Other Important Student Loan Debt Statistics

In addition, there are several other statistics regarding the state of student loan debt:

- Nearly seven in 10 seniors who graduated from public and private non-profit colleges in 2018 had student loan debt.

- There are approximately 2.4 million borrowers who have private student loans.

- The average student loan debt at public colleges and universities is $30,030 .

- The average student loan debt at non-profit private colleges and universities is $33,900 .

- The average student loan debt at for-profit colleges and universities is $43,900 .

- Almost half of private loan borrowers borrowed less than they could have in federal Stafford loans for college.

- 17.7% of student loan borrower are under the age of 25.

- 68.6% of student loan borrowers are between 25 and 50 years old.

Save By Refinancing Your Student Loans

Student loan refinancing is another way to pay off your loans faster and save money. With refinancing, youll take out a new loan with a lender like ELFI to pay off your existing one.*

Depending on the lenders student loan refinancing eligibility requirements, you could qualify for a lower interest rate and save thousands over the life of your loan. The benefits of student loan refinancing can be substantial, allowing you to become debt-free faster. Use ELFIs student loan refinancing calculator to find out how much you can save.*

Public Service Loan Forgiveness Statistics

As of November 30, 2020, here are the latest public service student loan debt statistics:

Public Service Loan Forgiveness cumulative borrowers: 1,378,000

Borrowers who submitted applications: 227,382

Total number of applications: 296,340

Number of applications approved: 6,493

Number of applications denied: 263,118

% of applications denied due to payments that dont qualify: 56%

% of applications denied due to missing information: 26%

Borrowers who have received student loan forgiveness: 3,776

Total dollar amount forgiven: $290.4 million

Average student loan balance forgiven: $76,906

Recommended Reading: How To Apply For Sss Loan

Roughly 4 In 10 Direct Loans Are On Hold

About $1.05 trillion of Americans student loan debt is in the form of direct loans. Thats a steep increase from five years ago when the total was $508.7 billion. Currently, 52% of direct federal loan debt is in repayment. About 8% is in default because the borrower hasnt made a payment in nine months or longer. The remaining 40% is on hold for a variety of reasons:

- 13% is held by students who are still in school

- 11% is in forbearance

- 5% is in a grace period

- 1% is classified as other

Forbearance and deferment enable many borrowers to postpone payments if they are experiencing economic hardship, like unemployment or a medical crisis are serving in the military or are continuing their studies through a fellowship, residency, or postgraduate study. The main difference is that interest always accrues during forbearance, but does not during some deferments.

The current breakdown is a significant change from the third quarter of 2013, when 42% of federal student loan debt was in repayment, 24% was held by students in school, 13% was in deferment, 8% was in forbearance, 7% was in a grace period, 5% was in default, and 1% was classified as other.

Covids Impact On Student Debt

Recent student debt relief efforts may have helped limit the growth of student loan debt.

- Compared to 2020, the total national student loan debt balance increased 52.6% slower in 2021.

- The federal student loan debt balance alone increased 2.9% in 2021.

- The nationwide total student loan debt balance increased 8.28% in 2020.

- The average student loan debt, meanwhile, increased 4.5%.

- In May of 2020, 9% of borrowers who attended public institutions were behind on their student loan payments.

- 7% of borrowers who attended private, nonprofit institutionts and 24% of borrowers who attended private, for-profit schools were behind on their loan payments.

- In early 2020, 75.3% of private student loans were in repayment while 20% were in deferment.

- While many private lenders offered suspension in payments of up to 3 months, few deferred interest.

Recommended Reading: How Much Land Can You Buy With A Va Loan

What The Average College Grads Debt Looks Like

Today, bachelors degree recipients with student loans graduate with an average debt of $37,172. Thats up from $20,000 just 13 years ago. And the mean debt for all people with outstanding student loans is $32,731.

To put it in context, we looked at what else you could buy with that sum. Todays average student loan balance could buy a brand new Audi A4, pay for a 141-guest wedding, or score four 50-yard line tickets to the big game. Its also equal to an 18% down payment on a $205,000 house which was the median home value in the U.S. in November 2017.

