Student Loan Planner Disclosures

Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Borrowers must complete the Refinance Bonus Request form to claim a bonus offer. Student Loan Planner® will confirm loan eligibility and, upon confirmation of a qualifying refinance, will send via email a $500 e-gift card within 14 business days following the last day of the month in which the qualifying loan was confirmed eligible by Student Loan Planner®. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. The bonus amount will depend on the total loan amount disbursed. This offer is not valid for borrowers who have previously received a bonus from Student Loan Planner®.

How Much Do You Get Back On Taxes For Student Loan Interest

How much money do you actually get back on your taxes for student loan interest? We did the research to find out. At first glance, it seems like the government gives a decent break to those with student loans by offering a tax deduction for up to $2,500 in interest paid per year. But is that really the case? Read on to see how the numbers play out. Spoiler alert: you may not be getting as big of a break as you thought!

What is the tax return on student loan interest taxes?

For tax purposes, you can deduct student loan interest. This deduction is available for all loans made to pay for higher education. There is a limit of $2,500 per year, which can be a substantial amount of money. It is important to remember that your college or university must be accredited and you must have earned a bachelors degree or higher in order to qualify. You may be eligible for more than one student loan deduction, depending on your circumstances.

To qualify for the student loan interest deduction, you must have paid interest on your student loan for at least one year. The deduction applies to borrowers who file jointly or separately. In addition, you must have earned at least $625 during the year. Filing separately will allow you to claim this deduction, but married borrowers cannot. If you are married, you need to file separate taxes. In order to claim this deduction, you must meet certain requirements.

Studying At A Private Institution

If you study at a private institution, you should be aware that that you may not receive the full tuition fee loan support to cover your tuition fees.

You will be responsible for funding the difference in the additional cost of your tuition fees. You should find out what tuition fees are charged by the private institution and what tuition fee loan support is available from your local Student Finance NI office before you start the course.

Don’t Miss: Va Home Loan Benefits 2020

Repayment Faqs Questions And Answers

Got an additional question about repaying your Masters loan? We’ve answered some common queries about repayment processes, terms and conditions.

When will my postgraduate loan repayments start?

You will be eligible to make postgraduate repayments from the April after your course finishes, but will only do so when you are earning over the threshold.

How will postgraduate loan repayments be taken?

Repayments will only ever be taken whilst you are earning over your threshold. The way this happens will depend on the kind of work you do:

- If you are employed your repayments will be deducted automatically from your monthly salary and paid to HMRC by your employer.

- If you are self-employed you will make repayments as part of your annual Self Assessment tax return.

However you pay, you will receive an annual statement of your loan balance. This will record your repayments and interest.

What happens if I live or work abroad?

HMRC will not be able to take automatic postgraduate loan repayments from outside the UK. However, you must still repay your loan when you are eligible to do so. You must notify your postgraduate loan provider if you will be living outside the UK for more than three months. They will help you assess the repayments you need to make and provide a means of doing so.

Do I repay a percentage of my total income, once I’m earning over the threshold?

What happens if I temporarily earn above the repayment threshold?

Will I have to repay my entire loan?

Other questions?

Plan 4 Student Loans Explained

In April 2021, a new type of Student Loan repayment plan was introduced: Plan 4.

This plan is exclusive to Scotland, and any Scottish students who started a degree in the UK on or after 1st September 1998 have now been moved to Plan 4.

Anyone with a Plan 4 loan would previously have been repaying under Plan 1, and the only difference is that the threshold for repayment is significantly higher great news for Scottish students and graduates.

Don’t Miss: Usaa Auto Lease Calculator

Student Loan Repayment Guide 2022

Your Student Loan is probably the biggest amount of money you’ve borrowed in your life so far. But do you totally understand the Student Loan repayment terms? We’re here to clue you up!

Credit: Marina Sun , Syda Productions Shutterstock

If youre like two in five students, your loan agreement is a bit like your appendix: you know youve got one, but youre not entirely sure how it works. And that’s not a good thing!

