Best Home Equity Loan Lenders

| Lender | NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. |

National / regional | Max LTV | Min. credit score

Minimum credit score on top loans other loan types or factors may selectively influence minimum credit score standards |

Learn more |

|---|

Best for Kansas City borrowers

Best for variety of loan terms

Best for variety of loan terms

National / regional

Why we like it

Flagstar offers one of the highest loan limits among home equity loan lenders researched by NerdWallet.

Pros

-

Offers a wide range of loan types and products, including FHA, VA and USDA.

-

Has a full suite of online conveniences.

-

Offers customized online rate quotes with monthly payment estimates, including mortgage insurance, when applicable.

Cons

National / regional

NBKC can be a strong choice for borrowers in the Kansas City metro area.

Pros

-

Offers government-backed loans and some harder-to-find products, such as construction loans and specialty mortgages for pilots.

-

Offers low rates and fees compared with other lenders, according to the latest Federal data.

-

Displays customized rates, with fee estimates, without requiring contact information.

Cons

Is The Lowest Rate Always The Right Option

As a matter of fact, the lowest rate doesnt always indicate the right mortgage for you. There are various other factors to consider, such as the reputation of the lender, length of repayment plan, customer service, and other terms that apply to the loan. The combination of all of these factors will give you a good mortgage loan in general, and more importantly, the right loan for your specific situation. For example, someone who wants to take out a loan and pay it off over 30 years will not be well-served by a company that only offers 20-year repayment terms, even if it is offering competitive interest rates. Consider all the factors involved in the loan and not just the interest rate before deciding on a lender.

What Are The Minimum Requirements

Many lenders have fixed LTV ratio requirements for their home equity loans, meaning you’ll need to have a certain amount of equity in your home to qualify. Lenders will also factor in your credit score and income when determining your rate and eligibility.

Minimum requirements generally include a credit score of 620 or higher, a maximum loan-to-value ratio of 80 percent or 85 percent and a documented source of income.

Recommended Reading: Capital One Auto Loan Address

Get The Best Home Equity Loan Rates In Maryland

If you are looking for a mortgage lender and broker to help you secure the lowest home equity loan rates in Maryland, your search ends with Federal Hill Mortgage. Our experts will proficiently guide you through the home equity process and ensure that you get the most out of your property. Apply today to see how we can make your home equity benefit you!

Compare Our Top Lenders

Bestmoney is a dba of Natural Intelligence Technologies Inc.

Natural Intelligence Technologies Inc. NMLS # 2084135

CT: Mortgage Broker only, not a mortgage lender or mortgage correspondent lender.

- Advertising Disclosure

This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which impacts the location and order in which brands are presented, and also impacts the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Close

Recommended Reading: How To Switch Parent Plus Loan To Student

What Is A Cash

With cash-out refinancing, you refinance your mortgage with a mortgage that is larger than the amount you still owe on the original mortgage and then you keep the difference. Cash-out refinancing differs from home equity loans in that you are actually taking out a new mortgage and not simply taking a loan off the equity youve built up on your property.

One thing to keep in mind with cash-out refinancing is that you will still need to collect all the documentation you would for a mortgage, including proof that you can keep up with the payments.

How To Apply For A Home Equity Loan

Prepare for a home equity loan application by checking your credit, calculating your home equity and taking stock of how much other debt you already have. Many lenders let you start the application process online by entering your personal and financial information.

The documents and information youll typically need to apply for a home equity loan include:

- Identification or Social Security Number

- Employment history and employers contact information

- Evidence of your income for the past two years, typically through your tax returns

- Last two W-2 statements

- Appraisal or valuation of your home

- Evidence of existing liens on your home

- Amount you pay in child support or alimony

Also Check: Home Equity Loan Vs Refinance

Theres More In Your Home Than Great Memories The Equity Youve Built Up Over The Years Can Be Turned Into Financing For Anything

- Convert the equity in your home into cash you can use

- Competitive fixed rates1 for a variety of short-term or one-time needs:

- Education expenses

1Contact your tax consultant for details on tax deductibility. Home Equity Loans are available on properties in the following states: DC, MD, VA, WV, and PA

2Consult a tax advisor.

- Turn the equity in your home into ongoing, affordable financing

- Competitive variable rates1

- Available for several ongoing or seasonal needs:

- Education expenses

What Is The Three

Unlike other loans, such as personal loans, home equity loans must go through a closing period. During this period, all home equity loans are legally subject to a three-day cancellation rule, which states that you have the right to cancel your home equity loan until midnight of the third business day after you sign your contract. Changes to the contract, as well as funds disbursement, cannot occur during this time.

You May Like: How To Stop Loan Payments

How To Qualify For Mortgage Refinancing

In order to qualify for mortgage refinancing, lenders will judge whether an applicant meets certain criteria. Broken down, these categories reference a borrowers credit score, income, savings, debt, and the ratios between them. By and large, these guidelines are meant to indicate whether the applicant has both the reputation and the means to repay a loan.

