qualify for pre-approval though what could be bad about knowing that youve been approved for a certain amount? Well, for one thing, that amount might not be enough for the car you had your heart set on, and can lock you into a certain subset of vehicles .

Pre-approval also doesnt last forever. The industry standard length is between one and three months, with three being the most common. There are plenty of lenders who only offer pre-approval for one month, although in some cases youll be able to renew it a further 30 days.

Recommended Reading: Loan Officer License Ca

Gather The Necessary Information

Getting preapproved can require quite a bit of information. Lenders often ask for information about your identity, income, employment information, credit history and other debt payments when reviewing your application for preapproval.

After you review your credit reports, gather the information your lender may request:

- Social Security number

- Drivers license, state ID or military ID

- Employment status

- Income

A lender may pull your credit reports as part of the preapproval process, which could generate a hard inquiry on your credit file. Before applying for preapproval, you can check whether the lender is running a hard or soft inquiry.

Hard credit checks from multiple lenders from around 14 days to up to 45 days will usually count as just one inquiry, depending on the credit scoring model used. To minimize the impact to your credit scores as you shop for rates, its a good idea to get all of your preapprovals within that 14- to 45-day window.

When your application is complete, youll typically receive a decision, sometimes in a matter of minutes. In some cases, a lender may need to contact you for more information before it can make a decision.

Best Overall Provider Of Pre

Our top-ranked provider of pre-approved car loans is Auto Credit Express. Founded in 1999, the company matches pre-approved borrowers with car dealers on its large network of direct lenders. In less than a minute, it can pre-approve you for an auto loan without hurting your credit score.

| 3 minutes | 9.5/10 |

To receive pre-approval, you complete a short loan request form with information about your monthly income, credit profile, housing costs, debt service, and garnishments.

You must document at least $1,500 in monthly income to show that you can afford the loan payment, including the sales tax. Youll then be connected to a dealership in your vicinity that is willing to work with you despite your bad credit.

Read Also: Usaa Car Financing Calculator

Get Protection From Dealer Markups

Dealer financing is convenient, but if you havent shopped around, a dealership finance manager might try to take advantage of that and mark up your interest rate. That could mean youre paying 1 or 2 percentage points more than you should, which can add up to hundreds of dollars over the life of your loan.

What Will I Need To Get An Auto Loan Preapproval

Application requirements for car loan preapproval are often the same or looser than a regular car loan application.

- Loan information: How much you want to borrow and the loan term

- Personal information: Name, contact details, date of birth, Social Security number

- Residence information: Address, length of residency, whether you rent or own, rent or mortgage payment

- Income information: Gross annual income, employer name and contact details

The lender may ask about the car you want to purchase. You could always change the vehicle by contacting the lender if you change your mind after test driving.

Preapproval vs. prequalification

An auto loan preapproval is a firm offer from a lender. When you finalize the loan, your actual APR will be very similar, if not the same, as your preapproval rate. On the other hand, a prequalification is not an official offer, but an estimate of the car loan you may receive. Because a prequalification is not firm, its much harder to use it when negotiating at a dealership.

| Auto loan preapproval vs. prequalification |

| Preapproval |

Recommended Reading: Calculate Pmi On Fha Loan