With tuition fees over £9,000 and interest being added all the time, your Student Loan debt is bigger than ever. As such, its easy to ignore the details when it comes to repaying it all but the reality is that the Student Loan isnt as complicated as you might think.

Weve scoured the small print and broken it down into manageable chunks, meaning you can get to grips with Student Loan repayments and then get on with your life.

Repaying Your Student Loan

Student loans must be paid back. Many students have two loans that need to be managed separately. Heres what to expect after you leave school.

On this page:

Most students leave school with an Alberta student loan and a Canada student loan.

Having two loans means you need to handle twodebts and two payment schedules.

Your Alberta loan is managed through MyLoan and your Canada loan is managed through the National Student Loans Service Centre Online Services. You must create individual accounts through these websites and handle your repayments separately.

This is what the lifecycle of student loans looks like:

|

While youre a student |

Loans are interest-free and you dont need to make payments. |

|

Grace period The first 6 months after you leave school, beginning the first day of the month after your end date |

Loans are interest-free, and you dont need to make payments. |

|

Repayment Begins 6 months after you leave school |

Interest is added to your loan balance monthly. |

|

Repayment begins. A monthly repayment schedule is set up for you automatically. |

You May Like: How To Get Loan Originator License

How Does A Change In Interest Rates Affect Student Loans

A rise in interest rates increases debt levels for everyone, but only the repayments of high earners Higher interest rates will increase the overall amount you owe on your student loan , but it wont impact your monthly repayments, and most people will end up paying no extra overall.

Monthly repayments

A rise in rates wont change what you repay each month, because that is based on how much you earn, not how much you owe .

Overall debt

Most people will be unaffected by a rise in interest rates, because they will not clear the original sum borrowed plus all the added interest, before their debt is wiped. Whilst they might pay some interest, it wont all be at the higher rate. And lower earners wont even repay the amount they borrowed, never mind any interest it has accrued. The borrowers who will feel most impact are bigger earners who are charged around the maximum interest rate and are set to pay off their loan within the 30-year period. The increased debt will take them longer to clear, with the higher interest adding thousands to the amount they pay back. The very highest earners pay off their loans more quickly faster repayments means their debt accrues less interest, so they will be less affected by a rise in rates.

Repayment Assistance Plan Stages

The plan has two stages: interest relief and debt reduction.

1. Interest relief

The interest relief stage is available for up to 60 months, or until you are out of school for 10 years, whichever comes first.

During the interest relief stage

- your monthly affordable payment will first go toward paying down your loan principal

- if your payment is large enough, the remainder will go toward monthly interest

- the governments of Canada and Ontario cover all monthly interest that is not covered by your payment

If you are not required to make any payments at all during this stage, the governments of Canada and Ontario will cover your entire monthly interest charges and your loan principal would stay frozen.

Visit the National Student Loans Service Centre website to get more information.

2. Debt reduction

The debt reduction stage occurs after the interest relief stage, which is after you have received interest relief for a minimum of 60 months or you have been out of school for 10 years, whichever comes first.

During the debt reduction stage:

- you will make either no payments or a monthly affordable payment, depending on your income and family size

- your monthly affordable payment, if any, will go first toward paying down your loan principal

- if your payment is large enough, the remainder will go toward paying monthly interest

Visit the National Student Loans Service Centre website to get more information.

Read Also: Fha Build On Own Land

Graduate Or Leave Full

You have six months after you graduate or leave full-time studies before you need to start repaying your OSAP loan. This is your six-month grace period.

You will be charged interest on the Ontario portion of your loan during your six-month grace period. This interest will be added to your loan principal .

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an OSAP loan.

Repaying student loans is an excellent way to establish and improve your credit score. You can make additional payments on your loan at any time if you want to repay it faster.

Get repayment assistance:

If you’re having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you can’t attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9½up to 14½ years. Log in to your National Student Loans Service Centre account.

How Much You Need To Repay

Verify your loan or line of credit contract to figure out the following:

- the total amount you owe

- the interest rate that will be applied to your debt

- how youll repay your debt

- how much youll pay

- how long it will take to pay back your debt

Contact the organization that provided your student loan or line of credit if you dont have the information listed above.