Some lenders are more flexible than others. A loan insured by the Federal Housing Administration , for instance, has more flexible standards and guidelines for approval. That said, for those with lower credit scores, the initial down payment will be markedly higher. In the case of a credit score of 550, the down payment will be around 10 percent. Higher credit scores, on the other hand, will require about four percent.

A loan backed by the Home Affordable Refinance Program is one insured by the Federal Housing Finance Agency. By design, it is meant for homeowners that have proven reliable in regards to their mortgage payments, but have very little equity in their homes.

In order to qualify for a HARP loan, an applicants mortgage must have been granted by Freddie Mac or Fannie Mae prior to June 2009. Additionally, eligible borrowers must have a loan-to-value ratio over 80 percent.

San Diego County Credit Union: Nmls#580585

Min. down payment

SDCCU offers conventional loans for as little as 5% down.

National / regional

San Diego County Credit Union can be a strong choice for California borrowers.

Pros

-

Offers purchase, refinance and jumbo mortgages, plus loans for second homes and home equity products.

-

Provides customized rate and fee quotes without requiring contact information.

Cons

National / regional

US Bank offers convenient online banking for borrowers.

Pros

-

Offers a full line of conventional and government loan products.

-

Provides home equity loans and lines of credit.

-

Allows borrowers to apply and track their loan’s progress online.

Cons

-

No personalized mortgage rates available online.

National / regional

Min. down payment

Navy Federal Credit Union offers down payments as low as 0% on loans for military families.

View details

Navy Federal offers flexibility to borrowers with a wide range of loan terms.

Pros

-

Offers a wide range of affordable mortgage products, including 0% down payment loans, designed for military members.

-

Offers HELOCs and home equity loans.

-

Offers low rates compared with most lenders, according to the latest federal data.

Cons

-

Website does not provide customized mortgage rates based on credit score or other factors before you apply.

Don’t Miss: Does Opp Loan Help Credit

How To Choose The Best Home Equity Lender

Finding the best lender for a home equity loan will depend upon your unique situation and needs.

- Do you have poor credit or blemishes on your financial record?

- Certain lenders tend to be better for different loan purposes.

- Are you looking for a home equity loan or a HELOC? Some lenders will tend to be better for one or the other.

- The amount you need to borrow will also be a factor as some lenders may be a better fit for larger amounts than others.

Choosing the right lender for our situation will require some homework on your part to determine what loan features are important to you and what type of borrower you are.

Third Federal Savings And Loan: Best Home Equity Line Of Credit With A Long Repayment Term

Overview: Third Federal offers home equity loans and HELOCs featuring long repayment terms, potentially low interest rates and few fees.

Why Third Federal Savings and Loan is the best home equity line of credit with a long repayment term: Third Federal’s HELOC offers one of the longest repayment terms of its competitors, which make payments more affordable for borrowers.

Perks: If you find a lower interest rate with another lender, you could qualify for an interest-rate match or a $1,000 check from Third Federal. Additionally, Third Federal has no closing costs or minimum draw requirements.

What to watch out for: Third Federal charges a $65 annual fee, which is waived for the first year. Additionally, there is a minimum monthly payment of $100.

- LENDER:

You May Like: Dental Loans For Low Income

How To Apply For A Heloc

With most HELOC lenders, you can generally get the application process started in just a few minutes online. Youll simply enter some personal and financial information, such as your name, address, salary, desired loan amount and estimated credit score.

To apply for a HELOC, start with these steps:

What Is A Home Equity Line Of Credit Or Heloc

A HELOC works a lot like a credit card. Its a flexible line of credit secured by your homes equity but with a draw period which you may access from your available balance. You can draw at any time from this balance up to your available credit limit for things like home improvement, a medical bill or a family vacation.

Interest rates on HELOCs are usually variable rates. With a SECU HELOC, you can lock in up to three fixed rate, fixed payment sub-accounts under one master line. Often the interest on a HELOC is tax deductible, although you should check with your tax advisor.

Don’t Miss: How To Get Mobile Home Loan

Alternatives To A Heloc

A HELOC is not the right choice for every borrower. Depending on what you need the money for, one of these options may be a better fit:

- Home equity loan – A home equity loan is a second mortgage with a fixed interest rate that provides a lump sum to use for any purpose. Unlike a HELOC with an interest-only period, youll be responsible for both interest and principal payments when the loan closes.

- Cash-out refinance – If you can qualify for a lower interest rate than what you’re currently paying on your mortgage, you may want to refinance your mortgage. If you refinance for an amount that’s more than your current mortgage balance, you can pocket the difference in cash.