Average Student Loan Debt In The United States

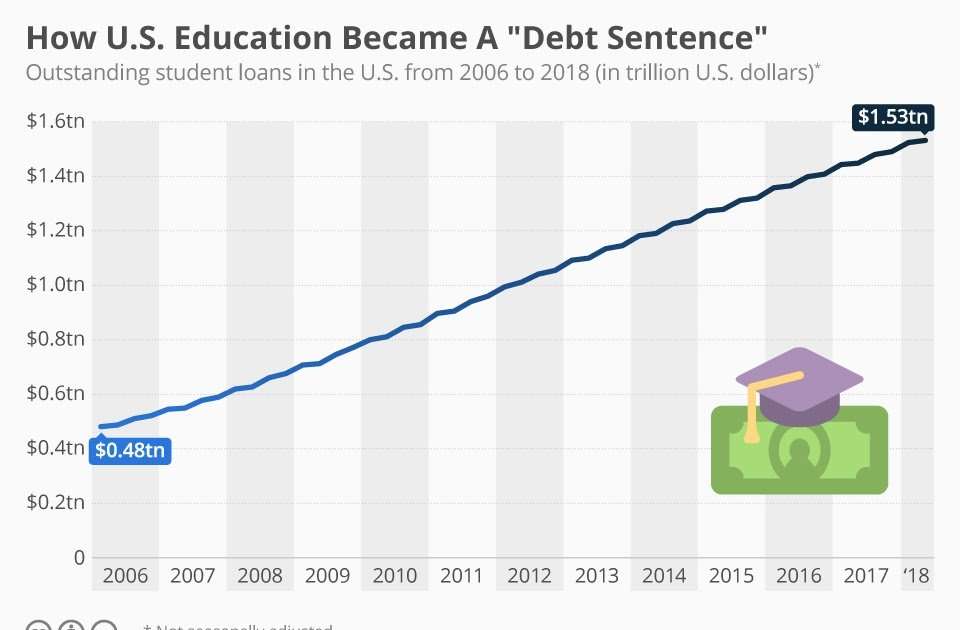

The average college debt among student loan borrowers in America is $32,731, according to the Federal Reserve. This is an increase of approximately 20% from 2015-2016. Most borrowers have between $25,000 and $50,000 outstanding in student loan debt. But more than 600,000 borrowers in the country are over $200,000 in student debt, and that number may continue to increase.

In total, the student loan debt outstanding in the country was $346 billion in 2004, and has ballooned to $1,386 billion as of late 2017. This represents a 302% increase in the total student loan debt in just 13 years. On average, the total student loan balance has increased by $80 billion each year since 2004.

| Year |

|---|

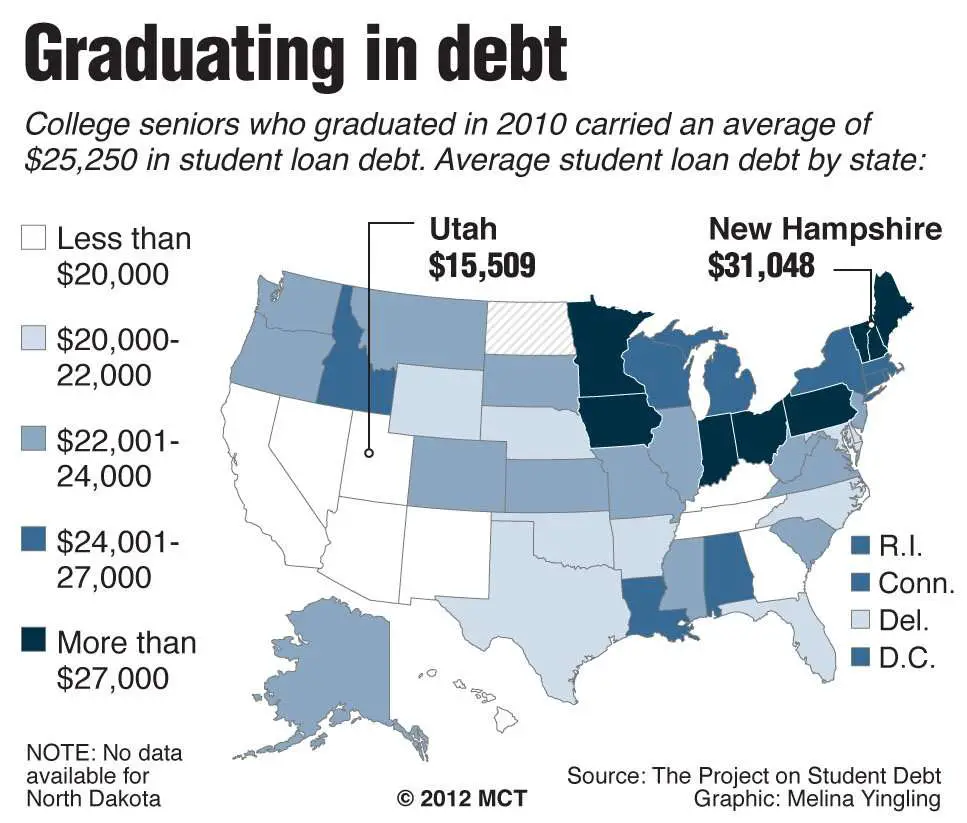

Average Student Loan Debt By State

- Connecticut has the highest average student loan debt for the Class of 2017 at $38,510.