Don’t Miss: Usaa Auto Loan Refinance Rates

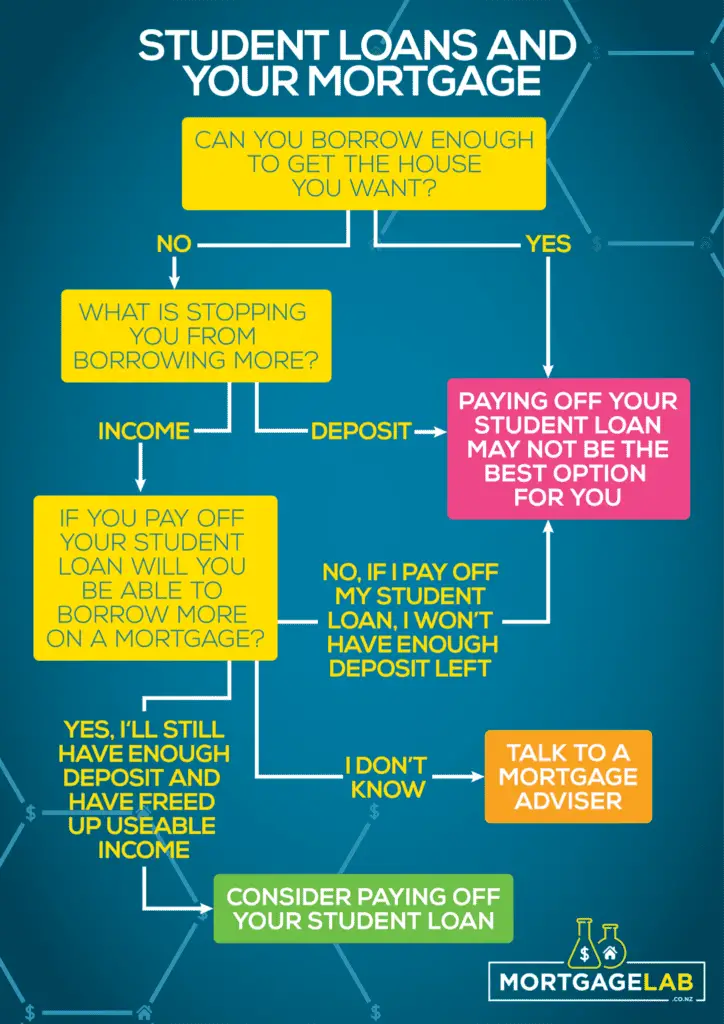

Get Trustworthy Financial Advice

Youre never too young to seek advice about a complex topic like your finances. Whether youre worried about the impact of your student loan on your future financial prospects or want to start planning for big milestones, like buying a home, its always best to speak to an independent financial adviser. Its their job to separate fact from fiction and give you honest, trustworthy advice thats tailored to your unique circumstances.

Unbiased has 27,000 independent financial professionals across the country. Let us match you to your perfect financial adviser.

Let us match you to your perfect financial adviser

Can I Make Voluntary Student Loan Payments

If you want to, you can also make voluntary additional payments, either on a one-off basis, or by direct debit. In theory this will mean youll clear your debts earlier, but if youre one of the majority who can expect to make repayments for 30 years, this wont save you any money in the long-run.

That said, for some people, this might be worthwhile. If you receive a windfall, such as an inheritance or company bonus, paying down your student debt could increase your chance of clearing your debt meaning youll stop being charged 9% of everything over the threshold.

These optional repayments will only really make sense if they let you clear your loan in full, or put you within touching distance of doing so. Unlike other types of loans, an overpayment wont reduce the amount you repay each month.

If you still have any outstanding debt, whether £2,000 or £20,000, youll pay 9% of everything over the repayment threshold.

If you want to make voluntary payments, you can do so by logging in to your account at SLC.co.uk.