- Reverse mortgage – With a reverse mortgage, you receive an advance on your home equity that you don’t have to repay until you leave the home. However, these often come with many fees, and variable interest accrues continuously on the money you receive. These are also only available to older homeowners .

- Personal loan – Personal loans may have higher interest rates than home equity loans, but they don’t use your home as collateral. Like home equity loans, they have fixed interest rates and disburse money in a lump sum.

What Are The Different Types Of Rates

Not all interest rates are created equal. There are different types, and each has their own benefits, including:

A fixed interest rate is one that remains the same throughout the entire time you are paying off the loan. The rate is predetermined, so if you like consistency and want to know exactly what youll be paying, this is the better option for you.

Variable rates fluctuate during the course of the loan based on the current index value. The rate can fluctuate, and go up or down depending on the market. People who want to try to save some money on their loan can opt for a variable rate. If the rate goes down, you’ll make a lower monthly payment for that period.

These rates are charged on an upward curve, meaning you pay less each month at the beginning of the loan and gradually increase your monthly payments as the loan progresses. The actual interest rate doesnt change, but the total amount you pay will decrease because you will be paying off more of the loan as time goes on.

Recommended Reading: What Is The Best Company To Refinance Auto Loan With

How Do Home Equity Loans Work

Home equity loans work as a second mortgage, allowing you to take out a loan against your property’s value. As with your primary mortgage, your home is at risk of foreclosure if you can’t make payments.

Contrary to home equity lines of credit, home equity loans provide a one-time lump sum amount at a fixed interest rate. The maximum amount you’re allowed to take depends on the value of your property and your credit history. Banks, credit unions and online lenders all offer home equity loans.

Will I Be Billed Separately For Each Sub

No. SECU will calculate one master payment for each of your sub-accounts and for any revolving balance you have outstanding. This one payment will be allocated to the appropriate sub-accounts. There is no need to individually pay each account or calculate separate payments. SECU does all that for you!

You May Like: Where To Get The Best Auto Loan

Isnt This Just A Home Equity Loan

Many people confuse home equity loans and cash-out refinancing, because both deal with using your home equity to attain money from a lender.

With a home equity loan you are using the equity of your property, or part of it, as collateral for a loan. These loans are often referred to as a second mortgage, and entail the lender making a one-off payment to the borrower, whose equity shrinks in relation to the size of the loan. As the owner repays the loanand the relevant interest and feesthe equity begins to increase.

Because a home equity loan is secured by the property, they typically have lower interest rates than unsecured loans.

Unlike a HEL, a cash-out refinance entails securing a new mortgage to cover more than the preexisting mortgage so that you can get the difference as a loan. The HEL, on the other hand, is taken out in addition to your existing mortgage.

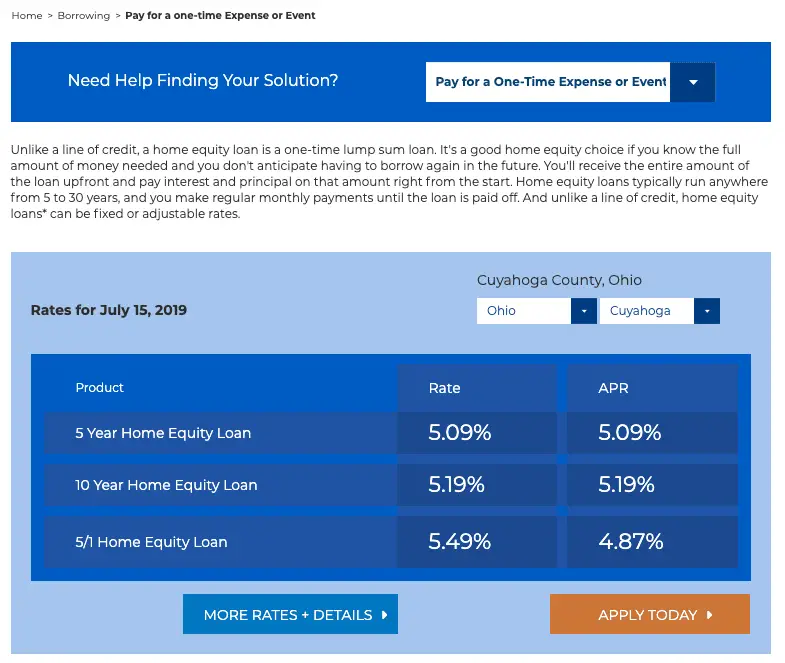

Home Equity Loan Rates

Other rates and options are available. Please call 1-800-225-2555 for more information today!

Rate based on Prime Lending Rate as published in the Wall St. Journal. Maximum 18% APR. Other terms and rates available. Some conditions apply. Offer good in MD, DE, PA, VA, FL, and NJ only. Subject to change without notice.

Read Also: Banks For Small Business Loans