- Utah has the lowest average student loan debt balance at $18,838 and the lowest percentage of residents with student loan debt, 38%.

- 74% of students in New Hampshire, South Dakota and West Virginia from the Class of 2017 have student loan debt.

According to data from The Institute for College Access and Success, the average student loan debt in each state for the class of 2017 is $28,650, ranging from $18,838 to $38,510. And in almost every state, 45% or more students are in debt, besides Utah. The table below shows the average college debt by state with their corresponding rank based on their average debt.

| Rank |

|---|

*Not enough useable data to calculate averages.

| Year |

|---|

You May Like: Does Interest Accrue While In School

The Types Of Federal Student Loans

Over three-quarters of all federal loans are direct loans. They are provided directly by the U.S. Department of Education and are available to most students regardless of financial need. Federal Family Education Loans are indirect loans, provided by accredited institutions but guaranteed by the government.

| Loan Type |

| 42.6 |

Perkins Loans are need-based loans of up to $5,500 a year for undergraduate students with very low household incomes they are issued directly by the universities. Federal loans are among the easiest for students to get, but most havelow annual limits, and interest rates can be high.

Graduates with multiple federal loans can turn to consolidation to streamline their finances and lock in lower interest rates.

Q Is College Worth The Money Even If One Has To Borrow For It Or Is Borrowing For College A Mistake

A. It depends. On average, an associate degree or a bachelors degree pays off handsomely in the job market borrowing to earn a degree can make economic sense. Over the course of a career, the typical worker with a bachelors degree earns nearly $1 million more than an otherwise similar worker with just a high school diploma if both work fulltime, year-round from age 25. A similar worker with an associate degree earns $360,000 more than a high school grad. And individuals with college degrees experience lower unemployment rates and increased odds of moving up the economic ladder. The payoff is not so great for students who borrow and dont get a degree or those who pay a lot for a certificate or degree that employers dont value, a problem that has been particularly acute among for-profit schools. Indeed, the variation in outcomes across colleges and across individual academic programs within a college can be enormousso students should choose carefully.

Read Also: Does Usaa Do Car Loans

Despite Cost Americans Still Opt For Higher Education

Higher education has long been considered the ticket to affluence and job satisfaction. The earnings premium for degree holders has grown steadily over the past several decades, and college graduates are more likely to become homeowners, according to the Federal Reserve Bank of New York. Among all Americans aged 25 and older, 58.9% have spent at least some time in college, and about 32.5% have earned a bachelors degree or higher. Younger Americans are more likely to prioritize going to college than previous generations. Among people aged 65 and older part of the baby boomer and silent generations 50% have spent some time in college, and 27% have a bachelors degree or higher. Among those aged 25 to 34 who would be considered millennials 65% have spent some time in college, and 36% have a bachelors degree or higher.

Surprising Facts About Graduate Degree Seekers

Its expensive, but Americans are still pursuing graduate and professional degrees and the majority are doing so as full-time students. Of the 1.84 million students enrolled in public or private not-for-profit graduate programs in fall 2016, 57.4% were registered full time. Graduate students are also now more likely to be women than men.

Recommended Reading: Stilt Loan Processing Time

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

Tips For Paying Off Student Loan Debt

Repaying student loan debt can be difficult, but it is possible. If youre overwhelmed by your student loans, use the following tips to control your debt and pay off student loans faster:

- Find Your Loans:The first step in becoming debt-free is knowing how student loans work. Use the National Student Loan Data System and AnnualCreditReport.com to find out what loans are under your name, how much you owe, and who manages your loans.

- Create a Budget:Make a budget to ensure your income outpaces your spending, and look for areas where you can cut back to free up cash for debt repayment. You Need a Budget and Mint are excellent tools for recent grads and can help you track your spending.

- Enroll in an Income-Driven Repayment Plan:If you have federal loans and your payments are too high, contact your loan servicer and ask to enroll in an IDR plan. The plans base your payments on your discretionary income and an extended repayment term, potentially reducing your minimum payments.

- Find Out of Your Employer Will Help:Some employers offer student loan assistance as an employee benefit. Talk to your HR department to see if your company offers that option.

- Make Extra Payments:Look for additional cash that you can put toward your debt. Even an extra $10 or $20 per month can reduce your repayment term by several months and help you save on interest charges.

Read Also: Usaa Loan Refinance

The Numbers Are Staggeringand Still On The Rise

Nearly one-third of all American students now have to go into debt to get through college, and the average student loan debt reached a record high of $38,792 in 2020. Collectively, they owe about $1.58 trillion as of November 2021, according to the Federal Reserve Bank of New York.

As any recent college studentor parent of a studentknows, obtaining a degree requires a much bigger financial sacrifice today than it did a generation or two ago. Over the past three decades, the average cost to attend a public four-year institution is more than three times the cost to attend a public four-year institution, and it more than doubled at both private and public four-year schools, according to the College Board.