Read Also: Www Upstart Com Myoffer

Do I Repay My Student Loan If I Live Abroad

Student loan repayments are calculated the same way if you work overseas, but the earnings may be higher or lower, depending on the country you work in. Thats because some countries have a lower or higher cost of living than the UK.

The principle is the same. Youll repay 9% of everything over the local threshold. You can see repayment thresholds for countries around the world in the map below.

Arguably this is unfair for some, as local living costs are quite different to national ones. The cost of living in China, for example, might be much lower than the UK but the cost of living in Beijing is higher than in Britain.

However, this is quite similar to the UK. Although the earnings threshold is £25,725 across the country, average wages and living costs in London are far higher than in Yorkshire, for example.

So if you are thinking of working abroad, youll want to factor in how much your income will be affected by student loan repayments.

If you do decide to work abroad youll need to let the Student Loan Company know where you are, and what youre earning.

If they dont have information about your income, youll be charged a fixed amount each month, which also depends on the country you are in.

Getting The Best Deal On Student Loan Refinancing

Although there are people who only want the security of a fixed-rate loan or the lower initial interest rate of a variable-rate loan, its smart to be flexible, as both options have their perks.

The key is that you pick the type of loan that best fits your current financial situation. And remember, if necessary, you can always refinance your student loans again in the future. Many of the best student loan lenders have eliminated all their fees, so youve got nothing to lose by refinancing again when a better deal is available.

The Motley Fool owns and recommends MasterCard and Visa, and recommends American Express. Were firm believers in the Golden Rule. If we wouldnt recommend an offer to a close family member, we wouldnt recommend it on The Ascent either. Our number one goal is helping people find the best offers to improve their finances. That is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Don’t Miss: Fha Title 1 Loan Lender

Should I Consolidate For A Better Rate

It depends. Loan consolidation can simply your life, but you need to do it carefully to avoid losing benefits you may currently have under the loans you are carrying. The first step is to find out if you are eligible to consolidate. You must be enrolled at less than part-time status or not in school currently making loan payments or be within the loan’s grace period not be in default and carrying at least $5,000 to $7,500 in loans.

What Can I Do To Help

The first step is to take action! Send an email to the Prime Minister to show your support for the elimination of interest on student loans.

Next, you can share the campaign on your social media. Spread the word and encourage your friends and family to show their support too!

You can also contact your students union to see how you can help with on-campus actions and promotion of the campaign.

Every volunteer can help make a huge difference!

Spread the Word!

Read Also: Usaa Auto Loan Credit Score

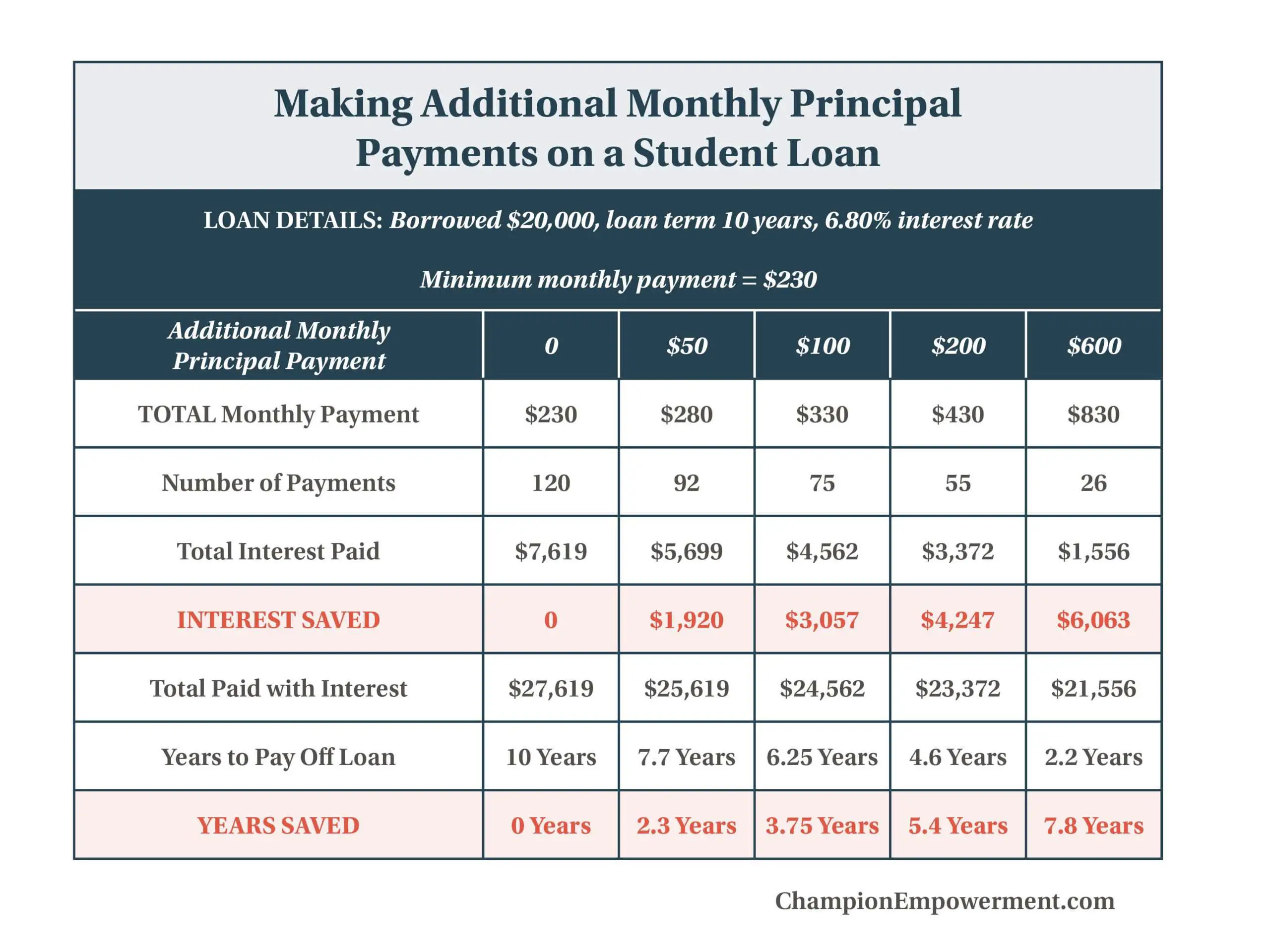

How Can I Save Money On My Student Loans

There are many ways you can save money on your student loans, including:

- Making payments while in school

- Paying more than the minimum payment

- Taking advantage of interest rate deductions

- And more

Some lenders will give you interest rate discounts on your student loans if you set up autopay or have a checking or savings account with them. So make sure to ask about these discounts first to ensure youre getting the best deal on your student loans.

See More Ways: 11 Strategies to Pay Off Student Loans Fast

How Much Are Plan 1 Student Loan Repayments

Youll only start making Student Finance repayments once youve left your course and are earning enough.

The repayment threshold for Plan 1 loans is currently £19,895/year before tax.

This threshold has risen in April of each year since 2012, so make sure you keep up to date with the figure. And remember: if you earn less than that in taxable income , you wont pay anything back until youre back above the threshold.

Once you earn more than the threshold, repayments kick in and you pay 9% on the amount above the threshold. So, if you earn £24,895 , youll pay 9% of £5,000, which is £450 for the year.

Heres what your monthly repayments could look like. If youre self-employed, use this as a guide to how much you should be putting away for your annual tax return:

| Annual salary | |

|---|---|

| £50,000 | £226 |

Student Loan repayments come with weekly and monthly thresholds, too. This means that even if you have a salary that falls below the annual threshold, receiving a bonus or completing extra shifts could mean you end up crossing the threshold and making a Student Finance repayment.

However, if at the end of the financial year your annual earnings are still below the annual repayment threshold, you’ll be entitled to a refund. Head over to our guide to Student Loan refunds to find out how to go about claiming your money back.

Don’t Miss: Fha Loan Limits Harris County