For many Americans, footing the bill through savings and investments simply isnt sustainable. The upshot is that more students and families are relying on loans to pursue higher education, and the average student loan debt keeps growing.

Alternatives To Student Loans

There is a simple, increasingly popular way to graduate from college without an overwhelming amount of student loan debt: live at home while earning your four-year degree.

The savings can be staggering. A Bachelor of Arts degree could be had for under $50,000!

That would mean two years at a local community college where the average tuition/fees , books , transportation and other expenses add up to $8,940 a year. Spend the next wo years at a local state university where average tuition and fees , books , transportation and other expenses total $14,170 per year.

As long as Mom and Dad supply room and board , your degree runs approximately $46,220.

If you dont live at home, you can still cut costs by finding a roommate to share expenses reduce personal spending take extra classes so you graduate in three years or live away from home for two years and spend two at home.

About The Author

Recommended Reading: Usaa Car Loan Calculator

Which Graduate Degrees Are Students Borrowing The Most For

Of all graduate degrees, a medical degree takes longest to earn and costs the most. Doctors emerge from their training with an average debt load of $161,772. Lawyers follow with $140,616 worth of student loans, and educators rack up an average of $50,879 in outstanding loans. Of all degree seekers, the least indebted after graduation tend to be those earning MBAs, with an average student loan debt of $42,000.

Student Loan Debt Statistics In : A Record $17 Trillion

getty

Student loan debt in 2021 is now about $1.7 trillion.

The latest student loan debt statistics for 2021 show that there are 45 million borrowers who collectively owe nearly $1.7 trillion in student loan debt in the U.S. Student loan debt is now the second highest consumer debt category second only to mortgage debt and higher than debt for both credit cards and auto loans.

The Covid-19 pandemic has impacted student loans. President Joe Biden paused federal student loan payments for eight months through September 30, 2021. This placed millions of borrowers into temporary student loan forbearance, which impacted student loan debt statistics. Congress and the White House are battling over student loan cancellation. Some progressive Democrats plan to cancel $50,000 of student loan debt, while Biden wants $10,000 of student loan cancellation. Biden has said he will not cancel $50,000 of student loans by executive order.

If you are a student loan borrower, the following student loan debt statistics can help you make more informed decisions regarding student loan refinancing, paying off student loans faster and student loan forgiveness.

Read Also: Bayview Loan Servicing Charlotte Nc

Student Loan Debt Statistics By Loan Status For Direct Loans

Approximately $887 billion in Direct Loans across 22.2 million student loan borrowers are in student loan forbearance as as result of the Covid-19 pandemic. Approximately 8.7 million student loan borrowers are in student loan deferment or student loan default.

Student Loans In School: $124.8 billion

Student Loans In Repayment: $14.7 billion

Student Loans In Deferment: $114.4 billion

Student Loans in Forbearance: $887.4 billion borrowers

Student Loans In Default: $122.2 billion

Student Loans In Grace Period: $43.7 billion borrowers

Tips For Avoiding Student Loan Debt

While the majority of college graduates leave school with student loan debt, you may be able to cover the costs of college using other forms of financial aid:

- Work Over the Summer:During school breaks, consider getting a part-time job or picking up a side hustle. Working for a few months and stashing your earnings can help cover a significant portion of your college costs.

- Fill Out the Free Application for Federal Student Aid: Even if you arent sure whether youll qualify for financial aid, fill out the FAFSA. Its what the federal government, states, schools, and some organizations use to determine your eligibility for all sorts of aid, including merit-based scholarships and grants.

- Search for External Scholarships and Grants:You can find gift aid on your own that is issued by companies and non-profit organizations. Use FastWeb and Scholarships.com to find and apply for scholarships and grants.

- Consider Work-Study Programs: Students that need financial assistance may be eligible for federal or state work-study programs. Working with the schools department of financial assistance, youll get a job related to your major and use the income to pay for some of your education expenses.

- Reduce your College Expenses:You can decrease the need for student loans by lowering your college costs. Commute to school, rent an off-campus apartment, and prepare your own meals to save money.

Read Also: Nerdwallet Loans

Pslf Application Denial Reasons

Much has been made of the 95%+ rejection rate for PSLF.

Here are the reasons why borrowers applying for PSLF have not been approved as of Dec 2019.

These three reasons account for 95% of all PSLF rejections.

When borrowers do not have enough qualifying student loan payments, they probably had non qualifying FFEL loans during some of their 10 year repayment period.

Borrowers often fail to get signatures from employers or date their application correctly.

Finally, borrowers sometimes apply with no eligible loans .

If you address these three rejection reasons, its likely your application will be approved.